Wise Business Card Review: Is It The Right Choice For Your Philippines Business?

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

Managing business expenses in the Philippines can feel like a constant struggle, especially for businesses that still rely on manual tracking and have to spend countless hours reconciling accounts at month-end, only to be hit with surprise fees. Corporate credit cards provide a practical solution, offering streamlined expense management, clearer oversight, and cost savings.

In this article, we’ll share the top corporate credit cards in the Philippines, and show you how to leverage them effectively for more efficient and cost-effective expense management. We'll also introduce the Wise Business Card as an alternative corporate card that offers similar benefits while letting you save even more on fees.

| Table of contents |

|---|

A corporate credit card is a company-issued credit card that lets employees cover business expenses while giving businesses centralised liability, tighter spending controls, and greater efficiency in managing costs.

Using a corporate credit card allows your Philippine business to:

Limiting business spending to corporate credit cards instead of relying on personal credit cards allows you to separate your business expenses from any personal spending. This reduces discrepancies that may occur during the reimbursement process and cleans up your accounting workflow. Separating business spending also protects your Philippine business from compliance issues and reduces the risk of irresponsible spending by employees.

Here's a quick overview of the popular business cards available in the Philippines.

| Card | Annual fee | Cash advance / ATM fee | Foreign transaction fee | Cashback and benefits |

|---|---|---|---|---|

| BPI¹ | 1,700 PHP² | 200 PHP per transaction | 0.85% plus Mastercard / Visa assessment fee of 1%, on top of prevailing foreign exchange rates. | Earn Real Thrills Rewards Points as you spend for rebates, miles and gift certificates. |

| UnionBank³ | 1,500 PHP⁴ First year is waived. | 200 PHP per transaction | 2% service fee plus Mastercard / Visa assessment fee of 1%, on top of prevailing foreign exchange rates. | 0.5% rebate for every spend. Access to Maharba Lounge and PAGSS Lounge. Free travel insurance for air tickets bought using the UnionBank corporate card. |

| BDO Unibank⁵ | Free⁶ (for Visa, Mastercard and Diners Club) 2,500 PHP⁷ (for American Express) | 200 PHP per transaction | 1% cross-border fee and 1.5% foreign exchange conversion fee. (for Visa, Mastercard and Diners Club) 2.5% conversion fee, of which 1% is retained by American Express. | Complimentary travel insurance of up to 5 million PHP. (for Visa, Mastercard and Diners Club) American Express BDO corporate card holders earn membership reward points on spending, and complimentary travel insurance of up to 15 million PHP. |

| RCBC | 1,500 PHP⁸ (Corporate Mastercard) 3,600 PHP⁹ (JCB Platinum) 5,000 PHP, first year free¹⁰ (Visa Platinum) 3,600 PHP¹¹ (Gold MasterCard) | 200 PHP per transaction | 3.5% service fee, which includes Mastercard/Visa/JCB/UnionPay assessment fees and the Bank's service fee. 2.25% service fee for foreign currency transactions at point of sale, for transactions of 1,000 PHP and above. | JCB Platinum, Visa Platinum and Gold MasterCard holders are entitled to: Free travel insurance and purchase protection. Access to airport lounges. 0% instalment on purchases abroad. Earn reward points and airmiles on your corporate card spend. RCBC Visa Platinum corporate card also grants complimentary access to the 24/7 Visa concierge service. |

| Wise Business Card¹³ | No annual fee One-time fee of 1,400 PHP applies. | 2 withdrawals of up to 12,000 PHP/month free, then 30 PHP + 1% fee | No foreign transaction fee | Mid-market exchange rate and options to hold and exchange 40+ currencies in the Wise Business account |

*Details are correct at the time of research - 18 September 2025

The BPI corporate card offers a complete business payment solution that enables Philippine businesses to control and monitor spending while enjoying low foreign conversion rates. Spends made on the BPI corporate credit card are eligible for Real Thrills Rewards Points, which can be exchanged for rebates, miles and gift certificates.

It is worth noting that:

UnionBank’s corporate Visa card helps simplify business spending while offering perks such as 0.5% rebate on spend, access to Marhaba and PAGSS lounges and complimentary travel insurance coverage of up to 5 million PHP when tickets are purchased with the card.

