Top Laptops for Virtual Assistants in the Philippines: 2025 Specs & Budget Guide

Searching for the best laptop for a virtual assistants? Our guide covers top specs, brands, and budget options to boost your WFH productivity.

Need to learn more about the BIR 2307 meaning? Or maybe you’re still wondering: what is BIR form 2307? This guide has you covered.

In the Philippines, the BIR 2307 purpose is to show what tax has already been withheld at source, so you don’t end up paying tax twice accidentally. The BIR form 2307 is a certificate of creditable tax withheld at source, provided by Bureau of Internal Revenue (BIR)1, which can help you calculate your tax dues by claiming tax credits you may be owed. This guide covers all the basics about BIR form 2307.

This guide is for information only. It does not constitute tax advice. For more information seek advice from a professional, or from the Bureau of Internal Revenue (BIR)***.***

The full name of BIR Form 23072 is the Certificate of Creditable Tax Withheld at Source.

This form is one way to make sure you’re not over-paying tax, as it details any areas where tax has already been withheld at source - by an employer or client if you’re a freelancer for example - so you don’t accidentally pay tax twice unnecessarily.

If you need to learn more about how to compute withholding tax 2307, it’s worth talking your personal situation through with a professional tax advisor.

Often you’ll need BIR 2307 if you’re a freelancer or self employed professional in the Philippines. However, if you’re a business owner paying a contractor, and withholding tax, you could also need to understand and complete a BIR 2307 form.

Freelancers may have to have a completed BIR 2307 to claim tax credits on things like professional fees, insurance agents or bookkeepers, for example.

In short - any time tax is withheld at source, you may find this form is needed to make sure all the tax affairs of both the person paying and the person being paid are kept straight.

Usually you’ll need BIR form 2307 as part of your filing for BIR income tax. If you’re filing BIR form 1701, or if you’re a freelancer filing BIR Form 1701 AIF (Account Information Form for Self-Employed Individuals), you may need this form as part of your submission. Other paperwork commonly needed alongside the 1701 forms include:

As you may expect, there’s quite a bit of paperwork that might be needed as part of your tax filing in the Philippines. If you’re not sure exactly what you fill out, or if you’ve not been able to get everything you need, it’s best to ask BIR directly, or take professional advice. The BIR website is very helpful and also has a chat function there that you can use if you’re not sure what you need to prepare.

Usually the payor will be the one completing 2307, as a confirmation that they withheld tax and remitted it to the government on behalf of the payee. Assuming you’re the payor, you’ll need to complete the personal information on the BIR 2307 form first, including:

You’ll then have to complete the same information for yourself as the payor.

Once you’ve completed the first half of the form it’s time to enter the payment details. Payments where tax was withheld at source are given alphanumeric tax codes (ATCs), which are helpfully detailed on the last page of the BIR 2307. Take a look at the table of ATCs and find the code for the payment type you need to report. Bear in mind that the reason for the withholding can be split into payments subject to expanded withholding tax, and different payments subject to tax because they were received from a government agency.

Enter the code, the amounts and any required notes into the BIR 2307 to fill out the form.

Usually, the easiest option to file 2307 online is to use the eBIR Form service that you can access on the BIR website.

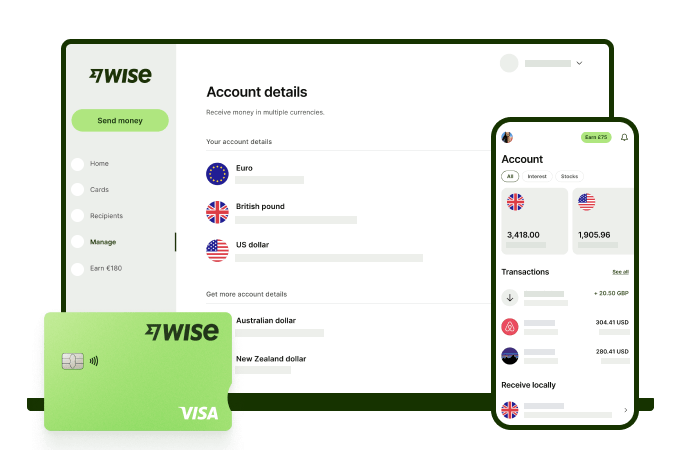

Did you know that over 76%* of Filipinos cite low and transparent fees as an important factor when receiving money from abroad? With Wise, that's exactly what you're getting - all you need to get started is to sign up for a free Wise account, and you'll be able to manage your money with just a few taps of your phone.

You'll have access to 8+ local account details for major currencies including PHP, USD, GBP, AUD, and more, allowing you to receive money directly, in a cheap and convenient manner. After getting your money, you can easily convert it to 40+ currencies, with low fees, and the mid-market rate - also known as the rate you see on Google. This includes exchanging to PHP with a one-time conversion fee from 0.57% that's shown upfront, and no markups or additional fees.

Get paid and move your funds to your local bank account in PHP in a cheap and convenient manner with Wise to stretch every peso.

*Disclaimer: The percentage figure mentioned above is based on an internal survey conducted by Wise in April, 2024

✍️ Sign up for a free account now

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Now you have a guide to BIR 2307, when it’s used, who completes it, and why it’s important. Use this guide alongside professional advice - and don’t forget to check out Wise too, for low cost incoming payments which use the mid-market rate and low fees.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Searching for the best laptop for a virtual assistants? Our guide covers top specs, brands, and budget options to boost your WFH productivity.

Ready for a non-voice WFH job? This guide covers roles (with salaries!), essential skills, where to find legitimate postings, and how to get paid.

Explore the types of virtual assistant work. Find your niche, from social media to data entry, and learn how to manage client payments easily.

Your guide to landing direct client virtual assistant jobs from the Philippines. Learn where to find clients, build your portfolio, and get paid easily.

Looking for an HMO for freelancers in the Philippines? Compare the best prepaid health card and plans to see how to avail coverage for your needs.

Find medical coder work from home jobs in the Philippines. Our guide covers the training, certification, and tips you need to land a remote medical coder role.