PNB OFW Savings Account: Requirements, fees and how to open

Working abroad or getting paid in foreign currency? Learn about the PNB OFW Savings account requirements and options to receive and remit money.

If you’re working abroad and sending money back to loved ones in the Philippines, you need a secure, convenient, and low-cost way to get your money moving. Opening a dedicated OFW account can offer flexible services both while you’re in the Philippines, and when sending money internationally - making the Metrobank OFW Savings Account¹ a popular choice for many overseas workers.

This guide walks you through the Metrobank OFW savings account requirements and how to send money. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

The Metrobank OFW Savings Account is designed for Filipinos working abroad, and their loved ones in the Philippines, to hold, send, and receive payments conveniently.

If you’re an overseas worker yourself, you can open a Metrobank OFW Savings Account in the Philippines before you travel, to receive salary payments and remit money home. Or, if you’re in the Philippines and receiving money from a loved one working abroad, you can also open a Metrobank OFW Savings Account in your own name to receive payments seamlessly.

Metrobank OFW Savings Accounts can be opened in several currencies, depending on your needs, including Metrobank Dollar Accounts specifically for OFW use. Read on to learn more about the features of OFW accounts from Metrobank and how to open an account in Metrobank for OFW.

Let’s look at some of the most important features of the Metrobank OFW Savings Account:

It’s helpful to know that, as a result of the Capital Markets Efficiency Promotion Act (CMEPA), which came into force in July 2025, withholding tax may apply on income from peso and foreign currency deposit accounts. If this applies to your account, the tax rate is 20%³. As this regulation is still very new at the time of writing, the full implementation details are being rolled out - check with the bank to see if this impacts your account before you start to transact.

To open your OFW account in your own name, you must attend a branch in person and take along a valid form of ID. For an OFW account, you may find the best ID to use is your Overseas Filipino Worker ID or e-card, but there are also options to use alternative ID documents, such as⁴:

If you’re already overseas, you can not open a Metrobank OFW Savings Account in your own name without returning to the Philippines to visit a branch. However, the person you’re remitting money to can open a Metrobank OFW Savings Account in their name, in a variety of currencies, to receive the money you send easily⁵.

To open a Metrobank OFW Savings Account, you’ll need to visit a branch of Metrobank in person. Here’s an outline of the steps you should take:

When you open your account, you can choose to take a passbook or an ATM debit card to access your money conveniently. You may be able to get these on the day of your branch visit, or they may be mailed to your home, depending on the branch policy.

One of the main purposes of the Metrobank OFW Savings Account is to send convenient international payments. Metrobank customers can remit money using the Metrobank app or online banking system, or in person at overseas Metrobank branches.

The funds can be deposited into your recipient’s bank account, or they can collect their money in person through Metrobank partners such as Pera Hub and Robinsons Department Stores. In total, cash pick up services are available in 11,000 partner locations in the Philippines.

Sending your payment digitally is often the most convenient option - but if you prefer to arrange your remittance in person, there are also Metrobank remittance facilities around the world in the US, Canada, Japan, China, Hong Kong, Singapore, Taiwan, Korea, and the UK. Fees⁶ and service availability can vary depending on the branch you select, so do check all the details in advance.

Metrobank remittances can often arrive in 24 hours - or even faster if you’re sending from Metrobank to Metrobank accounts. The exact delivery time depends on factors like the value and currency of the payment, but you can track your transfer in the Metrobank app if you need to.

Looking for a different option? Learn about how to send a Metrobank to GCash remittance here.

There’s no required minimum balance for your Metrobank OFW Savings Account, but you may find some fees and charges apply depending on how you use your account. Here are some costs to watch out for:

| Service | Metrobank OFW Savings Account fee⁷ |

|---|---|

| Withdrawal less than 5 days after deposit (USD account) | 0.0025% |

| Over-the-counter cash deposits | Variable fees depending on location of branch, value and currency deposited |

| ATM withdrawals in the Philippines | No fee at Metrobank ATMs 7.5 PHP at PS Bank ATMs Variable fees at other ATMs, set by ATM operator |

| ATM withdrawals internationally | 3.5 USD |

| Outgoing remittance fees | Variable fees depending on currencies, value and receive method |

| Incoming payment fees | Variable fees depending on the currency of your account and the currency being received |

*Details correct at time of research - 14th October 2025

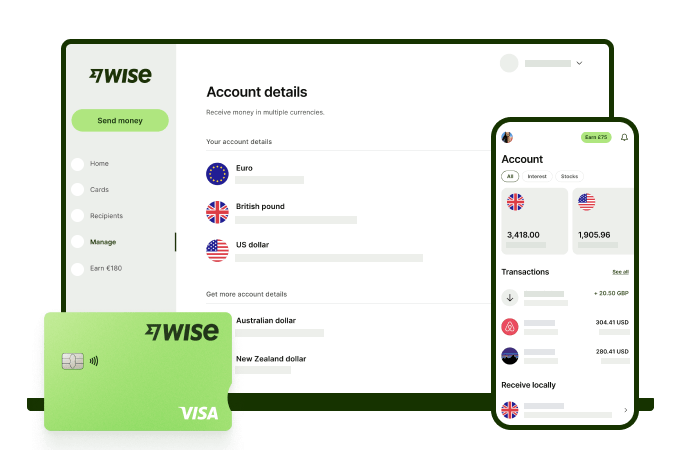

Receive foreign currency and exchange it directly to pesos at the mid-market rate with Wise.

With Wise, you'll get 8+ local account details including PHP, USD, GBP, AUD, and more. This way, you can receive money directly, in a cheap and convenient manner. All you need to get started is to sign up for a free account, and you'll be able to manage your money with just a few taps of your phone.

After getting your money, you can easily convert it to 40+ currencies, with low fees, and the mid-market rate - also known as the rate you see on Google. This includes exchanging to PHP with a one-time conversion fee from 0.57% that's shown upfront, and no markups or additional fees.

Receive, exchange, and move your funds to your local bank account in PHP in a cheap and convenient manner with Wise.

It’s simple and stress free - and lets you keep on top of your finances no matter what you’re up to.

Is Metrobank good for OFW?

Metrobank offers OFW Savings Accounts with no minimum balance requirement, which makes them a flexible choice for people working overseas and their beneficiaries in the Philippines. Accounts come in different currencies, with no ongoing fees to pay - some charges can apply depending on how you transact.

Which bank is best for OFW in the Philippines?

There’s no single best bank for OFW in the Philippines - the right one for you will depend on your preferences and how you want to transact. If you’re sending money to loved ones at home, having an account that offers low-cost transfers and fair exchange rates is important. Shop around, looking at banks like Metrobank and alternative services like Wise, to see which suits you best.

Can I open a Metrobank OFW account online?

You can not open a Metrobank OFW account online. You’ll need to visit a branch in person to open your account, taking along your valid ID Document. If you’d prefer an account you can open and operate entirely online, check out alternative services like

the Wise account instead.

Sources used:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Working abroad or getting paid in foreign currency? Learn about the PNB OFW Savings account requirements and options to receive and remit money.

Are you an OFW looking for a BPI savings account? Learn about the requirements, fees, how to open an account online, and remittances.

Learn more about requirements and how to open different Landbank account types including joint account, savings account, and more.

BPI¹ has a full range of account types including savings, checking and USD products. There are variable requirements in place for BPI accounts which usually...

Learn more about requirements and how to open different Metrobank account types including checking account, savings account, dollar account and more.

Learn more about requirements and how to open different UnionBank account types including joint account, savings account, dollar account and more.