The best small business banks in Texas balance affordability, accessibility and flexibility. Business accounts come with very different requirements, from minimum balances and transaction limits to fees for wires and transfers. Some banks emphasize nationwide reach and digital tools, while others focus on local service and personalized lending.

For many small firms, access to loans and lines of credit is as important as checking or savings accounts. Banks that provide clear pathways to SBA (Small Business Administration) loans or flexible financing often become long-term partners rather than short-term providers.

This article reviews 15 leading banks that serve entrepreneurs and small businesses across Texas. Each section highlights account features, fees, lending opportunities and customer service, helping you evaluate which bank best fits your needs. We'll also discuss the Wise Business account. The global account that can help your company with all things cross-border.

Do you send and receive global payments?

Try Wise Business >>

Wise Trustpilot Score: 4.3 stars on 230,000+ reviews

No minimum balance requirement and no monthly fees

Integrates with QuickBooks, Xero, Sage, and more

What to Look for in a Small Business Bank in Texas

Growing firms should treat banks as long-term partners that support both daily operations and future expansion. When comparing the best small business banks in Texas, these factors matter most:

| Small Business Bank Features | Feature Description |

|---|

| Account types and flexibility | A good bank should offer checking, savings and merchant accounts with options for multiple uses, such as separating operating funds from tax reserves or setting up specialized accounts for industries like health care, retail, or construction. Flexibility ensures that businesses can adapt their accounts as they scale. |

| Fees and minimum balances | Monthly service charges, transaction fees and cash-handling costs vary widely. For small firms, even modest charges can eat into margins. Look for banks that provide fee waivers, bundle services or keep minimum balance requirements realistic for growing companies. |

| Access to credit and lending options | Beyond day-to-day banking, small businesses need capital for expansion. Banks that actively support SBA loans, equipment financing and working capital lines of credit can help companies bridge cash-flow gaps or seize new opportunities. A strong lending relationship also builds trust for future financing needs. |

| Digital tools and integration | Modern business banking should streamline financial management. Mobile apps, online dashboards and compatibility with accounting platforms save time and reduce errors. This is especially valuable for entrepreneurs managing remote teams or serving clients across state or national borders. |

| Customer support and local presence | Local banks often provide relationship managers with regional expertise, while national banks bring the advantage of larger branch and ATM networks. The right balance depends on whether a company values personal guidance or broader accessibility. |

A bank that aligns with a company’s size, goals, and growth trajectory becomes a partner in long-term success.

Best Small Business Banks in Texas

1. Chase Bank

- Features: Chase is one of the largest banks in the United States, and its Business Complete Banking account is a common starting point for Texas entrepreneurs.1 It offers unlimited electronic deposits, cash deposits up to a set limit each month, and access to more than 4,700 branches nationwide.2 The mobile app supports mobile check deposit, bill pay and integrations with QuickBooks and other accounting tools, making it easier to stay on top of expenses.3

- Fees: The monthly service fee is $15, but it can be waived with a $2,000 minimum balance, qualifying card purchases or direct deposits.1 Additional transaction fees may apply if cash or checks exceed the included limits.

- Loans/Credit: Chase provides SBA loans, secured and unsecured business lines of credit and commercial real estate financing.4 The bank also issues popular small business credit cards like the Ink series, which offer cashback or travel rewards.5

- Why It Works for Texas Businesses: With nationwide scale, strong lending programs, and a large branch footprint in Texas, Chase is well suited for businesses that want convenience, flexible credit options and digital tools to support growth.

2. Frost Bank

- Features: Frost’s business checking accounts are simple and transparent, with options that scale for startups or larger firms. Frost also provides treasury management services, merchant card processing and tools to help with cash flow planning.6

- Fees: Frost avoids hidden charges. Business checking accounts generally carry modest monthly fees ($14), which can be offset by maintaining balances.7 Transaction fees are predictable, making it easier for firms to budget banking costs.

- Loans/Credit: Lending includes SBA loans, equipment financing, business line of credit and commercial real estate financing.8 Relationship managers often guide business owners through the application process.

- Why It Works for Texas Businesses: Entrepreneurs who want a bank rooted in Texas values often turn to Frost. Its focus on local decision-making and responsive customer service appeals to owners who value personal relationships over national brand recognition.

3. First National Bank Texas

- Features: First National Bank Texas provides low opening deposits, accessible for startups and small firms. Many branches are located in retail stores, which adds convenience for owners who want flexible hours.

