What do you need to receive money with Western Union?

Receiving money through Western Union? Learn about the process, from cash pick-up to bank transfers, and find out what to expect.

If you’re using Revolut in Ireland, you may want to move money to a traditional bank account, like Bank of Ireland, to cover bills, savings, or everyday spending. The good news is you can do this, but it’s worth knowing how long it takes, and what the fees look like.

In this guide, we’ll walk you through the process step by step, explaining what you need to know about sending money from Revolut to the Bank of Ireland. We’ll also introduce the Wise Account as an option in Ireland for receiving and managing money in multiple currencies.

Yes. If you need to transfer money out of Revolut to a bank, you can do that using a bank transfer.¹

The Revolut account supports payments to institutions within Ireland, including Bank of Ireland, as well as international transfers to banks in supported countries and currencies.

To complete a bank transfer from Revolut, start by making sure you have all of the relevant account information including the IBAN and SWIFT/BIC code.¹

When you’re ready, just follow these steps:

- Login to the Revolut app

- Go to 'Payments’ tab

- Press the plus (+) symbol at the top right corner

- Select ‘Bank recipient’ or scroll down to find a previous recipient

- Follow the prompts to enter the account details

- Input the amount, currency and a reference if you want

At the end you’ll have a chance to review the transaction before confirming and sending the money.

| Read more: Does Revolut have an IBAN? |

|---|

The fees for a Revolut transfer are variable based on factors like the currency, destination, day of the week and which Revolut plan you’re on.¹

You’ll be given a breakdown in the app before you send the transfer, but here’s a general guide:

| Region | Fee¹ |

|---|---|

| EUR transfers within SEPA region | No fee |

| GBP transfers within UK | No fee |

| Transfers outside UK and SEPA region | Variable fee |

This means if you transfer EUR from your Revolut account to a Bank of Ireland account, there should be no fees.

If you were to send money from Revolut to the Bank of Ireland in another currency, you can expect Revolut to charge fees. How the Bank of Ireland handles receiving a foreign currency, depends on which account it goes to.

When foreign currency is sent into a Bank of Ireland Current Account that’s in euros, the amount is converted before being deposited.⁴ It’s worth checking how much this can cost you in fees and the exchange rate, as it may not be the best choice.

Bank of Ireland also allows customers to receive foreign currency into an account that’s specifically for that currency. The currencies that are supported for the Bank of Ireland foreign currency accounts include²:

- Pounds sterling

- US dollars

- Australian dollars

- Canadian dollars

- Swiss francs

- Polish zloty

There may be other currencies available as well, with Bank of Ireland recommending you speak to your local branch or the Personal Banking Treasury team for more information.

Something to be aware of is that unlike providers like Wise, which allow you to hold multiple currencies in a single account, Bank of Ireland currency accounts only support one currency per account.

How long a Revolut transfer takes depends on where the money is going. Here are the general timeframes Revolut shares on their website:

| Transfer type | General timeframe³ |

|---|---|

| EUR Transfers (SEPA) | Few minutes to up to 2 business days |

| International transfers (SWIFT) | Up to 2 business days |

When you make a transfer with Revolut, you will be able to see the most up to date ETA before confirming the transfer, and you can track the progress through the app.²

Sending money from Revolut to Bank of Ireland is relatively straightforward, but is it the most cost effective, efficient way for you?

When it comes to managing money across borders, the Wise Account is a great option that offers a range of handy features.

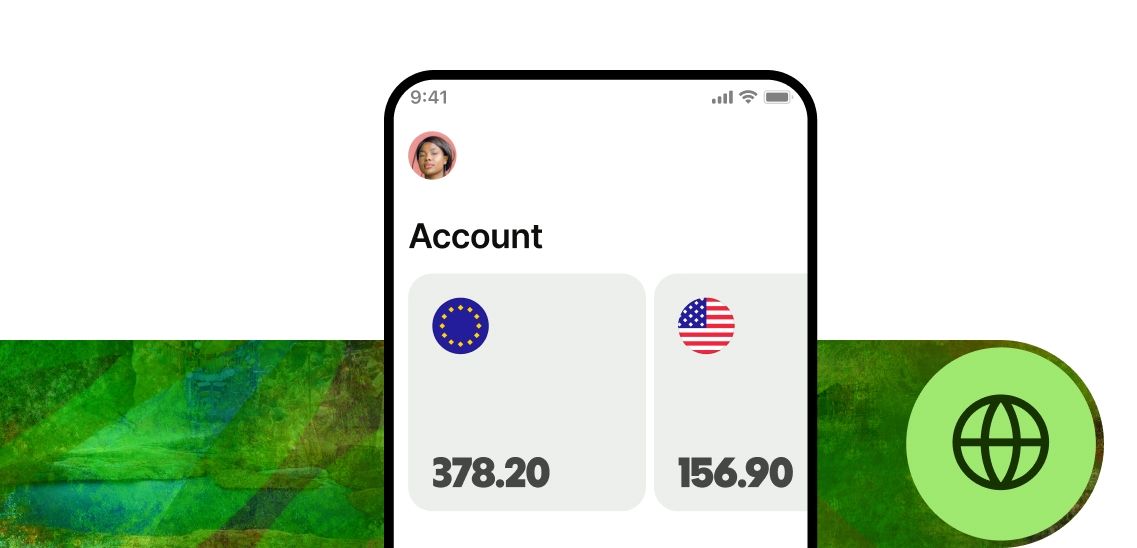

With Wise, you’ll get local account details for more than 8 currencies, including EUR and GBP, so sending and receiving money it's easier, and you don't need to open any extra currency account.

You can use your account details to receive payments directly in the local currency, avoiding international transfer fees and hidden conversion costs. In total, you can manage +40 currencies in one single account, meaning you can convert between many different currencies via the Wise app or website, in just a few clicks.

Open your Wise Account

today 🚀

Sources used:

Sources last checked on: 19 September 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Receiving money through Western Union? Learn about the process, from cash pick-up to bank transfers, and find out what to expect.

Need to get money from abroad? Learn about the ways you can receive international transfers through An Post in Ireland..

Discover the best way to send money from Ireland to the UK for property purchases. Compare costs, timing, and methods for transferring money safely.

Looking to receive a payment through Remitly? Discover all the ways you can get your money in Ireland.

Discover how you can send money abroad with An Post and what fees and rates you'll need to pay.

Here’s our guide to what you need to know to make an international transfer with AIB, including what information you need, and the fees and rates you'll pay.