Opening a Branch Office in Germany: Complete Step-by-Step Guide for UK Businesses

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

Are you considering expanding your business operations to Mozambique? Understanding the country's corporate tax landscape is crucial for making informed decisions about your investment and ensuring compliance with local regulations.

Mozambique offers significant opportunities for international businesses, particularly in sectors like natural gas, agriculture, and mining. However, navigating the corporate tax system requires careful planning and understanding of local requirements. With the right approach and financial tools, you can establish a successful presence in this growing African market.

Wise Business can help streamline your international operations in Mozambique by providing local currency accounts and cost-effective cross-border payment solutions, making it easier to manage your tax obligations and business expenses.

💡 Learn more about Wise Business

This publication is provided for general information purposes and does not constitute legal, tax, or other professional advice from Wise Payments Limited, its subsidiaries or affiliates, and it is not intended as a substitute for obtaining business advice from a tax advisor or any other professional.

The standard corporate income tax rate in Mozambique is 32% for companies. This rate applies to both resident and non-resident companies operating in the country.1 Companies in the extractive industries, including oil and gas operations, are subject to additional petroleum taxes and royalties on top of the standard corporate tax rate.2

Mozambique also offers various tax incentives for investments in priority sectors and regions. The Investment Promotion Law provides for reduced corporate tax rates of 10% for the first five years of operation for qualifying investments, particularly in manufacturing, agriculture, tourism, and infrastructure development.3

The country operates a territorial tax system for certain types of income, meaning that Mozambican companies are primarily taxed on income derived from sources within Mozambique, though this can vary depending on the specific circumstances and applicable tax treaties.4

Corporate tax payments in Mozambique are administered by the Tax Authority (Autoridade Tributária - AT), which operates an electronic filing and payment system called e-Tributação. All companies must register with AT and obtain a tax identification number (NUIT) before commencing operations.5

Companies are required to file annual corporate income tax returns (Modelo 101 or Modelo 22) by 31 May of the year following the tax year. The tax year in Mozambique typically runs from 1 January to 31 December, though companies can apply for different accounting periods with AT approval.6

Advance payments are required in three annual installments, calculated based on either 80% of the preceding year's CIT (due May, July, and September) or a Special Advance Payment based on 0.5% of the preceding year's turnover (due June, August, and October), subject to a minimum of MZN 30,000 and a maximum of MZN 100,000.6 Late payment of corporate taxes can incur penalties and interest charges.7

Let's calculate the tax liability for a company with annual turnover of 1.5 million USD (approximately 96 million meticais at current exchange rates). Assuming a profit margin of 10%, the taxable profit would be 9.6 million meticais.

At Mozambique's standard corporate tax rate of 32%, the tax owed would be:

9.6 million MZN × 32% = 3.072 million MZN (approximately USD 48,000)

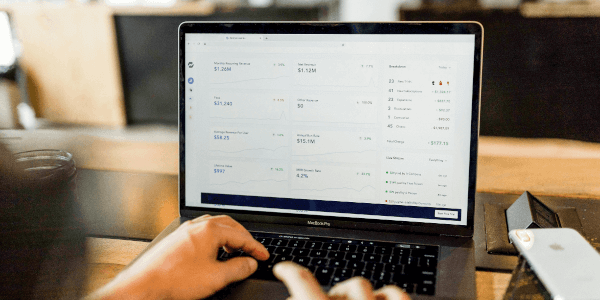

When expanding your business to Mozambique, the right financial tools will make the process smoother. Using a platform like Wise Business makes it easy to manage international finances. A multi-currency account allows businesses to pay for incorporation costs, registration fees, and government taxes in local currency without paying high exchange rate fees.

Get started with Wise Business 🚀

Some essential steps to help your company stay compliant with Mozambique’s tax regulations:8 9

Mozambique recently gained attention from international investors with its rich natural resources, strategic location, and growing consumer market. Situated on the southeastern coast of Africa, it borders six nations and serves as an entry point for the Southern African Development Community (SADC). Its ports, railways, and pipelines provide landlocked countries with reliable access to global markets, making Mozambique a natural trade hub.10

Natural resources, mining, and energy drive the economy in this country. Coal remains the largest export, complemented by significant rubies, aluminium, cobalt, graphite, and titanium reserves.11 Mozambique also hosts the world’s largest graphite mine and ranks as Africa’s third-largest holder of liquefied natural gas reserves, estimated at 180 trillion cubic feet.12

According to UNCTAD’s World Investment Report 2024, foreign direct investment inflows reached USD 2.5 billion in 2023, bringing the total stock of inward FDI to USD 57.28 billion, equal to around 268% of GDP.12 The government continues to strengthen fiscal and governance reforms under a three-year, USD 456 million IMF program, designed to enhance public resource management and promote transparency.11

Moreover, the USD 537.5 million “Connectivity and Coastal Resilience Compact” with the Millennium Challenge Corporation aims to improve transport, climate resilience, and business-enabling reforms.11 Such programs create a stable platform for investors who must also focus on corporate tax compliance. Understanding the Mozambique corporate tax rate and the processes for income tax filing or a potential corporate tax refund forms a key part of practical corporate tax accounting when entering this market.

