Wise Business Card Review: Is It The Right Choice For Your Philippines Business?

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

For Philippine businesses looking for corporate credit card solutions, the Bank of the Philippine Islands (BPI) is often the first option. As the country’s oldest bank, BPI has built a solid reputation since 1851, and their corporate credit card offering includes a solid business expense management service.

But, whilst BPI’s corporate card covers the basics, it might not offer the smartest features on the market, particularly when it comes to international transactions. Foreign transaction fees can add up quickly, and the limited multi-currency support could slow you down if you’re working with international suppliers.

This guide covers everything you need to know about the BPI Corporate Credit Card - from fees and features to application requirements. We’ll also show you why Wise Business Card might be a better option for modern Philippine businesses looking to avoid unnecessary fees and manage the spending of their wider international teams.

| Table of contents |

|---|

Corporate credit cards are designed to make managing business-related expenses simpler, with the credit line based on your company’s financial statements rather than individual creditworthiness. Unlike personal credit cards, the company holds liability for the debt, not individual employees.

The main benefit of a corporate credit card is being able to control and monitor employee spending of company money. Rather than submitting receipts, employees can keep personal and business expenses separate from the get-go, saving everyone time (particularly your accounts department). They’re perfect for online purchases - booking flights, paying for software subscriptions, sorting utility bills - as well as in-person purchases on expensed work trips. Plus, corporate cards often come with expense management tools and rewards that actually benefit your business.

Crucially, corporate credit cards come with some controls, so you can make sure only the necessary expenses go through the company account. Many cards let you set spending limits for specific employees, as well as limits on the type of thing they can be used for - for example, not a coffee on the way to work. Corporate credit cards can be hugely useful; but, as with everything, some are more useful than others. So, how does the BPI corporate credit card stack up?

BPI’s corporate credit card does what it says on the tin - manages business expenses with some helpful bells and whistles. You get up to 50 days of extended payment terms, which isn’t bad for cash flow management¹. Their Express Data Online (EDOL) system handles real-time transaction monitoring and expense approvals, so you can keep track of who’s spending what¹.

Express Data Online (EDOL) system

This secure web-based reporting and expense management system is probably BPI’s strongest feature. You can generate detailed reports, view transactions in real-time, and approve expenses online from anywhere. It’s particularly useful for companies with multiple cardholders since you can monitor all spending activity from a central dashboard.

Real 0% instalment plans

The Real 0% instalment plans are genuinely useful for spreading larger business purchases without interest charges¹. This works at participating merchants like Abenson and Power Mac Center, allowing you to break down significant equipment purchases into manageable monthly payments.

Real Thrills rewards programme

Your corporate spending earns Real Thrills Rewards points that can be redeemed for gift certificates, shopping credits, airline miles, or even charitable donations¹. Points earned by all cardholders in your company can be pooled and redeemed in bulk by your Authorised Company Administrator.

Company controls and security

From a control standpoint, it’s decent. Set individual credit limits per employee, block specific merchant categories, and get exemption from withholding tax on purchases per BIR RMC 72-2004¹. The card also includes BPI’s Credit Card Control feature, allowing real-time blocking and unblocking for security purposes.

Same-day processing is available for credit limit increases and card cancellations if requested before 2:00 PM¹. Lost cards can be blocked immediately through BPI's 24-hour contact centre.

One thing BPI gets right: no minimum employee requirements. You can issue just one corporate card if that’s all your business needs.

Let’s talk numbers, because this is where things get interesting (and a little bit expensive). Here’s a breakdown of what you’ll actually pay:

| Feature | BPI Corporate Credit Card Fee |

|---|---|

| Annual Fee | PHP 1,700 per card |

| Setup/Application | PHP 0 |

| Interest Rate | 3% |

| Foreign Currency Transactions | 1.85% (0.85% BPI = 1% Mastercard/Visa) |

| Cross-border PHP Transactions | 1% |

| Expense Management | Included with EDOL |

| Card Replacement | PHP 400² |

*Details accurate as of 23rd September 2025.

