How to Open a Bank Account for Work Permit Holders in Singapore

Learn how work permit holders in Singapore can open a bank account, including requirements, options, and how to receive salary payments.

The Monetary Authority of Singapore issued its first licenses for digital banks back in 2020, with GXS¹ and Trust Bank² becoming some of the first licensed providers. Both GXS vs Trust are popular banks with account and card services, as well as additional features like investment opportunities and loans. But which is best between Trust bank vs GXS?

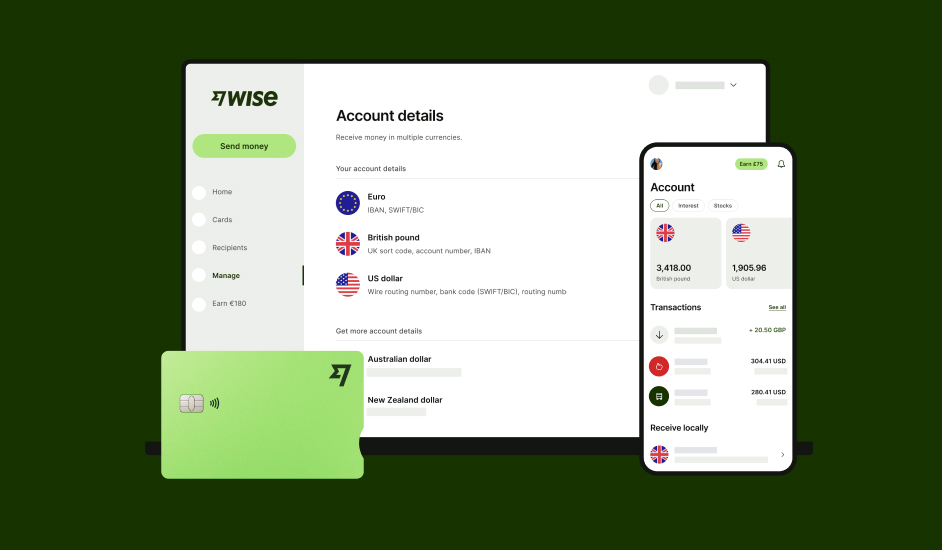

Join us as we cover a full GXS bank review and comparison to Trust Bank in Singapore. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees. This can complement the digital banking experience, offering flexible, low cost international services including ways to send, spend and receive foreign currencies with ease.

| Table of contents |

|---|

A digital bank is a licensed bank which offers many of the services you might expect from any other bank - but without the physical branch network. You can open an account to save or spend, get a credit or debit card, and access other services, managing everything from your phone or laptop. Wise is not a bank but an online money transmitter, though some of its services are similar to those of traditional banks.

If you’re thinking of getting a digital account to manage your money in Singapore you might be considering a digital bank like GXS or Trust, or an alternative provider like Wise. All of these options offer smart account and card services you can manage from your phone - but their features, fees and service availability do vary somewhat.

GXS Bank is backed by Singtel and Grab, and allows customers access to their accounts via its dedicated app, or through the Singtel and Grab apps³.

Trust Bank is a cooperation between Standard Chartered and Fairprice, and comes with flexible cards and the opportunity to get huge discounts on your Fairprice Group spending⁴.

Both GXS and Trust focus their services on Singapore residents only, and have some limitations on international account usage. You can’t send or receive international payments, for example, and accounts hold SGD only.

Wise is a little different, offering accounts to hold 40+ currencies all in one place, with ways to send, spend, receive and exchange foreign currencies conveniently.

This variation in account services can mean that GXS Bank vs Trust Bank vs Wise suit slightly different needs.

- GXS can be an excellent choice if you use Grab frequently

- Trust discounts on Fairprice spending make it an attractive option if you shop in Fairprice stores often

- Wise is more flexible for international use, and can be a great addition to either GXS or Trust for those times when you need to manage your money across currencies.

Here’s a side by side summary on features from GXS Bank vs Trust Bank vs Wise to give a flavour:

| Feature | GXS | Trust | Wise |

|---|---|---|---|

| Eligibility | Singapore residents aged 16 or older⁵ | Singapore residents aged 16 or older⁹ | Residents of Singapore and many other countries and regions globally |

| Card Type | Credit⁶ and debit cards available⁷ | Credit and debit cards available¹⁰ ¹¹ | International debit card |

| Available currencies for holding | SGD | SGD | 40+ currencies |

| Available currencies for spending | Spend with your card anywhere the network is accepted | Spend with your card anywhere the network is accepted | Spend in 160+ countries |

| ATM Withdrawals | No ATM withdrawal feature | No Trust Bank fee for ATM use | 2 withdrawals to the value of 350 SGD/month with no Wise fee 1.5 SGD + 1.75% after that |

| Exchange rate | Network rate | Network rate | Mid-market rate |

| Currency exchange fees | No fee applied for card spending | No fee applied for card spending | From 0.26% |

| Transfer availability | FAST, PayNow, Intrabank transfers in SGD⁸ | SGD transfers only¹² | Transfers offered locally and internationally in 40+ currencies |

| Savings & Interest | Variable interest on SGD holding - 1.58% to 1.98% depending on account selected | Variable interest on SGD holding - up to 2.25% depending on meeting qualifying conditions | Wise interest on SGD and USD holding SGD - 2.22% USD - 3.61% |

| Additional Benefits and Rewards | Earn additional Grab rewards as you spend | Get deep discounts on Fairprice Group spending | Receive payments in 8+ foreign currencies |

