Citibank Corporate Credit Card: Features, Fees, & Application Process [2025]

Complete guide to Citibank's corporate credit card for Philippine businesses. Compare features, fees, benefits, and alternatives for international spending.

The Philippines is one of Southeast Asia’s most promising markets for entrepreneurs.

Micro, Small, and Medium Enterprises (MSMEs) are growing quickly, digital payments are mainstream, and global opportunities are easier to reach than ever before.

But spending internationally is where many businesses stumble. Bank cards tack on foreign transaction fees, reimbursements slow down cash flow, and hidden foreign exchange markups quietly eat into profits.

The Wise Business account is designed to cut through that.

Companies can add and hold 40+ currencies, receive money with local account details in 8+ currencies, and issue Wise Business debit cards, allowing teams to spend on foreign currency transactions without incurring any foreign transaction fees¹.

This Wise Business card review covers how the card works, the fees that matter (including the 1,400 PHP one-time setup), who it’s best suited for, and which local alternatives are worth comparing.

| Table of contents |

|---|

Sign up for the Wise Business account! 🚀

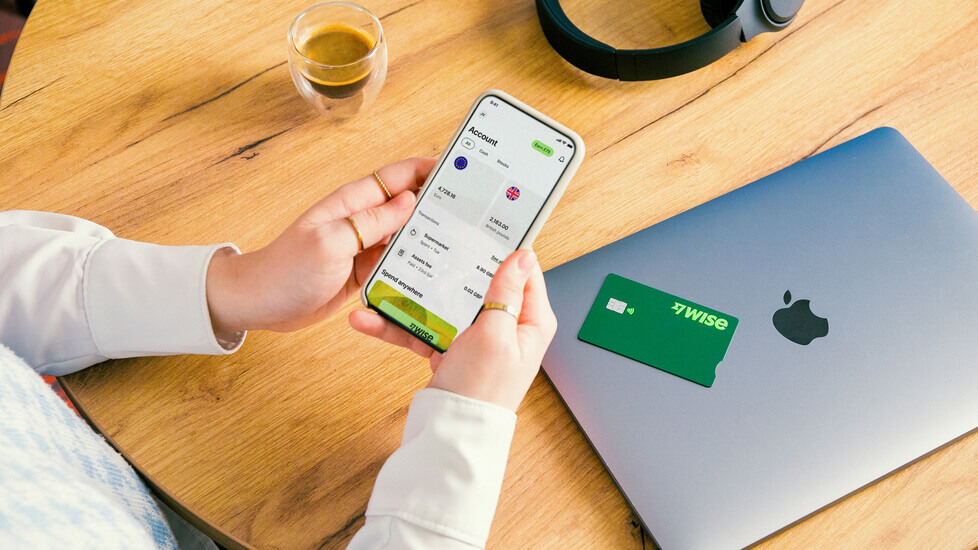

The Wise Business card is a debit card (available in both physical and virtual forms) that’s linked directly to a company’s Wise Business account².

Importantly, there’s no extra foreign transaction fee added on top, which sets it apart from many bank-issued cards.

To unlock these features, including the ability to receive money in 8+ currencies, Philippine businesses pay a one-time setup fee of 1,400 PHP. There are no ongoing monthly charges after that.

This setup makes the Wise Business card a valuable option for global spending: businesses gain cost transparency, clear reporting, and fewer surprises when settling expenses abroad.

The Wise Business card keeps company spending simple, transparent, and easy to track⁴.

For many MSMEs, managing employee expenses can be a complex task.

Staff use personal cards, claims pile up, and finance teams lose hours reconciling receipts. The Wise Business card streamlines this process by allowing each team member to make direct payments from the company’s account.

With team cards, businesses can:

Here’s what it costs to use the Wise Business card in the Philippines⁴.

| Service | Wise Business card Philippines fee |

|---|---|

| Order a Wise card | First card: FreeExtra team cards: PHP 0 (one-time per card) |

| Wise virtual card | Free |

| Monthly/annual fee | None (no subscription fees) |

| Spend a currency you hold | Free (no conversion needed) |

| Currency conversion when spending a currency you don’t hold | Low, transparent conversion fee at the mid-market rate (varies by route; from 0.57%) |

| ATM withdrawals | 2 free withdrawals/month per account if total ≤ PHP 12,000. If you withdraw > PHP 12,000 in a month: 1% on the amount over PHP 12,000. After your 2 free withdrawals, PHP 30 charge per extra withdrawal. (Local ATM operator fees may also apply.⁴) |

| Replace a lost or damaged Wise card | PHP 156.80 |

The Wise Business card is designed for transparent foreign exchange and simple team controls, but it’s not the only option. Depending on whether your business values rewards, advanced controls, or access to credit, here are the main alternatives worth considering.

| Provider and card | Payoneer Commercial Mastercard⁸ | Local bank corporate cards (e.g., BDO Mastercard Corporate Card⁹) |

|---|---|---|

| Card type | Prepaid Mastercard (linked to your Payoneer account) | Credit |

| Foreign exchange fee | Purchases in same currency as card: Free Purchases with conversion: up to 3.5% Cross-border purchase fee: up to 1.8% | 1% cross-border fee (Mastercard) + 1.5% BDO FX conversion fee on non-PHP transactions (≈ 2.5% total)¹⁰ |

| Rewards | No general cashback; occasional promos | Varies by corporate program |

| Setup/monthly fees | Annual card fee: USD 29.95 / EUR 29.95 / GBP 29.95 (first card; additional cards free) · Annual account fee: USD 29.95 if you receive < USD 2,000 in 12 months | Annual membership fee: depends on arrangement with BDO |

| Card issuance | Virtual & physical cards; standard delivery free; express DHL USD 40 | Physical only |

| Notable limits/notes | Fees are charged in the currency of the card (USD, EUR, GBP). Internal currency exchange between Payoneer balances: 0.5% | Credit line provided; Foreign exchange markups apply on non-PHP/USD spend¹¹ |

| Best for | Marketplace sellers & exporters spending in USD, EUR, GBP directly from Payoneer balances | Firms needing a local-bank credit line and corporate controls |

📖 Check out our handy resources on corporate card alternatives in the Philippines

The Wise Business Card is best for businesses that value transparent costs and control over cashback or rewards.

➡️ Get started with Wise Business today

💡Ready to simplify your team's business spending? Give them their own Wise Business Cards and connect them to your Wise Business account. No more using personal cards for business expenditure. No more manually reconciling personal card reimbursements. Wise Business lets you monitor and approve card payments instantly.

Here's what you get with Wise Business:

➡️Get your Wise Business Card today

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Complete guide to Citibank's corporate credit card for Philippine businesses. Compare features, fees, benefits, and alternatives for international spending.

Complete guide to RCBC Corporate Credit Card for Philippine businesses. Learn about features and fees, and find alternatives for international spending.

Complete UnionBank corporate credit card guide for Philippines businesses covering features, fees, applications, and smart alternatives.

A guide to BPI Corporate Credit Card for Philippine businesses. Learn about features, fees, applications, and discover alternatives for international spending.

Looking for a business debit card in the Philippines? We'll help you compare fees and features, plus learn a smarter way to manage international spend.

The best corporate credit cards for businesses in the Philippines that let you spend, track and manage expenses efficiently.