Opening a Branch Office in Germany: Complete Step-by-Step Guide for UK Businesses

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

If your company trades internationally, then you need to know about international treasury management. It’s essential for optimising global cash flow management and minimising the risks associated with foreign currency transactions.

In this guide for UK organisations, we’ll be taking a closer look at international treasury management. This includes info on what it is, what activities it encompasses and which companies need to make global treasury management a priority.

We’ll also show you another valuable tool - the Wise Business account, ideal for UK companies looking to manage finances across multiple currencies.

💡Learn more about Wise Business

International treasury management (TM) is the control of global payment processes, cash flow, financing and banking. It’s a key part of managing trade between global third parties, and is an important component of general treasury management plans and processes.

One of the main activities involved in TM is foreign exchange (FX) risk management

. FX risk occurs when global companies do business in multiple currencies, where exchange rate fluctuations can potentially lead to significant losses.

For example, an organisation may buy goods and supplies from one country, while having its products manufactured in another part of the world. The finished products are then sold to clients in a different part of the world, or perhaps in several different global markets.

Each part of this complex process will involve transactions in different currencies. The organisation needs to make sure it is getting the most favourable exchange rate for every transaction, which can require intensive management.

One way this can be simplified is with a multi-currency solution, such as the Wise Business account. With guaranteed mid-market exchange rate, low fees and a wide range of tools for managing finances in 40+ currencies, Wise can make international treasury management easier.

Learn more about Wise Business

multi-currency account 🌎

Any business which buys, sells or otherwise trades internationally will need to implement global treasury management processes.

Here are just a few examples:

Each organisation will need to take a customised approach to international treasury management, to develop solutions that meet their needs.

But there are a number of activities and practices that most global companies will need to pay attention to, such as:

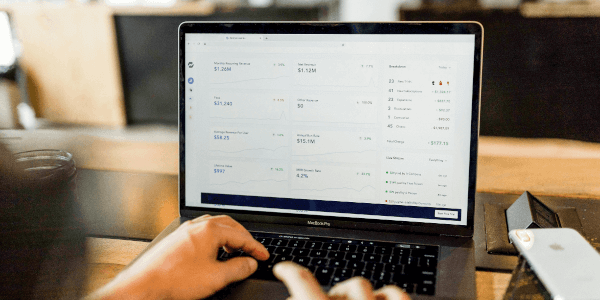

If your business trades in global markets, it’s well worth checking out the Wise Business account. This powerful online account is a hugely useful tool for companies that trade internationally, buy goods or employ people from other countries.

Wise aims to make business banking and international treasury management simpler, with features such as:

(only with Wise Business Advanced)

for 9 major currencies

Wise Business is fully regulated in the UK, and uses sophisticated security measures to keep your business data and finances safe.

Get started with Wise Business 🚀

After reading this guide, you should have a better idea of what international treasury management is and why it’s so important for companies with a global reach.

We’ve looked at the main activities, processes and best practices involved in global treasury management. But each organisation will need to develop a bespoke solution to meet its own particular needs.

Sources:

Sources last checked on date: 20-Aug-2023

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

Learn about the best ways to pay international contractors from the UK, including Wise Business, SWIFT, and other methods to help you save on fees.

Learn the features and fees of the best online marketplaces in Asia, Europe, Africa, Australia, and America to sell your products from the UK.

Learn how to apply for an entrepreneur visa in Hong Kong. Our guide explains eligibility criteria, business plan requirements, processing times and more.

Find out how to open a business bank account in Turkey. Our guide covers all the steps involved in detail.

Learn how UK startups can raise venture capital from US investors. Covers Delaware flips, pitching, legal requirements and practical fundraising tips.