Wise Business Card Review: Is It The Right Choice For Your Philippines Business?

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

For Philippine businesses looking for corporate credit card solutions, UnionBank is often one of the first names that comes to mind. As one of the Philippines’ leading digital banks, named Asia Pacific’s Digital Trailblazer by IDC in 2020 and The Asset Triple A’s Digital Bank of the Year four years in a row, UnionBank has built a solid reputation since 1968 for innovation and customer service.

But while UnionBank’s corporate card covers the basics, it might not offer the most cost-effective features for modern businesses, particularly when it comes to international transactions. Foreign transaction fees can add up quickly, and the limited multi-currency support could slow you down if you're working with international suppliers.

This guide covers everything you need to know about the UnionBank Corporate Credit Card - from fees and features to application requirements. We’ll also show you why Wise Business might be a better option for modern Philippine businesses looking to avoid unnecessary fees and manage international team spending effectively.

| Table of contents |

|---|

Corporate credit cards simplify business expense management by providing a clear separation between personal and company spending. The credit line is based on your company’s financial statements rather than individual creditworthiness, making the company liable for the debt rather than individual employees.

For Philippine businesses, corporate cards offer huge benefits. They eliminate the need for employees to use personal cards and submit reimbursement claims - a process that can be time-consuming and prone to errors. Instead, all purchases go straight to the company and can be monitored and approved centrally. They’re particularly valuable for online purchases, including software subscriptions, travel bookings, and utility payments. Modern corporate cards also provide spending controls, allowing businesses to set limits per employee and restrict purchases to specific merchant categories (for example, you can block the local coffee shop).

Corporate cards often come with expense management tools and rewards programmes designed specifically for business needs - so you can get a little something back from your business spending. The most advanced solutions provide real-time spending notifications, automated expense categorisation, and seamless integration with accounting software; again, giving you more control and visibility, and saving everyone time.

UnionBank’s corporate credit card provides essential business expense management with several useful features. You get enhanced working capital flexibility with up to 53 days interest-free period. The card eliminates manual cash advance processes for company expenses and reduces safety risks associated with employees carrying large cash amounts.

Convenience and cash flow management

The card streamlines your company’s expense processes by removing the need for employees to advance personal funds for business purchases. This eliminates the admin burden of processing reimbursements and helps maintain clearer financial records. The extended payment terms of up to 53 days can significantly improve your working capital management, giving you more flexibility in timing your cash flows².

Global acceptance and accessibility

The card offers VISA network acceptance at over 24 million establishments worldwide and access to over 12 million ATMs globally for cash withdrawals¹. This eliminates the need for foreign currency conversion during international business travel, making it convenient for companies with global operations. Even on small purchases, currency conversion fees can otherwise quickly add up.

Financial incentives

UnionBank offers a 0.5% rebate on all company spending under their Rebate Programme (subject to terms and conditions)¹. These rebates are credited directly to your corporate account upon request, and the first-year annual fee is waived for new applicants.

Travel and business perks

Corporate cardholders get complimentary access to Maharba Lounge and PAGSS Lounge with card presentation. The card also includes travel insurance coverage up to PHP 5,000,000 when tickets are purchased with the card¹.

Expense management and control

UnionBank provides a comprehensive expense monitoring system for corporate spending with real-time transaction tracking and reporting. This gives you enhanced visibility into employee spending patterns, helping maintain better control over company expenses. The system allows for multi-level approval workflows, which becomes increasingly important for corporate governance as your business grows, getting the right requests in front of the right people.

Dedicated corporate support

You’ll have access to a specialised corporate helpdesk and a direct hotline. This provides a separate support channel for corporate accounts versus individual cardholders, ensuring business-specific assistance when you need it most.

Security and fraud protection

UnionBank implements real-time transaction monitoring that flags unusual spending patterns and can temporarily block suspicious transactions. For lost or stolen cards, 24/7 emergency blocking services are available, with company administrators able to freeze individual employee cards instantly. The card includes purchase protection for business equipment and customisable transaction alerts for purchases above specified thresholds.

Understanding the cost structure is crucial when choosing a corporate payment solution for your business. UnionBank’s pricing model follows the traditional banking approach with annual fees and various transaction charges. Here’s a breakdown of what you’ll actually pay:

| Feature | UnionBank Corporate Credit Card Fee¹ |

|---|---|

| Annual Fee | PHP 1,500 per card |

| First Year Fee | Waived for new applicants |

| VISA Spend Clarity Access | PHP 200 annually per company |

| Interest Rate | 3% monthly on outstanding balances |

| Late Payment Fee | PHP 1,500 or unpaid minimum (whichever is lower) |

| Foreign Transaction Fee | Not specified (typically 1.5-3% industry standard) |

| Setup/Application | PHP 0 |

| Card Replacement | Not specified |

*Details accurate as of 24th September 2025.

