Opening a Branch Office in Germany: Complete Step-by-Step Guide for UK Businesses

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

If you’re looking to take your UK-based brand global in 2026, you’re picking a fantastic time to dive in. International ecommerce has never been more profitable for independent sellers 1.

In this guide, we’re going to walk through the 12 best online marketplaces across six continents. We’ll also shed light on specific logistics programs and fee structures that make these platforms suitable for British exporters looking to scale.

As you start reaching customers from Tokyo to Texas, the last thing you want is for high exchange rates to eat into your margins.

To make sure your international expansion stays profitable, it’s worth checking out Wise Business, which lets you receive and manage global payments with ease.

| Marketplace (Region) | Summary |

|---|---|

| Amazon (World) | Provides access to the largest global audience, allowing UK sellers to reach US customers using UK-held inventory via Remote Fulfilment with FBA. |

| eBay (World) | A household name especially strong in Australia for home and garden; its International Shipping program handles logistics, customs, and returns from a UK hub. |

| Walmart Marketplace (USA) | A curated challenger to Amazon with no monthly fees; requires a proven track record and a US return address to use its 2-day fulfilment services (WFS). |

| Zalando (Europe) | The leading gateway for fashion and lifestyle brands in Europe, offering end-to-end logistics and return handling across 25+ countries via Zalando Fulfilment. |

| Allegro (CEE) | The dominant platform in Central and Eastern Europe; it features a "One Fulfillment" program and AI tools to translate UK product listings into Polish. |

| Rakuten (Japan) | A premium "virtual mall" where UK brands can target brand-loyal Japanese consumers; requires higher upfront investment and local language support. |

| Shopee (Southeast Asia) | A mobile-first giant for the Singaporean and Malaysian middle class; handles operations and customer service for UK sellers through its SIP program. |

| Catch.com.au (Australia) | An Australian favourite for "daily deals" with a massive loyalty program; requires top-tier imagery and a strict 48-hour order acceptance window. |

| Mercado Libre (Latin America) | A single-account gateway to Mexico, Brazil, Chile, and Colombia; offers free storage for the first 4 months and automated English-to-Spanish translation. |

| Falabella / Linio (South America) | A household name in the Andean markets (Peru, Chile, Colombia) that features direct Shopify integration and zero fixed monthly subscription costs. |

| AliExpress (Asia) | A global powerhouse reaching 150 million shoppers; ideal for UK brands wanting to test cross-border and social commerce with low commission fees. |

| Takealot (South Africa) | South Africa’s largest online retailer; provides a blue-chip entry point to the region but requires local warehousing in Cape Town or Johannesburg. |

Amazon gives UK sellers access to the world’s largest eCommerce audience. This makes it a top choice for cross-border expansion - especially in the brand’s home country, the United States.

In 2026 (and beyond), Amazon’s Remote Fulfilment with FBA will allow UK sellers to reach US customers using UK-held inventory.

Yet, many still choose US-based fulfilment centres to qualify for the Prime badge and improve conversions.

Getting started is simple with your existing UK Seller Central account and a Professional Selling Plan:

Recommended reading: How to sell amazon

💡 You’ll also need a US-based return address, which usually means working with a local partner or 3PL provider for returns and logistics.

Instead, you can use Wise Business to get a local USD account number. It allows you to receive your payouts like a US resident and convert them back to GBP at the mid-market rate.

eBay remains a household name in many parts of the world. We’ve spoken about other areas of the world so we’ll mention Australia in particular here, given eBay Australia often outperforms Amazon in Australia specific niches like home, garden, and collectables.

Their eBay International Shipping program (the evolution of their Global Shipping Programme) helps UK sellers handle long-haul logistics with ease.

You simply ship the item to a UK hub, and the platform handles international leg, customs, and even returns.

Fees are standard. The breakdown is as follows:

Recommended reading: How to sell eBay

💡 One issue is that, while logistics are handled for you, Australian customers still expect relatively quick delivery times, so keep your “dispatch time” sharp. Payouts will be credited to your account in Australian Dollars (AUD).

By linking your Wise Business AUD account details, you can receive these funds without the conversion fee eBay often applies to international bank accounts.

Walmart is the primary challenger to Amazon’s crown in the US, and for UK exporters, it offers a slightly more curated environment.

In 2026, their Walmart Fulfilment Services (WFS) is the star feature, offering 2-day shipping that helps you compete with local giants. The cherry on top is that:

To list here, you’ll apply using your UK company details and a W-8 form 8. The catch is that Walmart is a bit pickier than Amazon. They want to see that you have a proven track record of selling online first.

💡 You’ll also need a US return address and a US-domiciled bank account for payouts. This is where Wise Business can be a lifesaver.

You can use your Wise USD account details to meet this requirement and receive your US earnings without paying hidden fees when moving profits back home.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Zalando is the definitive gateway to Europe for UK fashion and lifestyle brands. They’ve made life much easier post-Brexit with Zalando Fulfilment Solutions (ZFS). They handle all the complex EU-wide logistics and returns for you across 25+ countries 9.

