Bank Islam transfer limits and step-by-step on how to set, change and increase them

Learn more about Bank Islam transfer limits as well as how to set, increase and change them.

Lulu Money Malaysia¹ offers ways to send through a mobile app, from Malaysia to 140+ countries. You can also send money in person pretty much all over the world thanks to Lulu Money’s partnerships with brands like Western Union, and get foreign exchange services in a branch, through Lulu Money exchange.

This guide looks at how to send money online through Lulu exchange, how to find a branch if you prefer an in person service, and the features and benefits you might get when using Lulu Money Malaysia. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Lulu Money Malaysia is an authorised Money Service Business which offers services on behalf of US based payments platform Flywire². It is also an authorised agent offering over the counter remittance services with partners like Western Union³. This means you can send and receive payments easily.

Lulu Money has 26 branches in Malaysia, and 300+ branch locations worldwide, and has in person and in app services covering ways to send money, and ways to exchange funds over the counter⁴. We’ll explore the service offerings and how they work in this guide.

Here are some of the key things you can do with Lulu Money in Malaysia:

- Send money in the Lulu Money app to 140+ countries

- Use Lulu to send and receive payments with MoneyGram - which covers 200+ countries

- Lulu is also a Transfast agent, allowing payments to and from 120 countries

- Lulu partners with Western Union to let you send to 525,000 agent locations, pretty much anywhere in the world

- Send money over the counter to be collected in cash, for B2B payments

- Get a Lulu Money Gold Card⁵ to get extra benefits and rewards

- Exchange funds over the counter with Lulu Exchange

- Make payments over the counter for bills, loans and social security requirements⁶

You can see indicative Lulu Money exchange rates online, but it’s important to note that the rate you actually get when you exchange or send a payment may be different. Exchange rates change all the time, so you’re advised to find a local branch on the Lulu Money Branch Locator⁷, and get the live rate there - or download the app.

It helps to know that the Lulu exchange rate is likely to include a markup. That means there will be an extra fee added to the rate you see if you use Google or a currency conversion tool. This is a fee paid to Lulu Money and the partners it works with. Markups are variable, but can push up the costs of sending or exchanging money significantly - making it important that you compare the rates from Lulu against exchange rates from other in person and digital providers before you transact.

| 🤔 Still comparing providers? Read more about our Instarem review and how it compares with Wise |

|---|

If you’ve heard people mention both, you may be wondering - is Lulu Money and Lulu Exchange the same? While this can seem a little confusing, it’s simple enough - Lulu Exchange is the overarching company, and Lulu Money is the name of their app and digital service.

You can send money through Lulu Exchange by visiting your nearest branch and talking through your payment requirements with an agent. Or if you want to send a digital payment you can use Lulu Money.

Here’s how to send a payment digitally with Lulu Money⁸:

It’s helpful to know that the Lulu Money team may get in touch to ask for more paperwork relating to your transfer. If your account can not be verified within 5 days, the amount you paid is returned to the account you sent it from.

Assuming your account can be verified, your funds will be delivered 2 - 3 days after the verification process is completed.

Lulu Money does not release details of the fees and costs of transfers, as these depend on where you’re sending money to, how you pay, and the value of the payment.

If you’re sending money digitally, you can see the fee in the app before you confirm.

If you’re going to a branch to make your payment, the fees you pay will - in part - be set by the remittance partner you select - Western Union for example. Different remittance partners may offer their own fees, exchange rates and services, so you might find it useful to talk to the agent to understand what your options are with each of the partners they work with.

Generally in person transfers are more expensive than sending a payment digitally. This is because of the increased workload involved for both the agent processing the payment with the sender, and the agent at the other end who disburses the cash.

If you’re making a Lulu Money transfer in the app, you’ll need to pay by bank transfer and then upload your proof of payment before your transfer can be processed. If you prefer to manage your money in person and go to a branch, you can pay in cash. Some branch locations may also offer other payment methods - reach out to the location you’re going to ahead of time, to check your options.