Here’s where it’s worth doing the calculations. While UnionBank doesn’t explicitly publish their foreign transaction fees, most Philippine banks charge between 1.5% to 3% for international transactions. For businesses with regular international expenses, these percentages can translate to meaningful amounts.

If you’re spending PHP 50,000 monthly on foreign software subscriptions (like Shopify, Slack, Zoom), that could mean PHP 750 to PHP 1,500 in transaction fees every month. Many businesses don’t immediately notice these costs because they’re often integrated into statements rather than clearly itemised.

The annual fees might seem reasonable for a single card, but they multiply with your team size. Five cards would cost PHP 7,500 annually after the first year, before factoring in any transaction fees or finance charges. The VISA Spend Clarity fee of PHP 200 per company annually adds another layer of cost for enhanced expense management features.

For a mid-sized Philippine company with five corporate cards spending PHP 100,000 annually on international suppliers and software, you might be looking at around PHP 9,200 in combined annual fees and transaction costs - worth considering when evaluating your options.

It’s also important to factor in the opportunity cost of these fees. Many growing Philippine businesses operate on tight margins, particularly in competitive sectors like e-commerce, digital marketing, or software development. Every peso spent on banking fees is a peso that could potentially be reinvested in marketing, hiring, or product development.

Consider the cumulative impact over time as well.

A business spending PHP 200,000 annually on international transactions could pay PHP 3,000 to PHP 6,000 yearly in foreign transaction fees alone. Over five years, that's PHP 15,000 to PHP 30,000 - enough to fund additional marketing campaigns, employee training, or business equipment upgrades.

While UnionBank’s corporate card offers solid basic features, Philippine businesses dealing with international transactions or managing team expenses may find better value with Wise Business.

| 💡Ready to simplify your team's business spending? Give them their own Wise Business Cards and connect them to your Wise Business account. No more using personal cards for business expenditure. No more manually reconciling personal card reimbursements. Wise Business lets you monitor and approve card payments instantly. |

|---|

➡️Get your Wise Business Card today

If you’ve decided that UnionBank’s corporate card fits your business needs, here’s how to navigate the application process.

The application process must be initiated by your company and requires maintaining an existing UnionBank corporate banking account. You’ll need to complete a comprehensive documentation package with 11 total documents.

The processing timeline is 20 banking days after complete document submission. Getting the application forms you need from UnionBank requires you to email their Corp Card team¹.

UnionBank’s corporate credit card represents a traditional approach to business expense management that works well for many companies. If your business operations are primarily domestic, the rebate programme and travel benefits (particularly using ATMs in the local currency) provide tangible value. The comprehensive support structure and established banking relationship can be particularly valuable for companies that prefer working with familiar institutions.

The card makes particular sense for businesses operating primarily within the domestic market, where the expense monitoring capabilities and dedicated corporate support become genuine advantages that enhance day-to-day financial management.

However, the landscape of business payments has evolved significantly in recent years.

Modern Philippine companies increasingly work with international suppliers, subscribe to global software platforms, and manage distributed teams - all of which means more money going overseas. For these businesses, traditional banking fees can create unnecessary friction and expense.

