Wise Business Card Review: Is It The Right Choice For Your Philippines Business?

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

Philippine businesses exploring their corporate credit card options will probably think of Rizal Commercial Banking Corporation (RCBC) as a potential partner. As the nation’s 5th largest privately-owned universal bank, managing over PHP 1.3 trillion in assets, RCBC has had a strong market presence since the 1960s¹ - meaning it has established trust passed down through generations. Their corporate credit card programme gives its users those fundamental business expense management tools that every business needs, as well as several other practical features and rewards incentives.

But, despite offering all the core functions you could ask for in a bank, RCBC’s corporate card may not be the best solution for small to medium-sized businesses, particularly those dealing with regular international transactions or managing complex team spending patterns. Cross-border payment charges can build up rapidly, and restricted multi-currency capabilities create unnecessary obstacles when working with global suppliers, paying overseas teams, or managing international operations.

This guide examines the RCBC corporate credit card in detail, covering its pricing structure, key features, and application procedures. We’ll also demonstrate why the Wise Business Card could be a better choice for contemporary Philippine companies seeking to reduce excessive charges and streamline international team expense management.

| Table of contents |

|---|

Corporate credit cards simplify business expense tracking by establishing credit limits based on a company’s financial performance rather than its individual credit history. The business takes responsibility for all debt, removing personal liability from employees.

These cards are great for separating business and personal spending from the outset. Instead of employees using personal funds and requesting reimbursements later, corporate cards keep business payments entirely separate, allowing for immediate categorisation by the business. This approach saves considerable administrative time, particularly for accounting teams handling multiple expense reports, and allows for more proactive budgeting.

Corporate cards make every type of business purchase simpler - from flight bookings and travel-related expenses to software subscriptions and utility payments. Most programmes also include built-in expense tracking tools, letting you see exactly where your money is going and when, and business-focused reward structures that make certain types of spending feel more profitable.

Spending controls are another major advantage, allowing companies to restrict transaction types and set individual employee limits - different departments might need bigger budgets at different times, and some spending types might never be appropriate.

| 💡For Philippine businesses, corporate cards also provide compliance benefits through exemption from withholding tax requirements under BIR RMC 72-2004, reducing administrative workload for companies subject to purchase-related tax obligations. |

|---|

RCBC provides a comprehensive corporate credit solution available in PHP, USD, or dual-currency arrangements. The card functions across 220 countries through more than 35 million merchant locations worldwide, making it suitable for businesses with both domestic and international operations².

Spending control and employee management

RCBC lets you set individual spending limits for each employee. This means junior staff can have appropriate restrictions, whilst senior executives have higher spending capacity. You might set different limits for travel expenses versus office supplies, for example, giving you control over specific spending categories.

Transaction alerts arrive as purchases happen in real time. Your finance team gets notified immediately, making it easier to spot unusual spending patterns or unauthorised transactions before they become problems. This real-time visibility helps with budget control and cash flow forecasting.

Financial flexibility features

Need cash for business purposes? The RCBC corporate card offers cash advances up to 50% of your available credit limit². This comes in handy during business trips when vendors don’t accept cards, or when you’re dealing with cash-only situations. Customer support is available 24/7, which matters when your team travels internationally across different time zones².

RCBC uses a hold-out deposit system where 95% determines your credit limit, with 5% reserved for emergencies². You get substantial credit for regular operations, plus a safety buffer for unexpected expenses.

Getting started and managing expenses

Unlike many of its competitors, there’s no minimum number of cardholders required. If you only need one or two cards for key personnel, that’s fine - you’ll access the same features as companies with dozens of cardholders.

Billing is consolidated, which simplifies your accounting. Instead of tracking multiple card statements separately, you get one comprehensive report showing all company card activity. This makes monthly reconciliation less time-consuming and expense categorisation more straightforward for tax purposes.

You can block specific transaction types entirely through merchant category controls. If your policy prohibits entertainment expenses or personal purchases on company cards, you can configure these restrictions at the system level. Real-time monitoring gives management instant access to spending trends and budget usage across departments.

