AMP business account: Guide on features and benefits

Learn about AMB business account, their features and fees for transactions. More on how to open an AMP account online. Read here

A major objective for many businesses is to grow and expand. This is especially true for those companies located in smaller countries, where their native customer base is perhaps not large enough to drive significant growth. In order to achieve this expansion and scale up, businesses will often attempt to build their presence and generate revenue overseas.

However, there are certain logistical challenges to this, with one of the most prominent being the issue of foreign currencies and exchange rates. Native bank accounts will usually charge excessive fees for transacting with foreign equivalents, which can quickly eat into profit margins and revenue.

And so, many businesses will choose to set up a business foreign currency account to help them with this aspect of their operations.

In this article, we’ll be taking a look at what a foreign currency bank account is, who needs one, and the benefits it brings. We’ll provide the steps needed to set one up in Australia before comparing some of the best options available for Australian businesses in 2025.

*This article is provided for general information purposes and has been prepared without taking into account your objectives, financial situation, or needs.

| Table of contents |

|---|

A business foreign currency account is a type of bank account that allows a business to hold, send, and receive foreign currencies within a native account. As a result, they are an essential asset for businesses that deal with a number of overseas partners, suppliers, and customers.

Whenever you need to convert a transaction from your home currency to a foreign one, you’ll incur some form of conversion fee if done within a native bank account. With a foreign currency account, there is no need for conversion as you’ll already have the funds to send directly. This can save a lot of money on conversion fees, particularly for businesses that complete hundreds of transactions every day.

Not every business needs this type of account. It’s only really necessary to have one if your business engages with any form of overseas commerce or trade. Businesses with plans for overseas expansion might also want to get one in place early so that it’s ready to go.

Some of the main types of businesses or organisations that would benefit from a business foreign currency account include:

It should be noted that if you’re a business that engages in occasional overseas transactions or one-off orders, it might not be necessary to set up an entirely new account. Your regular native account should be sufficient to handle this.

There are several reasons why it might be beneficial for businesses to set up a business foreign currency account. We’ve already discussed the fact that it removes the need for conversion fees to be applied to every international transaction, which is clearly the biggest advantage that they have over native accounts.

But there are other notable positives as well.

One is that financial transactions between international partners become much faster if they are conducted in the same currency. This is essential for businesses that need to keep a tight leash on their cash flow schedules.

It also allows a business to have slightly better control over market conditions that can affect foreign currency exchange rates. They can convert their funds from native to foreign, and vice versa, when the exchange rates are more favourable, rather than being forced to implement them when they change.

And in a more general sense, it gives the business a more professional image and outlook. It informs potential international partners and suppliers that the business is prepared to cater to their needs, which can help to establish trust and authority in the relationship.

If you’re looking to open a business foreign currency account in Australia, there are a few things that you’ll need to have in place and be able to provide. Fortunately, it’s not an overly complicated process, and most providers will have similar requirements.

Some of the key things you’ll need include:

You may also need to have an explanation or business plan ready as to why you need to open the account, as well as the expected currencies you’ll be dealing with.

While most providers will broadly offer the same features, there is some nuance in terms of certain providers being more suitable for certain situations and businesses. When trying to decide which is best for you, there are some key features and metrics that you should pay close attention to, including:

Now that you have a better idea of what a foreign currency account is, how it works, and why it might be needed, let’s take a look at some of the key banks and providers that offer this service.

Before we take a look at each in more detail, here is a breakdown of the key metrics and features you should pay attention to.

| Wise Business1 | CommonwealthBank (CommBank)2 | WestPac4 | National Australia Bank (NAB)6 | |

|---|---|---|---|---|

| Account opening fees | Free | Free | Free | Free |

| Monthly account fees | None | None | None | None |

| Foreign conversion fee | Mid-market exchange rate | $30 for in-branch transactions, fees may apply for online | $32 for in-branch transactions, fees may apply for online | $30 for in-branch transactions, fees may apply for online |