- Fees: Business accounts typically come with low monthly fees and modest transaction costs, keeping expenses manageable for companies with limited resources. The $15 monthly fee can easily be avoided.9

- Loans/Credit: The bank offers small business loans and lines of credit, though availability and lending limits may depend on branch location and business profile.10

- Why It Works for Texas Businesses: First National Bank Texas works best for firms that prioritize affordability and a local connection.

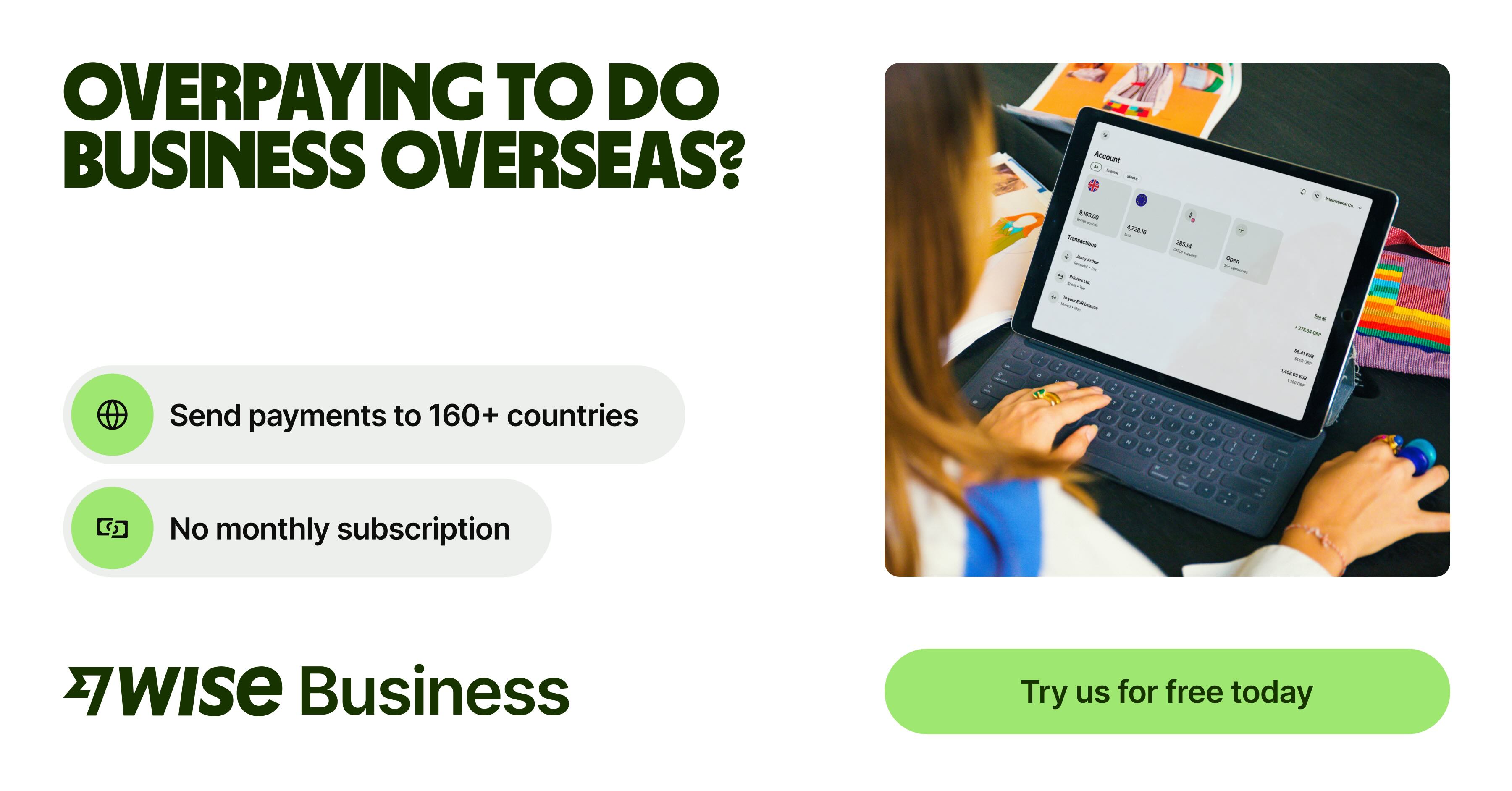

Save Time and Money On Overseas Payments With Wise Business

Wise Business can help you save big time on international payments.

Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. The Wise Business account is designed with international business in mind, and makes it easy to send, hold, and manage business funds in currencies.

Signing up to Wise Business allows access to BatchTransfer which you can use to pay up to 1000 invoices in one go. This is perfect for small businesses that are managing a global team, saving a ton of time and hassle when making payments.

