Does WeChat Pay (Weixin Pay) work in Hong Kong?

Explore how WeChat Pay works in Hong Kong, discover the difference between its mainland and HK versions, and find out the best payment alternatives.

Digital payments in Hong Kong currently is not something rare anymore, and you might have heard of the giant PayPal before. Being one of the first digital payments ever, PayPal is hugely well used by millions of active users worldwide.

Living in Hong Kong, you might wonder, "Does PayPal also work in Hong Kong?"

The short answer is yes, PayPal is indeed operational in Hong Kong. But local nuances and costs might be applied – and it is better that you understand all these to avoid any unpleasant surprises.

And if you are a resident in Hong Kong and want to open a PayPal account, you are at the right place! This article will cover everything you need to know about PayPal, the existence of the platform in Hong Kong, all the important fees, and any limitations you might face.

The article also introduces different alternatives to PayPal, like Wise - so you can have more choices that best suit your needs.

| Table of contents |

|---|

Yes, PayPal services are widely available to residents in Hong Kong. PayPal is licensed by the Hong Kong Monetary Authority (HKMA) to be a stored-value facility1.

Hong Kong residents can send money to other PayPal users globally. PayPal users can also receive money from other PayPal users. Just like any other global users, Hong Kong PayPal users can also make online purchases from international merchants that accept PayPal.

What makes it even better? You can link your credit or debit cards to the account to directly send and make payment, making your experience way more seamless.

A PayPal account comes with two types: PayPal individual and PayPal business. While different types of accounts will let you enjoy different benefits, you should always keep in mind that these accounts will vary differently, especially the cost structure.

While PayPal works seamlessly in Hong Kong, and has a high security of payment, PayPal - as a stored value facility- is not protected by the Hong Kong Deposit Protection Scheme1. Therefore, you should read up on terms and conditions to understand any risks associated with a PayPal account while keeping your deposit here.

As a resident in Hong Kong, you can also make payment to online stores that accept PayPal. And in fact, the platform is widely available, and millions of online stores worldwide Hong Kong accept PayPal – so you will barely have any trouble using PayPal.

Please still note that while opening a PayPal account is free, there are fees associated with using certain services. And these fees might add up to your expense as well, so it is always worth checking the final fees.

PayPal has a very detailed cost structure with many different fees. Let’s take a look at all the fees might incur when you have a PayPal Consumer account.

| Category | Fees2 |

|---|---|

| Sending domestic personal transactions (when no currency conversion is involved) |

|

| Sending international personal transactions |

|

| Withdrawals money from PayPal | Standard Transfer:

|

| Converting your balance into another currency | 3.00% above the base exchange rate |

| Converting when sending payments not in HKD | 4.00% above the base exchange rate |

The fixed fee mentioned in the table is listed below:

| Currency | Amount |

|---|---|

| Australian Dollar | 0.30 AUD |

| Brazilian Real | 0.60 BRL |

| Canadian Dollar | 0.30 CAD |

| Czech Koruna | 10.00 CZK |

| Danish Krone | 2.60 DKK |

| Euro | 0.35 EUR |

| Hungarian Forint | 90.00 HUF |

| Israeli New Shekel | 1.20 ILS |

| Japanese Yen | 40.00 JPY |

| Malaysian Ringgit | 2.00 MYR |

| Mexican Peso | 4.00 MXN |

| New Taiwan Dollar | 10.00 TWD |

| New Zealand Dollar | 0.45 NZD |

| Norwegian Krone | 2.80 NOK |

| Philippine Peso | 15.00 PHP |

| Polish Zloty | 1.35 PLN |

| Russian Ruble | 10.00 RUB |

| Singapore Dollar | 0.50 SGD |

| Swedish Krona | 3.25 SEK |

| Swiss Franc | 0.55 CHF |

| Thai Baht | 11.00 THB |

| UK Pounds Sterling | 0.20 GBP |

| US Dollar | 0.30 USD |

It is true that you can hold multiple currencies in one account, as long as these currencies are supported by PayPal. But if you live in Hong Kong and open a PayPal Hong Kong account, you can only withdraw funds in HKD.

So in general, whenever any currency conversation happens, PayPal charges a fee from your PayPay balance for that transaction. If your balance is not in the same currency as the fee, PayPal will convert the money from your balance into the currency needed to pay the fee. PayPal uses its own exchange rate, and on top of it will include a markup.

On top of these fees, PayPal’s exchange rate is not a mid-market rate – the rate that is highly recommended and widely used by Wise. You can see the reason you should consider this rate, by looking at this comparison between PayPal’s exchange rate with the mid-market rate. Let’s suppose you want to send HKD from Hong Kong with your wallet balance:

| Currency | PayPal | Wise |

|---|---|---|

| To USD | 0.1248 USD | 0.1287 USD |

| To EUR | 0.1065 EUR | 0.1104 EUR |

Rate is checked on October 20, 2025 at 14:17 HKT.

As you can see, with this rate, when making any international transactions of currencies other than HKD, PayPal’s exchange rate may not give you the best value. PayPal will also add up some fees to process the international payments. In that case for typical international transactions, you might be able to get substantial savings with Wise, compared to PayPal for Hong Kong residents.

The good thing is that both PayPal and Wise are very transparent about the cost. Both platforms will show you any fees and exchange rates when setting up payments and transfers. So before making any payments, you can always check both platforms to select the best for you!