| Currencies available | 40+ | 15 | 12 | 16 |

| Overdraft available | No | No | Yes | Yes |

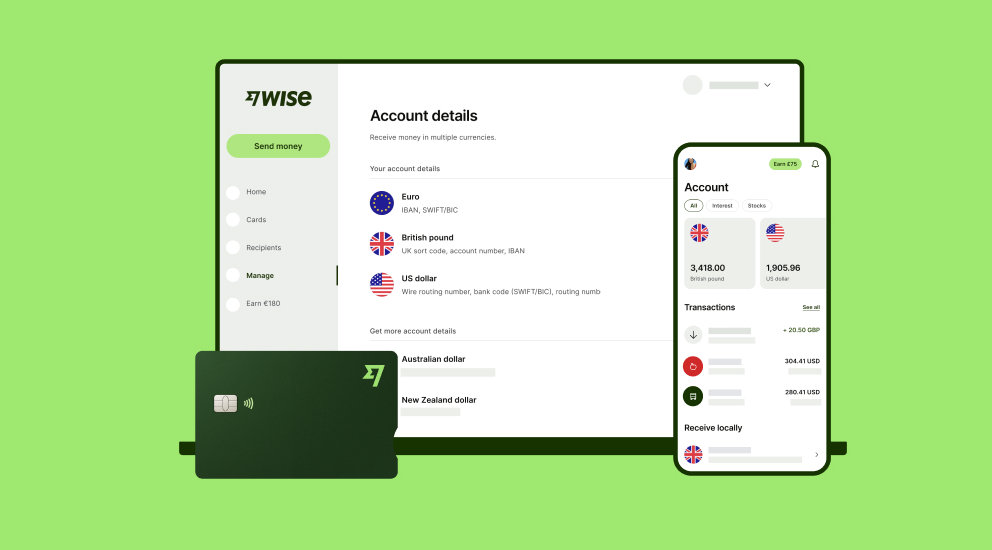

Wise Business is not a traditional bank, but it was set up specifically for international payments for both personal and business accounts. It’s built with transparency and openness in mind, with transparent pricing and no hidden markups.

It’s a modern platform with excellent app support and integration with platforms such as Xero and Stripe to provide fast, seamless international payments.

With no account fees to worry about, exchange rates starting from just 0.63%, Wise offers fast transactions, making it ideally suited for small- to medium-sized businesses with a frequency of daily transfers1. By setting exchange rates at the mid-market exchange rate, businesses will never fall foul of wildly fluctuating rates caused by external factors.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

** Capital at risk, growth not guaranteed. Interest is the name of a custody and nominee service provided by Wise Australia Investments Pty Ltd in partnership with Franklin Templeton.

CommBank is one of the big multinational banks based in Australia. With branches across New Zealand, Europe, Asia, and the US, it’s a good solution for businesses looking to conduct international trade. Transfer fees for sending fees to other accounts are $30AUD per transaction, though they are waived if the transaction is conducted between CommBank locations3.

In terms of receiving money from abroad, there is a flat fee of $11AUD per transfer, which can add up quickly if not monitored carefully3.

You will need to have an existing CommBank account in place if you wish to set up a business foreign currency account. And this will need to be done in person rather than online, which isn’t always ideal.

Additional features of note include:

Westpac offers a business foreign currency account that’s very quick and easy to set up, though, like CommBank, you’ll need an existing native account in place. It can mostly be set up online; however, if you require certain less common currencies (SEK, CHF, THB), you will need to find a branch to finalise this.

Its fee for receiving money abroad is $12AUD, making it slightly more expensive than CommBank5. Certain currencies will require an initial deposit maintenance fee.

It doesn’t offer interest rates, which puts it at a disadvantage against other providers5. However, it is one of the few banks that offers an overdraft for foreign currency accounts, which might be appealing to certain businesses and, in particular, sole traders.

Other notable features include:

A business foreign currency account from National Australia Bank (NAB) is another steady and secure option, with no account opening fee, no monthly account fee, and no minimum balance requirements. It places second on our list in terms of currencies available, and there are no fees for banker-assisted international transfers, which is a strong positive6.

It does have a steeper receiving fee ($15AUD) than the other options, and there may be additional fees charged on large foreign currency balances6.

Other notable features include:

When you hear the term ‘business foreign currency account', your first instinct is likely to think of setting up an account via a bank. And while there are a number of traditional financial institutions that do offer good deals, modern fintech operations such as Wise offer an alternative that thousands of people are turning to every year.

With our low fees and vast access to dozens of currencies worldwide, as well as access to our Wise international business card, we’re perfectly placed to assist with businesses across all sectors.

If you’re a business or sole trader looking to expand into overseas territories, then why not consider opening a Wise international business foreign currency account today?

Sign up for the Wise Business account! 🚀

1. Is it worth having a foreign currency account?

For businesses that conduct their operations primarily within their home territory, with only occasional overseas exchanges, it is perhaps not necessary. However, for businesses that engage with a high number of transactions, or for businesses looking to expand overseas, it is definitely worth it.

2. What are the risks of foreign currency accounts?

While they are much kinder in terms of international transaction fees (both sending and receiving) than native accounts, they are still there, and they can add up quickly if not monitored closely. You might also fall foul of sudden shifts in exchange rates, with your held funds suddenly not as valuable when compared to AUD.

3. Who cannot open a business foreign currency account?

If a provider deems your business to be in a high-risk industry (gambling, adult entertainment) they may decline an application. A business looking to open an overseas subsidiary without the correct registrations for the new territory (e.g., ASIC registration in Australia) will usually get rejected, as will applicants that fail the ID verification checks.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about AMB business account, their features and fees for transactions. More on how to open an AMP account online. Read here

Explore all of BankSA’s business account and finance solutions with a full run down of features, fees, and what you’ll need to do to sign up.

Learn more about the requirements to open a Wise Business account in Australia. Discover what documents you need and how to set up your own account online.

Learn how the OFX business account works, its features, and how it compares to other international payments solutions. Find out more here!

Discover the best small business bank accounts in Australia for 2025. Compare fees, features, and benefits to find the perfect solution for your business.

Is the Remitly business account available in Australia? How does it facilitate global payments compared to alternatives like Wise Business. Read for more info!