Best No Foreign Transaction Fee Credit Cards in Singapore (2026)

Compare the best no foreign transaction fee credit cards in Singapore, including fees, rewards, eligibility, and overseas spending benefits.

Malaysia is a popular retirement option for Singaporeans due to its lower cost of living, natural beauty, and proximity to Singapore. Just across the Causeway, Malaysia is over 450 times bigger¹ than Singapore, with diverse locations like Penang, Ipoh, and Kuala Lumpur. The upcoming Rapid Transit System (RTS) Link will also make travel between Singapore and Johor Bahru even faster².

This guide will walk you through everything you need to know about how to retire in Malaysia, including the pros and cons, the best places to live, and the visa options available.

We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Retiring in Malaysia is a popular option for Singaporeans because it combines affordability, cultural familiarity, and easy access back home, especially with the upcoming RTS Link. To help you decide if it’s the right move, here are some key pros and cons to consider:

| Pros | Details |

|---|---|

| Lower Cost of Living | Your retirement funds can go further in Malaysia. For example, the average monthly rent for a city-centre apartment is $505 SGD³, compared to $3,971 SGD in Singapore⁴ |

| Proximity to Singapore | The close distance makes travel easy. You can fly to most Malaysian cities in under two hours, and places like Johor Bahru are just a short land journey away |

| Familiar Culture | With similar cultures, shared languages (Malay and English), and comparable food preferences, the transition is much smoother than moving to a Western country |

| Affordable & Spacious Housing | Malaysia has a wider variety of affordable properties. The MM2H program also offers a renewable visa for those who purchase real estate |

| Slower Pace of Life | Cities like Ipoh and Penang offer a more relaxed atmosphere and a slower pace of life compared to fast-paced Singapore |

| Cons | Details |

|---|---|

| Higher petty crime rates | While Singapore is known for its low crime, Malaysia's crime index is higher (48.47 vs. 22.59).⁵ Many retirees choose to live in gated communities or condos with security for peace of mind |

| Seasonal haze and floods | Malaysia is more prone to severe seasonal haze from forest fires in Indonesia. During the wet season, many cities also experience flash floods due to less developed drainage systems compared to Singapore. |

The most common visa for retirees is the Malaysia My Second Home visa, created by the government to encourage foreigners (including Singaporeans) to buy property and move to Malaysia.

There are three tiers to choose from, plus options for specific zones. Here’s a closer look at each one.

| Silver | Gold | Platinum | Special Economic Zone/Special Financial Zone | |

|---|---|---|---|---|

| Age requirement | 25 years old or older | 21 years old | ||

| Participation fee (MYR) | 1,000 | 3,000 | 200,000 | 3,000 |

| Place fixed deposit (USD) | $150,000 | $500,000 | $1,000,000 | Ages 21–49: 65,000 Ages 50+: 32,000 |

| Pass duration | 5 years | 15 years | 20 years | 10 years |

| Renewal fee (MYR) | 5,000 | 5,000 | 5,000 | 300⁹ |

| Minimum stay in Malaysia⁷ | 90 days per year for under 50s. No minimum for over 50s. | |||

| Work eligibility | Not permitted | Not permitted | Permitted | Not permitted |

Other benefits of the MM2H programme include the ability to bring your spouse, parents, parents-in-law, and unmarried, unemployed children under 34 to Malaysia. And, you can enjoy tax exemptions on eligible foreign income, such as investment-related income, retirement payments, and property income.¹⁰

Wondering how much you need to retire in Malaysia? Here’s a comparison of the average monthly cost to retire in Malaysia vs Singapore.¹¹

| Malaysia | Singapore | |

|---|---|---|

| Rent (1 bed apartment in city centre) | 504.54 SGD | 3,971.43 SGD |

| Rent (1 bedroom apartment outside of centre) | 345.36 SGD | 2,936.59 SGD |

| Basic utilities | 64.89 SGD | 202.49 SGD |

| Transport - local ticket, one way | 0.91 SGD | 2 SGD |

| Meal in an inexpensive restaurant | 4.57 SGD | 12 SGD |

| Mid-range meal for 2 people | 30.49 SGD | 100 SGD |

| 1L Milk | 2.34 SGD | 3.82 SGD |

| 12 eggs | 2.62 SGD | 4.19 SGD |

| Cinema ticket | 6.10 SGD | 15 SGD |

When it comes to housing, retirees in Malaysia have a wide range of options, from modern high-rise condominiums to spacious properties, such as terrace houses, semi-detached homes, and bungalows.

Under the MM2H programme, there are minimum purchase price requirements for each tier, while developers set their own price for the special zone MM2H visa.

- Silver: MYR 600,000⁶

- Gold: MYR 1,000,000⁶

- Platinum: 2,000,000⁶

According to the Global Health Index, Singapore is the second healthiest country in the world, while Malaysia is 75th.¹² That shouldn’t stop you from retiring in Malaysia, though, as the country has plenty of private modern hospitals and well-trained doctors, many of whom received international qualifications.

