How to Open a Bank Account for Work Permit Holders in Singapore

Learn how work permit holders in Singapore can open a bank account, including requirements, options, and how to receive salary payments.

Sending money overseas or spending abroad shouldn't cost you a fortune in hidden fees and poor exchange rates. If you're looking for a smarter way to manage your money across borders, you've likely come across Wise and Revolut, two of the most popular multi-currency account options available in Singapore.

Both are regulated by the Monetary Authority of Singapore (MAS) as Major Payment Institutions, and both offer multi-currency accounts with linked debit cards. But which one is right for you?

In this updated guide, we'll compare Wise vs Revolut on fees, exchange rates, cards, and features to help you make an informed choice.

Revolut was founded in 2015 in the UK and launched in Singapore in 2019. They offer a multi-currency account with features including debit cards, budgeting tools, crypto trading, stock investing, and travel perks like eSIMs and insurance. In Singapore, Revolut offers three plan tiers: Standard (free), Premium, and Metal.

For a deeper look at Revolut's business offerings, check out our Revolut Business Singapore review.

Yes, Revolut is safe to use in Singapore. Revolut Technologies Singapore Pte Ltd is regulated by MAS as a Major Payment Institution under the Payment Services Act. The company also holds licences from regulators in other markets and employs robust anti-fraud measures.

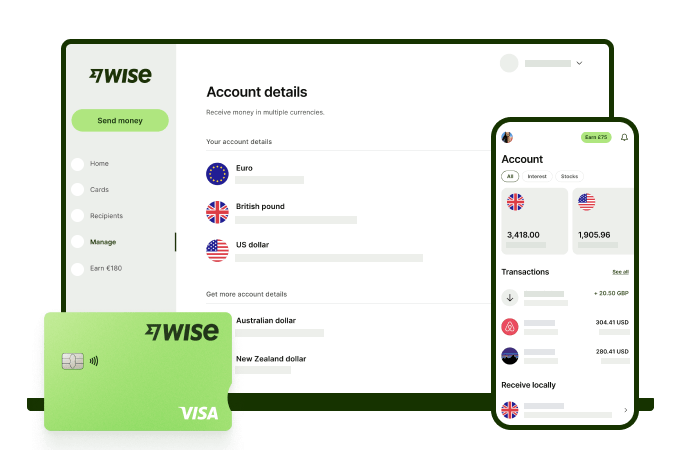

Wise was founded in 2011, originally as TransferWise, with a mission to make international money transfers cheaper and more transparent. The company rebranded to Wise in 2021.

Today, Wise serves over 16 million customers worldwide and has expanded beyond transfers to offer multi-currency accounts where you can hold and exchange 40+ currencies. Wise is known for using the mid-market exchange rate — the same rate you see on Google — combined with low, transparent fees.

Wise is safe to use in Singapore. Like Revolut, Wise is regulated by MAS - and also other global bodies around the world like the FCA in the UK, and FinCEN in the US. Both Wise and Revolut also offer a broad range of manual and automatic anti-fraud measures which run 24/7 to keep customers and their money safe.

On with the Wise vs Revolut review. First we’ll look at a broad comparison of the different features available from each provider, with a focus on personal accounts. Then we’ll look in more detail at a few key service areas.

| Feature | Revolut | Wise |

|---|---|---|

| Eligibility | Residents of selected countries and regions (including Singapore, UK, US, Australia, Japan, Switzerland, EEA) | Residents of most countries worldwide |

| Currencies you can hold | 30+ | Hold and exchange 40+ currencies |

| Local account details | SWIFT account details | Local account details for 8+ currencies (including SGD, USD, EUR, GBP, AUD) |

| Account opening fee | Free | Free |

| Monthly fee | Standard plan: Free; paid plans up to S$19.99/month | Free |

| Debit card | Available, no fee | Available, 8.50 SGD one-time fee |

| ATM withdrawals | Free up to S$350/month or 5 withdrawals (Standard plan). Then, 2% or S$1.49 (whichever is higher) | 2 free withdrawals/month up to S$350. Then S$1.50 + 1.75% per withdrawal |

| Exchange rate | Revolut rate (weekend markup may apply) | Mid-market rate |

| Weekend FX markup | Yes (typically ~1%) | None |

| Conversion fees | Included up to plan limits, then fair usage fees apply | From 0.33% |

| International transfers | Variable fees depending on currency and amount | From 0.33% |

| Investing / interest | Trading and investing features available | Interest-bearing account available |

| Business account | Available | Available |

One of the key services people may choose an online multi-currency account for is international payments. With both Wise and Revolut you can send money to other account holders, or to bank accounts around the world held in different currencies. However, the way each provider works is a little different.

Wise uses the mid-market exchange rate at all times. This is the midpoint between buy and sell rates on global currency markets, the same rate you'd find on Google. Wise then charges a low transfer fee from 0.33% which can vary based on the currencies and countries involved.

