Xero pricing Australia: Plans, costs & features guide

Explore Xero pricing in Australia. We break down all 4 plans, hidden costs, and features like payroll & multi-currency. Find more.

Paying super contributions is a fact of life for every employer in Australia. These contributions support employees’ financial futures and are essential for staying compliant and avoiding costly penalties. It’s important, then, to fully understand your obligations.

If you’re in a position where you wondering if you're one of the employers that have to pay super, then this blog is for you. We will look at super contributions from the perspective of an employer, detailing the rules, rates, due dates, and some case studies with calculations.

| Table of contents |

|---|

Superannuation is an investment and savings system in Australia based on employer super contributions. Employers are mandated by law to pay ‘super’ to ensure workers can live comfortably during retirement.

In Australia, employers must pay a minimum superannuation guarantee (SG) rate based on an employee’s earnings.

Superannuation eligibility rules changed in July 2022. Previously, workers earning less than $450 a month were exempt. That’s no longer the case. You now have to pay super on all earnings, regardless of the amount2.

Most employees aged 18 or older qualify for the super guarantee. That means you’ll have to pay if they work full-time or part-time, or are a temporary resident in Australia2.

Paying employees in Australia is relatively straightforward, but what if you have workers based overseas? Your superannuation obligations will depend on the tax residency of that employee and the nature of their employment.

Let’s take a look at a couple of examples:

| ℹ️ Any employees working in another country temporarily are not usually exempt from super contributions. That means you must continue to pay super while they are away. |

|---|

There are times when the host country may have a similar contributions system in place that must also be paid. Australia has a bilateral agreement with 24 countries to help with the issue of ‘super double coverage’4. You can apply for a certificate of coverage to be exempt from paying super twice when an employee is in one of the countries4.

As the super obligations for overseas workers can be very specific, it’s important to talk to a legal or financial advisor to make sense of your obligations. The Australian Taxation Office (ATO) can also provide guidance.

