Bank Islam transfer limits and step-by-step on how to set, change and increase them

Learn more about Bank Islam transfer limits as well as how to set, increase and change them.

Affin Bank¹ offers ways to send payments locally and internationally online or using your smart device. This means you can pay bills and send money to friends or family without even needing to leave home.

Read on to learn how to make an Affin Bank online transfer including the Affin Bank IBG transfer time and how long overseas payments may take. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

You can make a secure Affin Bank balance transfer online or in the AffinAlways app, either to an account in your own name, a local third party account or an overseas bank. Local payments are usually managed through Interbank GIRO (IBG) and DuitNow, while telegraphic transfers are used for overseas payments in foreign currencies.

Here are the most important points to know in advance - and if you ever have other questions, you can give Affin Bank a call or check out their online guides, tutorials and FAQ sections.

To send an Affin Bank online transfer you must have an eligible Affin Bank account, such as a deposit account or savings account, and you must be registered for online and mobile banking.

To register for the online or mobile banking service from Affin Bank you need to visit a branch in person and complete Know Your Customer checks, and then register. This means taking along your government issued ID document to a branch and then completing an online step to be able to access digital services.

Here’s how to register for Affin Bank online and mobile banking:

Once you have registered your account for online and mobile services you can send Affin Bank online transfers.

There are various fees for Affin Bank digital payments, depending on the type of transfer you make. Local IBG transfers cost 0.1 MYR each while a foreign telegraphic transfer can cost 33 MYR plus any exchange costs, for example².

An Affin Bank IBG transfer is used for sending payments locally within Malaysia. IBG transfers are not processed instantly, but rather at set points during the day. Here are the Affin Bank IBG request deadlines, and when you can expect your payment to be received³:

| Payment requested by | Payment received by |

|---|---|

| Monday - Friday, before 5 am | 11 am, same business day |

| Monday - Friday, after 5 am but before 8am | 2 pm, same business day |

| Monday - Friday, after 8 am but before 11am | 5 pm, same business day |

| Monday - Friday, after 11 am but before 2pm | 8.20 pm, same business day |

| Monday - Friday, after 2 pm but before 5 pm | 11 pm, same business day |

| Monday - Friday, after 5 pm | 11 am, next business day |

| Weekends and holidays | 11 am, next business day |

If you’re sending a different kind of Affin Bank payment a different transfer schedule and delivery timescale may apply. Foreign telegraphic transfers can take 1 - 3 days for example.

Here’s the Affin Bank transfer limit by different transfer type³:

These limits apply to online payments only. If you need to send more you may still be able to do so in a branch. Different fees may apply.

You can set your own Affin Bank online transfer limit, depending on the way you use your account. You may choose to add a lower limit for security reasons for example. Here’s how to change a transfer limit with Affin Bank:

Here’s how to transfer money from Affin Bank online, step by step:

You’re asked as part of the process if the payment is open - that is, to a new recipient - or registered, meaning it’s a payment to someone you’ve transferred to before. If you want to make an open transfer you’re prompted to enter the recipient’s banking information so that it can be pulled up more easily the next time you want to make a transfer.

You can track your Affin Bank IBG transfer by checking the transfer status information in the app. The transfer status should be updated once the online transfer has been approve and has gone through.

You can not make an Affin Bank 0 balance transfer - you must have enough balance in your account to cover the costs of the payment, and any relevant fees. Since the funds are deducted directly from your account, it is not possible to go below zero.

However, while you can't send money, you are able to make an Affin Bank online transfer to an account that has 0 balance.

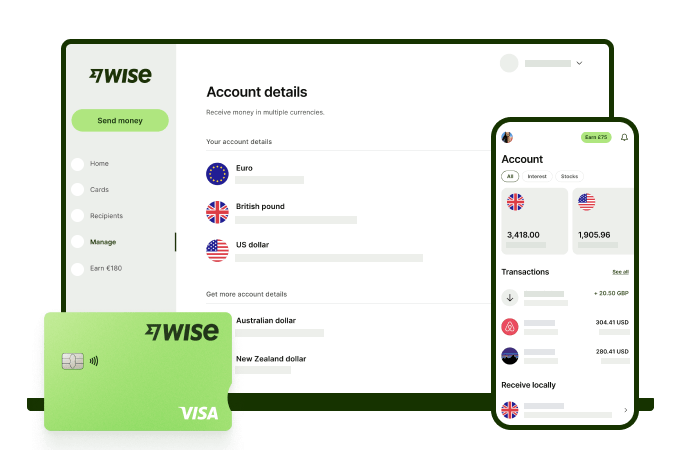

Make seamless foreign currency payments and transactions with low fees and the mid-market rate with Wise.

The Wise account is an easy way to hold and exchange 40+ currencies, including MYR, USD, GBP, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.77% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 1,000 MYR when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in MYR and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

Get the most out of every ringgit and save more when you use Wise.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Bank Islam transfer limits as well as how to set, increase and change them.

Learn more about how to change Maybank transfer limits as well as transfer time, fees, and more when making an online transfer.

Learn more about how to make an Bank Islam online transfer including limits, transfer time, and fees.

Learn more about how to use Lulu Money in Malaysia, as well as benefits, fees, and more.

Learn more about making IBG transfers with CIMB, including fees, how long it takes, and relevant timings.

Wondering how PayPal vs Wise compares in Malaysia? We compared the exchange rates, fees and features in our in-depth review of the two providers.