Complete guide to doing business in Spain in 2026, for growing startups and entrepreneurs

Thinking of expanding or starting a business in Germany? Our complete guide covers potential opportunities, barriers and cultural considerations.

Managing tax compliance across multiple jurisdictions is a complex challenge for international businesses. Global companies must constantly adapt to evolving cross-border tax regulations, ensure ongoing compliance, and meet strict tax filing deadlines in every country where they operate. This is where corporate tax software comes in.

In this article, we’ll explore some of the best corporate tax software for international businesses. We’ll also highlight Wise Business, a global payment processing platform that integrates with major corporate tax software and makes receiving and sending international payments seamless.

💡 Learn more about Wise Business

Corporate tax software helps businesses in the UK streamline their tax filings and compliance processes. Using corporate tax software not only saves time but also reduces the risk of errors when filing your taxes.

A corporate tax solution is an efficient tool that helps you:

On the other hand, manually filing your documents is labor intensive and prone to errors. These errors can lead to incorrect tax filings, increasing the risk of non-compliance and potential fines. For an international company, manually tracking different tax regulations in multiple countries and ensuring compliance is almost impossible.

Here’s a quick rundown of some of the tools we’ll review in this article:

Before we dive into a comprehensive review, here’s an overview of some of the best corporate tax software in the market for international organisations:

| Provider | Trustpilot score | Monthly fees | Best known for |

|---|---|---|---|

| Avalara Europe | 3.5 of 5.0 from 400+ user reviews¹ | Not listed | Suitable for businesses of all sizes |

| Fonoa | No Trustpilot page | Not listed | Providing real-time updates on global tax laws |

| Sage | 4.0 of 5.0 from 19000+ user reviews² | £95 - £245³ | AI-powered productivity assistant |

| Xero | 4.0 of 5.0 from 9000+ user reviews⁴ | £16- £65⁵ | Ideal for small businesses and sole traders. |

| Onesource | 1.8 of 5.0 from just 15 user reviews⁶ | Not listed | Suitable for tax, trade, and financial reporting professionals. |

In this article, we compared some of the best corporate tax software for international organizations. Here are some of the criteria we used in our review:

After reading this review, you should have all the information you need to choose the corporate tax software that best fits your company’s needs.

Avalara Europe is a cloud-based solution that helps organizations manage sales tax returns and reporting. Avalara was originally a provider of digital sales tax compliance solutions in the U.S, but today, it offers its services in the UK and many other countries.

This tax compliance solution enables businesses of any size to streamline their processes by automating manual tasks, minimising errors, improving compliance, and ultimately saving both time and money.

Avalara Europe has an average rating of 3.5 out of 5.0 on Trustpilot from 400+ user reviews¹.

Here are some of the core features that Avalara offers:

Avalara doesn’t explicitly state its prices on its website. However, the company website states that it offers volume-based pricing, which is determined by the number of integrated apps, monthly sales transactions, and the products and services purchased.

Avalara also offers licensing fees for selected products. For instance, Avalara offers License Guidance for as low as $119 and Avalara Sales Tax Registration for $403 per location⁷.

When it comes to third-party integrations, the platform integrates with Shopify, Stripe, Amazon, WooCommerce, BigCommerce, Salesforce, Etsy, and Oracle.

Fonoa is a comprehensive tax compliance stack for modern businesses. It’s built specifically for marketplaces, SaaS companies, and digital-first businesses.

This corporate tax software is equipped with Tax Intelligence 2.0. This AI-powered tax intelligence helps businesses stay up-to-date with changing tax requirements by extracting tax content from government websites, newsletters, and numerous publications.

Some popular features and services from Fonoa include:

Fonoa doesn’t publicly display its fees on its website, so you’ll need to reach out to the Fonoa team to get more information about its pricing options.

Sage positions itself as the market leader for integrated accounting, payroll, and payment systems for ambitious entrepreneurs. It automates tax preparations and filings for businesses of all sizes. It is an ideal corporate tax solution for calculating tax deductions and tax returns before deadlines.

Sage has an excellent rating of 4.1 out of 5 on Trustpilot, based on 18,000+ user reviews².

Some popular features and services from Sage include:

Sage integrates with third-party ERP, payroll, invoicing and CRM tools.

Xero Tax was launched in 2006 and now has 4.4 million subscribers. It ensures businesses stay compliant with timely preparation and accurately report corporate taxes. The platform is best suited for solo entrepreneurs and enterprises looking for seamless corporate tax solutions.

Xero Tax has an impressive 4.0 out of 5.0 on Trustpilot from 9,000+ reviews⁴.

Some popular features and services from Xero include:

Xero pricing ranges between £16 to £59 per month⁵.

Xero integrates with a wide range of invoicing, payroll, and CRM software, and it also connects with Wise Business accounts.