Some key features of Wise Business include:

-

Mid-market rate: Get the mid-market exchange rate with no hidden fees on international transfers

-

Global Account: Send money to countries and hold multiple currencies, all in one place. You can also get major currency account details for a one-off fee to receive overseas payments like a local

-

Access to BatchTransfer: Pay up to 1000 invoices in one click. Save time, money, and stress when you make 1000 payments in one click with BatchTransfer payments. Access to BatchTransfer is free with a Wise Business account

-

Auto-conversions: Don't like the current currency exchange rate? Set your desired rate, and Wise sends the transfer the moment the rate is met

-

Free invoicing tool: Generate and send professional invoices

-

No minimum balance requirements or monthly fees: US-based businesses can open an account for free. Learn more about fees here

Use Wise Business >>

4. PNC Bank

- Features: PNC’s Business Checking Plus account lets owners choose between lower fees for modest transaction levels or expanded services for higher volumes.11 Its Cash Flow Insight platform is a standout feature, providing dashboards that track expenses, receivables, and forecasts, and integrates with QuickBooks and other accounting software.12 Businesses can also access merchant services, business credit cards and treasury management solutions.

- Fees: Monthly account fees vary by plan but can often be waived with qualifying balances or transaction activity. Additional costs apply if transactions exceed monthly limits.

- Loans/Credit: PNC provides SBA-backed financing, term loans, secured and unsecured loans.13

- Why It Works for Texas Businesses: PNC appeals to entrepreneurs who want sophisticated financial tools along with access to a nationwide branch network. It’s particularly strong for companies that need cash flow management solutions or operate across multiple states.

5. Prosperity Bank

- Features: Prosperity Bank has over 320 Texas locations, making it one of the largest regional providers in the state.14 Business checking accounts are flexible, with options that match varying transaction volumes and cash-handling needs. Prosperity also offers merchant card services, treasury management, and online banking tools that support bill pay and cash flow monitoring.15,16,17

- Fees: Pricing is straightforward, with a monthly maintenance fee of $10 that can be avoided under certain conditions.18

- Loans/Credit: Prosperity provides SBA loans and commercial loans.19

- Why It Works for Texas Businesses: Prosperity Bank combines community focus with competitive loan programs. It is a solid choice for owners who want the balance of a Texas-based institution with the resources of a larger regional bank.

6. Bank of America

- Features: Bank of America serves millions of small businesses nationwide, and its Business Advantage 360 banking** **program is designed to grow alongside companies.20 Its Cash Flow Monitor helps track and project income and expenses, offering valuable insights for planning.21 Nationwide ATM and branch access also add convenience for Texas firms with multi-state operations.

- Fees: Monthly fees range from $16 to $29 depending on the account type, but they can be waived by maintaining a minimum balance, linking accounts or using a Bank of America business credit card.22

- Loans/Credit: The bank offers SBA loans, business credit cards, secured and unsecured lines of credit, and commercial real estate financing.23

- Why It Works for Texas Businesses: Bank of America is well suited for entrepreneurs who want advanced digital banking tools paired with extensive branch access and a wide selection of credit options.

7. Texas Capital Bank

- Features: Texas Capital Bank is a mid-sized institution that focuses almost exclusively on business clients, which sets it apart from consumer-heavy competitors.

- Fees: Monthly fees and transaction allowances depend on account activity, but structures are transparent. Texas Capital is less focused on ultra-low fees and more on providing value through advisory support.24

- Loans/Credit: Offers SBA loans, equipment financing, working capital lines of credit and tailored industry loans. Credit products are structured to fit cyclical business needs.25

- Why It Works for Texas Businesses: Texas Capital appeals to entrepreneurs who want a banking partner with regional expertise and personalized service rather than a one-size-fits-all approach.

8. Wells Fargo

- Features: Wells Fargo provides Initiate Business Checking and Navigate Business Checking accounts provide scalable solutions, with features like mobile check deposit, payroll support, and integration with QuickBooks.26,27

- Fees: Monthly fees start around $10 for basic accounts and can be waived with minimum balances, linked accounts, or transaction activity. Fees increase for premium accounts with higher transaction allowances.28

- Loans/Credit: The bank offers SBA loans, business line of credit and prime line of credit, among other things.29

- Why It Works for Texas Businesses: Wells Fargo is best for entrepreneurs who need a full-service institution with wide accessibility, extensive credit options and digital platforms that support businesses at multiple growth stages.

