Wise Business Card Review: Is It The Right Choice For Your Philippines Business?

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

Month-end rolls around, and the books look messy — stacks of receipts, reimbursements dragging on, and surprise foreign exchange charges eating into profit. For many Philippine Small and Medium-sized Enterprises (MSMEs), that’s business as usual. But it doesn’t have to be. A business debit card gives you real-time visibility, tighter controls, and a cleaner way to manage spend.

In this guide, we’ll explain how business debit cards work, compare the top options available in the Philippines, and highlight where Wise Business stands out for multi-currency payments and transparent pricing.

| Table of contents |

|---|

A business debit card works much like the one in your wallet, but it’s tied to your company’s account rather than your personal funds.

Each payment comes straight from the balance you already hold, which means no revolving credit, no interest, and cleaner reconciliation at the end of the month.

That’s what sets it apart from a business credit card, where you borrow first and repay later, which is helpful for cash flow, but risky if balances roll over and interest piles up. With a debit card, you spend only what’s available, and many providers now let you issue virtual or even single-use cards to ring-fence purchases for campaigns, staff, or vendors.

For Philippine MSMEs, a business debit card offers several practical benefits:

A Wise Business account lets you do all the above, and more.

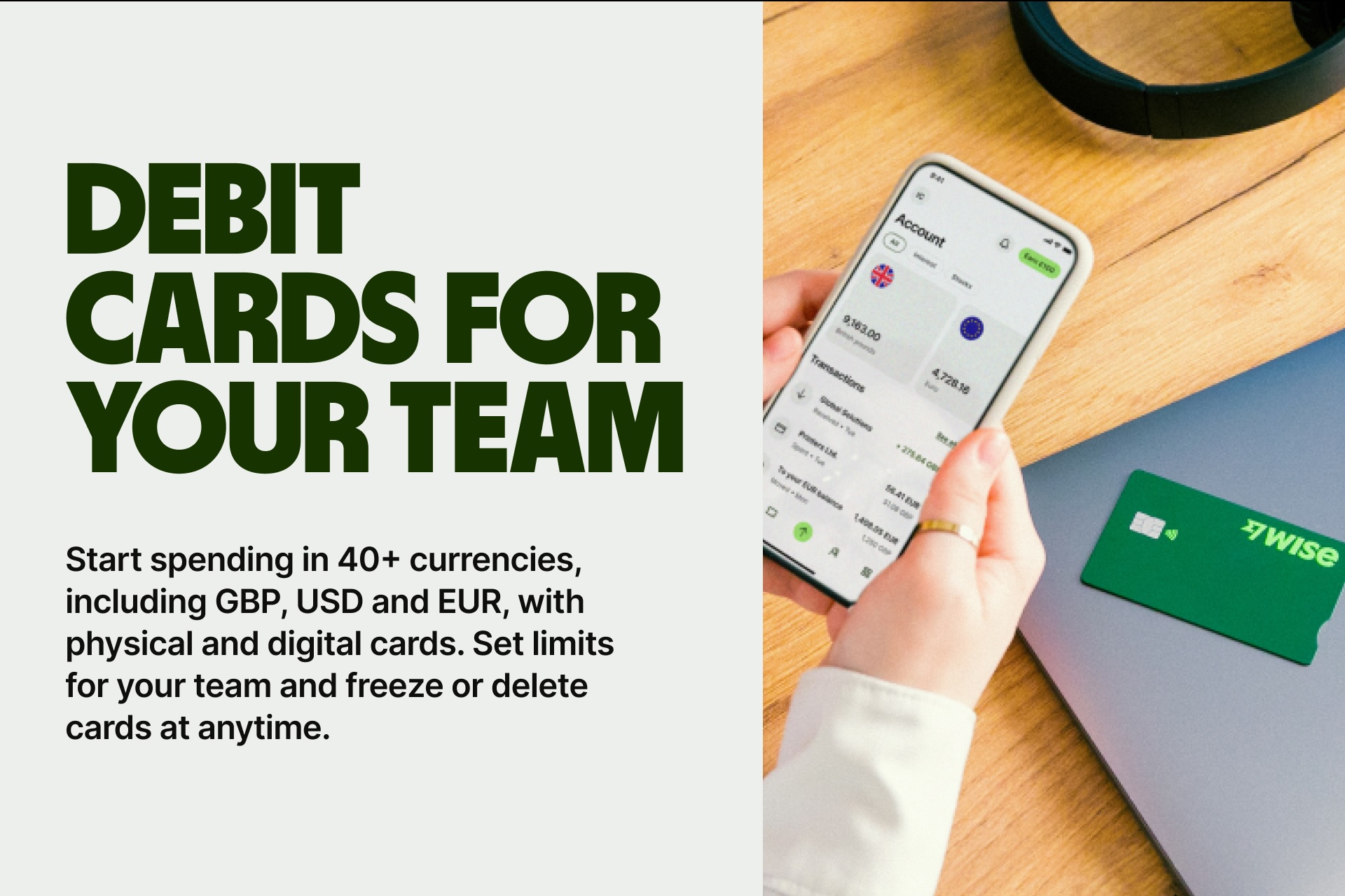

The Wise Business debit card links directly to your Wise Business account so that you can hold and spend in multiple currencies at the mid-market rate. Fees are transparent and low, and you’ll get instant notifications every time the card is used. On top of that, you can issue virtual or single-use cards for specific campaigns, vendors, or staff, a level of flexibility that’s rare in the Philippines.

Not all business debit cards are created equal.

Some banks keep fees low but charge heavily for foreign spend, while others are digital-first but still light on features. Below, we’ve lined up the essentials — maintenance fees, foreign transaction costs, ATM charges, rewards, mobile wallet support, digital card availability, and early closure fees — so you can see the trade-offs at a glance.

| Provider | Maintenance fee | Foreign transaction fee | ATM fee (local/overseas) | Cashback/rewards | Mobile payments | Digital card | Early closure fee |

|---|---|---|---|---|---|---|---|

| BDO Unibank debit¹ | No separate monthly card fee published (linked to account) | 1% Cross-Border + 1% foreign exchange conversion on international transactions, applied to the converted amount based on the prevailing rate of Mastercard and BDO, respectively, at the time of posting | BDO ATMs: Free BancNet ATMs: Fees may vary per ATM Terminal owner Mastercard and Visa ATMs: USD 3.50 | None published | Contactless only (no Apple/Google Pay*) | No | Yes, varies by account² |

