Wise Business Card Review: Is It The Right Choice For Your Philippines Business?

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

Philippine businesses looking for corporate payment solutions often consider Citibank's offerings. As one of the world's largest financial institutions with a strong presence in the Philippines, Citibank operates what it claims is the largest self-owned commercial card platform globally - servicing over 100 countries with local currency programs in 59 markets¹.

Citibank has been serving businesses here since 1902, making it one of the most established names in institutional banking. But after selling its consumer banking operations to UnionBank in 2022, Citi Philippines now focuses exclusively on serving corporate and institutional clients.

This guide breaks down Citibank's corporate credit card options for businesses in the Philippines. We'll cover the features, fees, and practical applications of their cards, then show you how Wise Business can help you manage international transactions without the foreign currency fees that typically come with traditional corporate cards.

Citibank offers several commercial card products, though not all may be directly available to Philippine businesses through their local operations. Here's how the main offerings compare:

| Card Type | Primary Use | Key Features | Best For |

|---|---|---|---|

| Citi Corporate Card | Travel & entertainment expenses | Global acceptance at 35M+ merchants, up to 55 days interest-free credit, travel benefits³ | Employees with regular business travel needs |

| Citi Virtual Card Accounts | Specific payment scenarios | Unique 16-digit numbers per transaction, validity from 1 day to 2 years, customisable controls | Contractors, infrequent travelers, group training expenses |

| Citi One Card | Multiple expense types | Single platform for all transactions, policy-driven with default limits, global multi-currency support | Organisations wanting streamlined, consolidated payments |

| Citi Purchasing Card | Procurement & B2B payments | Accepted at 90M+ merchants¹, ERP system integration, enhanced reporting | Teams buying goods and services for business operations |

*Details accurate as of 30th September 2025.

The main difference between these cards comes down to control versus convenience. The Corporate Card and One Card are physical cards your employees carry daily - the Corporate Card focuses specifically on travel and entertainment, while the One Card handles all expense types in one place. Virtual Card Accounts take the opposite approach by generating temporary digital card numbers for each payment, giving you tighter control over who spends what and when, but requiring more administrative setup for each transaction. The Purchasing Card sits somewhere in between - it's a physical card like the first two, but designed specifically for buying goods and services from suppliers rather than booking travel or paying for meals. For most Philippine businesses, the choice really comes down to whether you need specialised cards for different purposes (Corporate for travel, Purchasing for procurement) or prefer the simplicity of everyone using the same card type (One Card), with Virtual Accounts reserved for one-off payments where you need extra security controls.

The challenge for Philippine businesses is:

If your business has frequent overseas travel expenses or software subscriptions charged in USD, EUR or other foreign currencies on your corporate card, the foreign transaction fees will quickly add up.

Corporate credit cards simplify business expense management by basing the credit line on your company's financial statements rather than individual employee creditworthiness. The company holds liability for the debt, not individual cardholders.

For Philippine businesses, corporate cards solve several practical problems. Your team can keep personal and business expenses separate from the start, eliminating the tedious receipt submission process. They're useful for online purchases like booking flights, paying for software subscriptions, and handling utility bills, as well as in-person expenses during work trips.

The real benefit comes from the controls. You can set spending limits for specific employees and restrict what the cards can be used for - so that coffee on the way to work doesn't go through the company account. Many corporate cards also include expense management tools and rewards programs that actually benefit your business.

Let’s now look at the key features of Citibank’s most popular card options.

The Citi Corporate Card, designed for travel and entertainment expenses, includes several features relevant to Philippine businesses:

Citi Virtual Card Accounts offer a digital-first approach for businesses that need extra security and control over specific payments. Instead of issuing physical cards, the system generates unique 16-digit card numbers for each transaction.

Virtual Card Accounts work particularly well for managing contractor payments, group training expenses, interview travel, relocation costs, or emergency travel situations where you need payment capability without issuing a permanent physical card.

