How to open an AlipayHK business account in Hong Kong?

Tap into Chinese consumer spending by setting up an AlipayHK business account. This guide for covers the application process for getting paid from Alipay users.

Are you running a business in Hong Kong? Then you already know how essential a business bank account is for managing cash flow effectively. Beyond being a vital financial management tool, a business account also reinforces your company’s professionalism and credibility.

If you are still searching on which account is the best for your business, take a look at Citibank – a major financial institution coming from the U.S. With its established local reputation and global presence, Citibank is an easy choice for many businesses. But let’s be honest, the process to open a Citibank business is not a walk in the park.

Don’t know where to start? This one article will kick-start your research about a Citibank business account – from what it offers, its fees, and even its pitfalls. But this article won’t stop just there! You will also find an alternative as a comparison – the Wise Business account. Now let’s get started!

Before we dive deeper into how to open a Citibank business account, let’s first explore why you need a business account at all when doing business in Hong Kong.

While it may be true that a business account is not always required, it’s considered good business practice to open one anyway – especially for legal compliance and clear record-keeping. Plus, a business account with an established bank, like Citibank, also is a good way to maintain your brand name’s professional image.

More importantly, business account banking is crucial when your business grows bigger. For example, once you begin actively engaging in international trade or working with overseas suppliers and clients, you will need a reliable bank to facilitate smooth transactions, support cross-border payments, and help boost your business growth.

In a prosperous and bustling city like Hong Kong, many leading international banks will want to establish a strong presence. Citibank – part of the American multinational financial services group Citigroup Inc. – is no exception, having operated in Hong Kong for over a century. With its long-standing history, Citibank has built a trusted reputation among both personal and corporate clients.

Having a separate Citi business account helps you keep personal and business funds apart, making financial management so much simpler.

The good news is that Citibank offers different types of accounts tailored to businesses of all sizes.

Depending on different needs, Citibank Hong Kong’s business account has three plans available for clients1:

In addition, each tier comes with specific eligibility requirements that must be met to successfully open an account. Your business can fall under one of the following categories:

Before getting into the step-by-step guide on how to open a Citibank business account. Let’s take a look at all the documents you need to gather.

Sole Proprietorship:

Partnership:

Private Limited Company:

You can refer to the document checklist to ensure you have all the required paperwork prepared before your appointment.

After gathering all the required documents, you can proceed to apply for a business account with Citibank. To do so, book an appointment by calling the Hotline at (852) 2860 0333 or by visiting the nearest Citibank branch. Please note that at the time of writing, Citibank business accounts cannot be opened online yet.

You may also download the account opening form in advance. In addition, you will be required to submit the form together with all supporting documents during your appointment.

Citibank will conduct due diligence to verify your application; note that they might ask you to provide additional information beyond the list. Once your application is approved, you will receive a notification from Citibank, and can immediately access the online banking services.

Citibank business accounts have a monthly maintenance balance to keep the preferred tiers. Plus, there might be other additional charges, especially if your business requires frequent remittance needs. Here are the few main fees for Citibank business account: the details are broken out by account type in a moment:

| Type of charges | Fees |

|---|---|

| Application Fee |

|

| Outward remittance |

|

| Outward local transfers |

|

| Outward remittance service fees |

|

It is worth noting that while you might enjoy free remittance service via the Citibank Online banking, the amount your recipient receives might be way different than you expect. This is because the bank uses its own foreign exchange rate – which might be different from the one you usually see on Google (known as the mid-market rate). On top of that, Citibank will also charge you a Service Fee when you remit money outside of Hong Kong – just like in the table above.

Unfortunately, Citibank Hong Kong does not provide information on an estimated timeline for how long the account opening process might take. In general, opening a business account might take some weeks to process. However, the process might take several months to process under some circumstances.

Hidden fees and unfavorable exchange rates on international transactions can quickly erode your profit margin if you don’t keep track of them. Always stay mindful of these charges to avoid unpleasant surprises – especially if your business regularly remits money outside of Hong Kong

Citibank uses the traditional bank wire transfer (like SWIFT network) for sending money out of Hong Kong. While this system is widely adopted across many countries, it is not without drawbacks. Transfers can take several days to complete due to interbank settlement processes and compliance checks. Although Citibank offers “Express Transfer” to speed up remittances, this service is only available when sending money from Hong Kong to the UK, Singapore, or Thailand.

For businesses trading with multiple partners across different countries, these slow and inefficient international transfer processes can quickly become frustrating.

