BPI Rewards Credit Card Review: Features, Fees and Rewards

A detailed review of the BPI Rewards Credit Card, including fees, eligibility, rewards points, and whether it’s suitable for everyday spending.

Spending with a card is convenient and secure, and beats having to carry around a lot of cash all the time. If you want to get the best debit card in the Philippines for your home and overseas spending, you’ll want to read this guide.

We examine the options which might suit you for home use, and also the best debit card for international travel from the Philippines, covering banks and non-bank alternatives. We’ll share more about the Wise card, a handy travel card that lets you spend in 40+ currencies.

| Table of contents |

|---|

So - what is the best debit card in the Philippines?

That’s a bit of a trick question really, as there’s not one single best debit card in the Philippines, but rather many different cards which can suit different customer needs. Here are a few things to think about as you decide on the right one for you.

Debit cards are usually linked to accounts to hold PHP and in some cases other currencies. You may have a debit card linked to a deposit account from a bank for example, or to a digital international account from a specialist provider.

The eligibility requirements for the card will usually be pretty much the same as for the underlying account. While this varies you’ll normally find you need to provide ID and a proof of address, and pay a card order fee to get your physical card delivered to you, or to collect it in a branch.

The costs of debit cards in the Philippines can vary a lot, and may include ongoing charges, dormancy fees, foreign transaction fees, ATM fees, and other costs depending on the way you choose to transact.

It’s very important that you read the terms and conditions for any card you’re considering carefully, and bear in mind that where card providers have both a physical and a virtual card, the terms and fees may not be the same for both.

As you’ll need to be able to get cash from time to time, looking at the card’s ATM fees is also important.

This can be confusing as you’ll often find that cards have different fees depending on the ATM operator. So an ATM from one terminal may be free, but you pay a fee to use the next one you see down the street. Generally overseas ATM use is more expensive than local ATM use - and providers may also charge you to check your balance at a physical ATM terminal too.

Read the account fee schedule carefully before you use an ATM for the first time.

Let’s look at some candidates for the best debit card in the Philippines, including cards from banks and alternative digital account providers. There’s no single best debit card out there - which suits you will depend on your personal needs and how you like to transact. To help you pick we’ve looked at annual fees, eligibility, ATM and overseas costs and what perks and benefits you may get with each card.

