How to open a Citibank business account in Hong Kong?

Explore how to open a Citibank business account in Hong Kong with our comprehensive guide. Learn about eligibility, document requirements, and potential fees.

Are you running a business in Hong Kong? Then you already know how important it is to have reliable options to manage your company’s finances! Among all the choices available, Bank of China (Hong Kong), BOCHK, is a bank you shouldn’t overlook. Having been around the market for more than 20 years, BOCHK has become a trusted partner for both small businesses and large corporations with its diversity products. Even better – you can now open a BOCHK business account entirely online.

Like many leading banks in Hong Kong, BOCHK has quite a challenging application process: you will need to submit multiple documents! But don’t worry! This article will guide you through everything you need to know, from the services they offer and the fees involved, to the step-by-step process of opening a business account with BOCHK.

That said, while having a local bank account is convenient, the application process and ongoing maintenance costs might make you want to give up – especially if you frequently send money outside of Hong Kong. So, you should also consider adding some smart and more cost-effective business accounts, such as Wise. More on that later on!

BOCHK’s business account, known as the Business Integrated Account, is designed to cater to different stages of growth, offering three levels: Standard, Plus, and Elite. For startups and smaller businesses, there’s also the BOCHK Business Lite Account – This one account is said to be more flexible and less challenging to apply for!

Here are some of the key features that make BOCHK business accounts attractive:

In general, you can apply for a BOCHK business account remotely if your business meets the following criterias1:

Each type of business structure may be subject to specific requirements. Even if you qualify for remote account opening, BOCHK may still request additional documentation or require you to visit a physical branch to complete the process.

Required documents for a business account with BOCHK will vary based on the nature of your business and your business structure. Before submitting the documents, you will need to certify them as true copies of the original by any authorized entities. Here are the detailed checklist for each type company2:

Sole Proprietorship:

Partnership:

Limited Company:

Society:

Owners Incorporation:

Mutual Aid Committee:

There are two ways to apply for a BOCHK business account: through an online pre-application or by booking an in-person appointment at a branch. If you prefer to open an account at the bank, you can visit one of the branches or make an appointment via phone call or website.

Follow these steps to open your BOCHK business account remotely1:

Another common pain point with business accounts is cost. Traditional banks incur significant expenses from infrastructure, systems, and regulatory compliance, which are often passed on to customers in the form of higher fees. To give you a clearer picture, let’s take a look at some of the typical costs associated with opening and maintaining a BOCHK business account:

The most certain cost for a business account from BOCHK is the monthly fee. The bank will charge this fee to maintain your account, so sometimes you will see it under maintenance fees.

The good aspect of this fee is that the account maintenance fees sometimes will be free if you meet a certain threshold like:

| Account Type | Business Integrated Account | Business Integrated Account - Plus | Business Integrated Account - Elite |

|---|---|---|---|

| Monthly fee | 120 HKD | 150 HKD | 200 HKD |

| Fee waiver threshold | 50,000 HKD | 200,000 HKD | 1,000,000 HKD |

| Reduced fee option | Not available | Not available | 100 HKD (500,000 to 1,000,000 HKD) |

| Fee applied when balance | < 50,000 HKD | < 200,000 HKD | < 500,000 HKD |

Bank of China business account holders benefit from competitive local transfer options designed to meet various business payment needs. The following table outlines the comprehensive fee structure for local transactions:

| Transfer Method | Transaction Type | Channel | Amount Range | Fee |

|---|---|---|---|---|

| Express Transfer (RTGS/CHATS) | Outgoing transfers to other local banks | Branch | All amounts | HK$180 per item |

| Electronic channels | All amounts (HKD/CNY) | HK$25 per item | ||

| Electronic channels | All amounts (USD/EUR) | HK$55 per item | ||

| Incoming transfers to BOCHK account | Any | ≤ HK$500 equivalent | Waived | |

| Any | > HK$500 equivalent | HK$15 per item | ||

| Faster Payment System (FPS) | Outgoing HKD transfers | Electronic | ≤ HK$100,000 | HK$5 per item |

| Electronic | HK$100,001 - HK$1,000,000 | HK$10 per item | ||

| Outgoing CNY transfers | Electronic | ≤ CNY$100,000 | CNY$4 per item | |

| Electronic | CNY$100,001 - CNY$1,000,000 | CNY$8 per item | ||

| Incoming FPS transfers | Any | All amounts | Waived |

Among all the charges, international transfer fees are often the biggest burden. As a business in a global hub like Hong Kong, chances are you’ll need to remit or receive money overseas at some point.