It is worth noting that:

BDO Unibank offers corporate cards from Visa, MasterCard, Diners Club and American Express, all of which grant access to expense management solutions, payment consolidation, monthly reports and complimentary travel insurance of up to 5 million PHP.

The American Express BDO Unibank corporate credit card offers an advanced suite of financial management reports and more flexibility in expense control. It also offers additional perks such as the ability to earn membership reward points and complimentary travel insurance of up to 15 million PHP.

It is worth noting that:

RCBC offers a range of corporate credit cards for you to choose from. The RCBC corporate MasterCard⁸ is a no-fuss corporate card that helps simplify your business expense management. RCBC also offers premium corporate credit cards with advanced expense management tools such as the Spend Analyzer, Spend Monitor, and come with additional benefits such as free travel insurance, access to airport lounges and the ability to earn reward points and airmiles.

It is worth noting that:

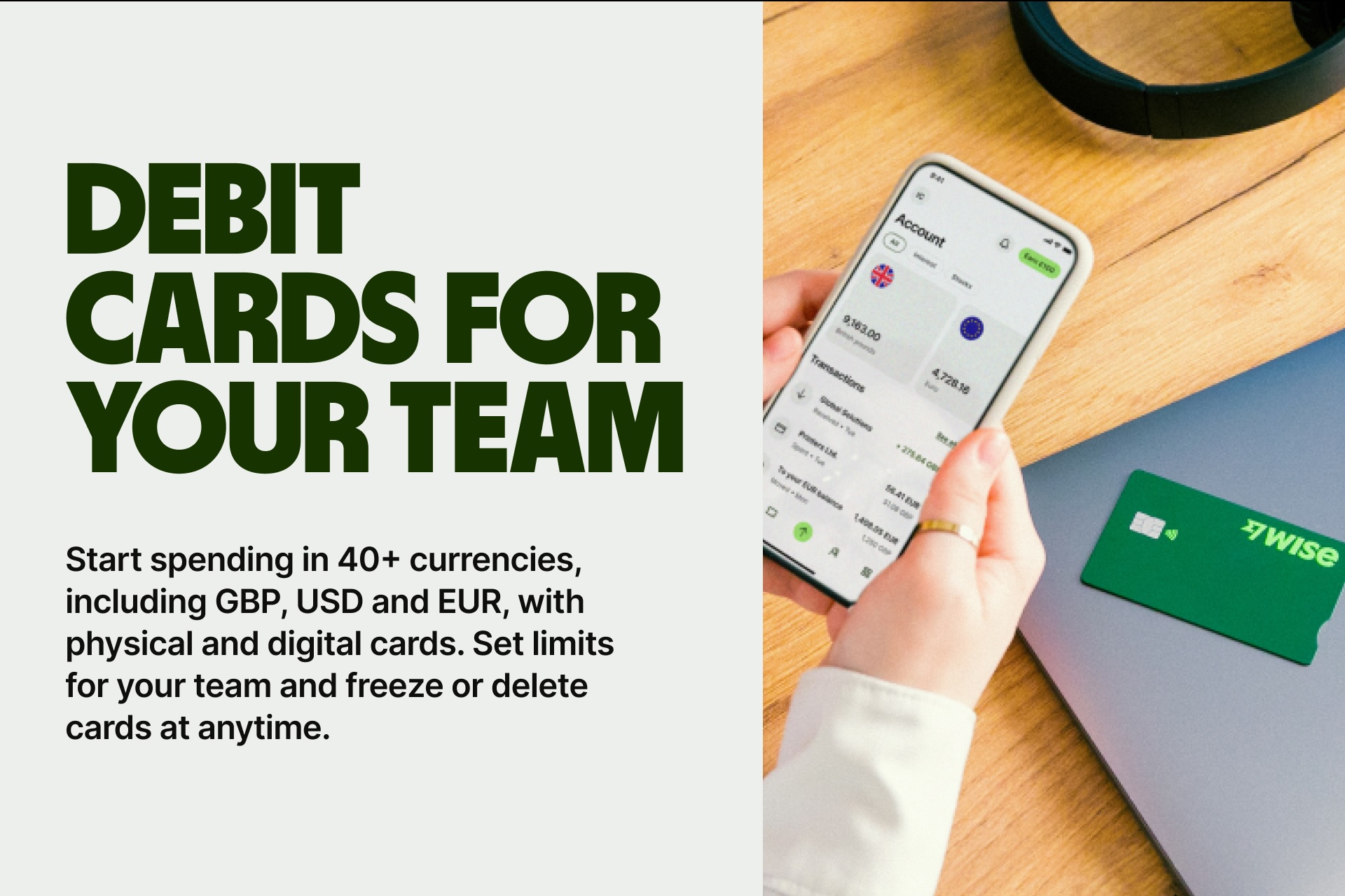

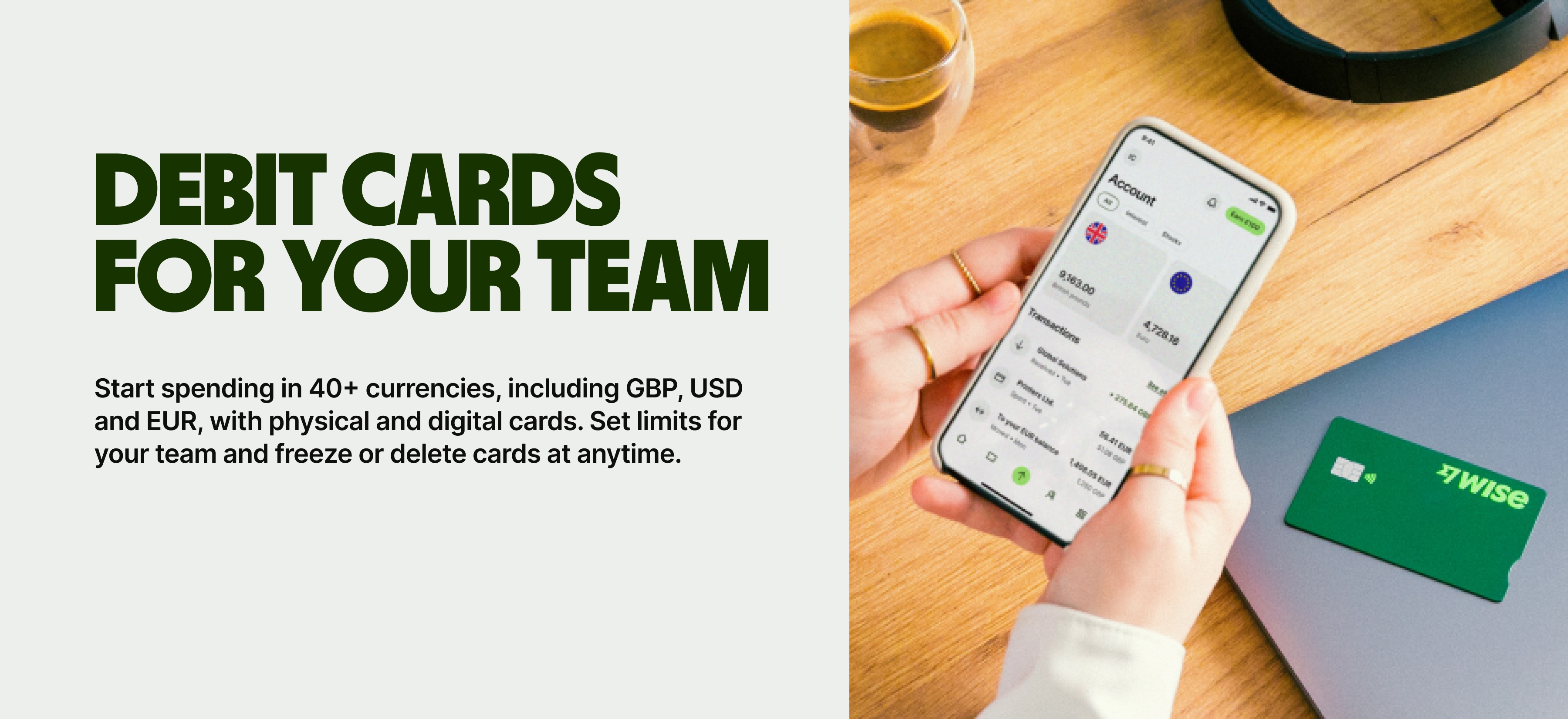

Wise Business is a banking alternative that lets you convert, send and spend money globally at transparent pricing. Your business will always enjoy the mid-market exchange rate for foreign currency conversions, and no foreign transaction fees when spending with the Wise Business Card.

