Bank Islam transfer limits and step-by-step on how to set, change and increase them

Learn more about Bank Islam transfer limits as well as how to set, increase and change them.

Open to residents with a registered address in the following countries: United States of America, Singapore, Malaysia, Australia or New Zealand.

If you’ve got a PayPal¹ balance you may be wondering how to get it to your regular bank account so you can spend or withdraw it more easily. It’s possible to withdraw money from PayPal Malaysia to a linked bank account or card, in just a few steps. However, depending on the transaction type, there may be a fee to pay, and you may need to wait a few days for your money to arrive.

This guide walks through how to transfer money from PayPal to a bank account in Malaysia, and how to withdraw money from PayPal Malaysia to a linked USD account. And because PayPal isn’t always the best bet when it comes to transacting internationally, we’ll also introduce Wise as a convenient way to send and receive international transfers with no currency conversion fee and the Google exchange rate.

| Table of contents |

|---|

You’ll be able to withdraw your PayPal balance to a Malaysian bank account in MYR - and depending on how your account is set up, you may also be able to link a USD account to withdraw in dollars as well. The process to follow will be the same for both options²:

Your money will normally be available in your bank account 1 business day after withdrawing³. However, withdrawals from PayPal Malaysia can take up to 5 days, depending on the processes your bank uses. If your money has not arrived within 5 days, you’re advised to ask your bank to understand if there have been problems processing your withdrawal.

If there’s any issue with the transfer from PayPal’s side you’ll receive an email explaining the steps you need to take to get your money.

You can withdraw money from PayPal to your linked bank account online or in the PayPal app. Both are pretty simple to do - but with the PayPal app you can manage your money on the move no matter where you are.

The process to follow when you withdraw money from PayPal using the PayPal app is the same as withdrawing online - simply follow the steps outlined above, and use the onscreen prompts to guide you.

Withdrawing your funds from PayPal to a bank account is pretty easy to do. To give an illustrated example, let’s look at withdrawing from PayPal to a Maybank account.

First you’ll need to make sure your Maybank account is linked to PayPal. If it isn’t yet, take the following steps:

Once your Maybank account is linked to PayPal you can set up your withdrawal:

Learn more about using PayPal and Maybank in this full guide.

Whenever you transact with PayPal you’ll want to make sure you’re aware of any relevant fees - to avoid any surprises down the line.

Withdrawing your money in MYR to a linked bank account in MYR may not incur any PayPal fees at all. However, there could be extra costs if you’re withdrawing to a card, or if any currency conversion is required. Currency conversion with PayPal can come with some pretty steep fees - pushing up overall costs.

Let’s walk through the various PayPal fees you’ll want to consider. You can also get a full guide to PayPal fees here.

PayPal’s transfer and withdrawal fees do vary depending on where in the world you’re based and the type of PayPal account you hold. Here’s a look at PayPal Malaysia’s most common withdrawal fees for personal accounts as an example.

| Service | PayPal Malaysia fee⁴ |

|---|---|

| Withdraw from PayPal to your MYR linked bank account | No fee where currency conversion is not required |

| Withdraw from PayPal to a USD bank account (where available) | No fee where currency conversion is not required |

| Withdraw from PayPal to a card | Fixed fee according to currency involved - 3 MYR for MYR withdrawals Currency conversion fees apply if you need to change your balance to the card’s currency to withdraw |

| Currency conversion | 2.5% - 3% in most cases |

We mentioned above that transacting internationally with payPal can come with a few extra fees. While the costs you pay will vary based on your account type (personal or merchant) and where you’re based, here are a few to watch out for:

| Service | PayPal Malaysia fee⁴ |

|---|---|

| Sending international payments - funded with PayPal balance or bank account | 4.99 USD or the currency equivalent + currency conversion charge |

| Sending international payments - funded with card | 4.99 USD or the currency equivalent + 3.4% + fixed fee + currency conversion charge |

| Currency conversion | 2.5% - 4% in most cases |

PayPal is a huge player in the world of digital payments and ecommerce - but it’s not always the best option for international transactions because of relatively high fees and currency conversion charges. Before you send your PayPal payment or choose PayPal to spend online in a foreign currency, check out Wise.

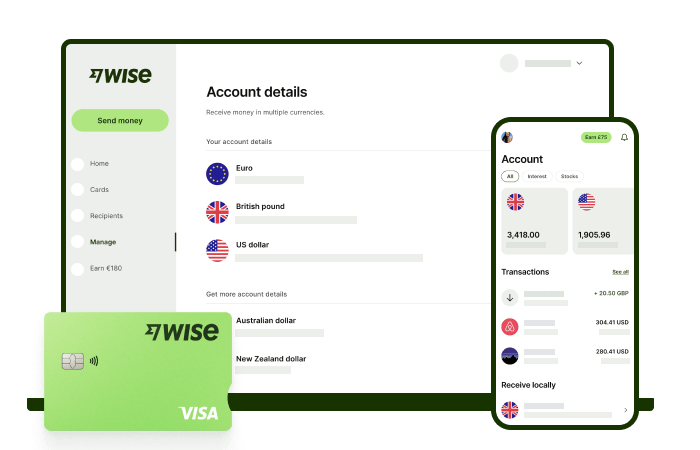

Wise Accounts can be opened for free, to hold and exchange 40+ currencies, and spend on your linked Wise card in 160+ countries. As well as being a great way to shop online and spend when you travel, Wise gives you local account details to get paid for free⁵ from 30+ countries.

Whenever you need to convert from one currency to another with Wise - to withdraw your funds, send a payment or buy something overseas - you’ll get the mid-market exchange rate. That’s the one you see on Google, with no markup or currency conversion charge added. You simply pay a low transparent fee which is clearly displayed - and which can mean you spend less compared to alternative services like PayPal.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Sources:

Sources checked on 12/01/2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Bank Islam transfer limits as well as how to set, increase and change them.

Learn more about how to change Maybank transfer limits as well as transfer time, fees, and more when making an online transfer.

Learn more about how to make an Bank Islam online transfer including limits, transfer time, and fees.

Learn more about how to make an Affin Bank online transfer including limits, transfer time, and fees.

Learn more about how to use Lulu Money in Malaysia, as well as benefits, fees, and more.

Learn more about making IBG transfers with CIMB, including fees, how long it takes, and relevant timings.