Outward Remittance Fees

| Service Type | Channel | Fee |

|---|---|---|

| Standard Telegraphic Transfer | Branch | HK$260 per transaction |

| Electronic channels | HK$120 per transaction | |

| BOC Remittance Plus | Branch | HK$260 per transaction |

| Electronic channels | HK$115 per transaction | |

| Correspondent Bank Charges | USD transfers | HK$160 per transaction |

| EUR transfers (€100+) | €25-€35 per transaction | |

| GBP transfers | GBP20 per transaction |

Inward Remittance Fees

| Service Type | Amount | Fee |

|---|---|---|

| Incoming Wire to BOCHK Account | ≤HK$500 equivalent | Waived |

| >HK$500 equivalent | HK$60 per transaction |

With most traditional banks, you’ll not only face remit transfer fees, but there might also be sneaky hidden exchange rate markups from many banks – these extra costs can accumulate quickly and eat into your margins!

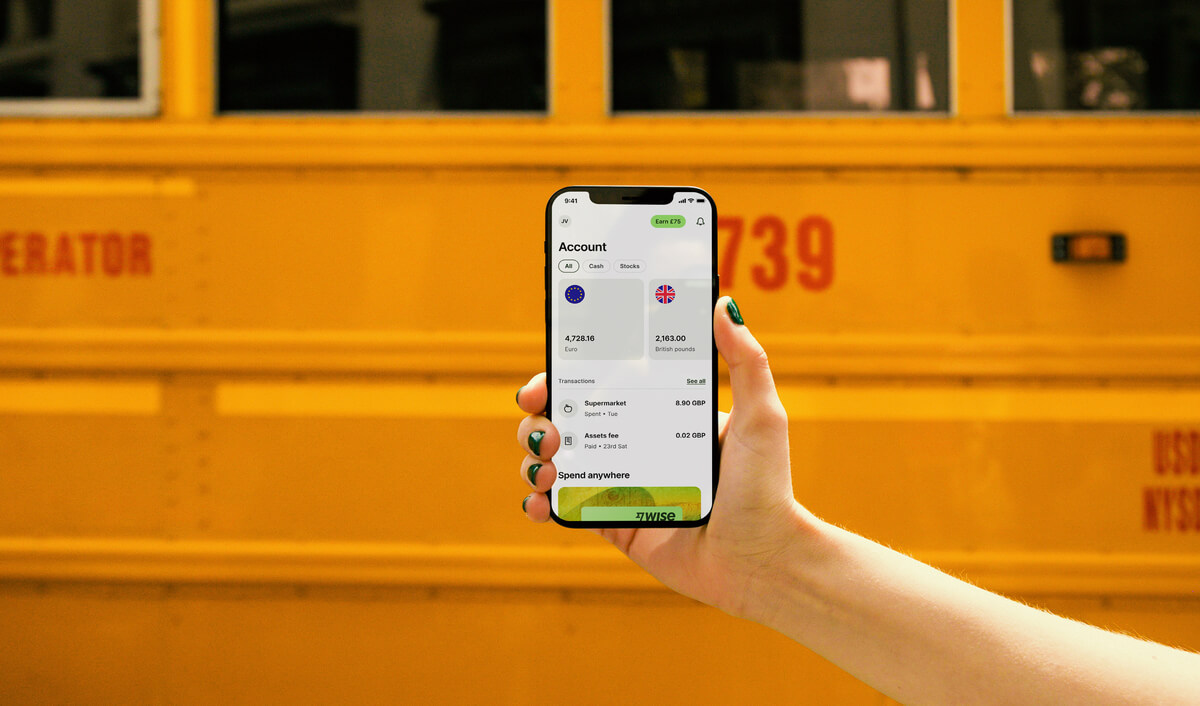

By contrast, institutions like Wise offer the real mid-market exchange rate with no hidden markup, making international transfers far more transparent and cost-efficient.

Let’s compare how Wise and BOCHK stack up when it comes to fees:

| BOCHK | Wise | |

|---|---|---|

| Sending money | Telegraphic Transfer: 115 HKD - 260 HKD, depending on chosen channels to transfer money. Correspondent Bank Charges (if applicable):

| From 0.26%, depending on the currency The actual fees will be shown on the app |

| Receiving money | ≤HK$500: Free >HK$500: HK$60 | Domestic payments (non-SWIFT or non-wire): Free Wire and SWIFT: Depending on the currency |

So let’s suppose you are transferring 10,000 HKD to USD, entirely online. Here how much you will get using BOCHK and Wise:

| BOCHK Business Account | Wise | |

|---|---|---|

| Exchange rate (HKD/USD) | 0.1273 USD | 0.1278 USD |

| Fees | At least 115 HKD | 37.89 HKD |

| Receiving Amount after fees | Around 1,258.36 USD | 1,272.93 USD |

Information last checked at HK Time: 2025/08/18 12:37:59

Wise is also very upfront about fee disclosure and transparency. So what you see on the app is what your recipients will receive – so you don’t need to worry about any hidden fees luring around your money

Besides the major costs, your BOCHK business account may also incur additional fees such as:

Other additional charges may apply depending on the features and services you choose for your BOCHK business account.