In return, you’ll pay:

Listing requires joining their Partner Program, where they’ll check your brand for quality and sustainability. The main requirements here are an EU VAT number (via the OSS scheme) and a valid EU return address.

💡 Since Zalando pays out in Euros (EUR), having a Wise Business EUR account lets you receive your sales revenue directly, without a forced conversion. This gives you total control over when you swap your EUR back into GBP.

If you want to avoid the hyper-competitive markets of Germany or France, Allegro is your best bet. Dominating the Polish market, it’s now the biggest marketplace in Central and Eastern Europe.

They offer a “One Fulfillment” program that is perfect for UK sellers looking for a hands-off approach to Eastern European shipping 11.

Fee structures are also quite friendly:

You can list using your UK business documents. Allegro even provides AI-powered tools to translate your listings into Polish. One caveat is that, while Poland is a high-growth market, price competition can be fierce here.

💡 Payouts are in Polish Złoty (PLN), which can be expensive to convert through high-street banks. By using Wise Business, you can hold your PLN and exchange it into GBP whenever you want at the mid-market exchange rate, with no hidden fees.

Japan is the world’s fourth-largest e-commerce market. For UK brands, it can be the best online marketplace to sell online if you’re targeting quality-focused, brand-loyal customers.

Japanese consumers place substantial value on “Made in the UK” products, particularly in categories like beauty, fashion, food, and lifestyle.

Rakuten Ichiba, Japan’s leading platform, operates like a virtual shopping mall. It gives sellers complete control over storefront design and branding.

The easiest entry point for UK businesses is to work with a Rakuten Service Partner. It manages Japanese-language listings, customer support, and ongoing page updates.

The platform requires a higher upfront investment than many global marketplaces, including 13:

You’ll also need Japanese-language customer service and a Creditsafe or D-U-N-S report to pass Rakuten’s strict onboarding 14.

💡 When you’re ready to bring your profits home, Wise Business can be a good option. You can use your Japanese Yen (JPY) account details to receive payouts directly at the mid-market exchange rate, with no hidden fees.

If you want to reach the fast-growing middle class in Singapore, Malaysia, and Thailand, Shopee is the mobile-first giant you need. Their Shopee International Platform (SIP) is designed explicitly for cross-border sellers.

You essentially list your products, ship them to a regional Shopee hub, and they handle the rest (including overseas store operations and customer service).

Shopee is very beginner-friendly, with no account-opening fees. As of 2026, they have introduced the following costs 15:

💡One thing to keep in mind is that Southeast Asia is a price-sensitive market, so lightweight, high-volume goods often perform best.

Payouts are usually made in local currencies, such as Singapore Dollars (SGD) or Malaysian Ringgit (MYR).

With Wise Business, you can hold these local currencies in a single account. It allows you to remit your profits back to the UK at the mid-market exchange rate, saving money by not paying hidden exchange fees.

Catch is a homegrown Australian favourite known for its “daily deals” and massive loyalty program, Club Catch. It’s an excellent alternative for UK brands that want high visibility without the intense competition of Amazon.

To sell here, you’ll need to apply to become a Catch Seller, and they generally look for businesses with a track record of good customer service.

The fee structure is:

Unlike eBay, Catch is more of a closed marketplace, so the quality of your listings and images needs to be top-tier to be accepted. You will also need to ensure you can meet their strict 48-hour order acceptance window.

💡 Catch only pays out into local Australian accounts, which is precisely where Wise Business comes in.

You can use your Wise AUD BSB and account number to get paid like a local, then move that money back to the UK with total transparency on fees.

The Wise account is not a bank account but offers some similar features and your money is safeguarded.

If you want to enter Latin America, Mercado Libre is the undisputed starting point. Their Global Selling Program is perfect for UK brands because it lets you manage sales in Mexico, Brazil, Chile, and Colombia from a single account.

Much like choosing the best online marketplace in China means following local buying habits, Mercado Libre sits at the cultural and commercial centre of South American e-commerce.

Also, listing on this platform is free, and you only pay a commission once you make a sale.

💡 When it’s time to get paid, Mercado Libre typically settles in USD. You can use your Wise Business USD account details to receive these funds directly. It lets you get your money back to the UK at the mid-market exchange rate.

Falabella is practically a household name across South America, and by integrating the Linio marketplace, they’ve created a massive gateway into the Andean markets of Chile, Peru, and Colombia.

If you’re a UK brand in the electronics, home, or fashion sectors, this platform should be your top priority because they’ve built an infrastructure that is incredibly cross-border friendly.

Here’s what you should know about their pricing plans:

The logistics model is also quite simple. You ship your goods to a central international hub, and Falabella handles all the local delivery, duties, and taxes for you.

You will need a registered business and a reliable supply chain to join, but they offer a direct Shopify integration to make syncing your UK store effortless.

