What do you need to receive money with Western Union?

Receiving money through Western Union? Learn about the process, from cash pick-up to bank transfers, and find out what to expect.

PayPal¹ offers easy ways to send and receive payments, and to shop securely online. When you send money to a friend or family member you can include messages and emojis, for a more personal experience - making splitting a bill, or chipping in for a birthday gift simple and fun.

But what about PayPal large transfers? Are there PayPal transfer limits, and if so, what is the limit for PayPal transfers and can it be increased?

This guide covers what you need to know. Plus, we’ll look at how to send a large transfer with Wise, which covers local and international payments with high limits and low fees.

Yes, but the PayPal maximum transfer limit depends on whether you have a verified account or not, plus some PayPal international transfer limits may apply if you’re sending a payment in a different currency.

Often, there’s no limit on the total amount you can send, but limits per payment may be in place for security reasons.²

The PayPal transfer limit will be lower if you have an unverified account, so you can often increase your PayPal transfer limit by getting verified - we’ll cover how that works later.

There’s no specific PayPal transfer limit per day or per week, but limits do apply depending on factors like account verification and currency.

Here are the PayPal large amount transfer rules you’ll need to know about²:

| PayPal transfer limit - unverified account | PayPal transfer limit - verified account | |

|---|---|---|

| Per payment | Limits apply which you can see in app or online when you transfer | Send up to 60,000 USD (about 51,000 EUR) per payment This may be capped to 10,000 USD (about 8,500 EUR) for some accounts Additional limits may apply for some currencies |

| Total cumulative limit | Limits apply which you can see in app or online when you transfer | Usually no limit applied |

*Details correct at time of research - 11th August 2025.

If you’re trying to work out how you can send large amounts of money on PayPal, the key is to verify your PayPal account.³

| Read more: PayPal fees in Ireland |

|---|

You can verify your PayPal account quite easily in app or online, by linking a bank account or card, and then confirming the linked payment method.

To link your bank account online you’ll simply need to log into your PayPal account and tap the Wallet button.⁴ You’ll see the option to link your bank, and can follow the prompts to do so. In the app, tap the + symbol, then Banks, and follow the onscreen instructions.

Once you’ve linked your account you need to confirm it.⁵ This can sometimes be done instantly, but you might find you need to follow a manual process. If you can’t see the instant confirmation option in the app, you’ll need to wait for PayPal to deposit 2 small payments to your bank, and then use this information to confirm your account.

To do this you need to:

- Log into PayPal and click Wallet

- Tap the bank you want to confirm

- Enter the exact amounts of the 2 deposits made to your bank account

- Click Submit, and your account will be confirmed

Once your account is confirmed you can access the highest available PayPal transfer limits.

PayPal offers transfers to friends and family all over the world - but it’s not your only option. PayPal transfers are sent to other PayPal accounts - so if your recipient wants to move the money to their bank for spending, they’ll have to initiate a withdrawal, which may take a few days to process.

For high value international payments which use the mid-market rate, and low, transparent fees, check out the options to send a large transfer with Wise before you send with PayPal.

