Best Ways of Paying International Contractors from the UK

Learn about the best ways to pay international contractors from the UK, including Wise Business, SWIFT, and other methods to help you save on fees.

UK startups raised 9 billion GBP in 2024,¹ while American tech startups raised 209 billion USD in the same year.² More UK founders are looking west because US venture capital offers bigger checks, and a market that's four times the size of Europe's entire VC ecosystem.

This guide walks through what makes the US funding landscape different, which legal and tax structures matter most, and how to position your UK startup for American investors. When you start working with US investors and customers, Wise Business handles the cross-border payment complexity that comes with operating across two continents.

Get started with Wise Business ✍️

US venture capital firms held 311.6 billion USD in committed but undeployed capital, also known as dry powder, at the end of 2023.³ That figure represents money already promised by investors to venture funds, sitting ready to flow into startups. The UK's entire venture and private equity market raised 20.1 billion GBP that same year.⁴

Artificial intelligence startups raised 110 billion USD globally in 2024, with 42% going to US companies.⁶ Foundation models and generative AI alone pulled in 47.4 billion USD. AI startups at seed stage commanded median pre-money valuations of 17.9 million USD in the US, 42% higher than non-AI companies.⁷

Doing business in the US also gives you access to a software-as-a-service market projected to reach 221.79 billionUSD in 2025,⁸ more than ten times the UK's 19.27 billion USD.⁹ The commercial infrastructure, talent pools and customer base support global scaling at speeds smaller markets cannot sustain.

The differences start with paperwork but run much deeper. US investors operate in a market where capital is abundant and the expectations around growth are fundamentally different. Here’s what makes the US funding landscape different from the UK.

Delaware hosts 2.1 million registered businesses despite being America's second-smallest state.¹⁰ The state's Court of Chancery handles business disputes without juries, and its corporate law has centuries of precedent that investors understand inside out.

UK startups usually need to complete what's called a “Delaware flip”. You create a new parent company in Delaware that becomes the owner of your UK business. Existing shareholders swap their UK shares for Delaware stock. No money changes hands, but the whole structure inverts.

American funds push for this because investing in foreign companies triggers two tax headaches called Passive Foreign Investment Company (PFIC) and Controlled Foreign Corporation (CFC) rules.¹¹ These regulations can create punitive tax outcomes for US fund managers, so they'd rather just avoid the issue entirely.

Some investors will back UK companies directly, especially at seed stage. But as rounds get bigger and valuations climb, the Delaware requirement stops being negotiable.

Here's where it gets complicated if you've raised money in the UK using Seed Enterprise Investment Scheme (SEIS) or Enterprise Investment Scheme (EIS). Those tax relief schemes require ordinary shares and a permanent UK establishment.¹² You can flip to Delaware and keep those benefits intact, but only with HMRC pre-clearance and proper legal work.¹³ Without it, your early investors lose their tax relief. That's a tough conversation.

American investors expect convertible preferred stock with liquidation preferences, anti-dilution clauses and board seats. UK angels taking SEIS money typically get ordinary shares that sit below everyone else if the company gets sold. This isn't just terminology. US venture capital firms start with senior positions and protective rights that most British angels never negotiate for.

Then there's registration rights. US investors want the ability to force an Initial Public Offering (IPO) so they can sell shares without breaking securities law. UK companies listing on AIM or the Main Market don't need these rights because all shares get registered at once.¹⁴ It's a structural difference in how the two stock markets work.

US Series A rounds typically start at 5 million USD.¹⁵ UK Series A deals can kick off from 2 million GBP.¹⁶ More capital means faster decisions. Companies can close funding rounds in weeks rather than spending months in negotiations.

The investment philosophy differs too. US venture capitalists tolerate higher risk and expect exponential growth over steady profitability. UK funds often take a more careful approach with lower potential upside but less downside exposure. Both strategies work, but they produce different outcomes at scale.

Late-stage funding shows the gap most clearly. Only 20% of UK venture capital in 2024 went to late-stage companies, compared to 35% in America.¹⁷ Over 60% of British late-stage deals now involve overseas investors, with 42% of that money coming from the US. UK companies that want to scale past a certain point end up looking west whether they planned to or not.

| 💡 Learn more about navigating startup growth stages |

|---|

American investors want to hear about billion-dollar markets and global ambitions. The same pitch that works in a London meeting room might feel too cautious for Sand Hill Road. UK founders often need to amplify their vision and communicate like they're already thinking about international dominance, not just European expansion.

The networks matter differently too. Only about 20-25% of approaches to venture capital firms even reach the pitch stage, and a small fraction of those pitches convert to actual investment.¹⁸ So, getting warm introductions is crucial. You need someone vouching for you before you walk in the door.

Raising money in America goes beyond having a better pitch deck. You need to understand how the game works over there and adapting before you start reaching out. These strategies will help you position your startup to win funding from US investors.

Warm introductions drive most venture capital deals. Start attending US tech conferences and accelerator demo days at least six months before you plan to raise. Join founder communities like On Deck or SaaS groups where American VCs participate. When you pitch, you want someone credible vouching for you rather than your email lost in an inbox with hundreds of others.

