Does WeChat Pay (Weixin Pay) work in Hong Kong?

Explore how WeChat Pay works in Hong Kong, discover the difference between its mainland and HK versions, and find out the best payment alternatives.

Have you ever heard about Alipay – one of the most well-known payment methods throughout China? Known as a super app of the Mainland, Alipay is used for almost everything – from paying daily grocery, settling for monthly bills, to even paying for holiday tickets.

But if you are living in Hong Kong, you've probably wondered: 'Does Alipay work in Hong Kong?’ The answer might not be too straightforward. When you search for an Alipay app, you might see two apps pop up – Alipay and AlipayHK. The difference between these two might be confusing to many Hong Kong residents.

Don’t worry, this one article will be the key helping you to navigate the differences between Alipay vs. AlipayHK. This guide simplifies the Alipay landscape for Hong Kong residents, advises you on which versions might work for you, and how to use them.

We’ll also show you another low-cost alternative to make payments and manage your money across borders: Wise. More on that later!

| Table of contents |

|---|

Launched by Ant Group to facilitate payments within Alibaba’s ecosystem, Alipay has since evolved into one of the world’s largest digital wallets. Its global success largely stems from its ability to adapt to every unique ecosystem of local markets. But that also makes every version of Alipay in each country might be different to each other, and Alipay’s features and services vary: what you can do with Alipay in China might be quite different from what’s possible in other countries. And because digital wallets have to follow local financial rules, each version of Alipay is designed to fit the regulations of the place it’s used.

So how about Hong Kong? Does Alipay also work in Hong Kong?

Alipay is indeed available in Hong Kong, but its primary purpose there is to serve visitors from mainland China. People from China can use Alipay to make payment outside of Mainland China, including Hong Kong. Users will need to verify their names and link a local Chinese bank in order to use Alipay in Hong Kong.

Hong Kong also has a diverse and tightly regulated payment landscape, so the standard Alipay app doesn’t just fully apply. To meet local requirements, Ant Group launched a separate version called AlipayHK, which follows Hong Kong’s financial regulations and is tailored to the everyday payment needs of local residents here.

Sharing nearly similar names, both Alipay and AlipayHK are related and created by the same company, that’s why many people might be confused between Alipay and AlipayHK. But they are actually two distinct apps, catering to two different segments and with very varied functionalities.

The main difference between Alipay and AlipayHK comes down to its customer segment, accepted currencies, as well as the fee structures – all of which will be covered in the later section.

Simply put, AlipayHK can be seen as a localized version of payment for Hong Kong residents.

The app is an excellent domestic transaction method within Hong Kong. With just this one app, you can make quick and simple online and mobile payments to restaurants, pay for goods and services, pay for your public transportation, or make bill payments – everything is included within just your phone. Another great functionality of AlipayHK is to send money to other Alipay users through their phone number or AlipayHK account number. Settling funds to your friend or paying to local small suppliers is never easier!

It is worth noting that AlipayHK only primarily operates in HKD – totally different to Alipay Mainland, which mainly operates in RMB.

Mainland Chinese can use Alipay to make in-store payments within Hong Kong – usually these stores will show a sign indicating they accept Alipay as well. Mainland Chinese can also use Alipay to shop online on many Hong Kong-based platforms and retailers.

However, the Alipay Mainland version can’t really get full access to pay for typical day-to-day local Hong Kong transactions. For example, you (as a Chinese user) cannot get access to functions like transferring money to another individual wallet in HKD.

You will need to have a local Hong Kong phone number to register for an AlipayHK account in Hong Kong. That’s it! It is still worth noting that AlipayHK might ask you to provide additional information under certain circumstances.

Here’s how you can register an AlipayHK account in Hong Kong1:

Another way you can register for an AlipayHK account is through Taobao registration. If you have a Taobao account, simply choose “Taobao login” – it will take you to the Taobao app. Now, provide your phone number, perform the SMS verification code, and create a safe payment password! You are ready to go!

After successfully registering for an account, you can link a bank account or a credit card to your AlipayHK account2.

If you want to link Hong Kong bank account to AlipayHK, you can also do so if you have an account at these banks: HSBC, Hang Seng Bank, BoCHK, Standard Chartered Bank, DBS Bank HK, The Bank of East Asia, Bank of Communications HK, China Construction Bank, ICBC, China CITIC Bank, and Nanyang Commercial Bank.

If you want to link your credit card instead, it is good to know that it is way friendlier. As long as you have a Visa or Mastercards, you can link to AlipayHK. Except for the case of Bank of China. Only credit cards from BoC from Hong Kong can be accepted – if your credit card is issued by BoC in another country, you cannot link to AlipayHK

AlipayHK gives users many convenient ways to top up an AlipayHK balance, like3:

AlipayHK is one of the most popular e-wallets in Hong Kong5. That means having an account with AlipayHK will make your life way easier when navigating daily life in Hong Kong. You can pay the selected merchants following these two simple steps:

While mainland Alipay is accessible to Hong Kong and you can also easily register for an Alipay account, this version is often not suitable for Hong Kong residents for local, daily transactions.

First of all, while Hong Kong users can also register for an account with Alipay, they cannot use the Alipay Mainland version in Hong Kong – unless they switch to the international version of Alipay. In this case, they will need to complete the real-name verification with a Home Return Permit, and link a bank card from a Chinese mainland bank.

Secondly, you won’t be able to store HKD in your personal Alipay Mainland account or make any personal transfers, making it extremely tougher to settle up funds in HKD. Lastly, while AlipayHK can support remit funds to Alipay for certain reasons, a Mainland Alipay user cannot make any cross-border transfer, even to AlipayHK – so it won’t be too convenient for you as a resident in Hong Kong.