Here's where traditional corporate cards get expensive, and Citibank is no exception. While specific pricing isn't publicly listed on their website, here's how Citibank's fees compare to Wise Business:

| Fee Type | Citibank Corporate Cards | Wise Business Card |

|---|---|---|

| Annual/Monthly Fee | Varies by card type as negotiated by individual businesses (typically charged per card annually) | Transparent 1,400 PHP one-time setup fee, no monthly fees |

| Foreign Transaction Fee | Typically 1-3% per transaction | No foreign transaction fees |

| Interest Rate | Applies if balance not paid in full | No interest rates on debit cards |

| Currency Conversion | Bank exchange rate (typically 2-4% markup) | Mid-market rate + transparent conversion fee from 0.57% |

*Details accurate as of 30 September 2025.

These “small” fees add up fast. For businesses paying for foreign software subscriptions, or managing overseas travel, the foreign transaction fees alone can significantly impact your bottom line.

While Citibank's corporate card offers solid basic features, Philippine businesses dealing with international transactions might find better value with Wise Business.

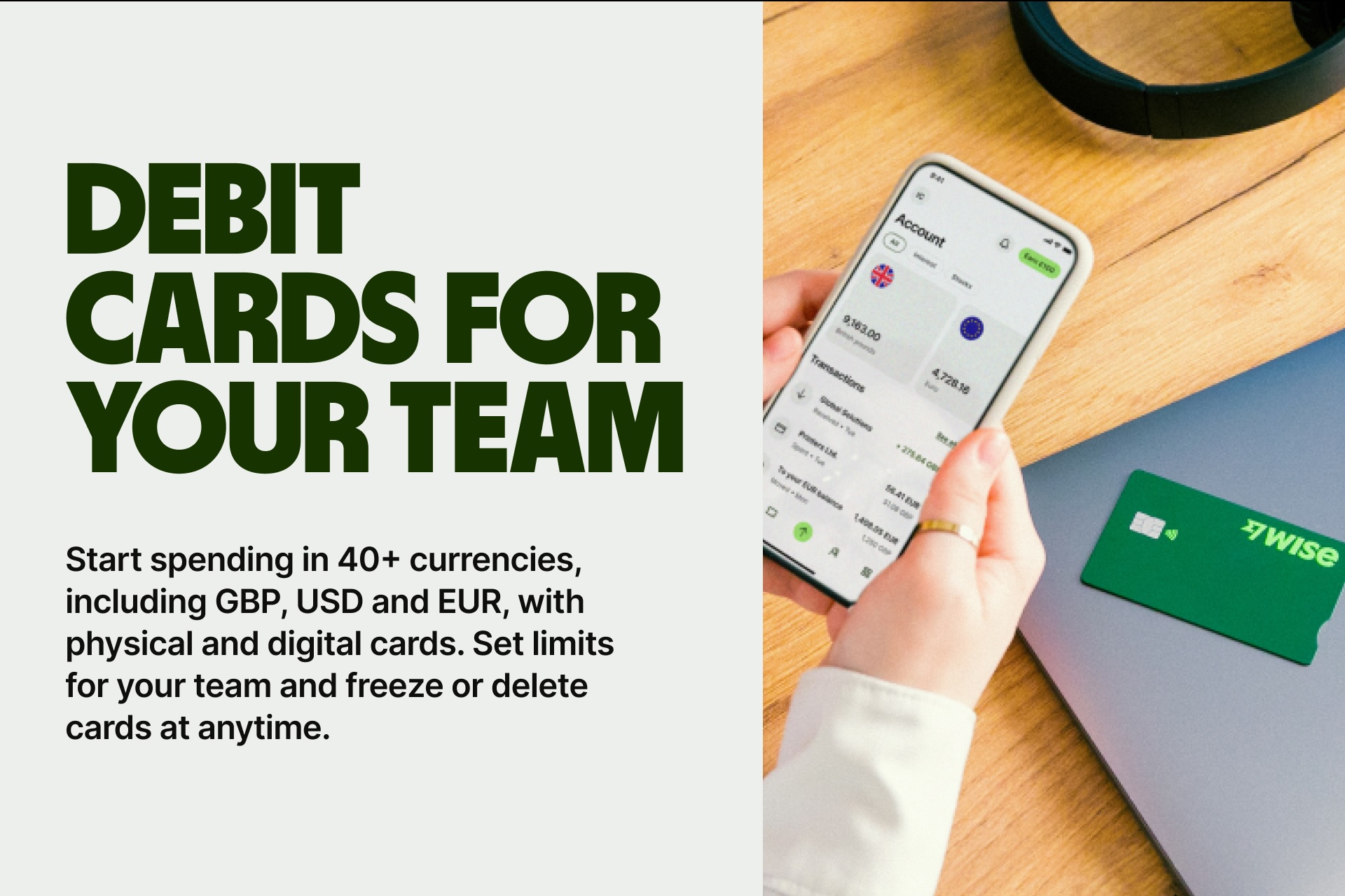

| 💡Ready to simplify your team's business spending? Give them their own Wise Business Cards and connect them to your Wise Business account. No more using personal cards for business expenditure. No more manually reconciling personal card reimbursements. Wise Business lets you monitor and approve card payments instantly. |

|---|

➡️Get your Wise Business Card today

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

If you've decided Citibank's corporate card fits your business needs, the application process requires working directly with their institutional banking team rather than applying online.

Your company must initiate the application and meet these basic requirements:

The process involves submitting company documentation, completing the corporate card application form, establishing company policies for card usage, and designating authorised administrators. Citibank then assesses your company's financial position and creditworthiness - this can take several weeks, depending on your business structure's complexity.

Once approved, cards are issued to designated employees, and your company gains access to the CitiManager expense management system.

Citibank's corporate card platform offers extensive global coverage and robust management tools, which make sense for large enterprises with complex international operations. The 24/7 multilingual support and acceptance at 35 million merchants worldwide provide reliability for businesses with significant travel requirements.

