What is Odoo? ERP features and pricing guide in Australia

Learn what Odoo is and how its ERP tools work. We explore key modules, Australian pricing plans, and how it integrates with Wise Business.

In Australia, about 1.1 million people, or 7.5% of the workforce, are independent contractors1. They’re common in construction, IT, healthcare, and professional services, usually hired for projects or specialist skills. Contractors aren’t the same as employees under Australian law. Businesses often engage contractors for short-term projects or specialist skills without adding permanent staff.

The catch is that contractors and employees aren’t the same in the eyes of the law. Knowing the difference matters because it affects tax, super, and workplace obligations.

This article explains what an independent contractor is, how they differ from employees in Australia, and how Wise Business makes paying contractors, especially overseas, easier.

| Table of contents |

|---|

Sign up for the Wise Business account! 🚀

An independent contractor is someone who works for themselves and gets hired by a business to do a job. They’re not part of your company like an employee; they agree on the work, set a price, send you an invoice when it’s done, and often work for more than one client at a time.

Most businesses bring in contractors when they need extra hands or specialist skills. It could be a builder on a construction site, a designer creating a new brand logo, or an IT consultant fixing a network issue. Contractors give businesses a way to get things done without adding permanent staff.

Thinking about hiring an independent contractor? Here are some reasons why you should:

Here are some of the common challenges businesses face when working with contractors:

1. Less control over work

Contractors usually decide how and when they’ll do the job. As long as the end result matches the agreement, you don’t get the same say you would with an employee.

2.Risk of misclassification

In Australia, misclassifying an employee as a contractor is known as sham contracting. It can lead to penalties, back payments, and legal disputes under ATO and Fair Work rules2.

3. Short-term focus

Most contractors are brought in for a project or task. Once it’s finished, they move on. That can leave you starting fresh with someone new next time.

4. Possible conflicts of interest

Contractors can work with more than one client at a time, so sometimes they might also be working with a competitor.

5. Quality can vary

Since contractors aren’t part of your team, the way they work and the quality they deliver can differ.

6. Knowledge walks out the door

When a contractor leaves, they take what they learned with them. Without a proper handover, important info can be lost.

7. Higher rates

Contractors usually charge more per hour or per project than employees. It works for short jobs but can get expensive if the work drags on.

In Australia, employees and independent contractors are treated differently. The rules cover how they’re paid, who controls the work, and what responsibilities each side has. Here’s a table that shows the main differences based on ATO guidance.

| Factor | Employee3 | Independent Contractor3 |

|---|---|---|

| Delegation | Can’t delegate or subcontract their work. Must do the work themselves. | Can delegate or subcontract the work, but must pay the person they hire. |

| Payment | Paid for time worked (hours or shifts), per item/activity, or commission. | Paid once the work is finished (to agreed standard). Usually receive all or most of the quoted amount. |

| Invoicing | No need to issue invoices; payment comes through payroll. | Must supply an invoice before being paid. |

| Tools & Equipment | Tools are provided by the employer, or costs are reimbursed/allowance given. | Bring and pay for own tools, equipment, and materials. |

| Leave | Entitled to paid leave (sick, annual, recreation, long service). | No paid leave entitlements. |

| Responsibility for Mistakes | Employer is responsible for fixing mistakes and covers costs. | Contractor fixes their own mistakes and pays the cost. |

| Control Over Work | Follows reasonable requests from the employer/supervisor. | Can choose how to do the work, as long as it meets the contract or agreed standard. |

| Business Connection | Seen as part of the business, not independent. | Runs their own business independently and can accept or refuse extra work. |

| 👆 Read here to learn more about the difference between an independent contractor and employee |

|---|

Employees in Australia are usually paid through payroll. Their wages or salaries are processed on a regular cycle, such as weekly, fortnightly, or monthly. The business withholds tax through PAYG, makes superannuation contributions, and provides paid leave such as annual, sick, or long service leave. Payments are steady, and employees are tied to ongoing workplace entitlements.

Independent contractors are paid differently. They quote for a job or project, and once the work is completed to the agreed standard, they send an invoice to get paid. They’re generally paid the full or majority amount of that quote rather than receiving ongoing wages. Contractors handle their own taxes, except in special cases where the business still has obligations, for example, labour-only contracts or work in the entertainment industry.

For employees, costs continue with wages and leave, even when projects slow down. Contractors, on the other hand, are paid for the work they deliver, but that also means handling invoices, deadlines, and quality checks. Simply put, employees are part of the business, while contractors operate on their own and get paid for results.

Paying independent contractors overseas can be complicated. Exchange rates change, banks add fees, and transfers are often delayed. For Australian businesses, this creates extra admin and uncertainty about the final cost of each payment. Contractors generally anticipate timely and reliable payment, and disruptions in this process can negatively impact professional relationships.

Wise Business helps simplify this. With one account, businesses can manage international payments without the usual complications.

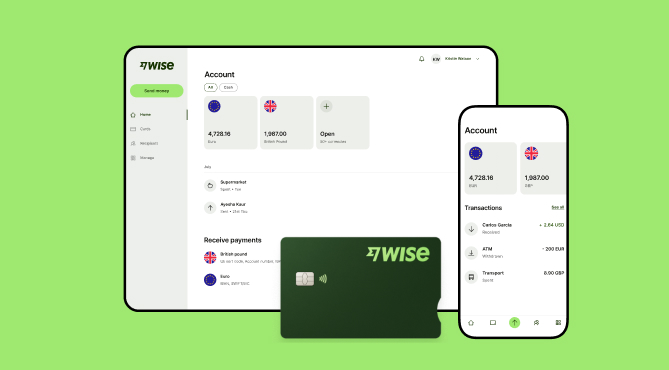

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn what Odoo is and how its ERP tools work. We explore key modules, Australian pricing plans, and how it integrates with Wise Business.

Learn about Zoho Books, it's key features, pricing plans, GST handling, and how Zoho Books compares with Xero and QuickBooks for business accounting.

Learn what an invoice number is and how to assign it. We cover sequential formats, best practices, organization ideas, and more.

What is a liquid asset? Learn liquidity meaning, examples, and why liquid assets matter for business cash flow and stability.

Learn what Microsoft Dynamics 365 is, how its main apps work, pricing in Australia, and how it integrates with Wise Business for easier cross-border payments.

Explore Australia's payment landscape. From cards and PayID to BNPL, learn how the right methods improve customer trust, cash flow, and global reach.