Sole Trader vs Self Employed: What’s the Difference?

Discover the difference between operating as a sole trader and self-employed in the UK. Our guide covers legal definitions, tax responsibilities, and more.

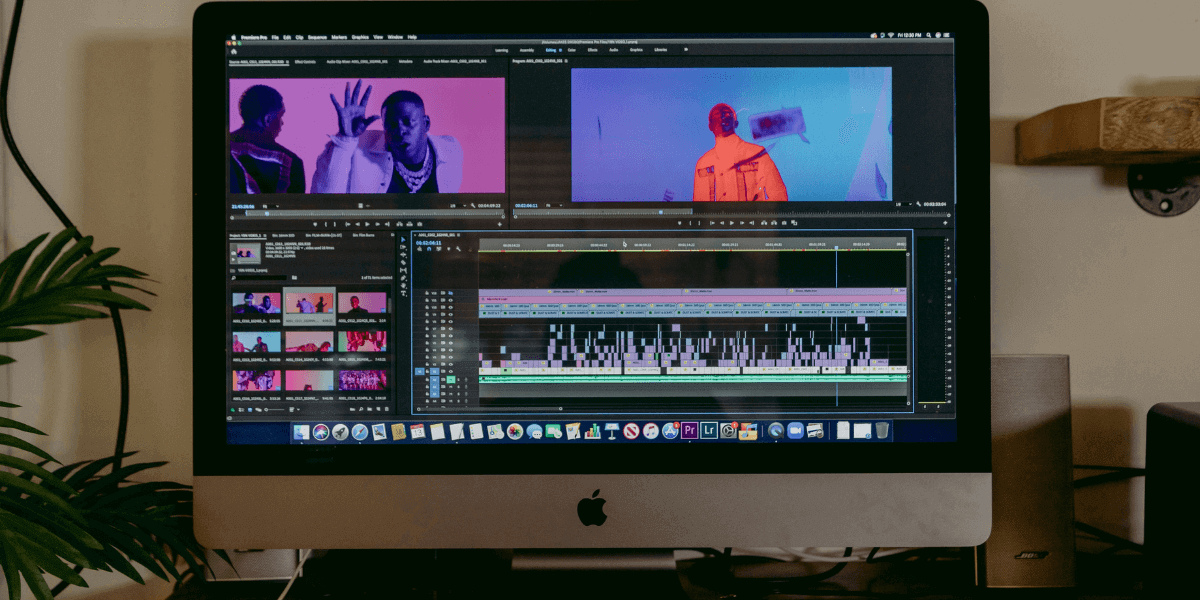

Creating professional and supremely edited videos from raw footage takes talent and hard work. But how do you convey that value to clients and get paid the right amount for it?

This guide answers this crucial question to help you nail the right rate as a freelance video editor. We’ve discussed pricing models, average rates for various types of video editing in the UK, and touched on ways you can make the most of your earnings with Wise Business.

Let’s dive in.

An hourly rate is exactly what it says on the tin - a rate you charge per hour spent doing the various aspects of videography and editing your client has requested.

With hourly rates, it’s important to note that while they offer a degree of flexibility, they might not be ideal in every scenario. For instance, the more efficient and the less time it takes you to do your work, the less money you’ll make.

This means if a task that would take you 6 hours now takes you half the time, you’ll most likely be making less money doing the same task.

Example scenario for charging an hourly rate:

You offer a wide range of video editing services covering long and short-form content. You don’t mind what type of editing you need to do, as long as you’re compensated for the hours you spent doing it.

In this case, you set your hourly rate according to your experience level and the research you’ve done on what your competitors (other freelancers) are charging.

Now it’s just a matter of tracking the number of hours you spend working on projects and doing a simple calculation to calculate how much to bill your client (by multiplying your hourly rate by the number of hours you worked).

Daily rates refer to charges on a daily basis. This isn't common among freelance videographers in particular, but you can choose to do it if you’re more comfortable with it.

The day rate, which is typically agreed upon between you and your client, covers one full workday. The number of hours normally varies based on your agreement and other factors, such as industry standards.

Example scenario for charging a daily rate:

You know a project will take at least 3 days to complete, with 2 additional days needed for revisions.

You’re unsure how many hours you can dedicate to completing rounds of edits on any given day, but you prefer being charged for the days it takes to complete the full project.

In this case, you can set a daily rate based on your experience level and what your competitors charge. You could base this on an average number of hours worked per day multiplied by an hourly rate (e.g. 8 hours of work in a day x £15 per hour = £120).

A project-based rate involves charging a fixed price for an entire project. Unlike charging per hour, the client pays you the agreed-upon fee for the entire project.

This is a great pricing model when you have a clearly defined project scope and deliverables. The client also has a clear picture of how much it is going to cost them, no surprises like you have when you are charging per hour.

Example scenario for charging a project-based rate:

You’re a freelance video editor hired to create a 5-minute promotional video for a local coffee shop.

You’ve been asked to film the main footage and B-roll, as well as to organise extras from the shop’s list of regulars.