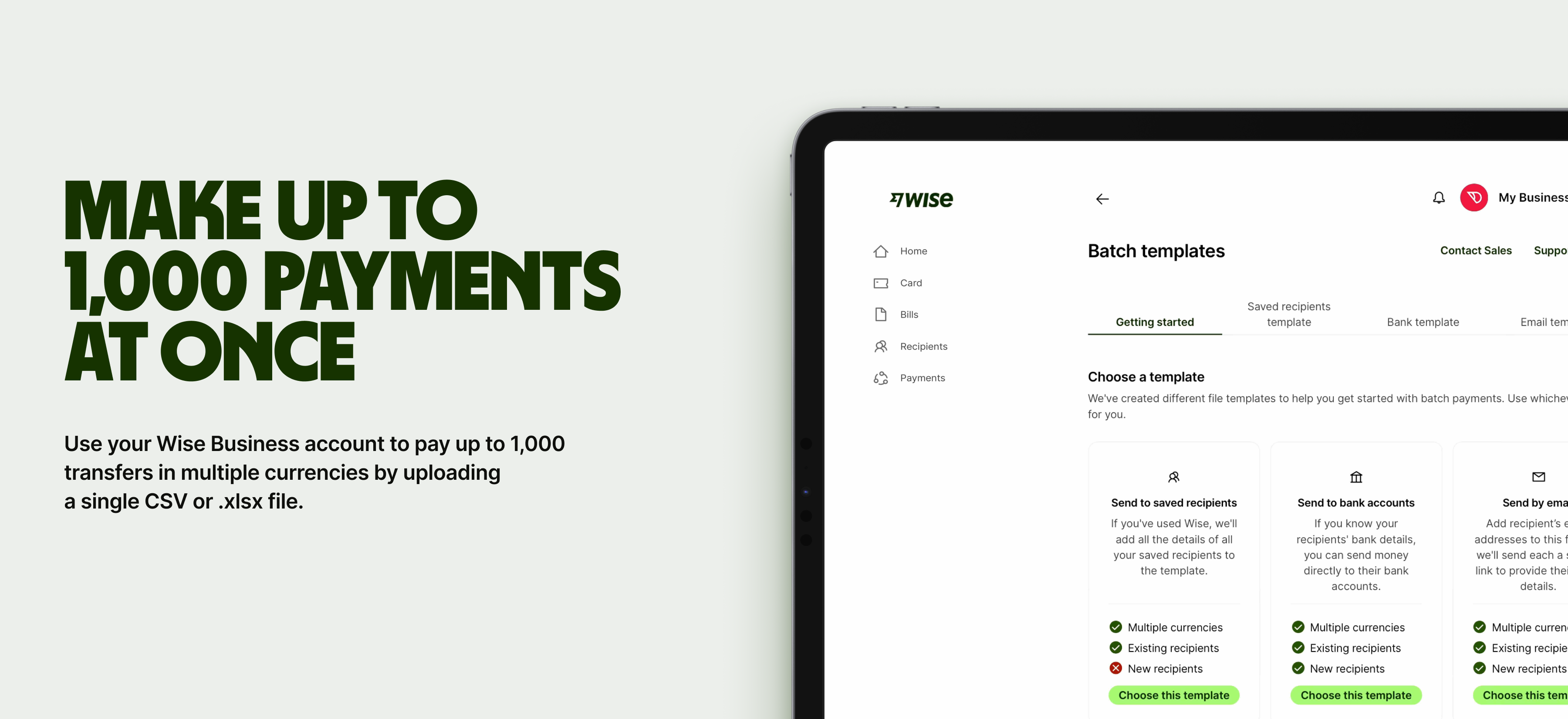

Got a team of employees/freelancers outside of Australia? No problem. With a Wise Business account, you can complete foreign transactions with low and transparent fees, so you never get caught out. Conversions are always made at the real mid-market rate, too, with no hidden markup.

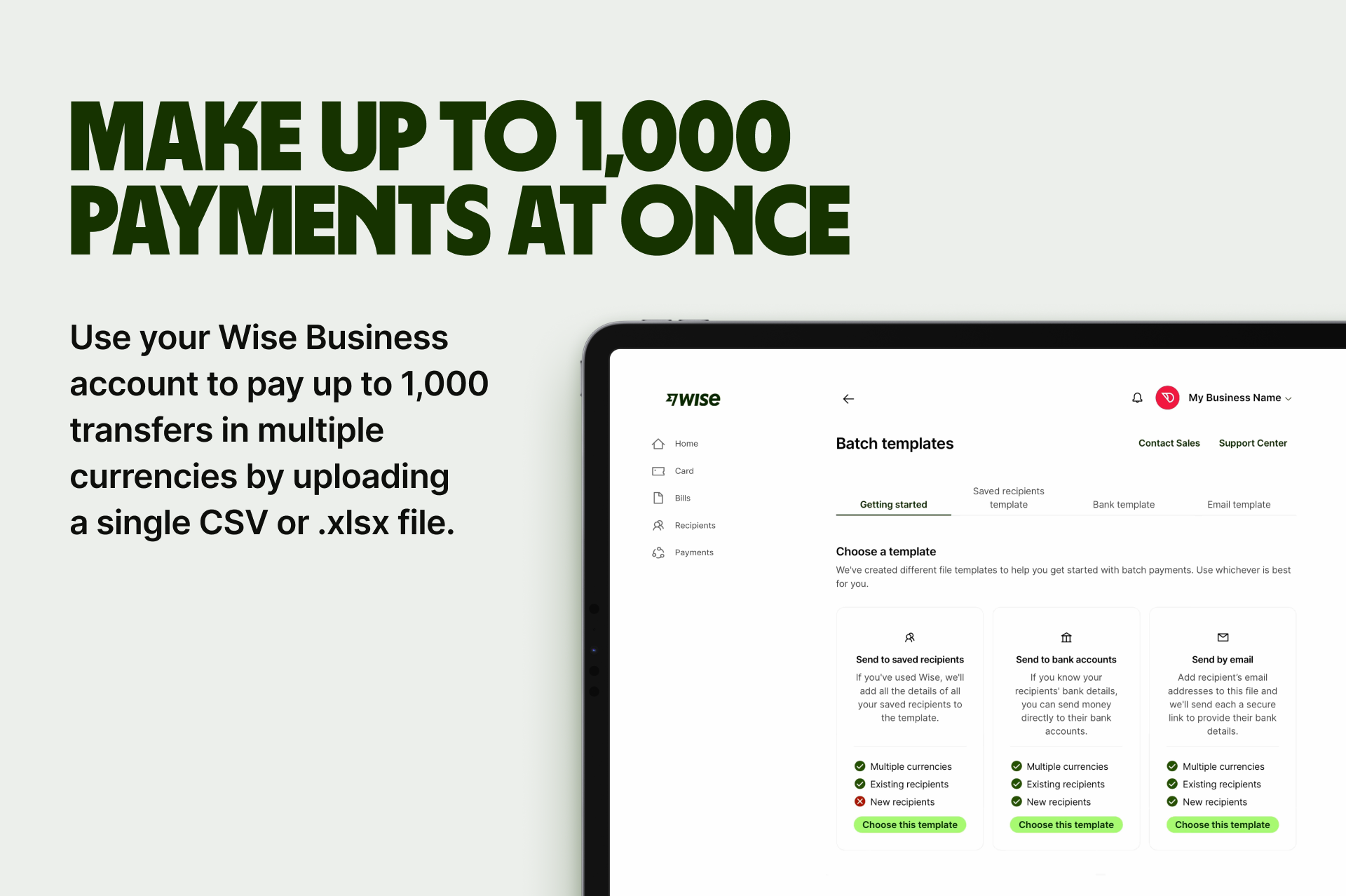

Businesses could also leverage the ‘Batch Transfer’ functionality where you can make multiple payouts faster, and for less!