Onesource provides the clarity and visibility needed to navigate the complexity of corporate taxes. Businesses can easily report and comply with Onesource’s tax automation.

Thomson Reuters, the parent company of Onesource, has a rating of 1.8 out of 5.0 on Trustpilot, based on reviews from just 14 users⁶.

Some popular features and services from Onesource include:

Onesource does not provide pricing information on its website, so you’ll need to contact their team for details about pricing options.

In terms of integrations, Onesource is compatible with over 200 in-house technology solutions.

When choosing corporate tax software for your business, there are different factors to consider that will help you make the right choice.

This section will highlight some of the major ones:

Your business needs: Start by considering the size of your organization, its structure, and the complexity of your tax returns. A company with straightforward tax returns might only need basic software to prepare and file a standard CT600 return. However, this type of tax software may not be a great fit if your company has multiple overseas entities. Companies in this category require more complex corporate software that can handle foreign tax credit calculations, transfer pricing, and VAT across multiple jurisdictions. Therefore, it’s crucial to select a solution that can keep pace with evolving tax regulations in real-time and manage tax filings for each country or region in which your organization operates.

Ease of use: Look for software with a simple, intuitive interface that your team can pick up quickly. Clunky or glitchy software can be frustrating, slow down your workflow, and even lead to mistakes. On the other hand, working with easy-to-use corporate tax software means less time and money spent on training, support, and troubleshooting. When your team can use the system confidently, you’re less likely to face delays or errors that could result in late filings or penalties.

Total cost of ownership: Consider the total cost of ownership. While most providers list their basic fees on their websites, be aware that additional costs may apply for extra users, advanced features, support, or updates. Make sure you understand the full pricing structure before committing, so there are no surprises down the line.

Integration: Your corporate tax software should also integrate smoothly with your existing accounting software and ERP platforms. This makes it easy to import financial data to your tax software and in turn, saves you the time and effort required to enter this data manually.

Researching corporate tax software is a crucial step when managing your tax obligations locally or internationally. And if your business is expanding overseas the next step is setting up the financial infrastructure to handle the complexities of operating across borders, from managing multi-currency cash flow to mitigating FX risk.

The Wise Business account provides the financial tools to make your international expansion to Ireland efficient and simple. It's the one account for managing your money globally.

With a Wise Business account, you can:

(only with Wise Business Advanced)

for 8+ major currencies to easily receive payments from customers or investors.

Wise is designed to support every step of your journey, from paying your first registration fee to receiving international payments and managing your global treasury.

Get started with Wise Business 🚀

Here are some of the frequently asked questions about how to choose a corporate tax software program:

If you are choosing corporate tax software for your company, here are some of the core features you should look out for:

A corporate tax software program that supports third-party integrations would allow you to link with major accounting and ERP systems, making it easy to import financial data directly into your tax software.

This is usually accomplished through APIs (Application Programming Interfaces), which enable secure and seamless data exchange between different software platforms. As a result, any updates made in your accounting or ERP system are automatically reflected in your tax software.

Yes, some corporate tax software can manage international tax obligations. However, it’s crucial to choose a solution specifically designed for global companies to ensure effective tax compliance across multiple countries.

Most UK corporate tax software vendors update their solutions frequently to reflect new tax laws and rules. These updates can either be in real time or as soon as HMRC makes new tax regulations.

Typically, HMRC communicates upcoming changes in advance, enabling software vendors to align their products promptly with these requirements. They “collaborate with software providers to embed tax and customs rules into their products, allowing for automated information and data sharing with HMRC.”⁸

Here’s a detailed process to deploy your corporate tax software

Source used in this article:

Sources last checked 11/09/2025

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Thinking of expanding or starting a business in Germany? Our complete guide covers potential opportunities, barriers and cultural considerations.

Discover which UAE business visas you can apply for from the UK, what to keep in mind and how the process works for each visa type in our guide.

Last month, the United States (US) Supreme Court ruled that many of the government’s tariffs were unconstitutional. The 6-3 decision found that the...

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...

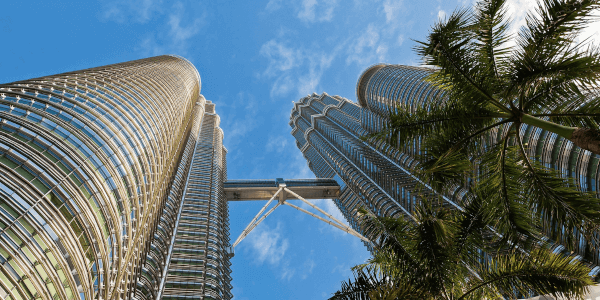

Discover the essential costs involved in starting a business in Malaysia as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

There comes a time in almost every startup’s journey — whether in the UK, Europe or further afield — when its executive team considers expansion to...