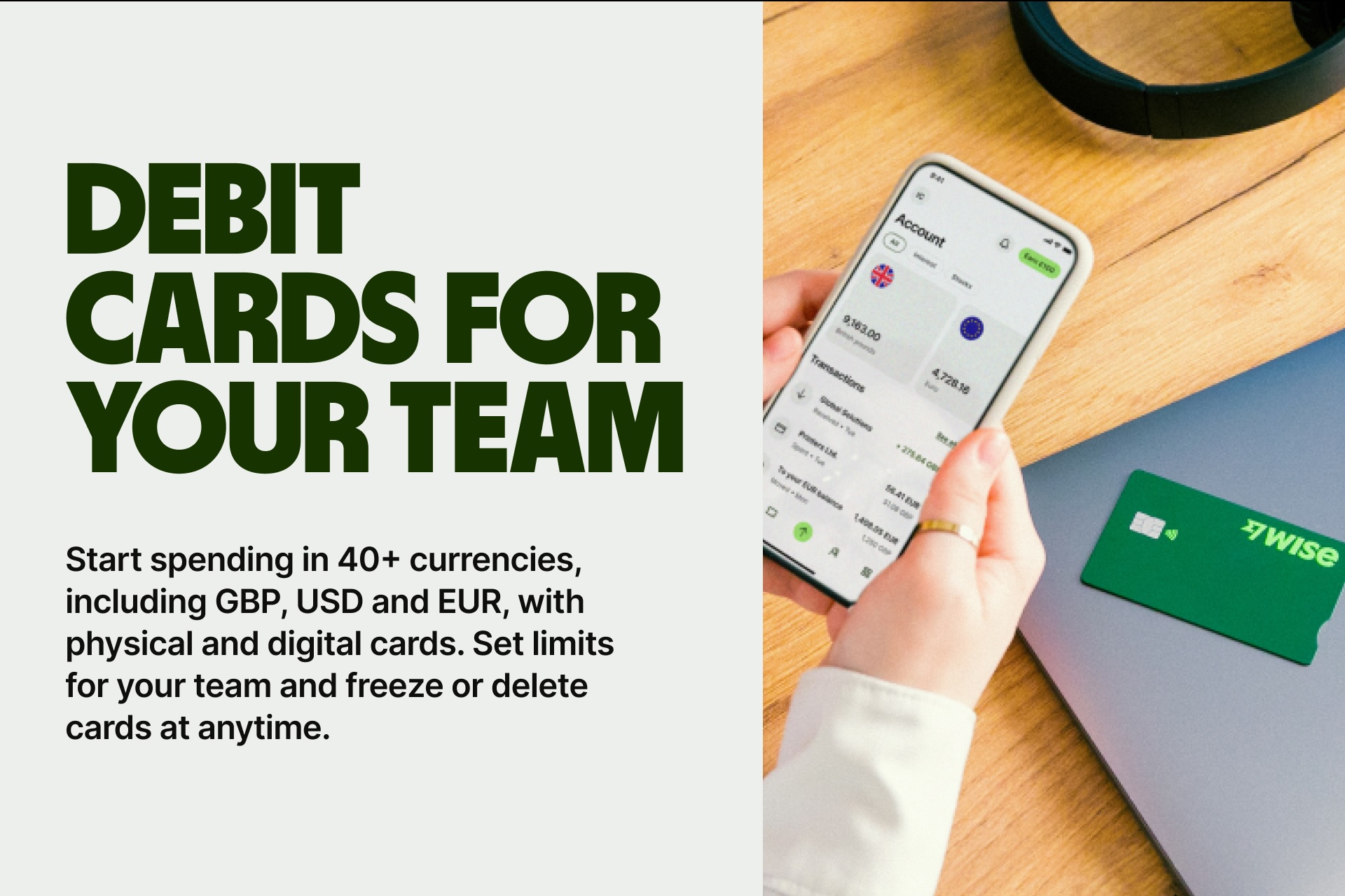

Wise Business addresses these modern business realities directly. With no foreign transaction fees charged on the Wise Business Card, and because you’ll always get the mid-market exchange rate for conversions, you can manage international spend without having to worry about incurring hidden exchange rate markups. Hold 40+ currencies in one account, receive payments with local account details in multiple countries, and give your team spending cards that work globally without additional costs.

Many forward-thinking Philippine companies now use both approaches strategically: maintaining their traditional banking relationships, like with UnionBank for domestic operations while leveraging modern solutions like Wise Business for international activities. This hybrid model gives you the best of both worlds - established local banking services plus cost-effective global financial tools.

The choice ultimately depends on your business model and growth plans. Traditional corporate cards serve established needs well, but if your business is expanding internationally or dealing with global vendors, exploring modern alternatives could significantly impact your bottom line.

You can read more about using personal bank accounts for business in the Philippines and thedifferences between Wise personal vs business accounts to help guide your decision.

➡️Get your Wise Business Card today.

Sources:

Sources checked on 24th September 2025.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

Complete guide to Citibank's corporate credit card for Philippine businesses. Compare features, fees, benefits, and alternatives for international spending.

Complete guide to RCBC Corporate Credit Card for Philippine businesses. Learn about features and fees, and find alternatives for international spending.

A guide to BPI Corporate Credit Card for Philippine businesses. Learn about features, fees, applications, and discover alternatives for international spending.

Looking for a business debit card in the Philippines? We'll help you compare fees and features, plus learn a smarter way to manage international spend.

The best corporate credit cards for businesses in the Philippines that let you spend, track and manage expenses efficiently.