Does WeChat Pay (Weixin Pay) work in Hong Kong?

Explore how WeChat Pay works in Hong Kong, discover the difference between its mainland and HK versions, and find out the best payment alternatives.

Wondering whether Apple Pay works in Hong Kong? There’s good news: Apple Pay is widely accepted across Hong Kong.

If you’re also curious about how Apple Pay works behind the scenes and how popular it is in Hong Kong, you’ve come to the right place. This article covers everything you need to know about using Apple Pay in Hong Kong, from the underlying technology to its everyday usage. You’ll also learn what to watch out for when paying with Apple Pay, so you can use it with peace of mind.

You will also find out about Wise, a cross‑border money transfer service available in Hong Kong. Let’s get started!

| Table of contents |

|---|

Yes, you can use Apple Pay in stores, in apps, and on the web wherever you see the contactless symbol and your card issuer supports Apple Pay.

In short, Apple Pay users in Hong Kong can add card details to the Apple digital wallet and start making contactless payments. Whenever you make a payment, Apple Pay will ask you for biometric authentication – Face ID, Touch ID, or a device passcode – to authorize payments, ensuring that only you can use your card.

Apple Pay compatibility in Hong Kong depends on your bank; specifically, your financial institution must support adding its cards to the Apple Wallet. Plus, the merchant must have an NFC-enabled payment terminal to accept Apple Pay payments. Apple Pay is compatible with a broad selection of credit, debit, and prepaid cards from major networks including Visa, Mastercard, and UnionPay.

Hong Kong is becoming increasingly supportive of cashless payments, so you should have little difficulty finding places that accept Apple Pay. In general, Apple Pay works at most merchants that support contactless payments. If your bank supports Apple Pay, you can use it at many large retail chains, popular restaurants, and major hospitality establishments.

Major retailers such as IKEA, Uniqlo, H&M, Zara, 7-Eleven, and Circle K widely accept Apple Pay.

In some cases, a merchant may not display the Apple Pay logo but still accepts it, especially if they use NFC-enabled payment terminals. If you see the contactless symbol, Apple Pay will usually work.

When in doubt, you can ask the staff whether they accept Apple Pay or contactless payments.

Yes, you can definitely use Apple Pay in Hong Kong’s MTR, KMB, Citybus, and Long Win buses

Most KMB, Citybus, and Long Win buses accept contactless credit/debit payments via Apple Pay. Hong Kong’s MTR used to primarily rely on the Octopus fare system. But recently MTR in Hong Kong has introduced “Light Blue” gates that accept contactless credit/debit payments via Apple Pay.

It is still worth noting that Octopus remains the only method for certain fare concessions and the Government’s Fare Subsidy Scheme. So, another way around it is to add an Octopus card to Apple Wallet. Then you can use your iPhone or Apple Watch to enter and exit stations. You can also top up your Octopus balance using Apple Pay, but the fare payment itself will still be processed through Octopus.

Yes, Apple Pay is widely accepted at Hong Kong International Airport.

Most airport retail stores, duty-free shops, restaurants, cafés, and lounges accept Apple Pay. This makes it convenient for shopping and dining while waiting to board.

Yes, Apple Pay is widely accepted in Hong Kong. If a merchant supports NFC contactless payment methods, they are generally likely to accept Apple Pay as well, provided your bank supports Apple Pay. Some stores may still use older payment terminals, which means Apple Pay may not be accepted.

Here is how you can use Apple Pay in HK:1

Yes, you can use Apply Pay on Hong Kong MTR’s “Light Blue” gates.You can also add an Octopus card inside your Apple Wallet, and then tap at the MTR’s entrance and exit.

While Apple Pay is the undisputed king of local convenience in Hong Kong, it doesn’t solve the headache of managing money across borders. For expats and international professionals, the challenge is often getting those Hong Kong Dollars (HKD) back home at competitive exchange rates.

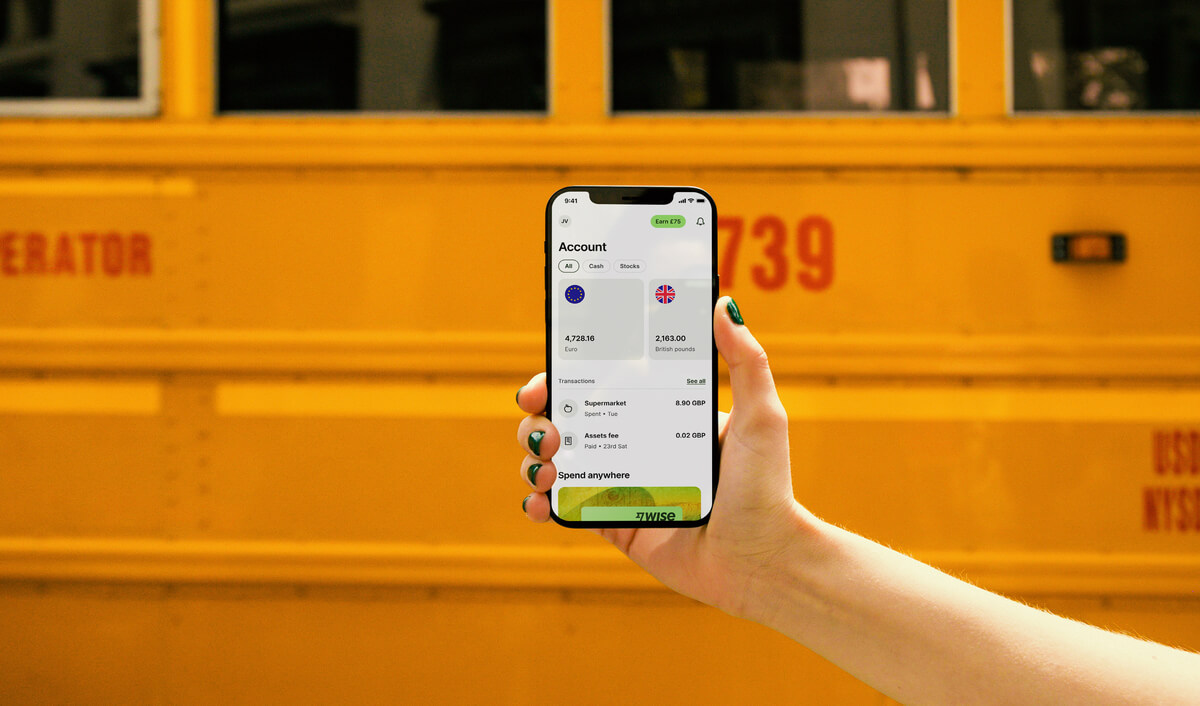

This is where Wise comes in. Send money with Wise at the mid-market rate. We'll show our conversion fees upfront.

Open your Wise account quickly and easily. All you'll need is your ID and a mobile device.

Sources used in this article:

Sources last checked on 22-Jan-2026

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore how WeChat Pay works in Hong Kong, discover the difference between its mainland and HK versions, and find out the best payment alternatives.

Discover how PayPal operates in Hong Kong, including fees. Learn about account types and cost-effective ways to manage international transactions.

Confused about Alipay in Hong Kong? Discover the differences between Alipay and AlipayHK and find the best options for cross-border payments in this guide.

Navigating China's foreign exchange controls? Understand key regulations, limits on international transfers and cash, and the annual quota for individuals.

Wondering if Revolut works in Hong Kong? Find out everything you need to know about using Revolut in Hong Kong.

This guide will compare the seven most popular and best credit cards from different providers in Hong Kong.