|

|---|

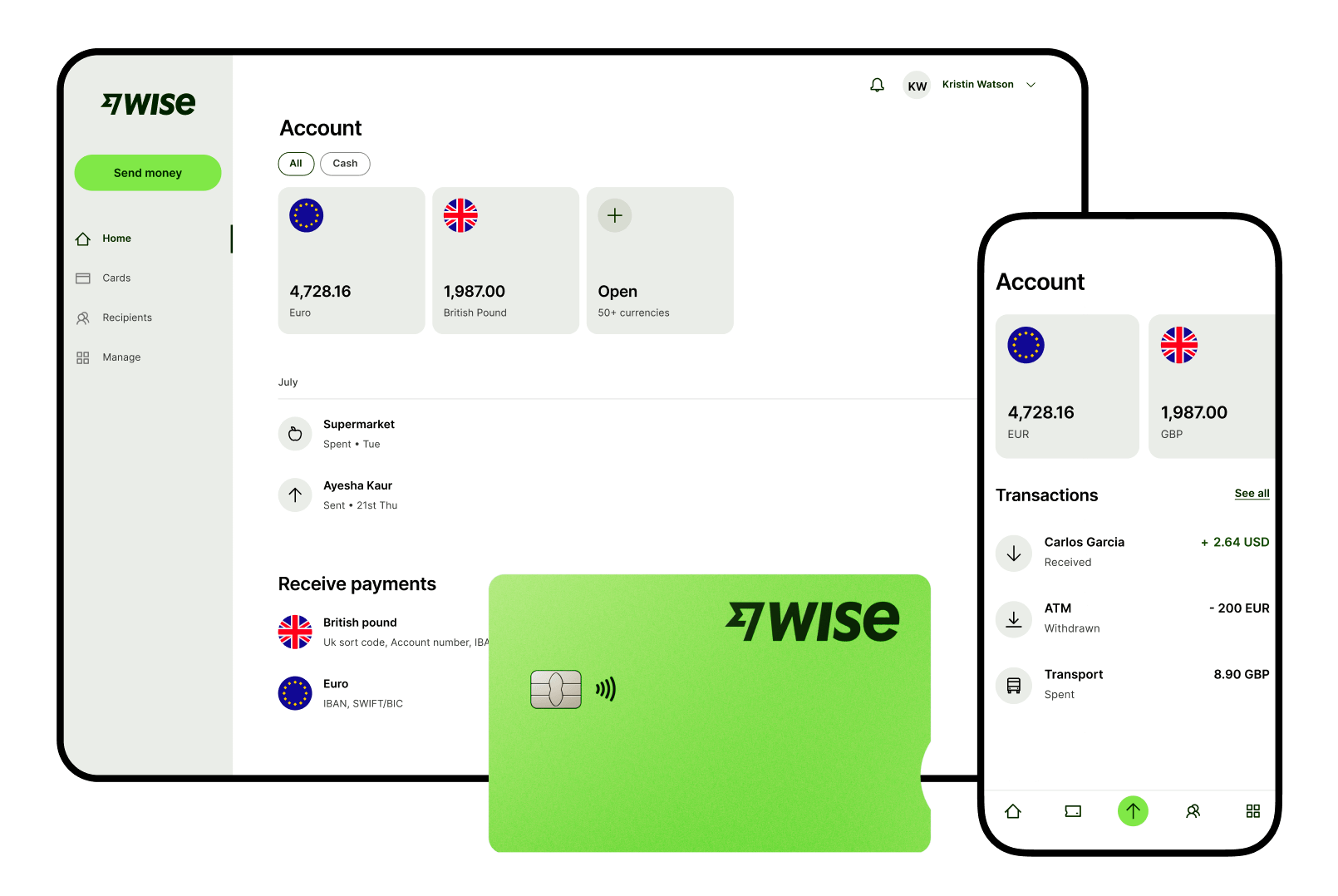

Open a Wise account online for free, with no annual or ongoing fee, and order your Wise cardconveniently for a low, one time fee. You can hold 40+ currencies in your Wise digital account, and spend with your Wise international debit card in 150+ countries at low, transparent fees - so you know you’ll be getting a great deal..

Add money to your Wise account in PHP and then just tap and pay in stores, make Chip and PIN payments, and get cash when you need it using your Wise physical or virtual card. Whenever you convert between currencies in your account or at the point of payment, Wise uses the mid-market rate - like the one you’ll see on Google - with no foreign transaction fee and low conversion costs.

|

|---|

The Maya Card is available as a virtual card or as a physical card. You may even find there’s a promotional deal which lets you order your physical card for a low fee - this varies from time to time. You can use your Maya Card to spend and withdraw your Maya digital wallet balance conveniently, with very few Maya fees to worry about.

|

|---|

EastWest customers can get either the EastWest Visa debit card or the Platinum card, which both link to underlying PHP accounts depending on your preferences and how you need to transact. You can apply for your Eastwest account online or in a branch, and to get your physical card you’ll need to visit a branch once your account has been approved. You can then start to transact at home and abroad.

|

|---|

The Atome Card isn’t quite a debit card - but we've included it in this round up because it’s not a credit card either, and so could be a handy addition to your wallet.

This card is a Buy Now Pay Later (BNPL) Card, allowing you to pay for purchases over 3 or 6 months in installments, with fees to pay depending on the way you choose to manage your card and account. This card can not be used in an ATM, but there’s no annual or monthly fee and no minimum income required to apply for the card.

|

|---|

Physical and virtual GoTyme cards are available, linked to GoTyme eligible account products. Use your card in person, online or at an ATM and earn GoTyme Points which can be converted to cash added to your account, as you spend. There’s 1 point for every 600 PHP spent on most transactions, with 3x points when you spend with GoTyme partner retailers. GoTyme allows customers to use some ATMs with no fees, but if you use an out of network terminal, the provider will set a fee.

|

|---|

CIMB customers in the Philippines can order either a virtual or physical card, although the exact card options available for you, and the fees involved, may vary depending on the type of CIMB account you have. There are no ongoing fees for your card, but you have to pay a card order fee to get your physical card, which is debited from your CIMB linked account. Overseas payments have a 3% foreign transaction fee, including when you use and ATM.

The range of debit cards available in the Philippines is very good, which should mean you can find the right one to suit your specific needs. However, it does mean it is important to consider a few and look at the features and fees available, before you sign up.

The Wise card lets you spend in 40+ currencies at the mid-market rate including USD, SGD, GBP, and JPY so you know you'll be getting a great deal in over 150+ countries. Simply create a free Wise account, order a card and top-up PHP to get started.

A physical Wise card can be ordered for a low fee of 369.60 PHP. Having a physical Wise card allows you to make chip and pin payments, as well as 2 free ATM withdrawals to the value of 12,000 PHP each month, before low fees start.

While abroad, you can choose to spend directly in PHP and let auto-conversion do the trick, or convert to your desired currency with your Wise account. Either way, you’ll get the exchange rate you see on Google, with low, transparent fees from 0.57%.

Do check respective bank websites for the latest information and promotions

Wise Pilipinas is regulated by the Bangko Sentral ng Pilipinas. For any questions or concerns, check out our Help Centre, or log into your account to talk to us by phone, email or chat.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A detailed review of the BPI Rewards Credit Card, including fees, eligibility, rewards points, and whether it’s suitable for everyday spending.

A detailed review of the Chinabank Freedom Credit Card, covering fees, eligibility, rewards points, and whether it suits everyday spending in the Philippines.

Confused about Maya Bank vs Maya Wallet? Learn the key differences, features, fees, and which Maya account suits your needs in the Philippines.

A detailed review of EastWest credit cards, covering travel features, fees, foreign transaction costs, rewards, and how to apply.

Find out more about the UnionBank Miles+ Visa Signature card for Filipinos - including fees, requirements and how to redeem miles.

Learn more about how to make money online in the Philippines through platforms like YouTube, TikTok, and more.