Best Accounts Payable Software 2026: Top AP Automation Tools for Businesses

Discover the best accounts payable software to streamline your business operations and optimize financial management.

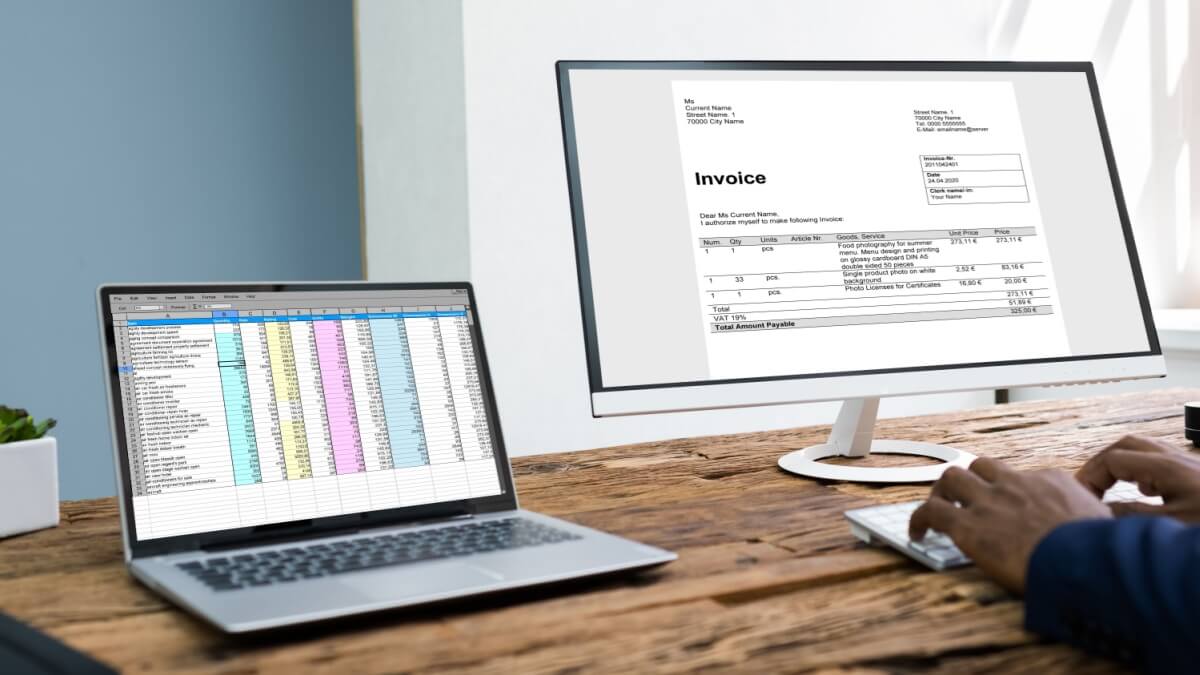

Processing invoices by hand can feel like a never-ending cycle of data entry, approvals and chasing down paperwork. For many finance teams, it’s one of those tasks that eats up hours but adds very little value. Accounts payable invoice automation changes that take the routine work off your plate. Instead of stacks of invoices sitting on a desk or buried in emails, automation keeps everything organized, speeds up approvals, and cuts down on mistakes.

The result is simple: vendors get paid on time, your team spends less energy on admin and you gain a clearer picture of cash flow. So with that being said, let’s explore how Accounts Payable Invoice Automations work and how they can benefit your business.

| Discover Wise Business: Simplify Your International Finances |

|---|

| Wise makes it easier to manage your business finances. You can manage everything from one app, there are no monthly fees, and international payments use the mid-market rate. It also integrates smoothly with accounting software to keep your operations running efficiently. |

| Find out more about Wise Business |

Accounts payable invoice automation refers to using software to handle the entire invoice process, from receipt to payment, without relying on manual data entry. Automation tools capture invoice data, route it for approval and integrate directly into accounting systems.¹ This helps you save significant time, reduces errors, and makes sure vendors are paid promptly.1,2

If you’re operating a growing business, you’re not just cutting costs, but you’re also reducing compliance risks and improving supplier relationships.³ Modern tools even incorporate AI to detect errors or duplicates before they become expensive mistakes.3,4

It’s also easy to use and works very well. Invoices are received either electronically or scanned into the system, where automation software captures and validates key details like vendor information, amounts, and due dates.1,2

Once verified, invoices are routed through predefined approval workflows, while reducing delays and human error.³ After approval, the system schedules payments and syncs records with the company’s accounting platform.4,5 So what was once manual paperwork is now turned into a faster, more reliable workflow.