💡 Payouts to international partners are often handled in USD. This means that you can link your Wise Business account to receive your South American revenue and remit it back to the UK at the mid-market exchange rate.

To round out the list with a powerhouse from Asia, AliExpress is an essential mention. Even though many people see it only as a buying platform, its seller ecosystem has evolved into a global gateway for UK businesses targeting over 150 million active shoppers across 200+ countries 20.

It’s especially appealing if you want to test cross-border and social commerce without the heavy upfront investment seen on other platforms.

Much like finding the best online marketplace in China requires staying on top of fast-moving trends and high-volume demand, success on AliExpress depends on spotting what’s gaining global traction. Its primary fees and costs include 21:

On the logistics side, sellers can use Cainiao. It’s AliExpress’s official shipping network, or their own 3PL. Know that it often settles its international payouts in USD or EUR.

💡 When you link your Wise Business account details, you can receive these funds like a local and avoid the platform’s high currency conversion fees. This lets you remit your global profits back to the UK at the real mid-market rate.

Takealot is South Africa’s largest online retailer and offers a blue-chip entry point into the continent’s most developed economy. It is known for its premium audience and high customer loyalty, making it an ideal fit for established UK brands.

To sell here, the key fees include:

Their fulfilment model requires you to use Takealot’s own delivery network and store your stock in their local warehouses in Cape Town or Johannesburg.

While you generally need a South African business entity or a local partner to register, the access to their massive Prime-like customer base is significant.

💡Payouts are made in South African Rand (ZAR), and because this currency can be expensive to transfer through traditional banks, using Wise Business to receive and hold Rand lets you bypass the hidden fees associated with high-street banks.

Using Wise Business is a strategic move for ecommerce sellers looking to streamline their international and domestic operations.

While it works seamlessly for local needs, you can also hold balances in 40+ currencies and send money to 140+ countries to pay global suppliers at the mid-market rate.

The account functions effectively as a primary business hub - you can receive payments like a local with 8+ local account details, allowing you to handle domestic GBP transactions or pull earnings from marketplaces like Amazon without the typical bank hassle.

And to keep your financial admin organised, you can sync with accounting software like Xero or QuickBooks, ensuring every sale and expense is reconciled instantly.

Whether you are paying local tax bills or international contractors, Wise Business provides the tools to manage your cash flow with total transparency.

Be Smart, Get Wise.

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

It depends on where your stock is held. If you use a fulfilment service like FBA (Amazon) or ZFS (Zalando) and store your products in an EU warehouse, you generally need to register for VAT in that specific country.

However, for direct exports from the UK to EU customers, you can often use the Import One-Stop Shop (IOSS) scheme to simplify VAT collection. Always consult a tax specialist in this regard.

Note: This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited, its subsidiaries or affiliates, and it is not intended as a substitute for obtaining business advice from a tax advisor or any other professional.

Technically, some platforms allow it, but it is rarely the best financial move. Marketplaces often use their own internal exchange rates, which can be 3% to 4% higher than the real mid-market rate.

Additionally, traditional UK banks may charge receiving fees for foreign wire transfers. Using a Wise Business account lets you receive these funds to your local account details (like an IBAN or Routing Number), avoiding hidden conversion costs.

The best online marketplace in Dubai is currently a tie between Amazon.ae and Noon.com.

While Amazon offers the familiar FBA infrastructure that UK sellers love, Noon is a homegrown super-app with massive local loyalty across the UAE and Saudi Arabia.

Given that global e-commerce sales are projected to exceed $6.8 trillion by 2028 2, the opportunities for British exporters are vast. But the landscape has become more sophisticated. Many factors now drive international trade. For instance:

Sources:

Sources last checked on 26th January 2026

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

Learn about the best ways to pay international contractors from the UK, including Wise Business, SWIFT, and other methods to help you save on fees.

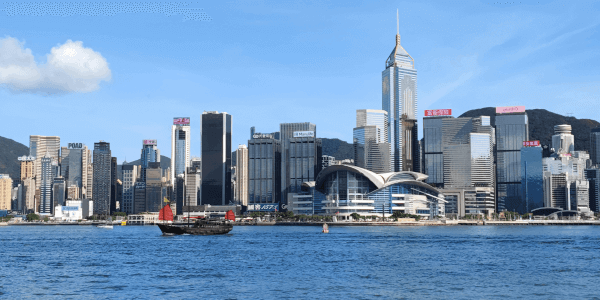

Learn how to apply for an entrepreneur visa in Hong Kong. Our guide explains eligibility criteria, business plan requirements, processing times and more.

Find out how to open a business bank account in Turkey. Our guide covers all the steps involved in detail.

Learn how UK startups can raise venture capital from US investors. Covers Delaware flips, pitching, legal requirements and practical fundraising tips.

Some of the most successful startups of the past ten years, including Klarna, Synthesia and Mistral AI, have come out of the European tech ecosystem. However,...