How to Open a Bank Account for Work Permit Holders in Singapore

Learn how work permit holders in Singapore can open a bank account, including requirements, options, and how to receive salary payments.

Open to residents with a registered address in the following countries: United States of America, Singapore, Malaysia, Australia or New Zealand.

Trust Bank¹ is a popular digital bank in Singapore, brought to you by a partnership between Standard Chartered and FairPrice Group. Trust offers some great ways to manage your money with just your phone - including the Trust Bank savings account², which has high interest options and a linked card for easy access.

Not sure if it’s right for you? This Trust Bank savings account review covers all you need to know. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

The Trust Bank Savings Account is one of the core products offered by Trust, allowing you to save in an easy access account which has a linked debit card for spending and withdrawals. You can get the account in 3 different tiered plans, which all offer their own interest-earning opportunities:

All of these accounts offer easy ways to manage your money through the Trust app, which is simple to use and has high-level security to keep your money safe. Keep reading for your full Trust Bank Singapore review, including a closer look at the savings interest rates, account features and benefits.

The Trust Bank Savings Account interest rates which apply to your account depend on the account plan you select, and also how you transact during the month. When you open your account, you’re assigned the Signature Plan, but you can change to one of the other plans at any time in the Trust app.

There are no ongoing fees for any of the account plans - the only real difference is how the Trust Bank Savings Account interest rates are calculated and applied:

| Plan³ | Zen | Signature | Flex |

|---|---|---|---|

| Maximum earning opportunity | 0.50% p.a. | 1.30% p.a. | 2.50% p.a. |

| Base interest | 0.50% p.a. | 0.10% p.a. | 0.10% p.a. |

| How to earn extra interest | Not offered |

|

|

*Details correct at time of research - 3rd December 2025

**NTUC Union Members get 0.30% p.a. while others get 0.20% p.a.

All account tiers have a maximum balance of 1.2 million SGD to earn the top rates available. Interest on amounts above this is paid at 0.05% p.a. Your interest is credited to your account monthly.

The Trust Bank Savings Account is the core account product from Trust and offers a large suite of features and benefits, and very few fees. Here’s a summary of the important things to know.

Open your Trust Bank Savings Account and get a linked debit card for easy spending. Your account has no lock-in period, so you can add money when you choose to, and then spend or make cash withdrawals as you need. Any balance in your account is eligible for the interest tier based on your account plan and the way you choose to transact.

There’s also a great reward-earning opportunity with your Trust Bank debit card. When you spend, you can earn Linkpoints, which you can redeem against spending in Fairprice Group stores and partner merchants. The earning opportunity depends on whether or not you’re an NTUC member, with members rewarded up to 9% and non-members getting up to 4%. Eligibility rules, including minimum spend on different categories, apply.

Before you sign up for the Trust Bank Savings Account, it’s important to also consider the drawbacks. One issue for some customers is that you can’t send a payment overseas with Trust Bank. This can be a problem if you need to pay overseas bills or send money to family abroad. We’ll look at how the Wise Account could help here in just a moment.

| Service/feature fee | Trust Bank Savings Account fee |

|---|---|

| Account opening fee | No fee |

| Monthly fee | No fee |

| Card issue fee | No fee |

| Foreign transaction fee | No fee |

| Account closure fee | No fee |

*Details correct at time of writing - 3rd December 2025

Still not sure if the Trust Bank Savings Account is for you? Here are a few key pros and cons to consider:

| ✅ Pros | ❌ Cons |

|---|---|

|

|

💡 Thinking about how Trust compares with other digital banks?

See our full guide on how GXS compares with Trust Bank to understand the differences in features, interest rates, and fees.

You can open a Trust Bank savings account by downloading the Trust app and using your Singpass and Myinfo to complete most of the required details:

Once your account is verified, you can add money and transact. This can be quick or instant, or may take a few days.

You can open a Trust Bank savings account as long as you meet the eligibility criteria⁴:

You can deposit money into your Trust account using bank transfer (FAST) or PayNow. In both cases, you’ll initiate the payment digitally from your bank for a speedy transfer into your Trust account.

It’s sensible to wonder if Trust Bank is safe - but you can rest assured it’s a licensed digital bank overseen by MAS. Your savings account deposits with Trust are insured by the Singapore Deposit Insurance Corporation up to 100,000 SGD per depositor.

The Trust Savings Account is designed for saving and spending in SGD, but it doesn’t support holding foreign currencies or sending money overseas. If you regularly deal with international payments, you may want an additional option.

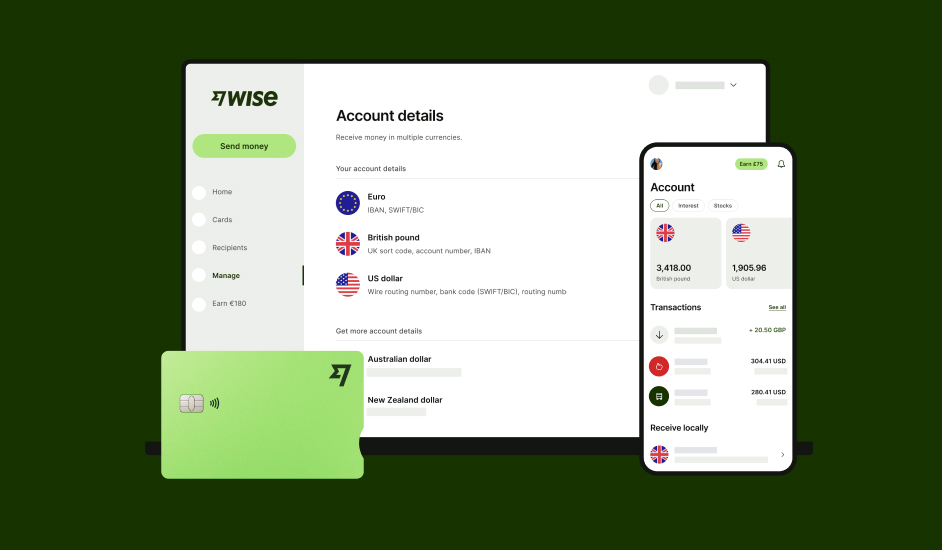

The Wise account is an easy way to hold and exchange 40+ currencies, including SGD, MYR, EUR, CNY, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.26% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 350 SGD when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in SGD and a selection of other major global currencies.

What's more, you can activate Wise Interest to earn returns* on your eligible balances while keeping your money available to spend.

*Growth is not guaranteed. Capital at risk.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

The Trust Savings Account is a good option for anyone in Singapore looking for a local savings product they can manage with just a phone. As Trust is a digital bank you can’t pay in cash or walk into a branch to get face to face service - but you can earn decent interest if you have a higher tier account and complete specified transaction types monthly to unlock bonus interest.

Bear in mind that Trust doesn’t offer all the services you may get from a bank with a physical network - and you can’t send money overseas with Trust either. If you need to make a payment in a foreign currency, receive foreign currencies, or hold a balance in foreign currencies, the Wise Account could be a good addition to your toolbox alongside Trust for local spending.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how work permit holders in Singapore can open a bank account, including requirements, options, and how to receive salary payments.

Review the GXS Savings Account in Singapore, including interest rates, features, pros and cons, and whether it’s worth opening in 2026.

A detailed review of the Mari Savings Account, including interest rates, fees, limits, cards, transfers, and how to open an account in Singapore.

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

Comparing GXS and Trust? Read on to find out what a digital bank is, compare features, interest rates, and understand their exchange rates

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before