And, medical treatment is significantly cheaper compared to Singapore. For example, private general practitioners in Malaysia charge a consultation fee of MYR 10–35 (proposed to be raised to 50–80 SGD)¹³ versus 50–200 SGD¹⁴ in Singapore.

Plus, you can use your Central Provident Fund (CPF) savings for specific medical expenses at MediSave-approved hospitals,¹⁵ helping you stretch your retirement fund even further.

The Singapore dollar is stronger than the Malaysian ringgit, so you can stretch your retirement savings further when retiring in Malaysia. But, when it comes to managing your SGD to MYR conversions, it’s important to note that traditional banks often offer a marked-up exchange rate and add hidden fees, making transfers more expensive.

A smarter alternative is opening a Wise account, which uses the real, mid-market exchange rate with low and transparent fees. Wise also allows you to hold a MYR balance, making it easy to manage regular expenses in Malaysia and convert money only when the rate is advantageous.

| Sending High Amounts? Large transfers need more than a great rate! |

|---|

| Wise offers dedicated support for high amount transfers to 160+ countries, with extra secure transactions, mid-market exchange rates, and low, transparent fees. Track your transfer every step of the way. |

Malaysia offers a wide range of retirement options, from bustling cities to serene coastal towns and highland retreats. But the best place to retire in Malaysia depends on what kind of lifestyle you’re seeking. Here’s a look at four options to consider.

If you think you’ll miss Singapore’s bustling atmosphere, you may want to retire in Kuala Lumpur.

| Pros | Cons |

|---|---|

|

|

Best for: Retirees who enjoy city life, world-class amenities, and excellent healthcare.

Known for its rich heritage, vibrant food scene, and high-quality healthcare, Penang is another great choice for Singaporeans retiring in Malaysia.

| Pros | Cons |

|---|---|

|

|

Best for: Retirees who enjoy a lively cultural environment, gourmet food, and coastal living.

Located just across the Causeway from Singapore, Johor Bahru provides convenience and easy access to your homeland.

| Pros | Cons |

|---|---|

|

|

Best for: Retirees seeking convenience, frequent trips to Singapore, and a more urban lifestyle.

Nestled among limestone hills, Ipoh is famous for its colonial architecture, cave temples, and relaxed pace of life.

| Pros | Cons |

|---|---|

|

|

Best for: Retirees who prefer a slower pace, heritage charm and natural scenery.

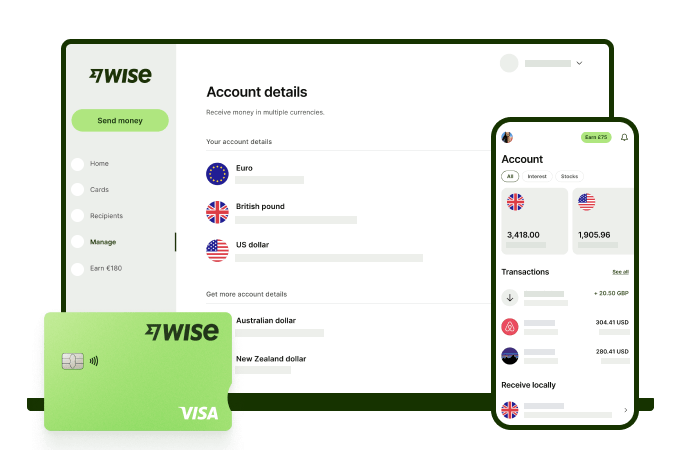

Seamlessly manage your finances between Singapore and Malaysia with a Wise account. The Wise account is an easy way to hold and exchange 40+ currencies, including SGD, MYR, EUR, CNY, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.26% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 350 SGD when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in SGD and a selection of other major global currencies.

What's more, you can activate Wise Interest to earn returns* on your eligible balances while keeping your money available to spend.

*Growth is not guaranteed. Capital at risk.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

✍️ Sign up for a free account now

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare the best no foreign transaction fee credit cards in Singapore, including fees, rewards, eligibility, and overseas spending benefits.

Looking to start trading? Check out our guide which compares top platforms like Moomoo, Tiger Brokers, and more to help you start investing

Learn how to invest in the S&P 500 in Singapore. Discover S&P 500 ETFs to buy, compare top brokers, and get tips on minimizing fees and tax considerations.

Considering the Maybank Family & Friends card? Read our 2025 review on its cashback, benefits, and fees. Find out if it's the right fit for your spending.

Compare the OCBC 90°N, VOYAGE and Premier Visa Infinite cards to find Singapore’s best OCBC miles credit card for your spending habits and travel goals.

Looking for the best credit card with free travel insurance in Singapore? Compare top cards like UOB and AMEX to get complimentary coverage and save on trips.