Paying with Wise: What are your options?

Everything you need to know about paying with Wise, including the card, online shopping and more.

You may have heard about Wise (formerly TransferWise) from someone you know, or read about it on the internet. And here is the main reason: Wise offers a super convenient way to manage money in an account both at home and abroad.

But managing money online is of course nothing new, there are more services that offer this. So what exactly is Wise and how does it work in Ireland? And what makes it different from other online accounts? In this article you can read everything about Wise in Ireland.

Wise is a global technology company, building the best way to move and manage the world’s money. Previously known as TranferWise, Wise was launched in 2011 by Estonians Kristo Käärmann and Taavet Hinrikus.

Wise's mission is as follows:

| "Wise is building the best way to move and manage the world’s money. Minimum fees. Maximum ease. Full speed." |

|---|

Wise has been very popular for a long time, especially among expats and travellers, and more and more people are now seeing the benefits of this service.

In the fiscal year of 2024, Wise supported around 12.8 million people and businesses, processing approximately £118.5 billion in cross-border transactions, and saving customers over £1.8 billion.

Wise Europe SA is a company incorporated in Belgium with registered number 0713629988. Our registered office is at Rue du Trône 100, 3rd floor, 1050 Brussels, Belgium. Wise Europe SA is a Payment Institution authorised by the National Bank of Belgium.

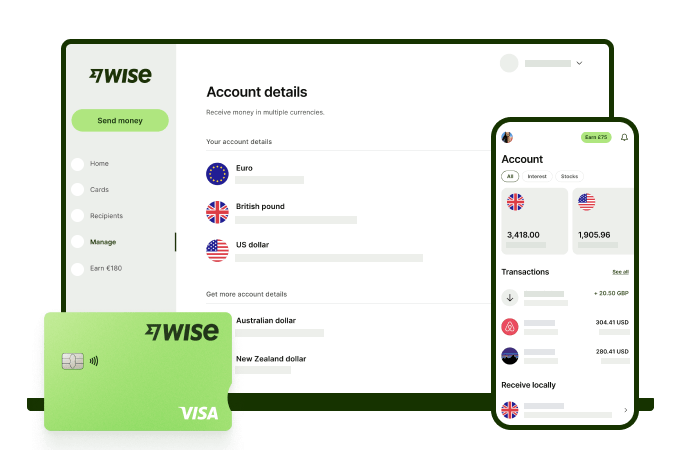

At Wise you can choose from various products that make managing, spending and receiving money easier. The following Wise products are available in Ireland:

- International transfers

- Multi-currency account

- Wise debit card

- Business account

- Assets

With Wise you can make international transfers, and send money to +140 different countries via the Wise website and the Wise app (which you can download from the Apple Store or via the Google Play Store.

With Wise you can always see in real time what you have to pay for an international transaction. There are no hidden costs.

Wise works from a local bank account in one country to another local bank account, but money never crosses borders. Wise partner with over 90 local banks and payment providers to make this possible.

This means that when a sender sends money to Wise, they make a local bank transfer or pay with a local debit/credit card. As a result, there are no international shipping charges found with normal international SWIFT bank transfers.

Wise always uses the mid-market rate, the same rate you normally find on Google. Using this exchange rate is the biggest difference between Wise and most banks, which often use a different exchange rate and add a certain amount of fees on top of it. Something they are usually not very clear about.

Wise also has an online currency converter tool that allows you to check exchange rates and receive alerts when an exchange rate changes.

Most banks and other companies set their own exchange rates, so there is no one answer to this question. But there is a 'real' exchange rate, and it is called the mid-market rate.

Bankers and investors buy and sell currencies at certain prices. The average of these prices is the mid-price. Since this is the rate that the market naturally sets, this is the most "real" and fairest exchange rate on the market. This is the exchange rate that Wise uses for its transactions.

With the Wise Account, a multi-currency account, you can do a lot of things that you can't normally do with most tradicional accounts. You hold and manage more than 40 different currencies in one account, and you can exchange currencies at any time online in just a few clicks via website or Wise app.

