Freelance Visa Dubai (Dubai Green Visa): The Complete Guide for UK Applicants

Learn how to get a freelance visa in Dubai as a UK freelancer, understand requirements, tax and free zones, and manage cross-border income with Wise.

Self-employment is booming in the UK, with the latest figures showing that roughly 4.4 million people work for themselves as of the second quarter of 20251. That translates to a fairly sizable chunk of tax being collected by the HMRC in accordance with rules like IR35. But how do these rules work, and what can you do to stay compliant?

In this article, we explain IR35 and how Wise Business helps contractors and their clients navigate the practicalities of managing their business finances within the IR35 framework.

*This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited, its subsidiaries or affiliates, and it is not intended as a substitute for obtaining business advice from a tax advisor or any other professional.*IR35 is a framework based on off-payroll working rules that ensure contractors (such as freelancers) pay a similar amount of Income Tax and National Insurance as permanent employees2.

Before IR35 was introduced, contractors were able to pay less tax by setting up a limited company to work through. They could leave a job on Friday and return on Monday, doing the same work for the same client, but paying less tax. IR35 prevents this ‘disguised employment’ from happening.

IR35 originally got its name from being the 35th press release issued by Inland Revenue, which is what HMRC used to be known as. This press release had the original set of off-payroll working rules within it.

IR35 makes it mandatory for medium and large companies operating in the private sector, as well as public sector companies, to check whether a contractor is attempting to work as a ‘disguised employee’ for them.

These companies must ask themselves:

Do we control how, when, and where the work is done by our contractor(s)? If the answer is yes, then the contract is more likely to be considered inside IR35.

Can the contractor send someone else to complete the work? If the answer is yes, then the contract is more likely to be considered outside IR35.

Are we obliged to provide work to the contractor, and are they obliged to accept it? If the answer is yes, then the contract is more likely to be considered inside IR35.

Key Fact ⚠️: If the client is a small business in the private sector, then it is the responsibility of the contractor’s company to determine IR35 status.

If you're a contractor, being 'inside IR35' means the company you're contracting for considers you an employee for tax purposes. As such, you must pay Income Tax and National Insurance just like a regular employee of the company.

Normally, the company you're working for takes care of this by deducting Income Tax and National Insurance from your fees each time you are paid.

If your day-to-day working arrangements change, it’s worth getting your IR35 status rechecked. Being classed as outside IR35 when you should actually be inside can backfire with heavy fines or penalties from HMRC.

Key Fact ⚠️: IR35 determines your status for tax purposes only. It does not automatically entitle you to benefits such as statutory sick pay or holiday pay.

When you’re classed as outside IR35, HMRC recognises you as genuinely self-employed.

In simple terms, you can run your freelancing work through your own limited company, file company accounts, and pay tax through Self-Assessment. This gives you more flexibility in how you take your income.

For example, you can pay yourself a salary and take the rest as dividends, which aren’t subject to National Insurance. If your profits are under £50,000, your company also pays corporation tax at 19%4.

Being outside IR35 usually comes down to how you actually operate as a business. Things like having your own website, business insurance, or equipment, and working with multiple clients, are all signs you’re not tied to one employer-like setup.

It’s worth noting that the client often decides if your contract sits inside or outside IR35 in both the public and private sectors. But HMRC can still review your working practices.

So, if you’re unsure, it’s smart to get an IR35 assessment for peace of mind.

For freelancers and contractors working through a limited company or personal service company (PSC), IR35 affects their taxes, career choices, and earning potential.

Since the IR35 reforms, many clients have taken a cautious approach, often pushing roles inside IR35 or moving work in-house, which has limited flexible opportunities.

What are the potential implications of IR35?

Tax liabilities: Being classed inside IR35 means you’re taxed like an employee. This may lead to extra National Insurance payments and possibly higher income tax.

Reduced tax efficiency: Contractors lose many tax perks of self-employment, such as expense claims and dividend options. Inevitably, it lowers take-home pay.

Employment rights: Those outside IR35 retain independence and flexibility. Inside IR35, contractors usually don’t receive full employee benefits, even though their taxes are similar to those of staff.

Client control: After the recent reforms, the client now decides their IR35 status, reducing the contractor’s influence over their tax.

Example scenario of being outside IR35:

You're a freelance IT consultant in the UK hired by a financial services firm.If your contract is classed outside IR35, it might be that you're operating through a limited company, split income between salary and dividends, and claim business expenses like software or travel.This setup helps keep your taxes lower and take-home pay higher.

And what if the same freelancer is inside IR35?