The fee structure for Alipay and Alipay HK are also different. Let’s tackle this difference between these two:

| AlipayHK | Alipay | |

|---|---|---|

| Transaction fee via credit card |

| Non-Chinese mainland bank card:

|

| Transaction fee using balance | Free | Free |

| Remittance transaction fee | To the Chinese Mainland:

To the Philippines:

To Indonesia:

| Not available |

| Receiving remittance | Free | Free |

You can use the Mainland China Alipay account in Hong Kong for shopping. However, this function is only available to those who live in China, and able to link with a Chinese bank account.

The main difference between Alipay and AlipayHK is the accepted currency. Alipay primarily works in RMB while AlipayHK is in HKD. This makes sense because these two platforms cater to different customer segments. If a user from Alipay Mainland pays a Hong Kong merchant who has an AlipayHK merchant account, the currency will be automatically converted.

AlipayHK is widely accepted in Hong Kong. In fact, AlipayHK supports over 150,000 local4 retail outlets in Hong Kong. So there is a high chance you will come across a merchant who accepts AlipayHK in the city. However, be aware that some small businesses might only use personal accounts – if you have an Alipay Mainland instead of AlipayHK, you might not be able to transfer funds to that account.

If you are constantly transferring money from Hong Kong to other countries, you might find out that AlipayHK might not be the only option. Let’s together explore another smart alternative – Wise.

AlipayHK indeed offers great services for many locals in Hong Kong, but you’ll begin to see the struggle, especially when you want to settle funds with personal accounts between Mainland China and Hong Kong.

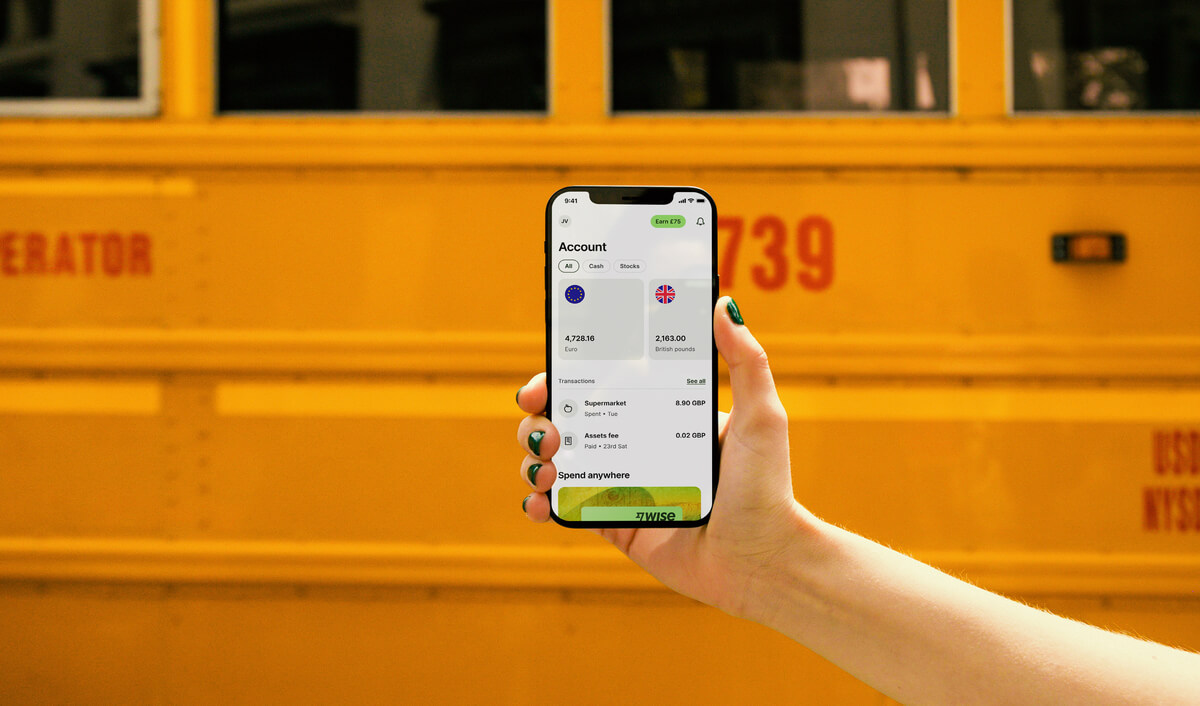

In that case, use Wise instead to send payments to friends who have an Alipay China account, or just in foreign currencies in general. Wise offers international money transfer services to users in Hong Kong. Enjoy the real mid-market exchange rate when you transfer money.

Plus, Wise shows you all fees upfront per transaction, and you’ll see exactly what your recipient will get into their account before you confirm the payment. And if you are a resident in eligible countries (note that this does not currently include Hong Kong residents), you can also get a Wise card to spend in Hong Kong.

Managing your money with just your phone is getting easier all the time. From simple in store payments and local transfers with AlipayHK, to cheap international transfers with Wise, you can do everything you need! Check out Wise today to see how you can save!

Sources used in this article:

Sources last checked on 10-Oct-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore how WeChat Pay works in Hong Kong, discover the difference between its mainland and HK versions, and find out the best payment alternatives.

Discover how PayPal operates in Hong Kong, including fees. Learn about account types and cost-effective ways to manage international transactions.

Navigating China's foreign exchange controls? Understand key regulations, limits on international transfers and cash, and the annual quota for individuals.

Wondering if Revolut works in Hong Kong? Find out everything you need to know about using Revolut in Hong Kong.

This guide will compare the seven most popular and best credit cards from different providers in Hong Kong.

This article explains how to open a PayPal account in Hong Kong, a few steps to set up your account, and guidelines for using it.