Opening a Branch Office in Germany: Complete Step-by-Step Guide for UK Businesses

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

Paying international contractors from the UK can be challenging - involving currency conversions, cross-border fees and compliance with both UK and local tax regulations.

To help you master the logistics of your growing venture, we’ve put this essential guide together covering the best methods to pay international contractors.

We’ve also detailed what makes Wise Business the ultimate global business account for both domestic and international use, so you can manage your business finances home and abroad with ease.

| Method | Notes |

|---|---|

| 1. Wise Business | A multi-currency account using mid-market exchange rates and local payment rails to provide fast, low-fee transfers and automated mass payouts. |

| 2. International Wire Transfers (SWIFT) | A traditional bank-to-bank network that is secure but often suffers from high intermediary fees, poor exchange rates, and slower delivery times. |

| 3. Global Payroll and EOR Platforms | Services like Deel or Remote that act as legal employers to handle local tax and compliance, offering a high-security but more expensive solution. |

| 4. Digital Wallets and P2P Platforms | Convenient tools like PayPal that are easy to set up but often lack business-grade automation and carry high withdrawal or conversion fees for contractors. |

| 5. Local Currency Rails and Global ACH | Domestic networks (like SEPA or ACH) that bypass international wire systems to move funds as domestic transfers, ensuring greater speed and predictability. |

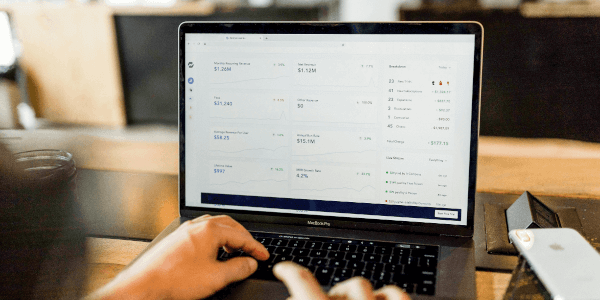

For many UK companies, Wise Business is one of the most cost-effective and flexible ways to support paying foreign independent contractors across the world.

This is because with Wise Business you get a multi-currency business account that makes sending, holding and converting money across borders easier and cheaper than traditional banks.

Other key benefits include:

Multi-currency accounting: Wise offers international payments to a wide range of countries and uses mid-market exchange rates, with low and transparent fees - meaning you can avoid hidden mark-ups that banks typically add.

Mass payouts: Wise makes bulk payments (paying lots of contractors at once) simple in just a few clicks. This makes it ideal for international contractor payroll.

Local account details: You can get dedicated bank details for 9+ major currencies (including GBP, EUR, USD, and AUD). This allows you to receive payments from overseas clients or marketplaces like a local, helping you bypass the hefty SWIFT fees usually associated with international wire transfers.

Seamless accounting integrations: Wise connects directly with popular software like Xero, QuickBooks, and FreeAgent. This automatically syncs your multi-currency activity and keeps your bookkeeping from becoming a full-time manual labor project.

Team management and expense cards: You can issue physical or virtual business debit cards to your team with pre-set spending limits. It also allows for multi-user access with customizable permission levels, so your accountant can see what they need without having the power to "accidentally" go on a shopping spree.

Whether you’re paying independent consultants, overseas contractors or remote employees, Wise Business takes away the hassle and costs commonly associated with traditional banks and other digital wallet services.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

The Wise account is not a bank account but offers some similar features and your money is safeguarded.

Instead of sending dozens of individual bank transfers, each with fees and mark-ups, Wise Business allows you to upload multiple invoices in a single batch. For example, take a UK-based digital agency with 15 contractors spread across 8 countries.

They can process all payments in EUR, USD and GBP at once. This reduces administrative overheads and with simple integration with accounting platforms like Xero and QuickBooks, Wise Business simplifies reconciliation too.

Wise Business allows you to hold balances in multiple currencies, making it easier to pay contractors in their local currency without repeated conversions.