Revolut on the other hand, offers currency exchange with no additional fees within market hours, with limits to the amount you can convert based on your account plan. If you exhaust your limit, Standard customers pay 1% fair usage fees, while Premium customers pay 0.5%. If you’re exchanging currencies when markets are closed there’s a fee of 1% in addition to this. Finally, there’s also a transfer fee, which is variable and depends on the currency you’re sending and the delivery method. Here’s a summary:

| Feature | Revolut | Wise |

|---|---|---|

| Exchange rate used | Revolut exchange rates (interbank during market hours) | Mid-market exchange rate |

| Currency conversion cost |

| From 0.33%, shown upfront before you confirm the conversion |

| International transfer fee |

| Low, transparent fee that varies by destination and amount |

Neither Wise or Revolut is a bank - but both providers offer flexible accounts with a great range of features, which can be really handy to hold, receive and spend in foreign currencies.

Wise offers local account details you can use to get paid from abroad in a selection of currencies - often with no fees. Revolut also has SWIFT details which others can use to pay you - with SWIFT, intermediary fees can sometimes be deducted which may reduce the amount you get in the end. Both providers also have cards for convenient payments on and offline, with no extra fee to spend a currency you hold in your account already.

One point to note, though, is that neither account allows ATM withdrawals in Singapore - although as cash is so seldom used these days, that may prove no issue at all.

Here’s a rundown of the features of each when it comes to receiving, holding and spending money.

| Revolut | Wise | |

|---|---|---|

| Currencies you can hold | 30+ | 40+ |

| Ongoing fees | Up to 19.99 SGD | None |

| Card order fees | None | 8.5 SGD |

| Spend | No fee to spend a currency you hold No fee for weekday currency conversion to plan limit - fair usage and out of hours fees may apply depending on account type and usage | No fee to spend a currency you hold Currency conversion from 0.33% |

| Receive payments | Receive with SWIFT details in select currencies | Receive with local account details in 8+ currencies, with SWIFT details for other currency payments |

Learn more from our in-depth Revolut vs Youtrip vs Wise comparison.

Both Wise and Revolut offer business services, with accounts which offer multi-currency functionality and business debit cards.

Wise Business accounts have a low one time fee for full feature access, and can then be used to hold and exchange 40+ currencies with the mid-market rate, spend payments and more. As well as the features available to personal customers, Wise offers business customers handy extras like batch payment options, cloud accounting integrations and a powerful API for streamlining workflow.

Revolut Business3 offers 4 different plans in Singapore, from a basic plan with no fee, to a higher end option with costs of over 400 SGD a month. This allows you to pick the option which works best for your size and type of company. Here’s a brief comparison of Wise vs Revolut on business features.

| Wise Business | Revolut Business |

|---|---|

|

|

For a deeper dive into Revolut Business, read our review here.

Both Wise and Revolut offer linked debit cards for spending abroad and at home.

| Feature | Wise Card | Revolut Card |

|---|---|---|

| Card availability | Physical and virtual cards | Physical and virtual cards |

| Card fee | One-time fee | Free on Standard plan |

| Spending in held currency | Free in 40+ supported currencies | Free |

| Currency conversion | From 0.26% when you don’t hold the currency | Depends on plan and timing; fair usage fees may apply |

Both cards allow you to spend currencies you already hold in your account with no additional fees. When you spend in a currency you don't hold, conversion fees apply, and with Revolut, weekend markups may also apply.

Let’s wrap up our Wise vs Revolut review. Which one is best for you may simply come down to the features you need and how you expect to use your account.

Revolut Singapore offers a range of fee-paid account plans which you can use to unlock higher transaction limits and extra perks. There’s also Revolut cashback on card spending if you’re a Metal account holder. However, if you’re more interested in an account with no monthly fee, it’s worth comparing the Revolut standard plan against the Wise account.

Some features from Revolut - like the Revolut virtual card - are only available on the fee paid plans, while Wise offers all its account features, including virtual cards, with no ongoing charges. Depending on where you’re sending to, the Revolut transfer to bank account fee may also work out to be higher than the equivalent with Wise.

When it comes to travel, Wise may be the better option for weekend trips or spending outside market hours, as it uses the same mid-market exchange rate every day with no weekend markup. Revolut applies a 1% markup on weekend currency conversions, which can increase costs. Both cards are widely accepted in over 150 countries and include a monthly allowance for free ATM withdrawals abroad, after which fees apply.

Use this guide as a starting point to do your own research into both Wise and Revolut - and pick the perfect match for your needs.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how work permit holders in Singapore can open a bank account, including requirements, options, and how to receive salary payments.

Review the GXS Savings Account in Singapore, including interest rates, features, pros and cons, and whether it’s worth opening in 2026.

A detailed review of the Trust Savings Account in Singapore, covering interest rates, plans, fees, rewards, and who it’s best for.

A detailed review of the Mari Savings Account, including interest rates, fees, limits, cards, transfers, and how to open an account in Singapore.

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

Comparing GXS and Trust? Read on to find out what a digital bank is, compare features, interest rates, and understand their exchange rates