An application to BOCHK Business Account, despite its online convenience, may still take several weeks or even months. In order to avoid a lengthy application time, you should try to avoid these common pitfalls:

Missing or incorrect documents can slow down your application. To keep things moving smoothly, be sure to go through BOCHK’s required document list carefully and double-check before you submit.

Traditional banks such as BOCHK exercise strict due diligence when reviewing a business for account opening or ongoing operations. So to avoid delays,you should present a clear and well-structured explanation of your business model and financial flows from the start. This way you can reduce the likelihood of additional requests and ensure the bank has everything it needs to process your application efficiently.

The process for BOCHK to review your document will take some time. You can monitor your application status via the app or talk to your Relationship Manager.

Yes, you can still open a BOCHK business account in Hong Kong if you are a foreigner, or your business is not incorporated in Hong Kong. In this case, BOCHK will just ask you to submit additional documents. You can prefer the detailed list of materials for each country here.

BOCHK has a minimum deposit requirements for different account levels, but the service fees will be waived if you are able to maintain

Local sole proprietorships, partnerships, and single-layer limited companies may be approved within 3 business days.

The actual time will vary depending on the completeness of the documentation and the complexity of the business. In some cases, the process may even take up to several months.

To stay informed, be sure to check your application status online or consult your Relationship Manager for a clear timeframe specific to your case.

Yes, BOCHK allows you to open a business account online if you meet the eligibility requirements. However, depending on your specific circumstances, you may still be required to visit a physical branch to complete the process.

Having a local bank account is indeed important, and it can be said that BOCHK is an excellent local foundation for you. BOCHK has all you need to perform your daily business operation within the local market of Hong Kong, from several key branches to smart loan solutions.

But in the international market such as Hong Kong, you should also consider additional options as well, including those that are more global friendly. Products like Wise can be your global solution, especially if you constantly make cross-border transactions.

Here are other great features that come with a Wise Business account:

Wise can be a perfect alternative if you’re looking for something faster and less bureaucratic. Wise is entirely digital — there’s no need to visit any physical branches.

Managing your money is never easier. Simply use the Wise app or any web browser to access the Wise platform. Plus, enjoy receiving 23+ currencies with just one account, including local account numbers for 8+ major currencies, and you can receive local transfers for free. You can also send money to 140+ countries while tracking your payment in real-time!

Even better, you don’t have to open separate bank accounts in every country where you do business. With Wise, you can manage global payments and receive money like a local in multiple currencies – all from one account.

Open a Wise Business account online for free! You don’t need to pay any monthly fees to maintain your account either!

All fees from Wise are transparent, with real-time market exchange rates/ Wise will not hide any of your fees. Saving every penny for your business!

You can receive more than 40 currencies in your account, and easily switch to another currency whenever you need.

Easily add team members to your account and work together on payments, download statements, and track transactions more efficiently. You can also create and send invoices, add your account details or payment links, making payments simpler and quicker.

Plus, just simply upload a CSV file – the system will process up to 1,000 payments at once. You can also integrate Wise’s API for fully automated payment workflows.

Wise is also regulated by different financial institutions worldwide, including Hong Kong.

Learn more about Wise Business

Sources used in this article:

Sources last checked on 18-August-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore how to open a Citibank business account in Hong Kong with our comprehensive guide. Learn about eligibility, document requirements, and potential fees.

Open a livi Bank business account in Hong Kong with fast approval, easy online setup, and secure services. Learn more about fees and features.

Learn how to set up a PayMe business account in Hong Kong, explore features, fees, and start collecting payments seamlessly for your business.

Learn how to open an Interactive Brokers business account for your company. Discover fees, features, and how to manage investments globally with IB.

Looking for a Mox business account? Mox doesn't offer business accounts yet, but discover the best alternatives for virtual business banking in Hong Kong.

Find out all you need to know about opening a business account with Standard Chartered in this article - from their fee structures to the process of applying.