The shop owner also asks you to coordinate with their social media team to share the final video on all platforms in the right aspect ratios.

Since this is a somewhat multifaceted project with numerous tasks, you decide to set a fixed project fee of £600. You believe this is fair compensation, irrespective of how long it takes to complete all of the tasks.

The average going rate for a freelance video editor in the UK is £50 to around £400 per day. This rate can vary considerably depending on:

Your experience level: If you’re an established freelance video editor with a solid portfolio, chances are you’ll be able to command higher rates than someone who’s just starting.

Project scope: What exactly does your client need? Does your client need a quick and simple edit, or do they need you to add subtitles, colour grade, and add motion graphics?

Client expectations: Would you be delivering in multiple formats or aspect ratios? Also, would you be editing for various platforms, such as YouTube, Instagram, and TikTok?

Number of revisions and turnaround time: How many rounds of revisions are you offering for free? And would you be billing separately for extra revisions? Additionally, what’s the turnaround time, and would you charge extra for rush projects?

Tools and resources: Do you need any professional software, audio licences, images, or plugins for your project?

Client’s industry and budget: Your client's budget or industry plays a huge role in how much you can charge. You can’t charge a Fortune 500 company the same rate you would charge a local coffee shop.

Value to client: What’s the impact of the project you are working on? Will it bring money to your client's business, improve awareness, or promote a new product to the market?

1. Calculate your monthly business and personal expenses. Business expenses include taxes, software and tools, courses, and internet expenses. Personal expenses can include food, rent, insurance, etc. Let's assume this is £2,600 in total.

2. Find out how many hours you can work. e.g. your weekly billable hours might be 30 hours after accounting for time off each week, such as weekends (assuming you don’t want to work weekends).

3. Factor in holidays and vacations. Let's say this is six weeks per year, which means you’ll work 46 weeks in a year (since there are 52 weeks in a year, and 52 - 6 weeks time off = 46 weeks remaining).

4. Multiply your preferred working hours by your billable hours. E.g. 30 hours a week x 46 work weeks = 1,380 hours a year.

5. Divide your yearly billable hours into months. In this case, 1,380 hours a year / 12 months a year = 115 hours a month.

6. Divide your total monthly expenses (which we calculated as £2,600 in step 1 above) by your total monthly billable hours. £2,600 ÷ 115 hours = £22.6/hour.

7. Add a profit margin. This is normally a percentage on top of your billable hourly rate and helps with things like getting better equipment, investing in yourself (such as completing training courses), etc. E.g. with a 30% profit margin, your hourly rate would be £22.6 + (30% of £22.6) = £29.38.

Note: As you improve and upskill, consistently revisit your rates. Maybe more clients are reaching out, you’ve built up a solid portfolio of successful projects, or the cost of the video editing software you use has gone up.

Even things like earning new certifications can justify charging more. The key is to make sure your pricing keeps up with your skills, the market, and your financial goals.

Your final email marketing rate card should have the following:

A list of your services: You should detail exactly what services you provide, from the basics (like editing, revisions, graphics) to add-ons (like coordinating with other freelancers, social media, scripting, etc.). This is especially important if you’re doing project-based pricing.

Your pricing model: Are you charging per project, by the hour, or both? Clarify this and the various caveats on your rate card.

Additional services: What fee would you set for extra services that are outside the agreed-upon project scope?

Payment terms: Do you charge a 50% upfront before starting the project, or do you charge your client for extra revisions or rush projects?

Your rate card should ultimately highlight the different types of services you offer, along with the prices you charge for each of these services.

This would give your prospect a clear idea of your services and how much they would cost.

Additionally, having a rate card shows prospects that you clearly thought about your services and have a standardised pricing structure for them.

Wise Business has a wide array of fantastic features for video editors. With an Advanced plan*, not only can you hold balances in 40+ currencies, but you can also send money to 140+ countries and receive payments in currencies without any hidden fees.

Plus, with the Wise Business card, you can earn 0.5% cashback on your business spending.

And if you find yourself moving from a solo freelancer to someone with their own agency, you can use the accounting software integrations within Wise Business to streamline your bookkeeping and save hours on financial admin.

Try Wise Business today to see what makes it the business account for freelancers.

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

Sources:

Sources last checked on September 30th, 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the difference between operating as a sole trader and self-employed in the UK. Our guide covers legal definitions, tax responsibilities, and more.

Learn the exact steps to become an Uber driver and start earning in the UK. Our guide explains rules, requirements and steps in detail.

With the rise in side hustle culture, and people wanting more flexible working arrangements, the freelance revolution isn't slowing down - in fact, it's going...

Discover what to charge as a freelance makeup artist in 2025. Our guide covers setting your rates for bridal, events, and photoshoots to boost your profit.

As a freelancer or sole trader, working with clients in different parts of the world can feel like a constant juggling act. One minute you're knee-deep in a...

Find and retain high-value clients for your freelance work. Our guide explains proven strategies to secure long-term revenue and grow your freelance business.