Opening a Branch Office in Germany: Complete Step-by-Step Guide for UK Businesses

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

Expanding your business to Taiwan? Understanding the corporate tax landscape is crucial for making informed decisions about this dynamic East Asian market. Taiwan offers a strategic location, advanced infrastructure, and a skilled workforce, making it an attractive destination for international businesses.

Whether you're considering setting up operations, hiring talent, or acquiring a local entity in Taiwan, understanding corporate income tax requirements will help ensure compliance and effective financial planning. With Wise Business, you can streamline your international payments and manage your finances efficiently as you navigate Taiwan's business environment.

💡 Learn more about Wise Business

This publication is provided for general information purposes and does not constitute legal, tax, or other professional advice from Wise Payments Limited, its subsidiaries or affiliates, and it is not intended as a substitute for obtaining business advice from a tax advisor or any other professional.

The standard corporate income tax rate in Taiwan is 20%, applicable to companies with taxable income exceeding NT$120,000. Enterprises with taxable income of NT$120,000 or less are exempt from corporate income tax, providing relief for very small businesses.1

Taiwan's corporate tax rate is competitive within the Asia-Pacific region, sitting below the global average of approximately 23.5%. The government has maintained this rate structure to attract foreign investment while ensuring adequate revenue collection for public services and infrastructure development.2

Resident companies in Taiwan are subject to corporate income tax on their worldwide income, while non-resident companies are only taxed on Taiwan-sourced income. A company is considered resident if it is incorporated in Taiwan or has its place of effective management in the country. In addition, a 5% surtax is levied on undistributed earnings of resident companies, and an alternative minimum tax (Income Basic Tax) may apply in certain cases.1

| Read more about Corporate Tax Planning best practices |

|---|

Corporate income tax in Taiwan must be paid in New Taiwan Dollars (TWD) through the country's electronic filing and payment system. The Taiwan tax authority, known as the Ministry of Finance, requires most companies to use its online platform for both filing returns and making payments.4

Companies must make provisional tax payments during the year. For calendar-year taxpayers, this is generally due in September and equals 50% of the previous year’s tax liability. Adjustments may be allowed if the company’s performance in the first half of the year shows a significantly different result. The balance of tax due is settled when the annual return is filed.5

The tax year in Taiwan follows the calendar year from 1 January to 31 December, and companies must file their annual corporate income tax returns by the end of May following the tax year.3

Late payment surcharges apply at a rate of 1% every three days on the outstanding balance, capped at 10% of the tax due. Additional fines may also apply for late filing or non-compliance, depending on the severity and duration of the delay.6

Let's calculate the annual tax liability for a company with a turnover of NT$48 million (approximately £1.5 million). Assuming a profit margin of 10%, the taxable income would be NT$4.8 million.

At Taiwan's standard corporate tax rate of 20%, the annual tax due would be:

NT$4.8 million × 20% = NT$960,000

When expanding your business to Taiwan, the right financial tools will make the process smoother. Using a platform like Wise Business makes it easy to manage international finances. A multi-currency account allows businesses to pay for incorporation costs, registration fees, and government taxes in local currency without paying high exchange rate fees.

Get started with Wise Business 🚀

Staying compliant with Taiwan’s tax regulations requires careful attention to both corporate governance and reporting obligations.7

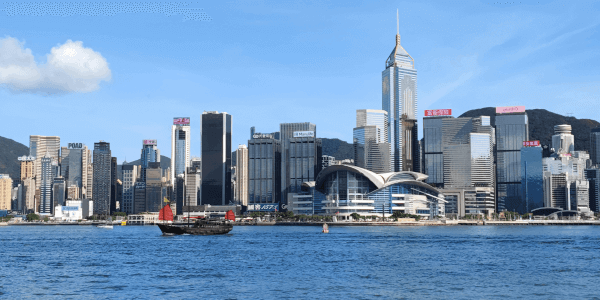

Taiwan has become one of the world’s most dynamic business destinations. Ranked among the top 20 global economies by GDP, it is the United States’ 8th largest trading partner and plays a critical role in high-tech supply chains. Its 23.5 million population supports an export-driven economy, powered by globally competitive industries such as semiconductors, 5G telecommunications, AI, and the Internet of Things (IoT).8

Strategically located in the Asia-Pacific, Taiwan provides quick access to key markets. It takes less than three hours by air from Taipei to reach Tokyo, Seoul, Beijing, Shanghai, Hong Kong, and Singapore, while the Port of Kaohsiung efficiently links major regional hubs within 53 hours by sea. This geographic advantage has made Taiwan a top choice for multinational companies establishing their Asia-Pacific headquarters.9

Foreign direct investment highlights this attractiveness. From January to July 2025, Taiwan approved 1,246 FDI projects worth USD 7.8 billion. Since 1952, more than 72,000 projects have been registered, with inflows totalling nearly USD 235 billion. The country also ranks 4th in the 2024 Index of Economic Freedom and 8th globally in competitiveness, supported by strong intellectual property protections and robust infrastructure.9

Taiwan’s workforce adds further appeal. The working population includes nearly 10 million individuals, with 38% holding a university degree. Over 300,000 graduates enter the labour market annually, ensuring access to skilled talent in technology, services, and commerce.9

For businesses planning expansion, the process typically involves:11

All of this makes Taiwan a strong choice for companies that want to grow in Asia. Doing Business in Asia 2025 requires careful evaluation of location, skilled workforce, and open market to give businesses an excellent base to expand across the Asia-Pacific region.

| Discover the top 5 best Corporate Tax softwares |

|---|

To set up a company in Taiwan, foreign investors must register with the Administration of Commerce, Ministry of Economic Affairs (MOEA). The process involves several key documents and approvals to ensure compliance with local regulations:12

Under the Taiwan Company Act, several structures are available:10

Foreign investors should consider how tax rules, such as quarterly payments and residency requirements, apply to their chosen entity. Working with a corporate tax advisor at the start can ensure that incorporation decisions support long-term tax planning and cost management. Companies can establish a strong base in Taiwan by selecting the right business structure and meeting MOEA requirements while keeping their tax and operational responsibilities efficient.