For example, say a tech start-up in the UK is hiring developers and designers internationally. By holding all of the respective currencies, the company can pay invoices directly at the mid-market exchange rate, avoiding hidden banking fees or currency fluctuations that might reduce contractor satisfaction. This will also help the company to plan their budget with more certainty.

Unlike digital wallets, Wise Business provides contractors with local account details such as IBANs for Europe, UK sort codes and routing numbers for the US. Payments then appear as domestic transfers for the recipient, which makes it easier for them to access their funds.

This means they don’t have to withdraw from a digital wallet with limited functionality and can instead receive money directly into their bank account.

Contractors can also use Wise Business debit cards to pay for project-related costs in their local currency. UK businesses can reimburse these expenses quickly, often on the same day, avoiding delays and fees from international transfers.

All Wise Business transactions are traceable with detailed records of payments, FX rates and recipient details. For UK businesses, this makes HMRC reporting and audit preparation much simpler.

What’s more, keeping clear documentation of payments, especially in multi-currency context, can help to demonstrate compliance for tax and internal finance management purposes.

Put simply, Wise Business isn’t just a tool for sending money abroad. It’s a comprehensive payment solution that addresses speed, cost, compliance and contractor convenience.

Another option for paying overseas workers or suppliers is international wire transfers (SWIFT) through your bank. While SWIFT is a reliable network, it does have a number of drawbacks:

By contrast, Wise uses local payment networks such as SEPA in the EU or Faster Payments in the UK, as well as its own network of accounts to send money. This means it’s able to bypass SWIFT, resulting in faster and cheaper payments to contractors abroad.

Note: The claim regarding the speed of transactions depends on fund availability, approval by Wise's proprietary verification system, and systems availability of our partners' banking system. It may not be the same for all transactions.

If you’re paying international contractor payroll in a way that requires payroll compliance, you might consider a global payroll or Employer of Record (EOR) platform such as Deel, Remote or Papaya Global. These services:

However, because these platforms handle employment obligations and taxes, it means they carry the legal employer liability and can therefore be more expensive.

While they are ideal when you need a full payroll solution and want someone else to manage local compliance, Wise Business offers an alternative solution for self-managed payroll.

Wise Business is a payment infrastructure provider. It provides fast and low-fee payments but doesn’t take on employer legal responsibilities. This remains with you as the UK business if you’re engaging contractors directly.

Platforms like PayPal are sometimes used for international contractor payments due to convenience. However, they also come with drawbacks.

That’s where Wise Business comes in. With an account, you get local bank details so payments appear like local transfers to contractors, making it much easier for them to withdraw or spend.

One of Wise’s strengths lies in its use of local currency rails. These are domestic payment networks in destination countries such as SEPA in the EU, ACH in the US and Faster Payments in the UK.

These networks allow funds to move like domestic transfers rather than international wires, which can be especially useful if you’re looking to pay foreign contractors. This means they are:

Therefore, if you need to pay overseas contractors regularly or in bulk, local currency rails can be a powerful option. And, by using Wise Business, you can leverage these rails for many international payouts, often at a fraction of the cost of SWIFT.

Wise Business simplifies the complexities of paying international contractors for businesses in the UK.

Numerous features make it the ultimate international account built for both domestic and global use. With the Advanced plan*, you can hold 40+ currencies and receive payments like a local with account details in 8+ currences.

And because Wise Business offers the same-currency features of a regular business account, you can easily handle UK-based overheads while sending money to 140+ countries at the mid-market rate, with no hidden fees.

What’s more, beyond simple transfers, you can utilise batch payments to pay up to 1,000 contractors at once and sync every transaction with your favorite accounting software for a 360-degree view of your finances.

Whether you are paying a local invoice or a remote team across the globe, Wise Business provides the speed and transparency needed to scale.

Be Smart, Get Wise.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Note: This publication and the information in the answers to the questions below is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited, its subsidiaries or affiliates, and it is not intended as a substitute for obtaining business advice from a tax advisor or any other professional.