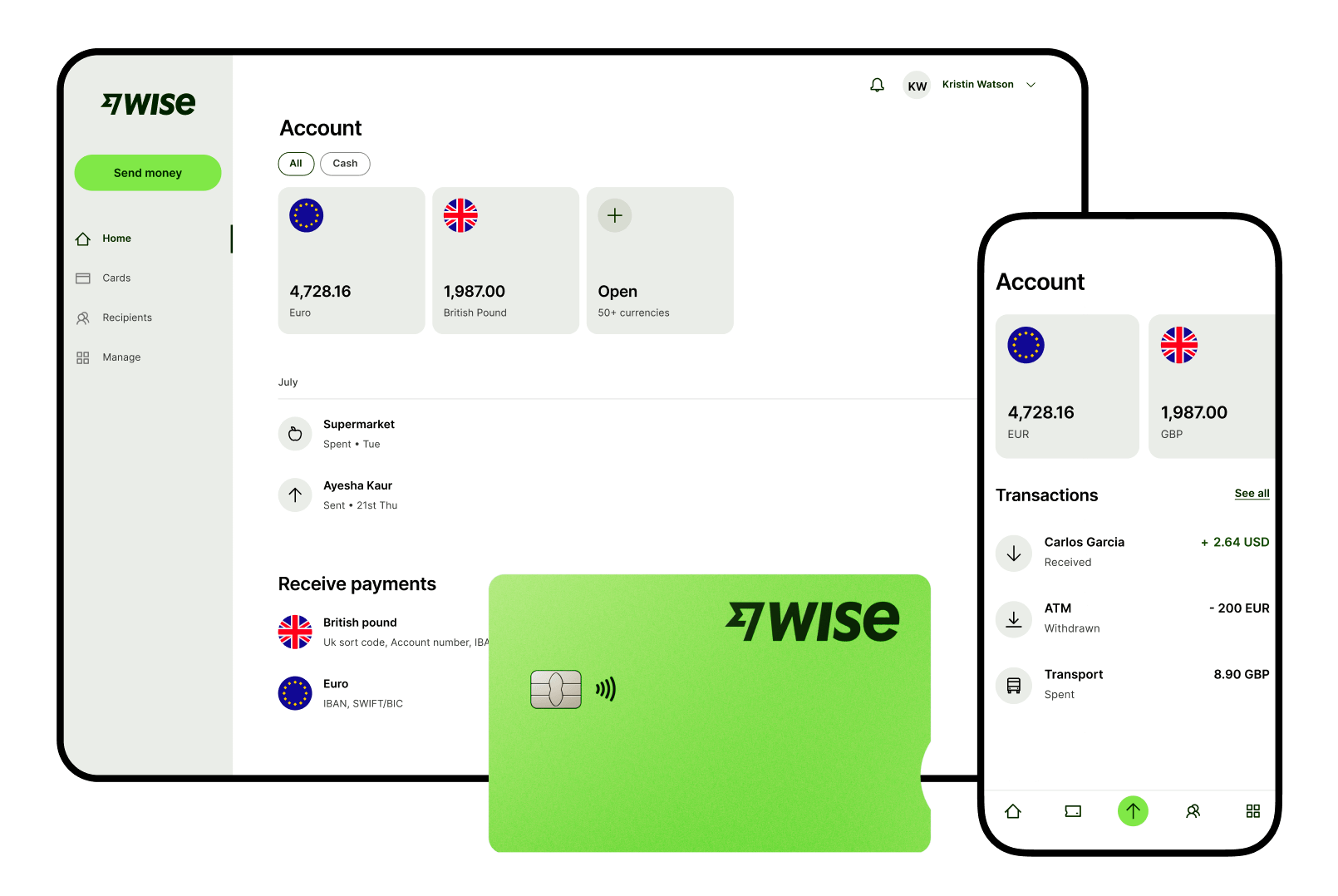

Wise international money transfers can be set up online or within the Wise app with low fees from 0.77% and the mid-market rate, to over 140+ countries. There’s no markup added to the exchange rate that’s used to convert your currency, which makes it easier to see exactly what you're paying for a transfer, and what the recipient will get in the end. Just transfer the amount indicated in MYR and let Wise do the rest.

Track your transfers easily when you create a free Wise account, and manage, hold, and convert your money in MYR and 40+ other currencies. You'll get the same great rates, and be able to track your transfers all from one place. As a bonus, you can also get 8+ local account details to be able to receive money in MYR, USD, GBP, and more.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Bank Islam transfer limits as well as how to set, increase and change them.

Learn more about how to change Maybank transfer limits as well as transfer time, fees, and more when making an online transfer.

Learn more about how to make an Bank Islam online transfer including limits, transfer time, and fees.

Learn more about how to make an Affin Bank online transfer including limits, transfer time, and fees.

Learn more about making IBG transfers with CIMB, including fees, how long it takes, and relevant timings.

Wondering how PayPal vs Wise compares in Malaysia? We compared the exchange rates, fees and features in our in-depth review of the two providers.