AMP business account: Guide on features and benefits

Learn about AMB business account, their features and fees for transactions. More on how to open an AMP account online. Read here

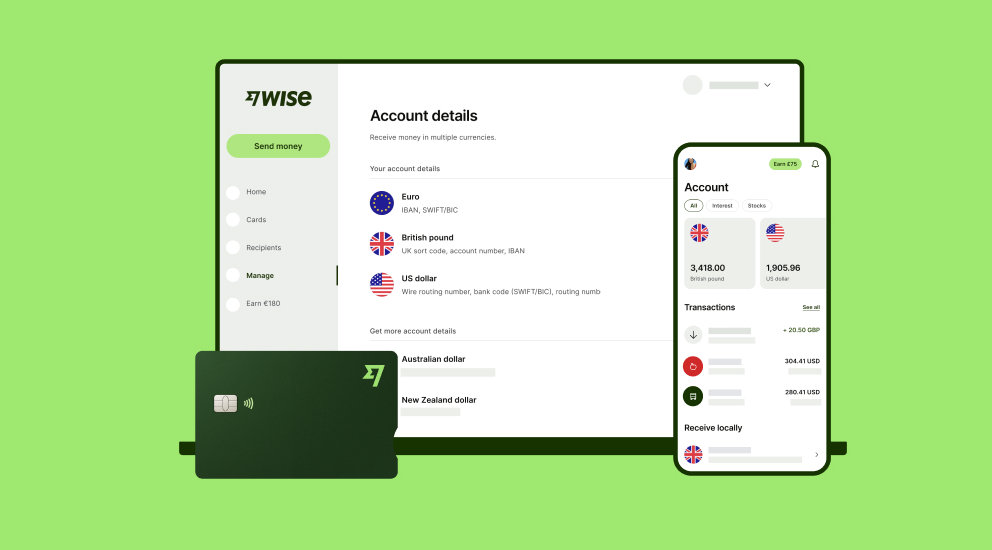

If you’ve been receiving international payments since around 2011, you might remember Wise by its old name: Transfer Wise. Today, Wise Business makes it easy to send, receive, and hold money in different currencies without the hefty fees involved with cross-border money transfers.

For businesses in Australia, this can mean getting paid by clients overseas, paying suppliers abroad, or covering team expenses in multiple currencies. And because everything is managed online, it’s straightforward for both small businesses and larger companies to stay on top of their global payments.

| Table of contents |

|---|

Sign up for the Wise Business account! 🚀

Wise isn’t a bank. It’s an Electronic Money Institution (EMI). Wise can hold and move money, but it can’t use customer deposits for lending or investments the way banks do. Instead, customer funds are safeguarded in separate accounts with trusted financial institutions. In Australia, it’s licensed by the Australian Securities and Investments Commission (ASIC) and holds an Australian Financial Services Licence (AFSL number 513764).

Wise also takes regulation seriously wherever it operates. In Australia, there are compliance teams and systems working all the time in the background to make sure customers’ money is protected. So while it doesn’t function like a bank, Wise adheres to strict financial regulations in Australia to keep your money secure.

| 💡 Learn more about how Wise keeps customers safe |

|---|

Having a dedicated business account is essential for keeping your company’s finances organised. It separates personal spending from business transactions, makes tax reporting easier, and builds credibility with clients and suppliers. Using a personal account can quickly become confusing, especially when it comes to reporting to the Australian Taxation Office (ATO). If you wish to see the differences, here’s a helpful guide: Wise Business vs Personal accounts.

Opening a Wise Business account is fully online and simple to complete. You’ll provide details about your business, such as business name, legal type, ABN or ACN, and addresses, along with information about directors or owners. An account representative (with a personal Wise profile) will also be needed. Supporting documents like proof of incorporation, identity documents, and proof of address may be required. Once everything is uploaded, Wise reviews the information, and accounts are often verified within a few business days.