Alumni networks open doors too. If you went to a university with strong US ties, use those connections. A Stanford grad at Sequoia is more likely to take a call from another Stanford founder. LinkedIn makes this research easy.

| 💡 Top tips to approach investors |

|---|

American investors want proof you can win in their market. 2 million GBP in UK revenue is great, but they'll ask what percentage of your customers are in North America. If the answer is zero, they'll worry whether your product fits US buyers and whether you understand American sales cycles.

Launch a US pilot before fundraising. Even 5-10 customers in Boston or San Francisco proves you've tested the market. B2B companies should close deals with American enterprises and put those logos on your pitch deck. Consumer companies need user growth in US cities with retention metrics that match your UK performance.

US venture capital firms want massive scale, but they still scrutinise the fundamentals. Your customer acquisition cost, lifetime value, gross margins and burn rate all face harder questions than you're used to in the UK. Expect investors to push on what happens when you scale to 10x current size.

If you're burning 200,000 USD monthly to generate 100,000 USD in new annual revenue, that's a problem. Know where your metrics sit and have a credible plan to improve them.

British founders often undersell themselves. The pitch that feels ambitious in London can sound cautious in Palo Alto. US investors look for companies that can return 100 times on their investment. That means billion-dollar outcomes.

You don't need to be unrealistic, but you do need to articulate how your company captures a meaningful slice of a genuinely large market. If you're targeting UK SMEs, reframe it as starting with the UK then expanding across Europe and North America. Show you're thinking about global dominance from day one, even if you're executing locally first.

| 💡 Explore how to write an elevator pitch |

|---|

Using an advisor to run your fundraising sends awful signals to US investors. They see it as proof you can't sell, can't build relationships and won't be able to hire great talent or close enterprise customers. American VCs expect the CEO to lead fundraising personally. It's a test of your ability to pitch, negotiate and convince people to bet on you.

Work with lawyers who specialise in US venture deals if you need help, or advisors who make introductions but don't carry your deck. Founders who successfully raise in the US spend 40-50% of their time on it while keeping the business running.

American investors can smell a company running out of cash. If you've got three months left and you're just approaching US funds, you're too late. Most fundraises take six months from first conversation to money in the bank. Start when you've got 12-18 months of runway remaining.

This timing lets you be selective. When you're not desperate, you can walk away from bad terms. You can find investors who actually understand your market and add value beyond capital. Raising from strength means better valuations and better partnerships.

| 💡 Read more about extending startup runway |

|---|

You've secured American investors. Now you need to move money between the UK and US without losing chunks of it to banks. Investor wires arrive in dollars, your team gets paid in pounds, and suddenly you're managing finances across two currencies with different payment systems.

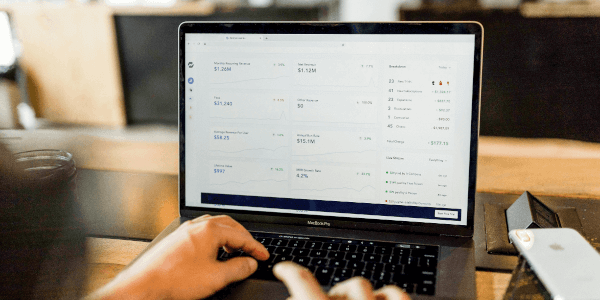

Wise Business sorts this out. Open an account for £50 (Advanced plan) or for free (Essentials plan) and hold money in 40+ currencies in one place. Send payments to over 140+ countries at the mid-market exchange rate. You see exactly what you pay in fees upfront.

Get account details in 8+ currencies so you can receive payments like a local business (only with Wise Business Advanced). When your American investors wire funds or you start invoicing US clients, the money lands directly in your USD account without conversion eating into your capital.

The Wise Business debit card works in 160+ countries and handles 40+ currencies. Your team uses it for expenses in London and San Francisco. You'll earn up to cashback on eligible spending. Connect Wise to your accounting software and your books stay clean across currencies.

Managing operations across two continents creates enough complexity. Let Wise handle the payment infrastructure while you focus on growth.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Yes. Most US investors don't require relocation, especially early on. They want to see US market traction and proof you understand American buyers. Some prefer at least one founder spending time in the States regularly, but full relocation isn't necessary for most deals.

They often see them as conservative. A £8 million UK seed valuation might be $15-20 million in Silicon Valley for similar traction. American investors price in bigger markets and faster growth, which helps if you've got US customers but means higher performance expectations.

Not at early stages. US VCs struggle with European markets and won't help much with local intros or sales cycles. Stick with European funds who know your territory. American growth investors make more sense at Series B when metrics matter more than market knowledge.

Sources used

Sources last checked: 19/12/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the best ways to pay international contractors from the UK, including Wise Business, SWIFT, and other methods to help you save on fees.

Learn the features and fees of the best online marketplaces in Asia, Europe, Africa, Australia, and America to sell your products from the UK.

Learn how to apply for an entrepreneur visa in Hong Kong. Our guide explains eligibility criteria, business plan requirements, processing times and more.

Find out how to open a business bank account in Turkey. Our guide covers all the steps involved in detail.

Some of the most successful startups of the past ten years, including Klarna, Synthesia and Mistral AI, have come out of the European tech ecosystem. However,...

Learn about the corporate tax system in Mozambique, its current rates, how to pay your dues and stay compliant, and best practices.