HMRC expects UK businesses to keep accurate records of all contractor payments.1 This includes invoices, contracts and proof of payment. This helps demonstrate correct classification of workers and compliance in case of an audit.

IR35 applies when a contractor might be considered an employee for tax purposes, regardless of where they’re based.3 UK businesses can use tools like HMRC’s Check Employment Status for Tax (CEST) to assess risks and document decisions.

Double taxation treaties stop individuals from being taxed twice on the same income.5 They specify where income is taxable and often provide relief options. The UK has a wide network of treaties with many countries.

SWIFT is reliable but often slow and expensive. Digital wallets are convenient but often not optimised for business payroll and may impose fees on recipients. Finally, local currency rails like Wise are often cheaper and faster because they leverage domestic networks.

Wise Business uses mid-market exchange rates with transparent fees, helping you avoid hidden mark-ups on currency conversion. With an account, you can also hold multiple currencies and use them to pay contractors at your convenience. This, again, reduces exposure to foreign exchange swings.

If your contractor is outside the UK, typically UK VAT isn’t charged on their invoices.6 But if your business receives services from a foreign contractor, you may need to apply the reverse charge for VAT accounting purposes.7

This ensures HMRC records the transaction correctly without affecting your VAT liability. Using Wise Business for payments ensures that all your invoices and transaction records are transparent and ultimately makes VAT reporting simpler and compliant.

Yes, but it does depend on the destination country. Wise Business supports a wide range of local payment networks and currencies but some countries have their own restrictions in place or longer settlement times.

This is why it’s important to check Wise’s supported countries and local banking conditions before sending any payments.

You should request a signed contract outlining the work scope and payment terms, official invoices detailing the services provided and proof of the contractor’s overseas residency for double taxation purposes.

Having this documentation alongside Wise Business transaction records will mean your business is better able to demonstrate compliance in the event you are reviewed by HMRC.

When scheduling international payments, consider the recipient’s local banking hours. Wise Business’ batch payment and scheduling features mean you can plan transfers in advance and ensure your contractors receive payments on time, even across multiple time zones.

Yes. Wise Business allows you to set up recurring batch payments, which is ideal for monthly contractor payroll. You can even set up payments in local currencies, reducing FX fees and administrative work, and integrate with your accounting system for seamless recordkeeping.

Even when you’re paying overseas contractors, who aren’t officially classed as employees, you must keep accurate records of all payments.1 What’s more, if contractors are UK tax residents, they may still be subject to UK tax rules on global earnings.2

HMRC expects businesses to maintain:

While contractors generally manage their own tax affairs, you must ensure you classify them correctly to avoid misclassification risks.

If you’re engaging individuals who operate via their own company or intermediary, you need to consider IR35, also known as off-payroll working rules in the UK.3 Ultimately, this determines whether a contractor is genuinely self-employed or should be taxed like an employee.

Key Fact ⚠️: If the client is a small business in the private sector, then it is the responsibility of the contractor’s company to determine IR35 status.

IR35 is complex, especially for international arrangements, so professional advice is often essential. Employers should keep documentation and status assessments as part of their due diligence.

When paying overseas workers, you also need to be aware that double taxation treaties (known as Double Tax Agreements) exist between the UK and many countries.5 This is to prevent income from being taxed twice.

As a UK business, you should retain evidence of the contractor’s residency and treaty position to support tax reporting.

Sources:

Sources last checked on 27th January 2026

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

Learn the features and fees of the best online marketplaces in Asia, Europe, Africa, Australia, and America to sell your products from the UK.

Learn how to apply for an entrepreneur visa in Hong Kong. Our guide explains eligibility criteria, business plan requirements, processing times and more.

Find out how to open a business bank account in Turkey. Our guide covers all the steps involved in detail.

Learn how UK startups can raise venture capital from US investors. Covers Delaware flips, pitching, legal requirements and practical fundraising tips.

Some of the most successful startups of the past ten years, including Klarna, Synthesia and Mistral AI, have come out of the European tech ecosystem. However,...