*Details correct at time of research - 21st July 2025

One of the main attractions of digital banks is that the fees charged are often very low. There’s no account maintenance fee for a GXS savings account for example, and you can get a GXS Debit card for free too. Trust Bank works similarly, with very few costs associated with a standard account. There may be some fees to pay when using a GXS or Trust Bank credit card, though, which are worth considering before you spend. Here’s a summary:

| Feature | GXS | Trust | Wise |

|---|---|---|---|

| Account maintenance fee | No fee | No fee | No fee |

| Debit card order fee | No fee | No fee | 8.50 SGD SGD |

| Debit card ATM Withdrawals | No GXS fee for ATM use | No Trust Bank fee for ATM use | 2 withdrawals to the value of 350 SGD/month with no Wise fee 1.5 SGD + 1.75% after that |

| Foreign transaction fee | No fee applied for card spending | No fee applied for card spending | From 0.26% |

| Credit card annual fee | FlexiCard annual fee 54.5 SGD | No fee | Not applicable |

| Credit card additional costs | 5 SGD monthly charge if you choose not to repay in full¹³ | Account transfer fees may apply¹⁴ Interest costs may apply depending on the card Split payment fees apply if you pay your card balance over multiple months | Not applicable |

*Details correct at time of research - 21st July 2025

GXS and Trust Bank only allow you to hold Singapore dollars in your account. However, when you have a debit or credit card you can then use this to spend in a broader range of currencies when you travel and shop online. Your foreign currency spending is converted back to Singapore dollars using the exchange rate set by the card network to be debited from your account. There’s no additional fee added by the bank.

The network exchange rate is usually pretty fair, but may not be the exact same as the mid-market rate - which is the one you’ll see on Google or using a currency conversion tool. You’ll need to check the rate which applies for your card online to know what you’ll pay for international spending as it can change frequently.

Because Wise is a multi-currency account provider you can convert and hold foreign currencies in your account for future spending if you’d like to. This lets you lock in an exchange rate, and can make it easier to budget and plan for travel spending in particular. Wise uses the mid-market rate for card spending and any other currency exchange. There’s then a low, transparent fee from 0.26% added.

Here’s a summary of the exchange rate used by GXS vs Trust vs Wise:

- GXS exchange rate - Mastercard rate

- Trust exchange rate - Visa rate

- Wise exchange rate - mid-market rate

The debit cards issued by GXS, Trust and Wise - as well as the alternative credit card options from GXS and Trust - can all be used internationally conveniently. All you’ll need to do is look out for the card network logo which will be displayed by the checkout when you’re overseas - or ask the merchant if they can accept your card when you pay.

You’ll be able to use your card abroad in the same way as you would in Singapore. Before you travel it’s a good idea to make sure all your contact information is up to date with your preferred bank or provider. This will allow the bank to contact you if there are any issues with your account while you’re away, and can avoid the hassle of having your card blocked if international transactions flag as suspicious in the bank’s fraud prevention tools.

| 💳 For a more detailed review of the GXS debit card, read our article here. |

|---|

GXS Bank and Trust Bank are both fully licensed banks in Singapore, and very safe to use. Wise is not a bank but is licensed and regulated in Singapore, and also considered safe to use.

All of these providers have been built to be used digitally, which means that their apps and websites have industry level security protections as a standard. You can view your transactions instantly with your phone, freeze and unfreeze your card in the provider’s app if you choose to, and keep on top of all your financial management even when you’re travelling.

GXS, Trust and Wise are all excellent options, which may suit different customer needs. Depending on the type of transactions you need to make frequently, you might even decide that having accounts with more than one of these providers makes sense.

If you’re a frequent Grab user and want to earn additional Grab rewards, GXS might be a natural choice for a way to manage your money locally in SGD. Or, if you regularly shop in Fairprice, the deep discounts available through Trust Bank might appeal.

Neither GXS nor Trust offer multi-currency account holding, and you can’t use your account to send or receive international payments. This might mean that in addition to your preferred bank for SGD money management, it helps to open a Wise account for international usage. You can receive payments in foreign currencies, hold 40+ currencies and send money to 140+ countries globally with just your phone. See if Wise can help you cut the costs of international spending, alongside your preferred digital bank account in Singapore.

Sources last checked: 24 July 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how work permit holders in Singapore can open a bank account, including requirements, options, and how to receive salary payments.

Review the GXS Savings Account in Singapore, including interest rates, features, pros and cons, and whether it’s worth opening in 2026.

A detailed review of the Trust Savings Account in Singapore, covering interest rates, plans, fees, rewards, and who it’s best for.

A detailed review of the Mari Savings Account, including interest rates, fees, limits, cards, transfers, and how to open an account in Singapore.

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before