Though often used interchangeably, invoice automation and accounts payable automation aren’t the same. The distinction matters for businesses deciding how deeply they want to digitize their workflows.

Invoice automation focuses specifically on capturing, validating and routing invoices for approval. Invoice automation is a piece of the bigger puzzle, as it helps with one of the most time-consuming tasks within AP.1,3

Automation in accounts payable covers the entire payables process, including vendor onboarding, purchase orders, payments and reporting.1,2 End-to-end AP automation integrates invoice automation into a broader system that connects procurement, approvals, compliance and payment execution.3,5

Some may start with invoice automation as a first step, while others move directly to full-scale AP automation for maximum efficiency.2,4 Both solutions reduce manual workload, but the scope and impact differ, so it’s important to choose the right approach based on company size, budget and goals.⁵

Manual accounts payable workflows can be slow and tedious, often involving invoices being passed between departments with multiple systems and approvals constantly being chased down. Automating the AP invoice process fixes these inefficiencies by creating a digital, rule-based workflow. Invoices are captured electronically, checked against purchase orders and sent automatically to the right approvers. This helps reduce delays, prevent duplicate payments and ensure internal controls are followed.

One of the biggest advantages is visibility, finance teams can see the status of every invoice in real time and spot potential bottlenecks quickly. Automated workflows also integrate with ERP systems, while also keeping data flowing smoothly across finance functions. The result is faster processing, fewer errors and lower costs.

If you’re a company that handles a lot of invoices, workflow automation is very practical in terms of scaling operations efficiently while letting staff focus on higher-value work instead of repetitive manual tasks.

Implementing end-to-end AP automation can transform how growing businesses manage accounts payable. If you’re a business who's scaling quickly, this means stronger cash flow management and fewer costly errors.

However, automation isn’t without challenges. It requires upfront investment, staff training, and integration with existing systems. Some small teams may find the transition disruptive before the long-term gains appear.

So with that being said, it’s important to understand the benefits vs. drawbacks so you can weigh whether AP automation is the right step for your growth stage.

| Benefits | Drawbacks |

|---|---|

| Faster invoice processing and approvals.¹ | Upfront software and implementation costs.³ |

| Reduced errors from manual data entry.² | Staff training and change management are required.³ |

| Improved visibility into cash flow and expenses.² | Possible integration issues with legacy systems.³ |

| Stronger fraud prevention through built-in controls.¹ | Initial disruption to existing workflows.³ |

| Scalable solution that grows with the business.² | It may be excessive for very small teams.¹ |

The right accounts payable invoice automation software isn’t always the one with the longest feature list; it’s the one that fits how your team actually works. Growing businesses should look for tools that connect smoothly with their accounting or ERP system, since duplicate data entry quickly eats away at efficiency.¹

Strong invoice capture, ideally with AI or OCR, is equally as important as well as Vendor self-service portals, which can ease the flood of “where’s my payment?” emails, while audit trails and fraud checks keep compliance in line.⁴

Key Criteria for Choosing AP Automation Software

| Selection Criteria | What to Look For | Why It Matters |

|---|---|---|

| Integration with ERP & systems | Native connectors or APIs.¹ | Smooth integration prevents duplicate data entry and saves time.¹ |

| Invoice capture & data extraction | OCR or AI that reads different formats.² | Cuts down on manual entry mistakes and exceptions.² |

| Approval workflows | Flexible routing by vendor, amount, or cost center.³ | Lets you mirror your existing processes instead of forcing new ones.³ |

| Supplier portal | Self-service for invoice submission and payment status.⁴ | Reduces AP inbox clutter and improves vendor relationships.⁴ |

| Fraud prevention & audit trails | Duplicate detection, role-based permissions, and detailed logs.² | Strengthens compliance and lowers the risk of errors or fraud.² |

| Scalability | Can handle increasing invoice volumes without slowdown.⁵ | Ensures the system keeps up as your business grows.⁵ |

| Implementation & support | Strong onboarding, training, and vendor SLAs.³ | Makes rollout smoother and avoids long-term headaches.³ |

Wise Business can help you save big time on international payments.

Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. The Wise Business account is designed with international business in mind, and makes it easy to send, hold, and manage business funds in currencies.

Signing up to Wise Business allows access to BatchTransfer which you can use to pay up to 1000 invoices in one go. This is perfect for small businesses that are managing a global team, saving a ton of time and hassle when making payments.

Some key features of Wise Business include:

Mid-market rate: Get the mid-market exchange rate with no hidden fees on international transfers

Global Account: Send money to countries and hold multiple currencies, all in one place. You can also get major currency account details for a one-off fee to receive overseas payments like a local

Access to BatchTransfer: Pay up to 1000 invoices in one click. Save time, money, and stress when you make 1000 payments in one click with BatchTransfer payments. Access to BatchTransfer is free with a Wise Business account

Auto-conversions: Don't like the current currency exchange rate? Set your desired rate, and Wise sends the transfer the moment the rate is met

Free invoicing tool: Generate and send professional invoices

No minimum balance requirements or monthly fees: US-based businesses can open an account for free. Learn more about fees here

At the end of the day, accounts payable invoice automation is about making life easier for finance teams. Instead of spending hours chasing approvals or re-entering data, invoices can move through the system quickly, with far fewer mistakes along the way.1,2 That means vendors get paid on time, cash flow is clearer, and your team can spend more energy on planning instead of paperwork.3,4

For some companies, starting small with invoice workflow tools makes sense, while others go straight to end-to-end AP automation to cover the whole process.2,5 However, you choose to approach it, automation in accounts can be a crucial step towards building a smarter, more efficient finance function that can grow with the business.1,5

Yes, AP invoice automation gives businesses greater visibility into their financial position, which directly supports cash flow management. Automated platforms centralize invoices, approvals and payment schedules into one dashboard, so finance leaders know exactly what’s owed and when.¹ This is considered a real-time view that makes it easier to forecast expenses and avoid surprises.²

Many systems also allow businesses to schedule payments strategically, while also taking advantage of early-payment discounts or delaying until due dates to optimize working capital.³

Remote and hybrid work have made manual invoice processes even more difficult, with paper invoices and in-person approvals slowing everything down. AP automation solves this by moving everything online, staff can review, approve and pay invoices from anywhere.³ Digital audit trails make collaboration simple, since everyone sees the same data in real time.² Automated notifications keep invoices moving, so approvals don’t get stuck in someone’s inbox while they’re away.¹

Many modern AP automation platforms don’t just handle invoices; they connect to broader financial workflows. An example of this would be linking AP with procurement systems so invoices match purchase orders and receipts before payment.² This is what’s called a “three-way matching,” which prevents overpayments and strengthens compliance.⁵

An often-overlooked advantage of AP invoice automation is its contribution to sustainability. Manual AP processes rely heavily on paper invoices, checks and physical filing systems, which create waste and require storage space. Automating invoices eliminates most of this paper use by switching to digital formats.¹ Cloud-based workflows also reduce the need for shipping or mailing invoices, cutting carbon emissions tied to logistics.² So switching to AP automation is much more sustainable than manual billing.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the best accounts payable software to streamline your business operations and optimize financial management.

Discover the best banks and credit unions in Arizona for small businesses. Compare fees, features, and lending to find the right financial partner.

Compare the best small business banks in Texas. Explore features, fees, loans, and credit options to find the right partner for growth.

Live Oak Business Checking Review for U.S. entrepreneurs and expats. Discover features, fees, and savings options designed to support growing businesses.

Compare Adyen vs. Airwallex to find out which global payments provider fits your business strategy and cross-border growth needs.

Learn how Supplier Cost Breakdown Analysis helps U.S. businesses cut costs, strengthen negotiations, and build transparent supplier relationships.