Verification of your business is an important part of the process to set up your Wise Business account. It ensures that every account is tied to a genuine business and helps Wise stay compliant with international regulations. Dedicated compliance teams check documents against financial standards in Australia and abroad to keep accounts safe.

To open a Wise Business account in Australia, you’ll need to provide some details about your company and its representatives. These requirements help Wise confirm who you are and ensure the account is being used for legitimate business purposes.

Here’s what you’ll be asked for:

1. Business name

Check out our article on How to register a business name in Australia.

2. Business legal type

For reference, here’s an overview of business registration in Australia.

3. Business category

4. Directors and owners

5. Business registration number

6. Registered business address

7. Trading address

8. Account representative’s details

9. Purpose of the account

10. Business description/industry questions

11. Business website (not mandatory)

Note: Wise will ask you for further documents to verify the information you supply. For instance, proof of address or incorporation certificates. This is a normal procedure with financial institutions and maintains compliance with local regulations.

| 👆 For more specific information on requirements for different business types in Australia, refer here |

|---|

| Feature | Price / Fee | Notes |

|---|---|---|

| Registering with Wise | Free | Creating a Wise profile is free. |

| Local Account Details | 65 AUD one-time | Unlocks all Wise Business features. |

| Sending money | From 0.63% | Fee varies by currency. Transparent, shown upfront. |

| Converting money | From 0.63% | Mid-market exchange rate, no hidden markups. |

| Receiving SWIFT in other currencies | Varies | See full list. |

| Domestic AUD transfers | Free | Non-SWIFT transfers in AUD are free. |

| Spending with Wise debit card | Free | Spend in the same currency online, in-store, or abroad. |

| ATM withdrawals | Up to 350 AUD/month (max 2 withdrawals): Free | After that: 1.50 AUD + 1.75% per withdrawal. |

| Holding money in account | Free | No ongoing charges. |

| Wise Interest | Keep your money in an interest-earning fund 0.72% annual fee. | Returns not guaranteed. |

Check out our pricing page for more details on Wise Business fees and pricing info in Australia.

Now that you know the requirements for a Wise Business account in Australia, you’re ready to set one up. Open your Wise Business account today and start managing your money globally with fewer fees and more control.

Setting up a Wise Business account in Australia is easy and entirely online. Once your account is set up, there are no ongoing fees or surprise monthly charges. The fees you may incur will only be when you send money or convert money. They will be 100% transparent to avoid any nasty surprises.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

With these features, Wise Business gives Australian companies a practical way to handle global payments, whether you’re a freelancer billing overseas clients, a startup paying remote staff, or a growing company managing suppliers worldwide.

1. How long does it take to open a Wise Business account in Australia?

Most accounts are verified within a few working days, but it depends on how quickly the required documents are provided and approved.

2. Can sole traders open a Wise Business account?

Yes. Sole traders, partnerships, companies, and other registered entities can apply.

3. Do I need a business website?

No. A website is optional, though providing one may help speed up the verification process.

4. What documents will I need?

You’ll usually need your ABN or ACN, registered business address, director or owner details, and ID for the account representative. Wise may ask for additional documents, such as proof of address or a certificate of incorporation.

5. Is my money safe with Wise?

Yes. While Wise is not a bank, it’s licensed and regulated in Australia by ASIC, APRA, and AUSTRAC. Customer funds are safeguarded in separate accounts with trusted financial institutions.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about AMB business account, their features and fees for transactions. More on how to open an AMP account online. Read here

Explore all of BankSA’s business account and finance solutions with a full run down of features, fees, and what you’ll need to do to sign up.

Check out our guide on the top business foreign currency accounts if you’re an Australian business looking to expand overseas.

Learn how the OFX business account works, its features, and how it compares to other international payments solutions. Find out more here!

Discover the best small business bank accounts in Australia for 2025. Compare fees, features, and benefits to find the perfect solution for your business.

Is the Remitly business account available in Australia? How does it facilitate global payments compared to alternatives like Wise Business. Read for more info!