Understanding the complete expense structure helps businesses make informed decisions about RCBC’s corporate card programme:

| Cost Component | RCBC Corporate Credit Card Fee² |

|---|---|

| Annual Subscription | PHP 1,500 (Peso cards), USD 35 (Dollar cards) |

| Monthly Interest | 3.00% calculated daily on outstanding balances |

| Supported Currencies | PHP and USD |

| International Transaction Charges (outgoing) | 3.5% service fee (promotional periods sometimes as low as 1.68%) |

| International Transaction Charges (incoming) | 2.25% conversion fee on transfers of PHP 1,000 and more |

| Replacement Card Fee | PHP 500/USD 10 |

*Information current as of 29th September 2025.

Those percentage-based fees can create substantial ongoing costs. Consider a business spending PHP 50,000 monthly on international software services - common for companies using platforms like Shopify, Slack, or Zoom. At the standard 3.5% foreign transaction rate, you’re paying PHP 1,750 in monthly fees.

That’s PHP 21,000 annually in transaction charges alone.

Even with promotional rates of 1.68%, you’re still looking at PHP 840 monthly on the same spending level².

These costs multiply when your team needs multiple cards, as each carries individual annual fees.

Five peso cards cost PHP 7,500 yearly before you factor in transaction charges.

It’s also worth understanding how currency conversion works with RCBC. Transactions in ten major currencies - AUD, CAD, EUR, HKD, JPY, KRW, SGD, THB, GBP, and USD - get converted to PHP using RCBC’s foreign exchange selling rate on the transaction posting date². For all other currencies, RCBC uses the Mastercard, Visa, JCB, or UnionPay currency conversion rate instead².

This means the exchange rate you get depends on which currency you’re transacting in, and you won’t know the exact rate until the transaction posts. It may not be the same as the exchange rate you see on Google.

For businesses with regular international spending, these accumulated fees represent significant operational expenses without providing additional value.

RCBC offers fundamental corporate card functionality, but Philippine businesses managing international transactions or team expenses often discover better value through Wise Business.