9. Capital One

- Features: Capital One is well known for its small business focus, offering the business checking accounts with unlimited digital transactions without fees.30

- Fees: The entry-level Basic Checking account charges a $15 monthly fee, waived with a $2,000 average balance. There are plans with higher price points that include more features.30

- Loans/Credit: Capital One is active in real estate term loans, business lines of credit and SBA loans.31

- Why It Works for Texas Businesses: Capital One is a strong choice for entrepreneurs who want straightforward accounts, competitive rewards and reliable lending options with a national footprint.

10. Comerica Bank

- Features: Comerica is one of the most established banks in Texas, with a long history of supporting small and mid-sized businesses. Its business checking accounts are flexible, ranging from entry-level packages for startups to accounts with higher transaction thresholds for larger firms.

- Fees: Monthly fees vary depending on the account type, but they can often be offset by maintaining average balances. Additional charges apply for transactions beyond limits, but Comerica’s pricing is designed to scale with the business.32

- Loans/Credit: Lending products include SBA loans, revolving lines of credit, term loans and commercial real estate loans.33

- Why It Works for Texas Businesses: Comerica is ideal for companies that value personal attention, Texas-based expertise and a range of lending solutions to support long-term growth.

11. Truist Bank

- Features: Truist offers business checking accounts that scale with company size, along with a mobile platform that allows for real-time account monitoring, bill payments, and fund transfers.

- Fees: Checking accounts either have no fee or a fee of $20, which is waived with $5,000 average relationship balance.34 There are some additional costs.

- Loans/Credit: Truist offers SBA-backed financing, vehicle and equipment loans, real estate loans and working capital lines of credit.35

- Why It Works for Texas Businesses: Truist appeals to entrepreneurs who want user-friendly digital tools backed by traditional credit programs and local business specialists. It suits firms that prioritize online convenience but still want access to in-person expertise.

12. Regions Bank

- Features: Regions has a strong regional presence in Texas and offers several business checking accounts.36 The Regions mobile app includes budgeting and real-time alerts, helping owners stay on top of cash flow. Branches are available across the state for those who value in-person banking.

- Fees: Accounts come with tiered monthly fees ranging from $12 to $25, which can be waived by maintaining balances.36 Transaction limits vary by account type, helping businesses select plans that fit their usage.

- Loans/Credit: Regions provides SBA loans, lines of credit and business credit cards, among other solutions.37

- Why It Works for Texas Businesses: Regions is a good fit for entrepreneurs who want flexible account choices and strong digital tools without paying for services they don’t need.

13. Centennial Bank

- Features: With several business account options to choose from, Centennial Bank is attractive for startups and small businesses watching expenses. Services include debit cards, online banking, bill pay and more.38

- Fees: Monthly fees are modest and designed to stay affordable for small firms. Accounts may include limited free transactions, with predictable charges for additional activity.38

- Loans/Credit: Centennial offers SBA and USDA, as well as business loans and agriculture loans. These products are tailored to local businesses and can be adjusted based on industry or size.39

- Why It Works for Texas Businesses: Centennial Bank is a solid choice for owners who prefer personalized service, simple pricing and accessible credit options from a community-oriented institution.

14. Grasshopper Bank

- Features: Grasshopper is a fully digital bank designed for modern businesses, particularly startups and remote-first firms. Its online checking accounts come with built-in expense management, virtual cards and integrations with accounting tools like QuickBooks.40

- Fees: Accounts have no monthly fees and no fees for ACH transfers, incoming domestic wires and unlimited transactions.40

- Loans/Credit: Grasshopper provides SBA loans and, for certain clients, venture-focused financing. While lending options are more limited than at traditional banks, they are geared toward growth-focused businesses.41

- Why It Works for Texas Businesses: Grasshopper is ideal for entrepreneurs comfortable with digital-only banking who want streamlined tools, low fees and modern features that support online operations and scalability.

Sending a Wire or Other Business Transfer Abroad? You Could Save!

15. Live Oak Bank

- Features: Live Oak Bank has built its reputation as one of the country’s largest SBA lenders. While it does not offer a full suite of checking accounts, it provides high-yield savings accounts and digital platforms to manage financing.

- Fees: Accounts have competitive rates and minimal fees, especially for savings. Because the bank is digital-first, overhead costs are lower and these savings are often passed on to customers.42

- Loans/Credit: Live Oak is particularly strong in SBA lending, offering term loans and lines of credit designed for small businesses seeking growth capital. It also provides customized lending for niche industries.43

- Why It Works for Texas Businesses: Live Oak is best used as a secondary partner, which is ideal for firms looking for financing and savings options while relying on another bank for day-to-day checking.