Managing corporate tax obligations across multiple jurisdictions requires a strategic approach that balances compliance with efficiency. International businesses should prioritise understanding local tax laws and maintaining accurate records to avoid costly penalties and ensure smooth operations.

Establish robust compliance procedures by working with qualified local tax advisors who understand Taiwan's specific requirements and can help navigate complex regulations. Regular reviews of your tax position and proactive planning can help identify opportunities for legitimate tax optimisation whilst ensuring full compliance with local laws.

Consider the impact of double taxation treaties when structuring your international operations. Taiwan has comprehensive tax treaties with numerous countries, which can help reduce withholding taxes on dividends, royalties, and interest payments between treaty partners.

Maintain detailed and transparent financial records that can withstand scrutiny from tax authorities. Digital record-keeping systems that integrate with your accounting software can streamline compliance processes and provide the documentation needed for tax filings and potential audits.

Researching corporate tax is a crucial step when expanding your business into a new country. The next step is setting up the financial infrastructure to handle the complexities of operating across borders, from managing multi-currency cash flow to mitigating FX risk.

The Wise Business account provides the financial tools to make your international expansion to Taiwan efficient and simple. It's the one account for managing your money globally.

With a Wise Business account, you can:

Pay suppliers and initial fees: Pay suppliers, global payroll, and one-off incorporation costs in the local currency.

Get paid like a local: Use local account details

(only with Wise Business Advanced)

for 8+ major currencies to easily receive payments from customers or investors.

Manage your money across borders: Hold and exchange 40+ currencies in one account, always with the mid-market exchange rate and low, transparent fees.

Streamline your accounting: Integrate with tools like Xero or QuickBooks to simplify tracking your company's international finances.

Empower your team: Provide multi-user access for your finance team and issue expense cards for international spending.

Wise is designed to support every step of your journey, from paying your first registration fee to receiving international payments and managing your global treasury.

Get started with Wise Business 🚀

All companies incorporated in Taiwan are liable for corporate income tax on their worldwide income, with taxable income above NT$120,000 taxed at 20% and income up to NT$120,000 exempt. Foreign companies with a permanent establishment (PE) in Taiwan are taxed only on Taiwan-sourced income attributable to the PE at 20%. Non-resident companies without a PE are generally not subject to corporate tax, but withholding tax applies on certain types of Taiwan-sourced income, such as dividends, interest, royalties, and service fees.

Yes, Taiwan offers several tax incentives to encourage investment and innovation. The Statute for Industrial Innovation provides tax credits for research and development activities, with companies able to claim up to 15% of qualifying R&D expenditure as a tax credit. Additionally, companies investing in smart machinery or 5G technology can benefit from accelerated depreciation allowances. Foreign companies establishing regional headquarters or operational headquarters in Taiwan may qualify for preferential tax treatment under specific programmes.

Dividends paid by Taiwan companies to resident shareholders are subject to Taiwan’s integrated tax system, under which the corporate tax already paid may be credited against the shareholder’s personal income tax. Dividends paid to non-resident shareholders are generally subject to 21% withholding tax, which may be reduced under applicable double taxation treaties. This system coordinates corporate and shareholder taxation to prevent excessive double taxation.

Companies must register for corporate income tax as part of their business registration process with the Ministry of Economic Affairs. This involves obtaining a unified business number (UBN) and registering with the local tax office within 15 days of commencing business operations. Foreign companies establishing a branch office must also complete additional registration requirements and appoint a local tax representative if they don't have a permanent establishment in Taiwan.

Common mistakes include failing to understand the distinction between Taiwan-sourced and foreign-sourced income, which affects tax liability calculations. Many businesses also underestimate the importance of maintaining proper documentation for transfer pricing, particularly for transactions with related entities. Another frequent issue is missing provisional tax payment deadlines, which can result in penalties and interest charges. Companies should also be aware that certain expenses may not be deductible for tax purposes, such as entertainment expenses exceeding prescribed limits or fines and penalties paid to government authorities.

Sources used in this article:

Sources last checked 02/10/2025

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

Learn about the best ways to pay international contractors from the UK, including Wise Business, SWIFT, and other methods to help you save on fees.

Learn the features and fees of the best online marketplaces in Asia, Europe, Africa, Australia, and America to sell your products from the UK.

Learn how to apply for an entrepreneur visa in Hong Kong. Our guide explains eligibility criteria, business plan requirements, processing times and more.

Find out how to open a business bank account in Turkey. Our guide covers all the steps involved in detail.

Learn how UK startups can raise venture capital from US investors. Covers Delaware flips, pitching, legal requirements and practical fundraising tips.