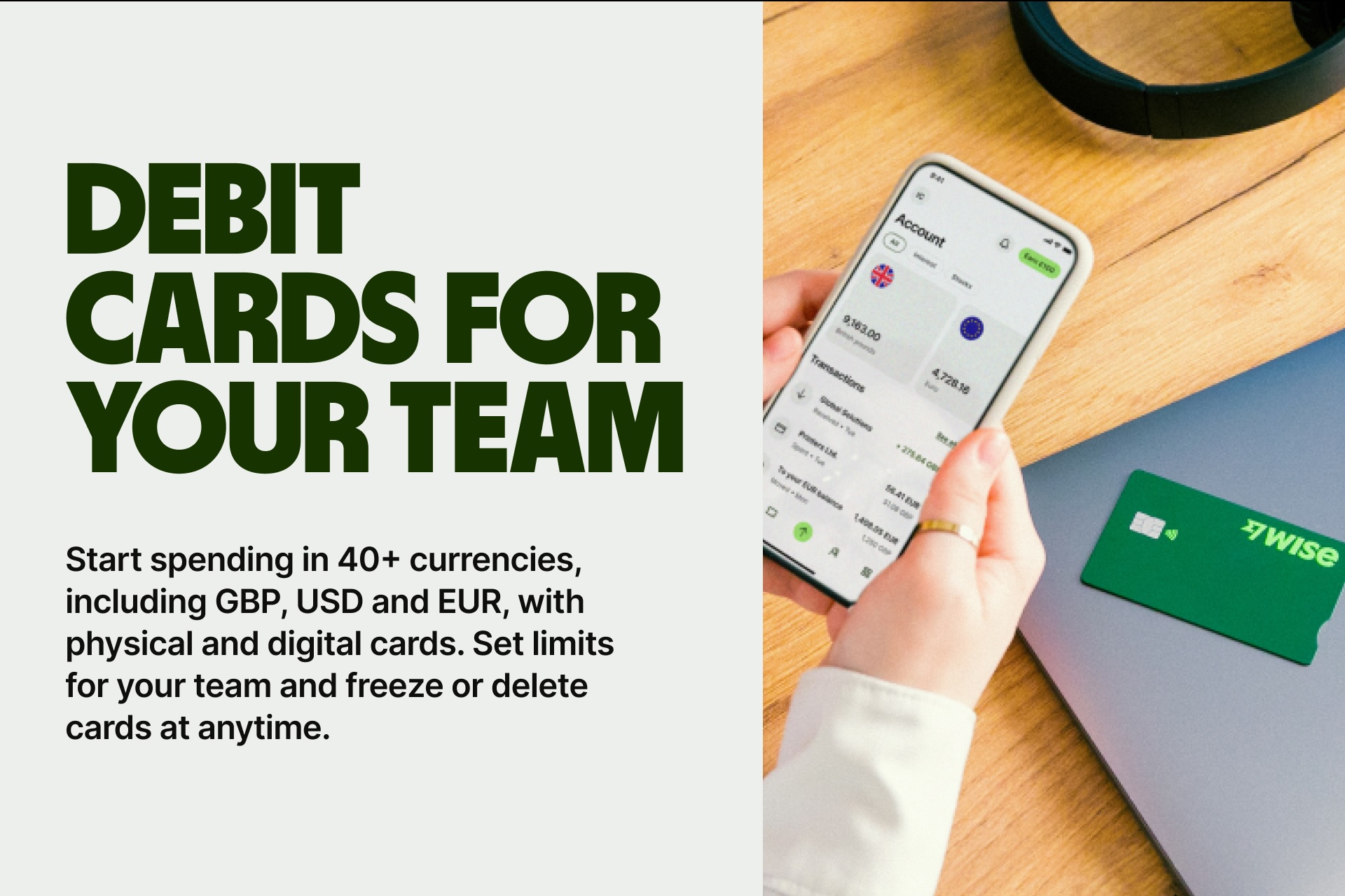

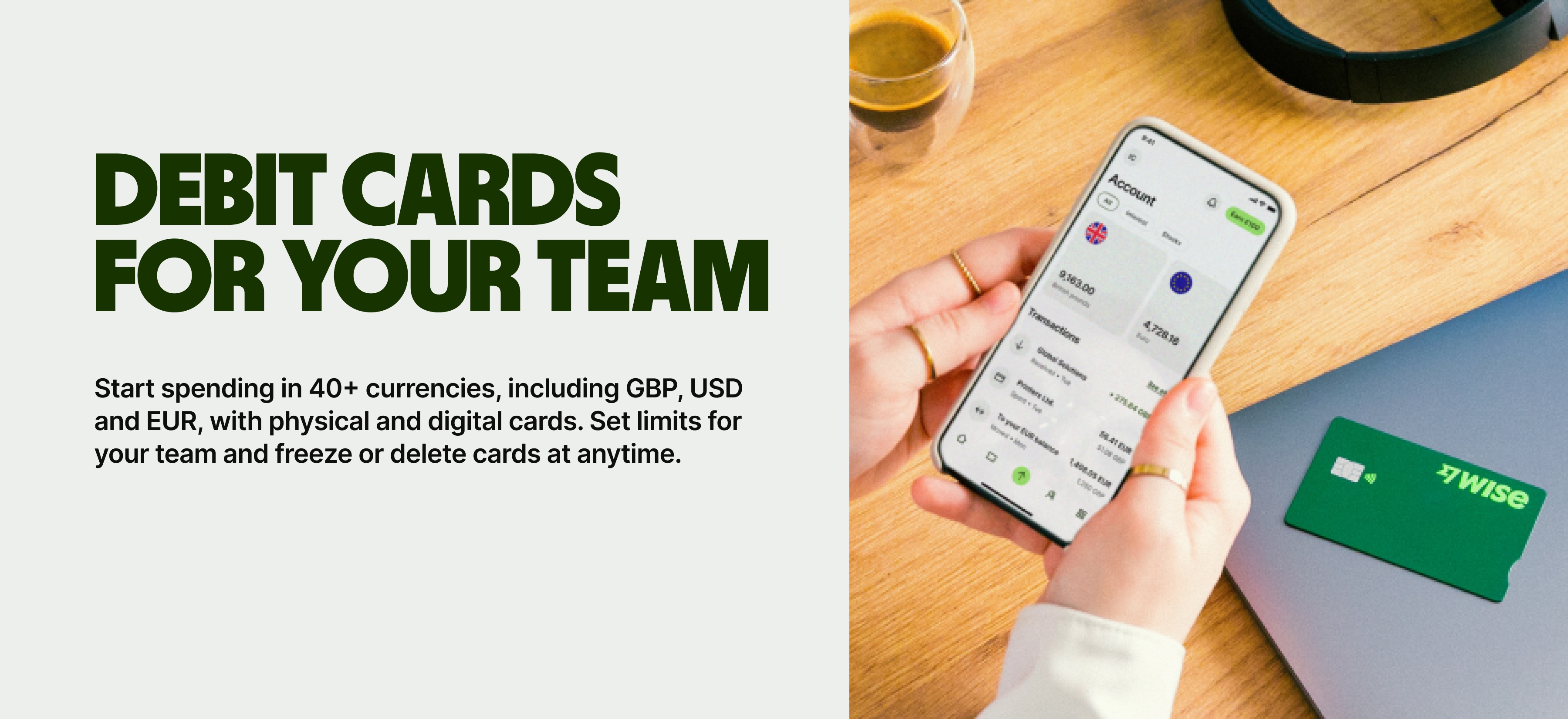

| 💡Ready to simplify your team's business spending? Give them their own Wise Business Cards and connect them to your Wise Business account. No more using personal cards for business expenditure. No more manually reconciling personal card reimbursements. Wise Business lets you monitor and approve card payments instantly. |

|---|

➡️Get your Wise Business Card today

If you’ve weighed the costs and decided RCBC’s corporate card fits your needs, here’s the application process.

You’ll need to initiate the application at the company level rather than as individual employees. Online applications aren’t available - you’ll coordinate directly with RCBC’s corporate banking division.

What you’ll need

Although no minimum employee threshold exists, businesses looking to apply for an RCBC corporate credit card must meet these requirements before starting:

You will also need to provide the following documents:

The application steps

Credit limit adjustments process within 2-3 banking days. You can pay through an Auto-Debit Arrangement from your company account or make over-the-counter transactions at any RCBC location.

RCBC’s corporate credit card does its job if you need basic expense management and mostly operate within the Philippines. The hold-out deposit structure provides security measures, and if you’re already banking with RCBC, service consolidation might make sense. The withholding tax exemption benefit under BIR RMC 72-2004 also delivers meaningful administrative savings and compliance advantages for qualifying businesses.

However, there are real downsides. Foreign transaction fees are 3.5% as standard, and annual fees multiply with additional cardholders. These ongoing expenses can significantly impact operational budgets without delivering proportional benefits. The temptation might be to try to use a personal account as a business account, but, although Wise offers both personal and business options with varying benefits, taking that approach eventually comes with new problems as businesses grow.

Wise Business does things differently.

There are no foreign transaction fees applied whether you’re subscribing to Silicon Valley software in USD or spending on business travel expenses. You always get the mid-market exchange rate with a small, transparent conversion fee starting from 0.57%.

Whether you’re managing software subscriptions or travel expenses, the right corporate payment solution significantly influences business financial efficiency. RCBC’s corporate card addresses basic requirements, but understanding available alternatives helps you make more informed decisions, matching your company’s specific needs.

➡️Get your Wise Business Card today.

Sources:

2 - RCBC - Corporate Credit Card

Sources checked on 29th September 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A practical Wise Business Card review for the Philippines covering everything MSMEs need to know about its fees, features, pros and cons.

Complete guide to Citibank's corporate credit card for Philippine businesses. Compare features, fees, benefits, and alternatives for international spending.

Complete UnionBank corporate credit card guide for Philippines businesses covering features, fees, applications, and smart alternatives.

A guide to BPI Corporate Credit Card for Philippine businesses. Learn about features, fees, applications, and discover alternatives for international spending.

Looking for a business debit card in the Philippines? We'll help you compare fees and features, plus learn a smarter way to manage international spend.

The best corporate credit cards for businesses in the Philippines that let you spend, track and manage expenses efficiently.