A growing young population, nearly 65% under 25, adds to Mozambique’s potential.12 This is supported by fertile agricultural land, a tropical climate, and vast arable resources, which make Mozambique one of Africa’s most dynamic investment destinations.

Steps for starting a business in Mozambique are:13

These steps help businesses stay compliant and manage corporate tax effectively. Setting up in Mozambique also opens doors to wider international expansion across Southern Africa.

To incorporate a business in Mozambique, you must complete the registration process through the Conservatória do Registo das Entidades Legais (Legal Entities Registry). The process involves several steps designed to ensure legal compliance and alignment with Mozambique’s corporate tax policy:14 15

The Mozambique Commercial Code (Decree Law No. 1/2022) regulates the main types of entities:16 17

Managing corporate tax obligations across multiple jurisdictions requires a strategic approach that balances compliance with efficiency. Companies operating internationally should maintain robust documentation and ensure they understand the tax implications of their global structure.

Establishing clear transfer pricing policies is crucial when operating in Mozambique, particularly for companies with related-party transactions. The country follows OECD guidelines on transfer pricing, requiring arm's length pricing for intercompany transactions. Proper documentation can help avoid disputes and ensure compliance with local regulations.

Consider the benefits of Mozambique's double taxation agreements (DTAs) with various countries, including Portugal, South Africa, and several other nations. These agreements can help reduce withholding taxes on dividends, royalties, and interest payments, potentially lowering your overall tax burden while ensuring compliance with international standards.

Maintaining accurate financial records in both local currency and your functional currency is essential for tax compliance and business management. Regular reconciliation and proper documentation of foreign exchange transactions will help during tax audits and ensure accurate reporting to both local and home country tax authorities.

Researching corporate tax is a crucial step when expanding your business into a new country. The next step is setting up the financial infrastructure to handle the complexities of operating across borders, from managing multi-currency cash flow to mitigating FX risk.

The Wise Business account provides the financial tools to make your international expansion to Mozambique efficient and simple. It's the one account for managing your money globally.

With a Wise Business account, you can:

Pay suppliers and initial fees: Pay suppliers, global payroll, and one-off incorporation costs in the local currency.

Get paid like a local: Use local account details for 8+ major currencies to easily receive payments from customers or investors.

Manage your money across borders: Hold and exchange 40+ currencies in one account, always with the mid-market exchange rate and low, transparent fees.

Streamline your accounting: Integrate with tools like Xero or QuickBooks to simplify tracking your company's international finances.

Empower your team: Provide multi-user access for your finance team and issue expense cards for international spending.

Wise is designed to support every step of your journey, from paying your first registration fee to receiving international payments and managing your global treasury.

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

All companies incorporated in Mozambique are liable for corporate income tax on their worldwide income. Non-resident companies are subject to tax only on Mozambican-source income, including income from permanent establishments, rental income from Mozambican property, and capital gains from the disposal of Mozambican assets.

Yes, Mozambique offers several tax incentives through its Investment Promotion Law. Qualifying investments can benefit from reduced corporate tax rates of 10% for the first five years, accelerated depreciation allowances, and exemptions from customs duties on imported equipment. Special economic zones and industrial free zones offer additional incentives, including extended tax holidays and reduced rates.

Dividends paid by Mozambican companies to residents are generally exempt from withholding tax. However, dividends paid to non-residents are subject to withholding tax at rates ranging from 10% to 20%, depending on the applicable double taxation agreement. The standard rate is 20% for countries without a DTA.

Companies must register with the Tax Authority (AT) to obtain a tax identification number (NUIT) before commencing operations. This process involves submitting incorporation documents, proof of address, and details of business activities. Registration can be completed online through the e-Tributação platform or at AT offices. The process typically takes 5-10 business days.

Common pitfalls include failing to register for tax obligations before starting operations, inadequate record-keeping in local currency, missing quarterly advance payment deadlines, and not properly documenting transfer pricing policies. Companies should also ensure they understand the distinction between the simplified tax regime and standard corporate tax to avoid applying incorrect rates.

Sources used in this article:

Sources last checked 24/10/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

Learn about the best ways to pay international contractors from the UK, including Wise Business, SWIFT, and other methods to help you save on fees.

Learn the features and fees of the best online marketplaces in Asia, Europe, Africa, Australia, and America to sell your products from the UK.

Learn how to apply for an entrepreneur visa in Hong Kong. Our guide explains eligibility criteria, business plan requirements, processing times and more.

Find out how to open a business bank account in Turkey. Our guide covers all the steps involved in detail.

Learn how UK startups can raise venture capital from US investors. Covers Delaware flips, pitching, legal requirements and practical fundraising tips.