| BPI Debit Mastercard³ | No separate monthly card fee published (linked to account) | 1.5% cross-border fee + ±1% foreign exchange mark-up (international online & in-store) | Local ATMs: Free Overseas ATM: USD 3.50 or 1.75% (whichever is higher) | None published | Contactless only (no Apple/Google Pay*) | No | PHP 500⁴ |

| Metrobank Debit Mastercard⁵ | No separate monthly card fee published (linked to account) | Not itemized as a flat % for debit; foreign usage settled at network rates with possible assessment/processing fees per T&Cs⁶ | Metrobank ATMs: Free⁷PSBank ATMs: PHP 7.50⁷Other local ATMs: Fees may vary according to the fees set by the owner of ATMs⁷International ATMs: USD 3.50⁷ | None published | Contactless only (no Apple/Google Pay*) | No | PHP 200⁷ |

| CIMB Biz (Visa SME debit)⁸ | No monthly Biz account fee⁹ | Follows Visa rules; detailed foreign transaction fee schedule pending for Biz card | Network ATM fees apply; full schedule pending | None published | Contactless card expected; Apple/Google Pay not supported for PH-issued cards | No | No |

| Wise Business debit Card¹² | None | No foreign transaction fee; convert at mid-market rate with a transparent conversion fee starting from 0.57% | 2 free ATM withdrawals/month up to PHP 12,000 limit; then 1% of withdrawal + PHP 30 per withdrawal | None | Wallet support varies by country; PH-issued cards not yet supported for Apple/Google Pay | Virtual and single-use cards | None |

*Apple/Google Pay in the Philippines: Google¹³ and Apple¹⁴ support pages do not include the Philippines on their contactless payments country lists, so Philippines-issued cards cannot be added for tap-to-pay (physical contactless still works).

Details correct at time of research — 23 September 2025

BDO’s debit card is widely accepted and backed by the country’s largest branch and ATM network. There’s no monthly card fee, and contactless tap is supported. But international spend is expensive: a 1% cross-border fee plus a 1% foreign exchange conversion fee, with USD 3.50 per overseas withdrawal. No cashback, digital card, or Apple/Google Pay support. Early closure fees depend on the linked account.

Bottom line: This card is good for domestic use, but not so much for global spend.

BPI publishes fees more transparently than most banks. The card supports contactless payments and has no monthly card fee. Still, foreign transactions add up quickly with a 1.5% cross-border fee plus about 1% foreign exchange markup. Overseas ATM withdrawals cost USD 3.50 or 1.75% (whichever is higher). No rewards, digital card, or Apple/Google Pay support. Early closure fees vary.

Bottom line: The card is reliable for local transactions, but fees start to add up quickly for cross-border transactions.

