Dubai Tourist Visa for Filipinos: A Step-by-Step Guide (2026)

A step-by-step guide to the Dubai tourist visa for Filipinos, covering requirements, visa types, costs, validity, and how to apply in 2026.

If you’re working abroad and remitting money back to the Philippines, or if you’re receiving money from a loved one overseas, you might be considering one of the BDO Kabayan savings account¹ products. These accounts are available in pesos and US dollars, to make remitting and receiving money internationally easy.

This guide covers the BDO Kabayan savings requirements, features and benefits. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

The BDO Kabayan Savings Account is aimed at Filipinos working overseas and sending money back home, and their beneficiaries. BDO recommends that you open an account before you relocate abroad for work, to make it easier to remit funds back through a BDO remittance center. BDO has 19 remittance offices located outside of the Philippines to allow cash payments to be sent home.

The BDO Kabayan Savings Account is offered in 3 different forms:

- BDO Kabayan Savings Peso account² - hold, send and receive PHP

- BDO Kabayan Savings Dollar account³ - hold, send and receive USD

- BDO Kabayan Shipping Dollar account⁴ - hold, send and receive USD, aimed at customers working as seafarers

All accounts have the option of an account passbook and ATM card for cash withdrawals. If you hold a high enough balance, you can earn interest from your account, with variable rates depending on the specific product you select.

Each account has a slightly different minimum opening deposit requirement, and the amount you need to hold to earn interest can also vary.

| Account | Minimum opening deposit | Minimum amount to earn interest |

|---|---|---|

| BDO Kabayan Savings Peso account | 100 PHP | 5,000 PHP |

| BDO Kabayan Savings Dollar account | 100 USD | 200 USD |

| BDO Kabayan Shipping Dollar account | 10 USD | 200 USD |

*Details correct at time of research - 19th July 2025

It’s helpful to know that the BDO Kabayan savings account expiration date is one year. If no remittances are made via BDO to or from the account in 1 year, the account is automatically changed into a regular savings account⁵, which may have a minimum balance requirement, or different fees to consider. There’s also a fee if you close your account within 30 days.

When you use your BDO Kabayan ATM card, fees may apply. These include a 3.5 USD overseas ATM fee, and a 1% foreign transaction fee if you’re sending with your card in a foreign country⁶.

Kabayan Savings BDO benefits include:

- Opportunity to earn interest if you meet the minimum balance requirement

- Complimentary insurance cover which could be up to 2 million PHP if you qualify

- Promotions and discounts with BDO partners

- Easy ways to send and receive international payments, including cash transfers arranged in a BDO remittance center

- There is no BDO Kabayan savings account maintaining balance to worry about

- Opportunities to apply for loans and other BDO products

You can open a BDO Kabayan Savings account online if you’re a Filipino citizen, even if you’re overseas. You’ll need an ID document like a passport, and a Philippines phone number to register your account. It’s helpful to know that the account card and passbook can only be mailed to an address in the Philippines - this means it’s a good idea to open this account prior to moving abroad if you’re planning to work overseas.

If you’re a foreigner you can open a BDO Kabayan Savings account online if you have a local address in the Philippines and a resident visa. You’ll need to provide 2 pieces of ID from a list provided by the bank, and may then need to upload additional documents to meet regulatory requirements.

If you can’t provide the documents needed, you’ll have to get in touch with BDO, or visit a branch in person, to confirm your eligibility for this account.

You can apply for the BDO Kabayan Account online in most cases. The steps you need to take are as follows:

You’ll receive your ATM card, passbook and BDO Kabayan savings account number once the account has been approved.

The document you use as part of the account application and verification process can be one of the following for the standard PHP or USD accounts:

If you’re applying for the Shipping Dollar account product you’ll need an appropriate ID to show you’re a seafarer.

Once you have a BDO Kabayan Account you can find it’s easier to qualify for additional products such as a BDO Kabayan loan⁷. The BDO Kabayan loan is offered with no collateral, up to 300,000 PHP for qualified borrowers. You can apply online once you have a BDO Kabayan Savings Account. The requirements for this loan include:

To apply you’ll need to provide proof of income and employment, as well as ID for verification.

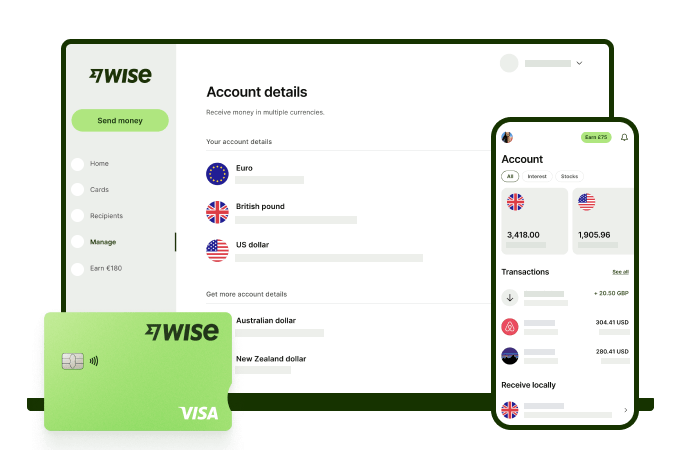

Receive foreign currency and exchange it directly to pesos at the mid-market rate with Wise.

With Wise, you'll get 8+ local account details including PHP, USD, GBP, AUD, and more. This way, you can receive money directly, in a cheap and convenient manner. All you need to get started is to sign up for a free account, and you'll be able to manage your money with just a few taps of your phone.

After getting your money, you can easily convert it to 40+ currencies, with low fees, and the mid-market rate - also known as the rate you see on Google. This includes exchanging to PHP with a one-time conversion fee from 0.57% that's shown upfront, and no markups or additional fees.

Receive, exchange, and move your funds to your local bank account in PHP in a cheap and convenient manner with Wise.

It’s simple and stress free - and lets you keep on top of your finances no matter what you’re up to.

The BDO Kabayan Savings Account is aimed at Filipinos sending or receiving international remittances. You can open your account online from overseas if you’re a Filipino citizen, although the passbook and ATM card can only be distributed in the Philippines. Once you live abroad, you can use BDO remittance offices to send money home conveniently.

To retain your BDO Kabayan Savings Account you must use it regularly to send or receive international payments. If no BDO remittances are processed through the account for 1 year, the account is automatically changed to a regular savings account which may mean higher fees or a minimum balance requirement.

The BDO Kabayan Savings Account has a minimum opening balance, but does not then have a minimum maintaining balance. If your account is not used it will be converted to a regular savings account and the minimum balance may start to apply.

There’s no Kabayan savings maximum withdrawal amount stated in the account terms and conditions. However, there are some limits on the amount you can withdraw from an ATM, and for card spending. You can take 10,000 PHP in a single ATM withdrawal, up to 50,000 PHP over the course of a day. You can spend up to 100,000 PHP on PIN secured card transactions, or up to 2,000 PHP in tap and pay transactions.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A step-by-step guide to the Dubai tourist visa for Filipinos, covering requirements, visa types, costs, validity, and how to apply in 2026.

Working abroad or getting paid in foreign currency? Learn about the Metrobank OFW Savings account requirements and options to receive and remit money.

Working abroad or getting paid in foreign currency? Learn about the PNB OFW Savings account requirements and options to receive and remit money.

Are you an OFW looking for a BPI savings account? Learn about the requirements, fees, how to open an account online, and remittances.

Learn more about requirements and how to open different Landbank account types including joint account, savings account, and more.

BPI¹ has a full range of account types including savings, checking and USD products. There are variable requirements in place for BPI accounts which usually...