Beyond the Hype: Top AI Predictions for 2026

AI predictions for business owners and startup founders. What they should expect and how they can use AI to improve their output.

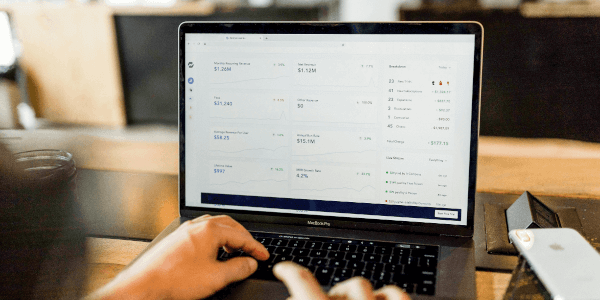

Increase profits - and cut outgoings - when doing business internationally in the UK or elsewhere with our guides, reviews and ideas. You'll also learn more about how Wise Business can save you time and money, to give your business a boost.

AI predictions for business owners and startup founders. What they should expect and how they can use AI to improve their output.

Plan your next corporate retreat in Portugal! Discover top venues, mild weather, and the perfect balance of work and play from Lisbon to the Algarve.

Plan the ideal corporate retreat abroad. Discover exclusive venues, unique team-building activities, and seamless logistics for a successful event.

Discover how to plan a corporate retreat in Italy, compare destination costs, and see how Wise Business can cut FX fees when paying venues and suppliers.

Explore the corporate retreat cost in the UK and abroad, what drives per-person prices, and how Wise Business can cut FX fees on international spend.

Plan your perfect corporate retreat in Greece. Discover stunning venues, unique team-building activities, and luxurious accommodations for your team.

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

Learn about the best ways to pay international contractors from the UK, including Wise Business, SWIFT, and other methods to help you save on fees.

Learn how to apply for an entrepreneur visa in Hong Kong. Our guide explains eligibility criteria, business plan requirements, processing times and more.

Learn the features and fees of the best online marketplaces in Asia, Europe, Africa, Australia, and America to sell your products from the UK.

Planning to start a business in Bulgaria? This guide helps you navigate the process for opening a business in Bulgaria. Get tips on how Wise Business works.