What is Odoo? ERP features and pricing guide in Australia

Learn what Odoo is and how its ERP tools work. We explore key modules, Australian pricing plans, and how it integrates with Wise Business.

Thinking of starting a cleaning business? There are currently 32,000+ domestic cleaners and 153,000+ commercial cleaners in Australia, highlighting the popularity and demand for workers in home and business spaces¹.

To launch a business in this industry, it’s important to understand what’s involved so you can set everything up legally and attract clients while building a service that stands out in a competitive market. There are lots of niches you can explore.

In this blog, we’ll walk you through the main types of cleaning businesses and the steps to get started in Australia. There’s also an introduction to Wise Business for managing small business finances.

| Table of contents |

|---|

Sign up for the Wise Business account! 🚀

You can start a cleaning business entirely on your own or hire staff to create a team, depending on how ambitious your plans. Before you get started, though, there are certain building blocks you need to put in place to give your business a sound legal and financial footing to work from.

Follow these eight steps — from registering your business to building your brand — to get your cleaning enterprise up and running.

Start by looking at the demand in your state in Australia. Residential cleaning tends to be competitive, but you could carve out a niche in eco-friendly cleaning or office cleaning. Take a deep dive into “competitor analysis.” Find out who they are, what they charge, and whether there are any gaps in services you use to differentiate yourself.

We’ll look at the different types of cleaning businesses in more detail later.

When you’ve decided what direction to go in, you’ll need to sort out a few legal requirements. You must decide on a legal business name. This could be your own personal name, but it might be better to choose something that supports your branding efforts later. However, you must register any business name other than your own name with ASIC².

You should also:

Next, use your legal details to finalise a business structure. Many opt to work as sole traders at this stage as it’s easier to set up with lower costs. But you could also register as a company (e.g., Pty Ltd) if you want a bit more structure and legal protection.

| 👆Read our blog on the Pty Ltd meaning in Australia for more information about how this works (and the differences to registering as a sole trader or partnership) |

|---|

Another common question is: how much money do I need to start a cleaning business? Startup costs vary depending on the type of cleaning business you choose and the industries and clients you work for. A small residential cleaning service could cost $2,000 to source basic equipment and supplies, but commercial setups might need $15,000+ for industrial machinery and vehicles.

Don’t forget insurance, either. You’ll definitely want to take out public liability insurance to cover for accidental damage to a client’s property. And you might also benefit from income protection and equipment insurance.

Here’s a round-up of common costs:

To cover these startup costs, you can use personal savings early on if you’re in a financial position to do so, or take out a small business loan. To get lenders to agree to a loan, you’ll need to meet the eligibility criteria — which can be strict — and provide a business plan.

| 👆Check out our guide on business startup loans in 2025 |

|---|

If you’re wondering what licences are needed to start a cleaning business, the barrier to entry is quite low. You usually don’t need to acquire any in Australia. However, you can take courses to get domestic and commercial cleaning certifications. These provide you with practical skills, as well as a “seal of approval” to show customers that you’re a professional with high standards.

Even though there aren’t any specific regulations, there are still local requirements in Australia to keep in mind:

Once the legal stuff is sorted, you’ll need to get the word out there that your cleaning business is up and running and ready to serve clients. You can do this the old-fashioned way with flyers and leaflets (still useful for local businesses), and by setting up a website and running ads on Google and across social media.

You can also:

Going solo is a likely starting point for a new cleaning business. But if you expand, you’ll need to hire staff and make sure they are trained to meet safety standards and deliver consistent results. You’ll also need your business bank account to pay your staff and manage things like superannuation and tax obligations in line with Australian employment laws.

There are multiple types of cleaning businesses in Australia. Each catering to different environments and clients' needs across homes, offices, industrial sites, etc. Every space needs cleaning, so you should find demand in most areas.

Here are nine examples:

It might be easier to stick to one niche at the start, but you can always scale up and offer a wider variety of services eventually to grow your business.

Managing cash flow is a big challenge for small cleaning businesses. You might have to juggle multiple clients paying at different times of the month, or work with overseas suppliers to stock up on inventory. This is why the Australian government says it’s a “good idea” to open a separate business bank account, even if you’re a sole trader.

You’ll be able to manage your business finances without them getting mixed in with personal funds. This is much better for accounting and tax reporting, too.

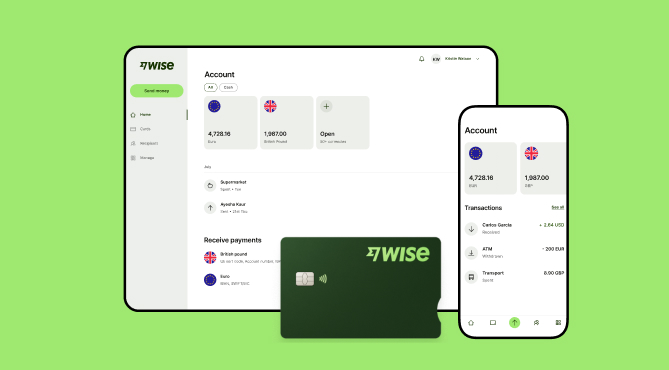

If you’re just starting out, a Wise Business account gives you all the tools to streamline payments and keep finances organised so you can focus on growing your cleaning business.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn what Odoo is and how its ERP tools work. We explore key modules, Australian pricing plans, and how it integrates with Wise Business.

Learn about Zoho Books, it's key features, pricing plans, GST handling, and how Zoho Books compares with Xero and QuickBooks for business accounting.

Learn what an invoice number is and how to assign it. We cover sequential formats, best practices, organization ideas, and more.

What is a liquid asset? Learn liquidity meaning, examples, and why liquid assets matter for business cash flow and stability.

Learn what Microsoft Dynamics 365 is, how its main apps work, pricing in Australia, and how it integrates with Wise Business for easier cross-border payments.

Explore Australia's payment landscape. From cards and PayID to BNPL, learn how the right methods improve customer trust, cash flow, and global reach.