How to Travel from Osaka to Kyoto: Fast, Cheap and Easy Options

Compare the fastest and cheapest ways to travel from Osaka to Kyoto, including trains, costs, travel time, and tips for visitors to Japan.

Open to residents with a registered address in the following countries: United States of America, Singapore, Malaysia, Australia or New Zealand.

Alipay and WeChat Pay are both digital payment platforms that allow customers to make secure online and in-app payments, as well as mobile payments in person in stores and restaurants.¹ ²

Both Alipay and WeChat Pay originated in China, but can be used internationally. However there are some eligibility requirements you’ll need to know about depending on when, where and how you set up your accounts.

This guide will walk through how to use Alipay and WeChat Pay in Singapore.

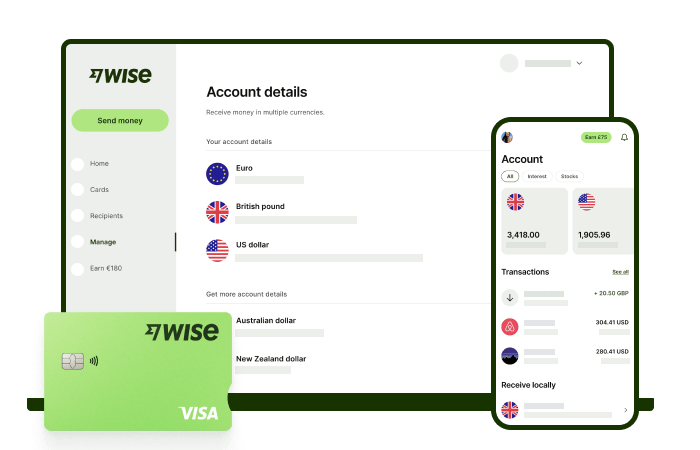

We’ll also cover another great way to spend online and in person when you travel or shop internationally, with the Wise multi-currency account and linked card. You can use your Wise account to spend in foreign currencies using the mid-market exchange rate, which could save you a lot of money when travelling abroad or shopping online. More on that later.

| Table of Contents |

|---|

This is really two questions rolled into one. Firstly - do merchants in Singapore accept Alipay or WeChat Pay. And secondly, can Singaporean citizens and residents get an Alipay or WeChat Pay account. Let’s look at each point in turn.

Singapore is moving towards a cash free future, with digital payments offered now in many stores, restaurants and even hawker centres. If mobile payments are available you’ll see the QR code displayed by the merchant, alongside a list of the payment platforms which can be used. There’s then just a simple, single QR code to scan in most cases - no matter which payment platform you want to use.³

Alipay and WeChat Pay are offered by some merchants in Singapore - especially in areas where Chinese residents and tourists may visit⁴. You’ll be able to see the logos of the payment platforms available alongside the QR code when you’re in a store, restaurant or food centre.

Singapore citizens and residents can set up an Alipay or WeChat Pay account if they fulfil the eligibility requirements. All you’ll need to do is download the apps, and set up an account. You can then link your preferred eligible card or bank account, including Visa, Mastercard and Diners Club cards, to start spending.

To pay anywhere in China, WeChat Pay and Alipay are often the preferred method. Setting up one - or both - can significantly ease your experience.

As a Singapore resident, you can readily use both Alipay and WeChat Pay in China by linking your internationally issued debit or credit card to your accounts. This functionality has been significantly improved in recent years, making it much easier for foreigners to pay like locals.

While the platforms are constantly developing (keep an eye on local review sites for the latest updates), recent changes have made WeChat Pay, which was historically restricted, widely accessible for Singaporeans with international debit and credit cards. Do check the most up-to-date eligibility requirements online if you’re unsure, and we’ll walk through the step-by-step instructions for getting started later.⁵ ⁶

Once your eligible card is linked, you’re ready to make payments directly. Alipay will debit funds from your linked international card. If you have funds in your Alipay balance, you’re free to spend and send however you want.