Final Thoughts

The right small business bank provides affordable checking and savings accounts, reliable access to credit, and digital tools that reduce administrative burdens. For many entrepreneurs, these services are not just helpful but essential to keeping operations efficient and competitive.

Texas offers a wide range of options, from nationwide institutions like Chase and Bank of America to regional banks such as Frost and Prosperity that prioritize local relationships. Digital-first providers like Grasshopper appeal to startups, while Live Oak Bank distinguishes itself with SBA lending. Credit unions also play an important role, offering cost-effective solutions and personalized support that can complement or replace traditional banking.

Ultimately, the best choice depends on the size of the business, its growth stage and its priorities.

Frequently Asked Questions

What Should You Look for in a Business Bank?

When choosing a business bank, it’s important to evaluate account options, fees and lending opportunities. Entrepreneurs should look for banks that provide low-cost checking and savings accounts, flexible credit options such as SBA loans or lines of credit, and strong digital platforms for managing transactions. Customer support and branch access also matter, especially for firms that value in-person guidance alongside online convenience.

Are There Credit Unions for Businesses in Texas?

Yes. Several credit unions in Texas offer services designed for entrepreneurs, including Texas Trust Credit Union, Randolph-Brooks Federal Credit Union (RBFCU) and Greater Texas Credit Union. These institutions typically provide lower fees, competitive loan rates and personalized support. While they may not have the nationwide reach of larger banks, they are often more affordable and accessible for local businesses.

What Bank Is Best for Small Business in Texas?

The best bank depends on the needs of the business. Chase and Bank of America are strong choices for entrepreneurs who want national reach and robust digital tools. Frost Bank and Prosperity Bank are preferred by companies that value local expertise and personal service. Live Oak Bank stands out for SBA lending, while Grasshopper appeals to startups seeking a fully digital experience.

Which Is the Best Bank for a Small Business Account?

For everyday banking, Chase’s Business Complete Banking and Bank of America’s Business Advantage accounts are popular because they scale with business growth. Frost Bank also offers straightforward accounts with transparent pricing, while credit unions provide cost-effective options for entrepreneurs focused on minimizing fees.

Which Bank Is Best to Open for a Business Account?

The answer depends on whether businesses prioritize low costs, access to credit, or digital tools. Chase and Capital One are good for firms that want both lending options and nationwide convenience. Frost Bank and Comerica are strong for local support, and Grasshopper is ideal for entrepreneurs who want to manage everything online.

Which Type of Bank Account Is Best for Small Business?

Most businesses benefit from a dedicated checking account that separates company finances from personal spending. Accounts with low monthly fees, minimal transaction costs and easy digital access are ideal. For growing firms, pairing a checking account with a savings account for tax reserves or emergency funds ensures better financial stability.

Sources:

- Business Complete Banking | Chase

- Branch and ATM Locator | Chase

- Accounting Integrations | Chase

- SBA Financing | Chase

- Ink Business Preferred Credit Card | Chase

- Treasury Management | Frost Bank

- Business Checking Account Fees | Frost Bank

- Business Financing | Frost Bank

- Business Checking | 1st National Bank

- SBA Loans | 1st National Bank

- Business Checking Plus | PNC

- Cash Flow Insight | PNC

- Business Loans | PNC

- Branch Locator | Prosperity Bank

- Merchant Services | Prosperity Bank

- Treasury Management | Prosperity Bank

- Business Online Banking | Prosperity Bank

- Small Business Checking | Prosperity Bank

- Business Loans | Prosperity Bank

- Small Business Online Banking | Bank of America

- Digital Banking Demo | Bank of America

- Fees at a Glance | Bank of America

- Business Financing | Bank of America

- Small Business Banking Fee Schedule (PDF) | Texas Capital Bank

- Small Business Loans | Texas Capital Bank

- Initiate Business Checking | Wells Fargo

- Navigate Business Checking | Wells Fargo

- Compare Business Checking Accounts | Wells Fargo

- Business Credit | Wells Fargo

- Business Checking | Capital One

- Business Lending | Capital One

- Small Business Checking Solutions | Comerica

- Small Business Financing Solutions | Comerica

- Small Business Checking | Truist

- Small Business Loans | Truist

- Business Checking | Regions Bank

- Business Financing | Regions Bank

- Business Checking | Centennial Bank

- Business Loans | Centennial Bank

- Small Business Checking | Grasshopper Bank

- SBA Lending | Grasshopper Bank

- Business Checking | Live Oak Bank

- SBA Loans | Live Oak Bank

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.