How to Open a Bank Account for Work Permit Holders in Singapore

Learn how work permit holders in Singapore can open a bank account, including requirements, options, and how to receive salary payments.

Open to residents with a registered address in the following countries: United States of America, Singapore, Malaysia, Australia or New Zealand.

MariBank¹ is a licensed digital bank in Singapore which is owned by the group behind Shopee. MariBank offers several great products for Singapore residents, including the Mari Savings Account². This MariBank review focuses on the savings account features, fees, and limits - and also looks at how to get started and how to top up a Mari Savings Account once you have one.

We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

The Mari Savings Account is a digital high-interest account which pays out daily interest.

You can get a Mari debit card with your account, which lets you access your money instantly to make payments online and in stores, and you can also send local and international transfers right from your account. Manage your transactions from the MariBank app to keep things simple, with no need to go to a branch to make a payment.

Let’s dive into our full Mari Savings Account Review to learn more.

The Mari Savings Account interest rate is variable, with the following rate available at the time of research (21st November 2025)³.

Interest is paid daily and calculated based on the account balance from the previous day. There are very few fees associated with the Mari Savings Account, but there are important limits to know about. The maximum amount you can hold across all your Mari Bank accounts, including both the savings account and any fixed deposit account you open, is 100,000 SGD.

There are also transfer limits for some transfer types, including overseas transfers, which start at 500 SGD per payment.

Here’s a quick overview of the key features, fees, and limits you should know about before opening a Mari Savings Account.

| Feature | Mari Savings Account |

|---|---|

| Account opening fee | No fee |

| Account maintenance fee | No fee |

| Account maximum balance limit | S$100,000 total across all Mari accounts |

| Overseas transfer limits | S$500 – S$150,000 |

| Ways to transfer into account |

|

| Ways to transfer out of account |

|

| Transfer fees |

|

| Card availability |

|

| Card perks |

|

| Card fees |

|

*Correct at time of research - 21st November 2025

You can open a Mari Savings Account in Singapore using just your phone, with no need to go to a bank branch. Here’s what to do:

Applications are verified in 1 - 5 days, and you’ll get a push notification or message to confirm your account is ready to use.

To open a Mari Savings Account in Singapore, you’ll need to be⁷:

If you’re applying with Singpass, you may not need to provide any additional paperwork⁸, but for work pass holders, you’ll normally have to provide address documents⁹ as your residence may not be reflected on your Singpass account.

You can top up your MariBank account using bank transfer, PayNow or PayNow QR transfer. Limits may apply, which you can see in your MariBank app.

Topping up your account is managed in your own local banking service or the MariBank app. If you’re topping up with a bank transfer, you’ll need to get your MariBank account number from the app and then use it to make a transfer from your preferred Singapore bank account in the bank’s online or mobile banking system.

For PayNow transfers, you need to register MariBank to PayNow and then send money from the PayNow app, or use the PayNow feature in your online banking service.

Yes. You can send a MariBank overseas remittance¹⁰ to select countries and currencies, with the transfer fee waived until the end of 2025. After this, fees will apply that vary depending on the country you’re sending to and the currency. These fees can run from 0 SGD to 28 SGD, depending on the payment you’re making.

Bear in mind that costs may also apply in the exchange rate being used. Compare your options with other providers to see if the exchange rate offered is attractive, or if a better deal may be found elsewhere.

Yes. MariBank is MAS-licensed, and so your deposits are protected to the legal maximum by the Singapore Deposit Insurance Corporation. There are also in-app security features, including encryption and multi-factor authentication, to help keep your account and your money safe.

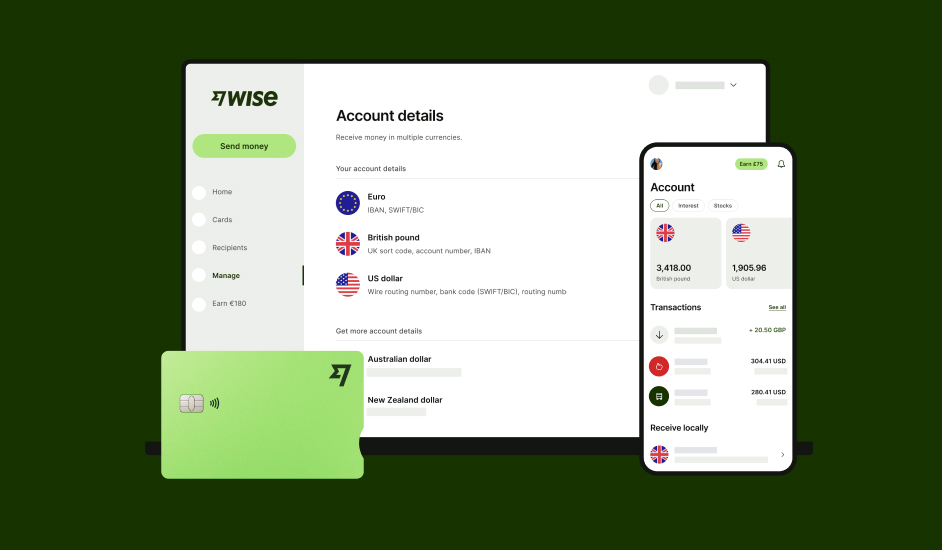

The Wise account is an easy way to hold and exchange 40+ currencies, including SGD, MYR, EUR, CNY, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.26% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 350 SGD when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in SGD and a selection of other major global currencies.

What's more, you can activate Wise Interest to earn returns* on your eligible balances while keeping your money available to spend.

*Growth is not guaranteed. Capital at risk.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

MariBank offers low cost, intuitive products which can help you manage your money day to day in Singapore dollars. You can save and get interest in the MariBank Savings Account, and also earn cashback when you spend with your Mari debit card.

Bear in mind that some fees can apply when you use your MaryBank account. In particular, international costs may creep in, including a 3% foreign transaction fee if you spend overseas, with international remittance costs set to begin in January 2026 if you’re sending money abroad.

You may find that you’re better off if you use your Mari account for local payments and savings, but also get an account from a provider like Wise for your international needs. Wise offers low cost currency conversion with the mid-market rate, and cheap, fast payments to 140+ countries - which may make it the perfect partner to Mari for your overseas payments and spending.

Sources used:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how work permit holders in Singapore can open a bank account, including requirements, options, and how to receive salary payments.

Review the GXS Savings Account in Singapore, including interest rates, features, pros and cons, and whether it’s worth opening in 2026.

A detailed review of the Trust Savings Account in Singapore, covering interest rates, plans, fees, rewards, and who it’s best for.

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

Comparing GXS and Trust? Read on to find out what a digital bank is, compare features, interest rates, and understand their exchange rates

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before