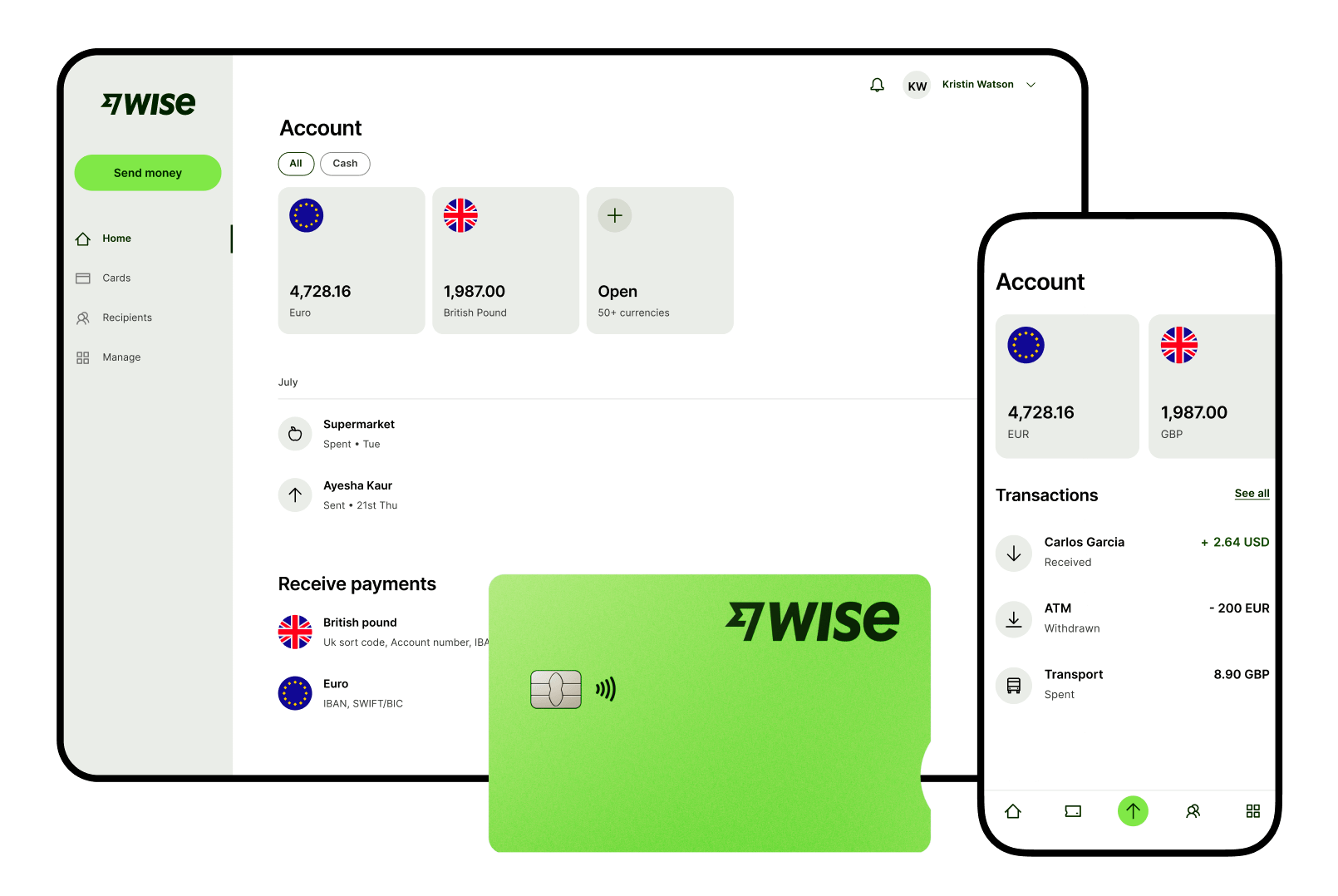

Wise payments can be set up via desktop or via app but the money is deposited right into your recipient’s bank so it’s easy for them to withdraw or use. Wise payment limits are also set high so you can transact freely.

If you’re sending to and from Euro you can send up to 20 million EUR per transfer if you transfer from your Wise Account. You can also send using a card, iDEAL and Trustly, but then limits vary depending on payment method.

There’s no fee to open a Wise personal account, and Wise currency conversion uses the mid-market rate (the same you normally see on Google) with costs split out for transparency.

If you’re sending more than the equivalent of 20,000 GBP (about 23,000 EUR) in a payment, or over the course of a month you can get automatic fee discounts and a dedicated support team.

Check out Wise for high value payments you can send online, with low fees to bank accounts in 140+ countries around the world.

Sources used:

Sources last checked on date: 12th August, 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Receiving money through Western Union? Learn about the process, from cash pick-up to bank transfers, and find out what to expect.

Need to get money from abroad? Learn about the ways you can receive international transfers through An Post in Ireland..

Discover the best way to send money from Ireland to the UK for property purchases. Compare costs, timing, and methods for transferring money safely.

Looking to receive a payment through Remitly? Discover all the ways you can get your money in Ireland.

Need to move money from Revolut to your AIB bank account? Learn how to make a quick and easy transfer with our guide.

Transferring money from Revolut to Bank of Ireland? Here’s everything you need to know about the process, from fees to transfer times.