Is Revolut debit card VISA or Mastercard?

Wondering if your Revolut card is Visa or Mastercard? Get the lowdown on the differences and how it impacts your spending.

If you plan to receive incoming payments to your Revolut¹ account, you’ll need to give the person sending you money some information about yourself and your account to make sure the payment arrives correctly.

Usually, this means providing an IBAN (International Bank Account Number) for euro payments, or an account number and SWIFT code for other currencies.

This guide looks at how to get an IBAN on Revolut, the move to Revolut Irish IBAN numbers, and where to find the details you need about your own account. Plus we’ll also introduce the Wise Account that offers local account details for +8 currencies, including an IBAN for EUR and GBP currencies.

Before we get into the details of whether Revolut has an IBAN, let’s take a quick look at what an IBAN is and why you might need it.

IBAN stands for International Bank Account Number. IBANs are used by banks and other payment service providers in many countries including Ireland - although they’re not the preferred format everywhere.

So, in this case, a Revolut IBAN is a unique code which captures all the information required to receive an international payment to your account with Revlolut.

The IBAN it’s structured to include:

- your bank account number

- your bank’s code

- the country code showing where your account is held

- check digits.

While different countries have a slightly different length of IBAN, the format is codified to make it easy for banks to process international payments efficiently.

But IBANs aren’t used in all countries or for all payment types. In some cases you’ll simply need your account number to receive a payment.

Here are some key differences between an account number vs IBAN:

| Feature | Account Number | IBAN |

|---|---|---|

| Coverage | All countries use account numbers | Not all countries use the IBAN format |

| Payment type | Local payments most commonly | International payments |

| Information captured | Your account number | Your account number, plus bank code, location and checking digits |

When you open a Revolut account in Ireland you’ll get the following account information²:

- IBAN for local EUR transfers within the EEA

- GBP local account sort code and account number

- SWIFT account for international transfers in all supported currencies

All Revolut Ireland accounts have an IBAN you can use for receiving EUR payments. Initially, IBANs were issued through Revolut’s Lithuanian entity, which means the IBAN itself follows the Lithuanian format. This is slightly different to the standard format used for Irish IBANs.

Revolut is in the process of migrating all Irish account holders to an Irish IBAN for receiving euro payments.³ If you have an Revolut Irish IBAN already, the format will look like this:

- 2 letter country code - IE

- 2 digit check number

- 4 characters from the bank's bank code

- 6 digit code for the bank branch

- 8 digit code for the bank account number

This means that a Revolut Irish IBAN is 22 characters long, while the old Lithuanian IBANs were 20 characters. You can receive EUR payments with whichever Revolut IBAN is attached to your account, as customers migrate to the IE IBANs over time.

Here’s how to find your IBAN on Revolut:

- Log in to the Revolut app and go to 'Home'

- Tap 'Accounts' and select EUR as the currency to receive

- Below your balance, tap 'Details' to see the IBAN

You can then give this IBAN to the person sending you money, to receive a euro payment to your account.

If you need a different currency, tap the currency you want to receive to get the GBP account details or Revolut SWIFT information to receive other currencies.

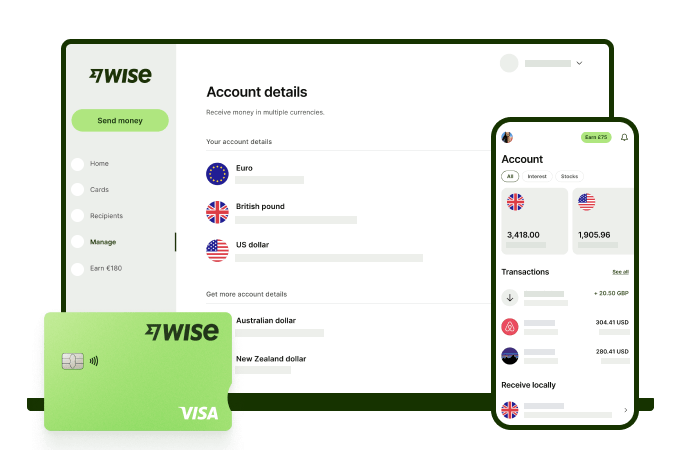

Before you start receiving payments to Revolut check out the Wise Account which has IBANs for EUR and GBP payments, as well as local account details for other 7 currencies such as USD, CAD and AUD, and SWIFT information for many more currencies.

You can open a Wise personal account online with no upfront fee, no minimum balance and no ongoing charges. Other benefits are the ability to hold and convert 40+ currencies, send money to 140+ countries and spend with the Wise card in 150+ countries.

If you’re using your Wise Account to receive incoming EUR or foreign currency payments there’s no Wise charge to receive money using local account information, and fixed fees when receiving a SWIFT transfer.

You can then hold currencies without converting the money to spend later or convert to euros using the mid-market rate and low, transparent fees within your account. That can keep down the costs of managing your money across currencies, and make it easier and more flexible to deal with everyday international payments.

Remember that even if you have account details for multiple currencies in your Wise Account, you always have only one payment account with the Wise entity operating in your region (for Ireland, that is Wise Europe).

Open your Wise Account

for free 🚀

Sources used:

Sources last checked on date: 21st October, 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering if your Revolut card is Visa or Mastercard? Get the lowdown on the differences and how it impacts your spending.

Wondering if Revolut is safe in Ireland? Our comprehensive analysis covers deposit protection, security measures, and more.

Can Irish citizens open a Swiss bank account as non-residents? Read all about it in this guide.

If you need a UK bank account, read this article, as it covers the requirements and documents needed.

Discover how you can open a bank account in Australia from Ireland, including the documents and steps.

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.