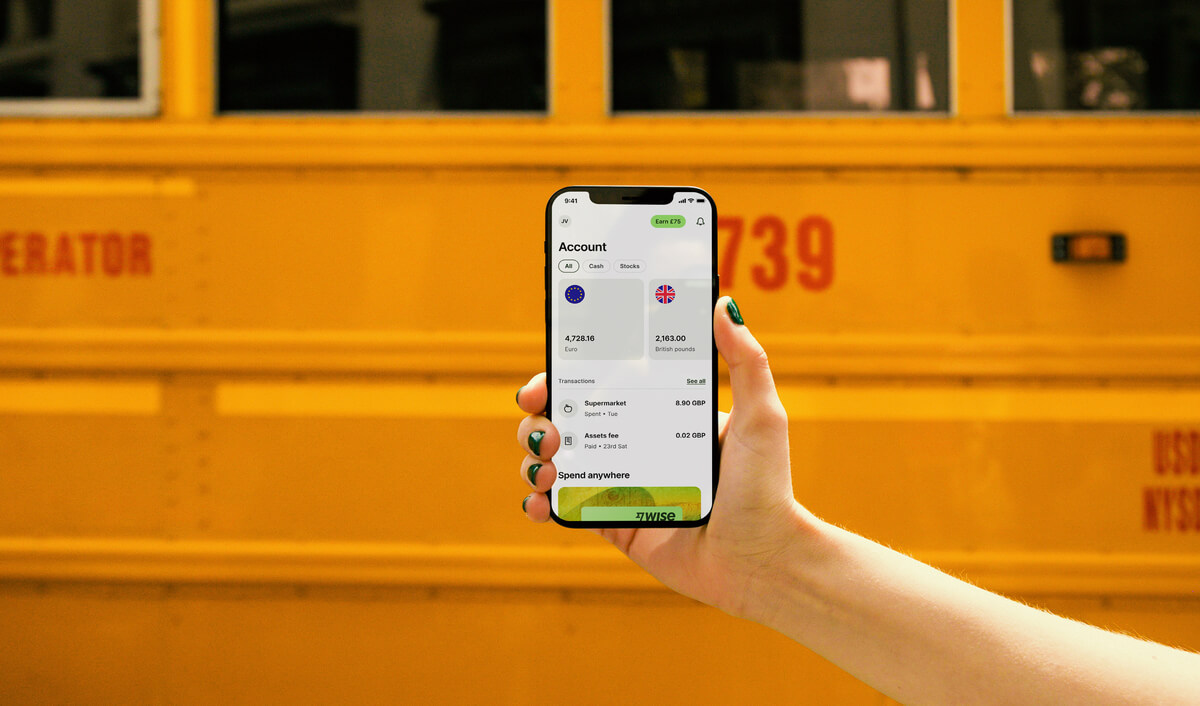

While finding out which one is the right account for your business, you will want to compare different options to choose which one is the best for your business. Don’t forget to take a look at Wise.

Wise is not a bank, but a Money Services Business provider, and Wise is a smart alternative to avoid all the common pitfalls of traditional banks. Here is how Wise can help you run business:

Wise is using the mid-market exchange rate, which is very competitive compared to the bank’s rate. You can send and receive money in 40+ different currencies around the world. This makes an excellent choice to save costs for your business.

Plus, you will know exactly how much your recipients receive in their account – what you see is what you pay!

With speed at its core, Wise’s platform ensures most international transfers arrive within hours, giving your business greater cash flow efficiency and agility.

Wise Business makes it easy to get started – no monthly fees, no minimum balance, and free online registration. The quick, no-frills application lets you spend less time on paperwork and more time growing your business.

No, you cannot apply for a Citibank business account online in Hong Kong. The process begins with booking an appointment with Citibank. To save time and avoid unnecessary delays, make sure you prepare all the required documents in advance.

Citibank doesn’t provide a clear timeline for opening a business account in Hong Kong, and the process can sometimes take several months. Businesses with more complex structures may experience longer processing times.

It’s important to regularly check your application status with your Relationship Manager, so you can promptly provide any additional documents if required.

The specific documents required will depend on your business structure. Commonly requested documents include a Company Registration Certificate, Certificate of Incorporation, proof of identity and address for all directors and beneficial owners, and in some cases, a detailed business plan.

Is a Citibank Business Account the right fit for your business? The best business bank account should align with your company’s specific needs. If you value a trusted global brand, access to international branches, and the convenience of comprehensive banking services in one place, Citibank Business is a strong option worth considering.

However, if your priority is seamless international transactions, transparent fees, and payments at the real mid-market exchange rate, Wise Business may also be the smart choice.

Explore Wise Business today and discover a fast and simple way to manage your global business finances.

Learn more about Wise Business

Sources last checked on 08-Sep-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Tap into Chinese consumer spending by setting up an AlipayHK business account. This guide for covers the application process for getting paid from Alipay users.

Learn how to open a WeChat Pay HK business account with our step-by-step guide. Accept payments from customers and boost your Hong Kong business.

Explore how to open a Bank of China business account in Hong Kong with our comprehensive guide. Discover the key features and benefits.

Open a livi Bank business account in Hong Kong with fast approval, easy online setup, and secure services. Learn more about fees and features.

Learn how to set up a PayMe business account in Hong Kong, explore features, fees, and start collecting payments seamlessly for your business.

Learn how to open an Interactive Brokers business account for your company. Discover fees, features, and how to manage investments globally with IB.