Metrobank’s debit card comes with free withdrawals at Metrobank ATMs and supports contactless payments. There’s no published monthly card fee, but foreign usage relies on Mastercard’s conversion rates plus possible network/processing charges. Fees aren’t itemized clearly, so costs can be unpredictable. No rewards, digital cards, or Apple/Google Pay support. Closing a peso-based account within one month incurs PHP 200.

Bottom line: The card is a practical option for domestic spend, but less transparent fees for international use mean you might have some challenges predicting the fees for your transactions.

CIMB launched its Biz Visa debit in 2025 as part of a fully digital SME account. It has no monthly fees and leverages Visa’s wide acceptance. However, detailed foreign exchange transaction rates, fees, and ATM fees are not yet published. No cashback, no digital cards, and no Apple/Google Pay support for Philippines-issued cards.

A plus: CIMB waives account closure fees entirely.

Bottom line: This card is a promising digital-first option, but fee transparency and track record are still limited.

The Wise Business debit card stands out for MSMEs with cross-border needs. There’s no monthly card fee, and your first card is free after signing up. Unlike many bank cards, there are no foreign transaction fees with the Wise Business Card — conversions use the mid-market rate with a small transparent conversion fee starting from 0.57% of the converted amount. You also get two free ATM withdrawals a month (up to PHP 12,000 total), plus virtual and single-use cards for staff or campaigns.

Bottom line: The card is best for handling international transactions such as ad-hoc business travel expenses, or any subscriptions billed in foreign currencies (popular business SaaS tools come to mind).

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

Using a typical business debit card in the Philippines works fine for local purchases, but the cracks show up as soon as you go cross-border.

Banks like BDO and BPI tack on hefty foreign transaction charges. With BPI, international purchases come with a 1.5% cross-border fee plus an extra ±1% foreign exchange markup on the rate itself. BDO isn’t much better: it applies a 1% cross-border fee and another 1% FX conversion fee, and if you withdraw cash overseas, you’ll pay USD 3.50 per transaction.

On top of these hidden costs, visibility is another headache.

Many MSMEs still share a single card or rely on reimbursements, which means receipts go missing, VAT or BIR documentation gets delayed, and there’s no clear picture of who spent what until month-end.

That’s where a modern option like Wise Business changes the game.

Wise Business lets you issue virtual and physical cards to your employees, so you can ring-fence spending by campaign, vendor, or staff member in just a few clicks.

Every transaction triggers an instant notification, giving you real-time visibility and cleaner records for accounting.

Most banks charge foreign transaction fees and foreign exchange markups when you spend abroad. BPI adds a 1.5% cross-border fee plus about 1% foreign exchange markup; BDO charges a 1% cross-border fee + 1% foreign exchange conversion fee. Overseas ATM withdrawals typically incur a fee of USD 3.50 or more. But with the Wise Business debit card, there are no foreign transaction fees — just the mid-market exchange rate and a low, transparent conversion fee.

Debit cards spend directly from your account balance, so you avoid overspending. Real-time alerts and dashboards give visibility, while staff cards prevent delays from reimbursements. Wise Business adds per-card limits, instant notifications, and exportable records for accounting.

Banks may bundle a debit card with a business account, though fees still apply for overseas use. With Wise, your first business card is free when you open a Wise Business account, with no monthly card fees.

For everyday local spending, a standard business debit card from a Philippine bank does the job.

But as soon as your business starts paying for ads in USD, or software in EUR and USD, or ad-hoc business travel expenses charged in different currencies, those hidden fees and foreign exchange markups quickly pile up. That’s why the right card isn’t just about convenience; it’s about efficiency, cost savings, and having clear visibility over every dollar your team spends.

| 💡Ready to simplify your team's business spending? Give them their own Wise Business Cards and connect them to your Wise Business account. No more using personal cards for business expenditure. No more manually reconciling personal card reimbursements. Wise Business lets you monitor and approve card payments instantly. |

|---|

➡️Get your Wise Business Card today

Sources:

Sources checked on 23 September 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

Complete guide to Citibank's corporate credit card for Philippine businesses. Compare features, fees, benefits, and alternatives for international spending.

Complete guide to RCBC Corporate Credit Card for Philippine businesses. Learn about features and fees, and find alternatives for international spending.

Complete UnionBank corporate credit card guide for Philippines businesses covering features, fees, applications, and smart alternatives.

A guide to BPI Corporate Credit Card for Philippine businesses. Learn about features, fees, applications, and discover alternatives for international spending.

The best corporate credit cards for businesses in the Philippines that let you spend, track and manage expenses efficiently.