Here’s what you’ll generally need to do to link a card:

While Alipay typically debits payments directly from your linked card, you can also manage a balance within Alipay if you prefer to load funds for certain scenarios. To add funds, follow the prompts on screen and enter the amount you want to add to your Alipay balance.

For tourists who prefer a pre-loaded balance, Alipay offers a “TourCard” option. Find out more here.

Singapore residents can easily link their card and use WeChat Pay, especially when travelling to China. WeChat will debit payments from your linked card, simply use the scan-to-pay feature or present your QR code for transactions.

If you wish to add funds to your WeChat balance, you can do so by navigating to “Balance” in the app and selecting “Top Up”. You could also ask friends who have WeChat accounts to send you funds, which will be added to your balance for your spending.⁷

If you’re going to China or shopping in Chinese e-commerce stores, you’re going to need a reliable and easy way to make payments without getting ripped off by bad exchange rates. The Wise account and card can be a great solution for spending CNY with no hidden costs or sneaky rate markups by linking it directly to Alipay or WeChat!

With Wise, you can just add SGD to your account and spend in CNY using the mid-market exchange rate. This makes it easy to top up your Alipay or WeChat wallets or use them directly for payments, ensuring you save money on CNY conversion rates.

Also, you can use Wise to send Chinese Yuan directly to Weixin or Alipay users in China!

Looking for more? You can hold over 40+ currencies with your Wise account and spend with your linked Wise card here at home, or abroad wherever you’re travelling.

Here’s how to get your Wise card in just a few simple steps:

| 👀 For a detailed, visual guide on linking your Wise card to Alipay or WeChat, check out this article. |

|---|

Start saving money with Wise 🚀

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

The first step to get started with either WeChat Pay or Alipay is to download the latest version of the app. You’ll then find it’s relatively simple to follow the onscreen instructions to create your account. Here’s a runthrough of the basic steps required:

Both WeChat Pay and Alipay offer overlapping functionality, and where you find one platform accepted - you’ll often find the other is, too. That means that which one you choose is largely down to personal preference. WeChat Pay has the advantage of being embedded in WeChat, making it a social way to send and receive payments, shop in apps, or buy within WeChat. As an alternative, Alipay offers some buyer protections, which can be useful, depending on how you use your account.⁸

For Singapore-based customers, both WeChat Pay and Alipay are readily available for use by linking international credit/debit cards, and you can always get the Wise multi-currency account and linked card as an alternative to make SGD to CNY transfers with the mid-market exchange rate.

With huge numbers of active accounts already, and growing influence in the world of digital payments, both Alipay and WeChat Pay are here to stay. Do a little research into which might work for your needs, and keep an eye on developments as increased functionality is rolled out to a wider audience over time.

No longer need your WeChat account? Here’s how to close and delete a WeChat account.

You can use a foreign debit card with Alipay International. However, WeChat Pay is not available to Singapore based customers. To register with WeChat Pay you’ll usually need to be in one of the supported countries, with a local bank account or card from that location.

Some merchants in Singapore might offer AliPay and WeChat pay QR codes, however payment using QR codes might be unavailable for Singaporeans without a linked Chinese bank account.

Since AliPay and WeChat Pay payments in Singapore are mainly catered towards users with a linked Chinese bank account, using AliPay or WeChat Pay at local merchants might not work. Regardless, rest assured that your QR payments should work in China, should you be planning a trip.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare the fastest and cheapest ways to travel from Osaka to Kyoto, including trains, costs, travel time, and tips for visitors to Japan.

Planning Tomorrowland Thailand 2026? See ticket sale dates, prices, festival location, travel tips, and budgeting advice for Singapore travellers.

Driving overseas? Compare the best travel insurance with car rental excess cover in Singapore. See coverage limits, prices, and top providers for 2026.

Compare the best extreme sports travel insurance in Singapore, including what’s covered, exclusions, prices, and top providers for adventurous trips.

Compare Agoda, Booking.com, Trip.com and Expedia to see how prices, features, rewards and payment options stack up for travellers in 2026.

Travelling soon and looking for the most budget-friendly travel insurance providers in Singapore? We reviewed the cheapest options for international travel.