Sign up for the Wise Business account! 🚀

The employer super contribution rate will rise to 12% from July 1, 2025. This rate is a percentage of an employee’s ordinary time earnings (OTE) before tax. You will contribute this amount based on the amount an employee earns per quarter, not annually.

Several factors influence the superannuation rate you pay in Australia. These include:

Does an employer always have to pay super? The ATO has a handy decision tool to help you determine whether employees qualify for the super guarantee.

Based on the eligibility factors and minimum super guarantee rate, you can start working out exactly how much you must contribute each quarter. Let’s look at a few scenarios to demonstrate some calculations.

Temporary residents qualify for superannuation. Mateo, a 25-year-old working full-time at a hillside resort for two months with an $800 per week income, would earn $6,400 in total before tax.

At the 12% rate effective from July 2025, you would have to contribute $768 in superannuation on top of his wages.

Under 18s only qualify for 30+ hour working weeks. Ella is 17 and works at a bakery for 16 hours most weeks and 35 hours a week during school holidays.

You would only have to pay superannuation in the weeks she works 35 hours. The rate is 12% of the amount she earns during a quarter for those longer weeks. The 16-hour work weeks are not eligible until she turns 18.

Australian residents for tax purposes qualify for SG even if they move overseas temporarily. James, a marketer, relocates to Portugal for six months to work remotely but is paid by you, an Australian employer with an Australian contract.

You must continue to pay superannuation as normal. If James earns $5,000 a month, you will contribute $600 as super based on the 12% rate. During the whole six months, this will amount to $3,600 in contributions.

An employer has to pay super every quarter in Australia. However, the payment deadline doesn’t fall on the final day of the super quarterly dates. You get one month to calculate the contributions owed to your employees and to pay them.

The quarterly superannuation dates follow the calendar year7.

You can choose to pay super more frequently, which might be beneficial if your pay periods are fortnightly or monthly, but quarterly is the maximum period by law.

If you don’t settle your super obligations on time, you will have to pay a superannuation guarantee charge (SGC)7. This isn’t tax-deductible.

You’ll need information from your employees when they start a new job so you can start paying superannuation contributions correctly. These details include8:

When an employee joins your business, you can send them a form to nominate a default super fund, if they are eligible to do so. However, you can’t offer financial advice or provide recommendations about which fund to choose.

You must fill in the relevant details for the Superannuation standard choice form before sending it to an employee9. They can then complete it and submit it online via the myGov platform.

Contributions are taxed. However, employers have no direct tax obligation for super contributions10. Your contributions will be taxed at a 15% rate, which is typically lower than income tax, but these are handled by the super fund. Your main role as an employer is to ensure that the super contributions are calculated correctly and paid on time.

Example: If you contribute $10,000 to an employee’s superannuation fund, the fund will pay $1,500 at a 15% tax rate. The employee will then see their super balance increase by $8,500 after tax.

Australian employers must always stay on top of superannuation. Paying employees super guarantee (SG) at the minimum rate, which is set to rise to 12% in July 2025, is required by law every quarter and at least four times a year. Getting it right will ensure you support employees and stay compliant.

With the help of Wise Business, you can also save money along the way when paying employees overseas. You can leverage automated payments, batch transfers, and even manage international payroll through our Wise Business account.

What's more, you'll benefit from the following with a Wise Business account:

Sign up for the Wise Business account! 🚀

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore Xero pricing in Australia. We break down all 4 plans, hidden costs, and features like payroll & multi-currency. Find more.

Wondering how to reactivate your ABN? Find out more on ABN reactivation, eligibility, required documents, and overall process.

Discover how Xero integration connects works and connects to over 1,000 apps, from ecommerce to payments. Read here.

Learn how to create a compliant tax invoice in Australia. We cover ATO requirements, GST rules, mandatory fields, and more.

Aussie guide on finding the right dropshipping supplier. Explore directories vs wholesalers, checklists, and saving on international payments.

What does it mean to buy direct from China suppliers safely. Discover platforms, steps, and best ways to pay vendors overseas.