Best International Money Transfer Apps in the Philippines

Compare the best international money transfer apps in the Philippines. See fees, exchange rates, speed and payout options to find the right app for you.

If you’re wondering - can BPI1 receive money from overseas - we’ve got good news for you. You can use BPI to receive money from overseas in a few different ways, depending on your preferences and how the person sending you money wants to set up the payment.

Join us as we explore the topic, looking at important questions like how long does it take to receive an international wire transfer in BPI accounts, can a BPI account receive dollars, and what are the fees I pay if I receive money from abroad to BPI?

| Table of contents |

|---|

So - can BPI receive international transfers? Or are there better ways to get money from overseas through BPI?

As you’d expect with a major bank, you’ve got a few good ways to get money from someone overseas through BPI. The exact options available to you depend on the account type you hold with BPI, and whether or not your sender also holds a bank account with BPI.

Your options to receive a BPI remittance payment can include2:

We’ll look at some of these options - including the costs involved - in more detail in a moment. You can also learn more about how to receive money from overseas with BPI in the Philippines by logging into your account online or in the app and navigating to the FAQ and Help sections.

How long your remittance to BPI will take will depend on several factors, including where it’s being sent from, the currency, the value and how the sender structures the payment. If the sender also has a BPI account and uses this to remit money to BPI Philippines through a foreign tie up, you may be able to receive your payment within 24 hours3.

So, if you’re waiting for an international bank transfer to BPI, how many days is it likely to take if your sender is not with BPI themselves?

Payments sent from different banks overseas to BPI accounts, via SWIFT, are likely to take a couple of days. While this can still vary a lot, it’s common for an international SWIFT transfer to take up to 48 hours to be deposited.

If you have a BPI deposit account which can accept international remittances, the easiest option to receive a payment from overseas is to have your sender transfer the money directly to your account. BPI accounts can be in multiple currencies, including pesos or US dollars, which means your sender can choose PHP or USD for deposit, depending on which type of account you hold.

The sender will need to set up the payment with their own bank - usually online or using a mobile app, or with a third party service like Wise. All you’ll need to do is make sure they’ve got all the right details to process the transfer - usually:

Once your payment is on the way you’ll just need to sit back and wait for it to be deposited to your account - usually within 1 to 2 days.

Learn more about the BPI SWIFT code, or check if the code you have is correct with our SWIFT code finder.

The costs of sending a remittance with BPI, or of receiving a BPI remittance, can vary depending on the way the payment is arranged and routed5. Fees may be deducted by agents or other banks processing payments for cash collection or delivery, or by correspondent banks if you’re receiving a remittance via SWIFT. In either case the amount deposited to your account or made available for collection or delivery is net of fees and taxes.

Here’s a rundown of the BPI fees to receive money from abroad to BPI, assuming you get a payment sent directly to your BPI account, or you choose to collect cash in a branch:

| Remittance type | BPI receive fee6 |

|---|---|

| Credit to account - peso account | 150 PHP |

| Credit to account - dollar account | 6.5 USD |

| Bank to bank - peso (BPI as intermediary) or credit to another bank | 150 PHP |

| Bank to bank - dollar (BPI as intermediary) or credit to another bank | 10 USD |

| Branch pickup - peso | 150 PHP |

| Branch pickup - dollar | 6.5 USD |

| Direct deposit/US pension: Credit to account - peso account | 6.5 USD + 0.60 PHP in documentary stamps for every PHP 200 or fraction thereof |

| Direct deposit/US pension: Credit to account - dollar account | 6.5 USD |

The amount you can receive as an international remittance with BPI will depend on the account you hold with BPI, and also the sender’s own bank limits and processes. If you’re unsure about your own account limits you can find these by logging into BPI online or in the BPI app, and you can ask your sender to check their own limits, too. To give an example,if your sender has a BPI account, the outward remittance limit is set at 10,000 USD for online transfers7.

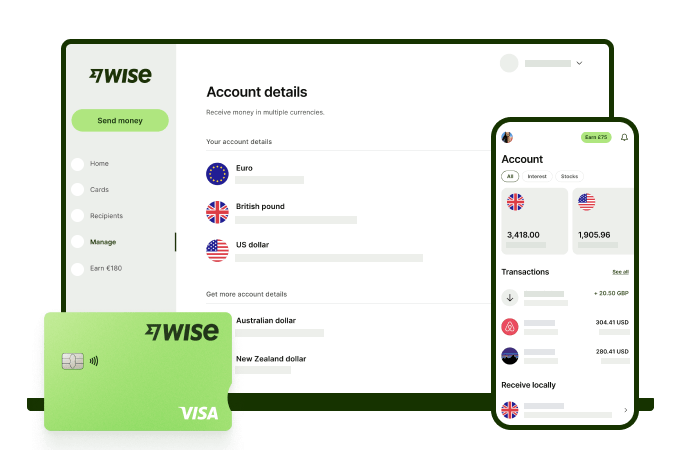

With Wise, you'll get 8+ local account details including PHP, USD, GBP, AUD, and more. This way, you can receive money directly, in a cheap and convenient manner. All you need to get started is to sign up for a free account, and you'll be able to manage your money with just a few taps of your phone.

After getting your money, you can easily convert it to 40+ currencies, with low fees, and the mid-market rate - also known as the rate you see on Google. This includes exchanging to PHP with a one-time conversion fee from 0.57% that's shown upfront, and no markups or additional fees.

Receive, exchange, and move your funds to your local bank account in PHP in a cheap and convenient manner with Wise.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Still got questions about how to receive money from overseas with BPI Philippines? Here are a couple more common questions and answers:

Generally SWIFT transfers will only be processed during banking hours - which may mean the process is paused over the weekend.

Several banks can be involved in processing a single payment - the sender’s bank, 1 to 3 correspondent banks, and BPI - so in the end the delivery time will depend on the policies of all banks, correspondents and agents involved in the particular payment. If you’re worried about a payment being delayed, reach out to BPI directly for individual support.

Yes. You can receive USD to a BPI USD account if you have one, or someone could send money to BPI for cash collection - which you can pick up in USD at a BPI branch or agent.

Receiving money from overseas with BPI shouldn’t be complicated. You might find you pay a fee, which can vary depending on how the payment is processed in the first place - but usually all you’ll need to do is give the sender your account information and wait for the money to arrive.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare the best international money transfer apps in the Philippines. See fees, exchange rates, speed and payout options to find the right app for you.

Wondering how to pay for your Atome bill using GCash? Learn more about how to make payments for your Atome card and more.

Need to send money from Paypal to GoTyme? Our 2025 guide covers the step-by-step online transfer process, fees, and processing times.

Learn how to transfer money from GCash to Wise with our detailed guide. We cover fees, processing times, verification steps, and account requirements.

Sending money from Japan to the Philippines? Learn how to transfer from SBI Remit to GCash with our guide, covering fees, exchange rates, and transfer times.

Learn how to transfer money from the eCebuana app to GCash. We cover the step-by-step process, transfer fees, and how long it takes.