In this case, the company you're providing work to deducts PAYE (pay as you earn) tax and National Insurance contributions upfront. Moreover, expense claims are restricted.Ultimately, you pay taxes just like company employees, but you don’t get full employment benefits.

IR35 does not directly catch sole traders because the legislation only applies to those working through an intermediary (like a personal service company). Still, that doesn’t mean sole traders are completely untouched.

The client organisation is responsible for determining employment status and paying any additional taxes.

If HMRC later decides that a sole trader is effectively working as an employee, the client, not the sole trader, will be liable for back taxes, interest, and possibly penalties.

Since the 2021 IR35 reform, many compliance departments have become more cautious, and sole traders may increasingly be involved in client status-checking processes.

That said, while sole traders don’t carry tax liability themselves, they could still feel the impact.

If a client reclassifies their role as employment, the sole trader may end up on the payroll. Eventually, it leads to lower take-home pay and less flexibility.

As a sole trader, you and your business are considered one entity for tax purposes. You pay tax through an annual Self-Assessment submitted online via your Government Gateway account.

Unlike a limited company setup, there’s no separation between you and your business. Also, you’ll need to keep two key Self Assessment deadlines in mind5.

Registering with HMRC: You must register for Self Assessment by 5 October following the end of the tax year when you started trading. For instance, if you began in the 2024/2025 tax year, your deadline is 5 October 2025.

Filing and payment: Your completed tax return and any tax due must be submitted by 31 January of the following year. So, the 2024/2025 tax year deadline is 31 January 2026.

👀 Find out more by reading our guide on how much tax a sole trader pays in the UK.

Even though IR35 doesn’t directly apply, sole traders should still take steps to avoid being misclassified:

In short, being a sole trader doesn’t exempt you from employment status rules. If you aren’t genuinely operating as a self-employed business, HMRC may still view you as an employee for tax purposes, regardless of your chosen business structure.

If you disagree with an IR35 decision, you can begin by raising a disagreement with the party that issued the Status Determination Statement (SDS).

The client (or deemed employer) must respond within 45 calendar days, keeping the current tax treatment until they do6.

You can escalate the issue to an independent tribunal if that doesn't resolve matters. You must submit written evidence (contracts, working practices, correspondence) and show why HMRC’s assessment is incorrect.

Note: if HMRC issues a direction notice (such as for underpaid tax), you typically have 30 days to appeal in writing, citing your grounds and evidence7.

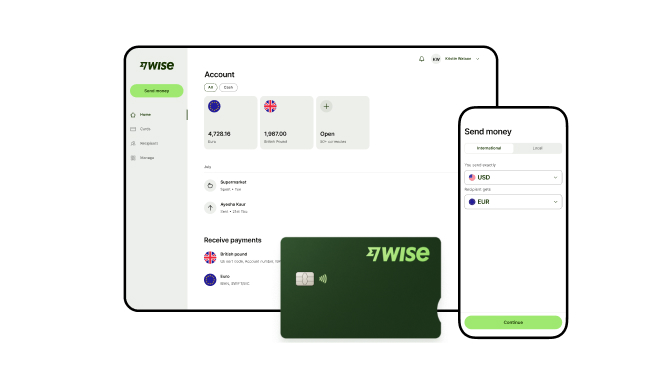

The Wise Business Advanced plan* is ideal to manage your finances and demonstrate your status as a genuine business at the same time.

You get local account details for 8+ currencies, making it simple to receive payments from international clients at the mid-market exchange rate with no hidden fees.

Plus, you can create and send professional invoices directly from your account, helping to establish a clear client-supplier relationship.

What’s more, you can manage payments and track all your business expenses with theWise debit card, showcasing the financial risk and independence that are key to any IR35 assessment.

Get started with Wise Business today to strengthen your business operations and solidify your outside-IR35 status.

\****Disclaimer**: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are **not** available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest [pricing information](https://payout-surge.live/gb/pricing/business%29.%3C/small%3ESources:

Sources last checked on October 2nd, 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to get a freelance visa in Dubai as a UK freelancer, understand requirements, tax and free zones, and manage cross-border income with Wise.

Learn how to sell on Temu in the UK. Our guide explains account registration, how to optimise listings, and compliance requirements to start making money.

Discover the difference between operating as a sole trader and self-employed in the UK. Our guide covers legal definitions, tax responsibilities, and more.

Learn the exact steps to become an Uber driver and start earning in the UK. Our guide explains rules, requirements and steps in detail.

With the rise in side hustle culture, and people wanting more flexible working arrangements, the freelance revolution isn't slowing down - in fact, it's going...

Essential advice for freelancers in Singapore, covering taxation and best practices for managing your finances effectively.