You can withdraw funds to a Hong Kong bank account within minutes. PayPal offers an Instant Transfer function, allowing you to receive your money to your bank account typically within 30 minutes with a fee3. There is also a** Standard Transfer service** as well. This method usually takes within 3-5 working days, depending on your bank's clearance process.

Even with Instant Transfer service, PayPal might still delay your withdrawals in certain situations, so always monitor your PayPal app and bank account to ensure that your money is safely transferred. It is worth noting that there is a fee associated with each Instant Transfer (with any amount), and Standard Transfer (if your amount is less than 1000 HKD).

Like mentioned earlier, PayPal may place a hold on funds for certain transactions, including those from new sellers, higher-risk categories, or sellers with performance issues. PayPal also reserves the right to suspend or close accounts if users engage in restricted activities. A lot of people also noticed about the high fees when making cross-border transactions.

PayPal is an excellent choice if you use this platform for purely domestic HK transactions.

But international service with PayPal will be a different story. The reason is mostly dedicated to the high fee to process international service.

You can indeed use PayPal to send money to Hong Kong. All PayPal accounts will allow you to send and receive money, shop online, and make payments using your credit or debit card.

Plus, PayPal is available in millions of online stores worldwide, so it is a pretty neat platform for you to have an account from.

If you want to withdraw money from PayPal in Hong Kong, you can do so by electronically transferring it to your Hong Kong bank account by following these steps:

The main drawback of using PayPal for international transfers from Hong Kong is that it is quite expensive. PayPal uses their own foreign exchange rate, which is higher than the mid-market rate. Plus, you will need to pay additional fees to process your international payment with PayPal.

PayPal is indeed available in Hong Kong, it is one of the best options for your daily expenditures within Hong Kong. However, one thing you might have known by now is that PayPal's exchange rate markups and fees can be quite high.

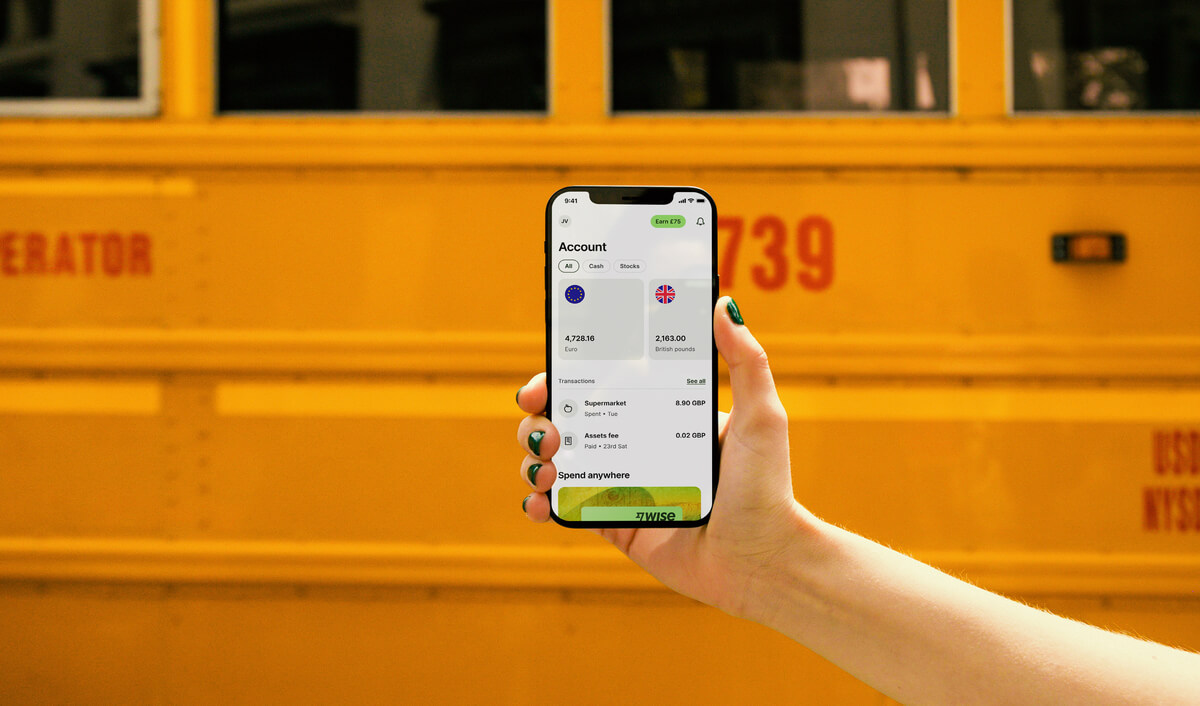

If you are looking for another option, you might consider using Wise instead. With Wise, you can effortlessly send money abroad from Hong Kong. Same with PayPal, Wise reveals all your transaction costs before sending – what you see is what you pay!

Ready to send money internationally with confidence? Experience the Wise difference. Get your free Wise account today and save on fees and exchange rates!

Sources used in this article:

Sources last checked on 20-Oct-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore how WeChat Pay works in Hong Kong, discover the difference between its mainland and HK versions, and find out the best payment alternatives.

Confused about Alipay in Hong Kong? Discover the differences between Alipay and AlipayHK and find the best options for cross-border payments in this guide.

Navigating China's foreign exchange controls? Understand key regulations, limits on international transfers and cash, and the annual quota for individuals.

Wondering if Revolut works in Hong Kong? Find out everything you need to know about using Revolut in Hong Kong.

This guide will compare the seven most popular and best credit cards from different providers in Hong Kong.

This article explains how to open a PayPal account in Hong Kong, a few steps to set up your account, and guidelines for using it.