However, the foreign transaction fees present a real cost for businesses making regular international payments.

Those fees - typically 1-3% per transaction - quickly add up when you're subscribing to foreign software, or managing international travel expenses.

Here's where Wise Business Card takes a different approach.

There are no foreign transaction fees. You get the mid-market exchange rate (the one you find on Google) with transparent conversion fees starting from 0.57%. Hold 40+ currencies in one account instead of juggling multiple bank accounts. Get local account details in major currencies so overseas clients can pay you like you're a local business.

When choosing between using a personal bank account for business in the Philippines versus proper business financial tools, remember that professional business accounts like Wise Business or Citibank's corporate cards provide better expense tracking, clearer separation of business and personal finances, and features specifically designed for company needs. Understanding the differences between Wise personal and business accounts can also help you choose the right solution for your specific situation.

Whether you're paying for software subscriptions, or handling travel expenses, the right corporate payment solution significantly impacts your business's financial efficiency. Understanding your options helps you make informed decisions for your company's unique requirements.

➡️Get your Wise Business Card today

Sources:

3 - Citibank Corporate Card Documentation

4 - Citibank Virtual Cards Documentation

Sources checked on 30th September 2025.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

Complete guide to RCBC Corporate Credit Card for Philippine businesses. Learn about features and fees, and find alternatives for international spending.

Complete UnionBank corporate credit card guide for Philippines businesses covering features, fees, applications, and smart alternatives.

A guide to BPI Corporate Credit Card for Philippine businesses. Learn about features, fees, applications, and discover alternatives for international spending.

Looking for a business debit card in the Philippines? We'll help you compare fees and features, plus learn a smarter way to manage international spend.

The best corporate credit cards for businesses in the Philippines that let you spend, track and manage expenses efficiently.