It is worth noting that:

The best corporate credit card depends on your needs and spending patterns. Key considerations include:

| 💡Ready to simplify your team's business spending? Give them their own Wise Business Cards and connect them to your Wise Business account. No more using personal cards for business expenditure. No more manually reconciling personal card reimbursements. Wise Business lets you monitor and approve card payments instantly. |

|---|

➡️Get your Wise Business Card today

While corporate credit cards offer a range of benefits, they come with common disadvantages that you should keep an eye out for.

A major drawback of traditional corporate cards is the markups banks add on foreign exchange rates. This means you are paying more than the mid-market rate shown online.

For example, a USD 99 software subscription could cost noticeably more after repeated markups steadily erode your bottom line.

Many Philippine businesses still rely on paper-heavy workflows for employee expenses, especially when multiple corporate credit cards from various banks do not integrate with their accounting software, resulting in the need for manual reimbursement.

Without immediate insights, managers often see spending when monthly statements arrive, which is often too late to prevent overspending or misuse of company funds. While many corporate cards offer spending controls, these are often unused. Ensure that limits are in place for every corporate card you issue.

Wise Business helps businesses in the Philippines to overcome these challenges with access to transparent mid-market exchange rates with no hidden markups. All transactions made are tracked and reflected immediately within your account, allowing real-time tracking. You also have the option to issue debit cards to your employees with pre-set spending limits that give you direct control over business spending.

When used effectively, corporate credit cards offer more than just a convenient way for employees to pay for business expenses. Here are some practical ways they can help enhance efficiency.

Beyond these use cases, corporate credit cards may offer integration with expense management that allows you to solve the headache of tracking team expenses and managing business spend.

| 💼Wise Business Case Study |

|---|

| Jonathan Dizdarevic, co-founder of anyIP, a SaaS business with a global team, experienced the headache of reconciling expenses which were manually submitted through WhatsApp. Too much time was wasted in tracking down the expenses, the employees to reimburse, and verifying records. After rolling out Wise Business cards to his team, the company not only saved time, but they are now able to control spend limits while enjoying improved security with the ability to freeze or unfreeze cards instantly.➡️Read how anyIP transformed their expense management using Wise Business here |

Employees should not use corporate credit cards for personal expenses. Businesses should set clear spending policies and controls to prevent such practices. Corporate credit cards may allow you to set category restrictions that could help limit such instances as well.

Credit cards allow repayment to be carried over to subsequent months, incurring interest if the balance is not fully paid off each month while charge cards require all balances to be paid off at every billing cycle. Corporate credit cards are typically preferred for the spending controls and reporting features, while company charge cards tend to offer higher spending limits and are typically used by companies with significant cash flow.

Business expense management is a complex process which can be simplified with the use of corporate credit cards. Above, we have provided a list of the best corporate credit cards in the Philippines along with their fees and benefits.

While corporate credit cards help to centralise payments and simplify reconciliation, they often come with hefty foreign transaction fees and/or hidden exchange rate markups if you happen to convert currencies for a transaction. Keep an eye out for these hidden, unnecessary costs to ensure that your business remains cost-effective while you strive for efficiency and control over your spending.

Wise’s corporate card solution can help your Philippine business to streamline your expense management while saving on fees.

➡️Get started with Wise Business today

Sources:

Sources checked on: 18 September 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

Complete guide to Citibank's corporate credit card for Philippine businesses. Compare features, fees, benefits, and alternatives for international spending.

Complete guide to RCBC Corporate Credit Card for Philippine businesses. Learn about features and fees, and find alternatives for international spending.

Complete UnionBank corporate credit card guide for Philippines businesses covering features, fees, applications, and smart alternatives.

A guide to BPI Corporate Credit Card for Philippine businesses. Learn about features, fees, applications, and discover alternatives for international spending.

Looking for a business debit card in the Philippines? We'll help you compare fees and features, plus learn a smarter way to manage international spend.