Here’s where it gets painful. That 1.85% foreign currency transaction fee might seem negligible until you do the maths². If you’re spending PHP 50,000 monthly on foreign software subscriptions (like Shopify, Slack, Zoom), that’s PHP 925 just disappearing into fees every month.

The additional 1% cross-border PHP fee that kicked in during February 2024 makes it even worse. This applies to any PHP transaction processed by foreign merchants, which includes most of the software subscriptions Philippine businesses rely on daily.

PHP 1,700 per year, per card². Not the end of the world for one card, but multiply that by your team size and it adds up. Five cards? That’s PHP 8,500 yearly before you even factor in transaction fees.

BPI calls their foreign transaction fees "competitive” compared to other banks. And that may be true. But next to the modern banking alternatives available to Philippine businesses, like Wise Business, it makes more sense for companies to check out the alternatives on the market to see what makes the most sense for their spending needs.

Managing your BPI card is fairly simple, which means the fees take centre-stage when comparing the BPI corporate offering against competitors. Same-day processing is available for credit limit increases if requested before 2:00 PM. Cards can also be cancelled the same day upon company request. The automatic billing updater feature through Mastercard’s ABU service ensures seamless recurring payments.

While BPI’s corporate card offers solid basic features, Philippine businesses dealing with international transactions or managing team expenses may find better value with Wise Business.

| 💡Ready to simplify your team's business spending? Give them their own Wise Business Cards and connect them to your Wise Business account. No more using personal cards for business expenditure. No more manually reconciling personal card reimbursements. Wise Business lets you monitor and approve card payments instantly. |

|---|

➡️Get your Wise Business Card today

If you’ve weighed the costs and decided that BPI’s corporate card fits your business needs, here’s how to navigate the application process.

The application process must be initiated by your company rather than individual employees. This isn’t something you can do online like personal credit cards - it requires working directly with BPI's institutional banking team.

Before starting the application, ensure your company meets these basic requirements:

The BPI Corporate Credit Card does its job if you need basic business expense management and mostly operate within the Philippines. The Real 0% instalment feature is handy, and if you’re already deep in BPI's banking ecosystem, it might make sense to stick with what you know.

But there are some real downsides - namely, the high foreign transaction fees and the PHP 1,700 annual fee per card. Over the course of the year, that’s a lot of money incurred in fees.