You can get local account details in +8 different currencies , including EUR, GBP, USD and more, making it possible to pay and receive money avoiding foreign exchange fees in those cases.*

You can open a Wise Account online, and you don't have to pay anything to open this account as a personal customer. You read that right: opening a Wise multi-currency account is free for private users.

With a Wise Account you can not only receive payments, you can also use the account if you want to send money abroad.

By the way, you do not necessarily have to have a multi-currency account from Wise to be able to send money abroad. You can use Wise as a service for this.

Please see Terms of Use for your region and visit Wise Fees & Pricing for the most up to date pricing information.

After opening the Wise Account, it is possible to order the Wise debit card. With this card you can pay and withdraw money in +150 countries in the local currency.

You can make up to 2 withawals up to €200 per month for free with the physical card.¹ In addition, the Wise card can be linked to Google Pay and Apple Pay, making payments even easier.

The Wise card has a one-time fee of 7€ and it does not have any monthly or annual fees. Check all the Wise card prices.

In addition to a physical debit card, it is also possible to create for free a Wise virtual card. This card is suitable for making online purchases with an extra layer of security. You can delete your virtual cards after a purchase, for example.

If you find it useful to have a Wise debit card, you can order it after opening your account. This is how you do it:

After ordering your physical Wise card, you don't need to wait to start spending, you can create the virtual card to pay in shops and shop online. You'll be able to create it in the cards tab for free.

You can also apply for a Wise digital card without requesting the physical one. In this case, you'll need to add money to your account.

Wise can not only be useful for private use, there are also many advantages to a Wise account for companies and self-employed people.

Here are some features of Wise's Business account you need to know.

With the free Wise Business Essentials plan your company can:

With the Wise Business Advanced plan (one-time fee of €60) your company can get access to:

Check the Wise website for the latest pricing.

Open your

Wise Business account 💼

Disclaimer: The Wise Business pricing structure is changing with effect from 02/02/2026. Receiving money, direct debits and getting paid features are not available with the Essential Plan, which you can open for free. Pay a one-time set up fee of €60 to unlock Advanced features including account details to receive payments in +20 currencies. You’ll also get access to invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check Wise website for the latest pricing information.

With Wise Assets, you can decide how you'd like to hold the money in your currencies or Jars. At the moment, both Interest and Stocks are available in Ireland.

If you select Interest, Wise will invest your money in the jar or currency in an interest-earning fund that holds government-guaranteed assets.

If you select Stocks, Wise will invest your money in the jar or currency in the index tracking fund it has chosen.

Read more about Wise Assets product here.

Whether it is a business account or a personal account, opening a Wise Account is easy:

To fully open your Wise Account, you'll need to get verified, usually with photo ID, proof of address, and/or a photo of yourself with that ID.

Opening a Wise account is free for personal customers.

The Wise Business Essentials plan is free, and the Wise Business Advanced plan has a one-time fee of €60.

Disclaimer: The Wise Business pricing structure is changing with effect from 02/02/2026. Receiving money, direct debits and getting paid features are not available with the Essential Plan, which you can open for free. Pay a one-time set up fee of €60 to unlock Advanced features including account details to receive payments in +20 currencies. You’ll also get access to invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check Wise website for the latest pricing information.

Sources last checked on 11 September 2024.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Everything you need to know about paying with Wise, including the card, online shopping and more.

If you're looking for an Australian IBAN, find the quick, and authentic alternatives in this article.

Looking for the best euro to pounds rate? We break down the best ways to exchange your money for your next trip to the UK.

Heading to Canada? Find the easiest way to exchange your Euros for Canadian dollars. Say goodbye to complicated rates and hello to clarity.

Your guide to grabbing US Dollars in Dublin. Where to exchange, what to avoid, and how to get the most for your Euro.

EUR to AUD exchange made simple. Learn the best way to move your money, how the fees really stack up, and what exchange rates to look for.