| 💡Here’s where Wise Business takes a fundamentally different approach. |

|---|

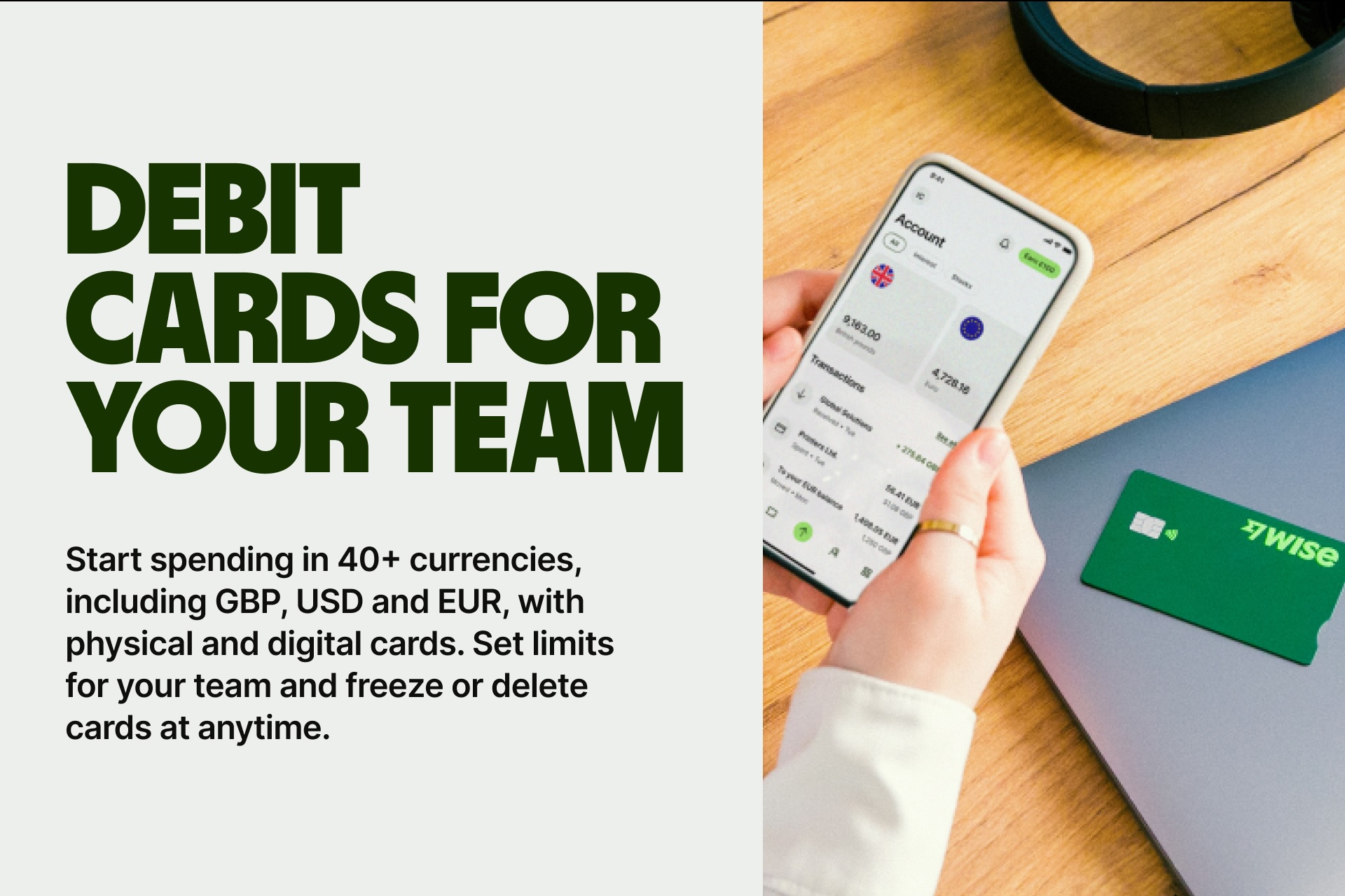

| No foreign transaction fees - whether your team is spending on meals during a business trip or subscribing to software from Silicon Valley. You will always get the mid-market exchange rate (the one you find on Google) with small, transparent conversion fees starting from 0.57%.Hold 40+ currencies in one account instead of juggling multiple bank accounts. Get local account details in major currencies so overseas clients can pay you like you’re a local business. Your team gets free debit cards with real-time spending controls. |

If you’re ready to reduce your international transaction costs and streamline your team's expense management, consider exploring Wise Business for your financial setup.

➡️Get your Wise Business Card today.

Sources:

2 - BPI Credit Card Rates and Fees

3 - BPI Institutional Banking - Corporate Credit Card

Sources checked on 23rd September 2025.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

Complete guide to Citibank's corporate credit card for Philippine businesses. Compare features, fees, benefits, and alternatives for international spending.

Complete guide to RCBC Corporate Credit Card for Philippine businesses. Learn about features and fees, and find alternatives for international spending.

Complete UnionBank corporate credit card guide for Philippines businesses covering features, fees, applications, and smart alternatives.

Looking for a business debit card in the Philippines? We'll help you compare fees and features, plus learn a smarter way to manage international spend.

The best corporate credit cards for businesses in the Philippines that let you spend, track and manage expenses efficiently.