5 Best business bank accounts in Canada for UK businesses to consider

Find the best business bank accounts in Canada with our easy guide. We compare top banks and digital providers so you can choose what fits your business best.

As one of the UK’s largest banks, it’s no surprise that Royal Bank of Scotland is a popular choice with consumers and businesses alike.

There are a number of RBS business bank accounts available, including dedicated options for startups.

If your business banks with RBS but you’re thinking of switching to another provider, read on. We’ve put together a handy guide on how to close an RBS business account, covering everything you need to know.

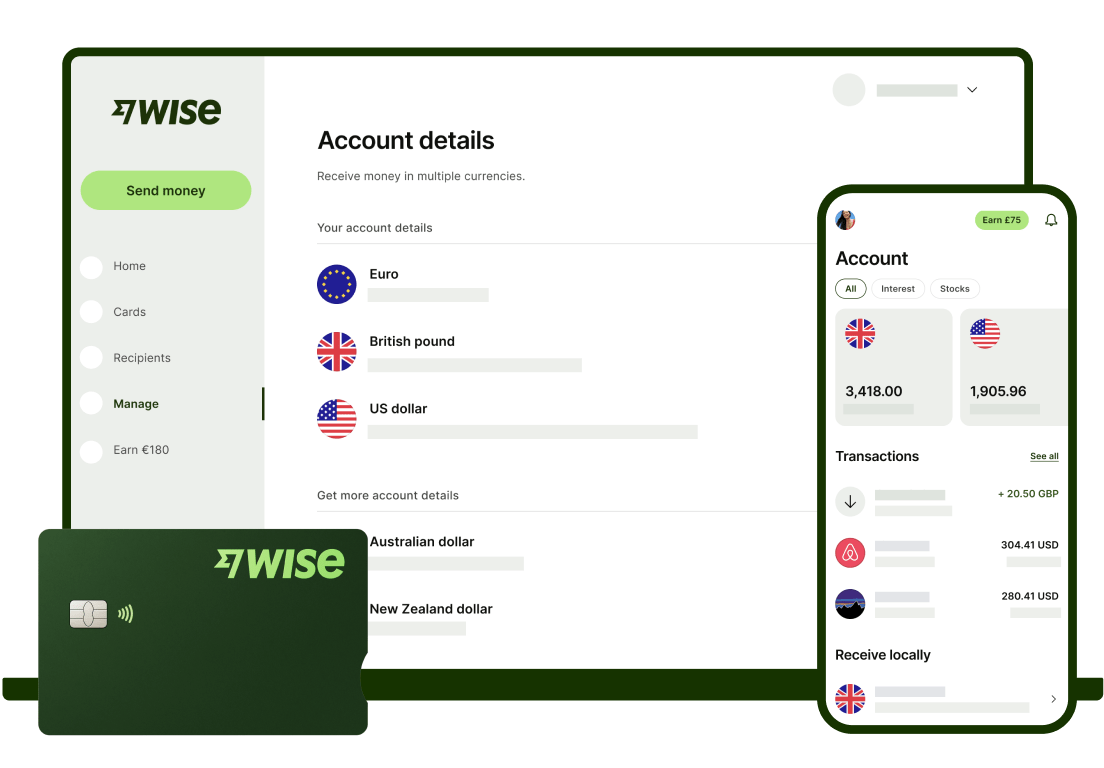

When you’re ready to find a new way to manage your business finances, check out the Wise Business multi-currency account. With Wise, you can manage your company’s money in 40+ currencies, and send and receive international payments for low fees.

💡Learn more about Wise Business

But for now, let’s focus on getting that RBS account closed for you.

There are two different ways you can close your business account with RBS. The first is to sign into your online banking or the RBS mobile app, while the second is to complete the digital Business Account Closure Form.

Let’s start with option 1 - using the RBS app or online banking. Here’s what you need to do:¹

This option is only available if you’re closing a sterling or deposit account with RBS.¹ If it’s your main business account that you’re closing, and won’t have any RBS accounts left after doing so, you may need to use the second method.

Now for option 2 - closing your RBS business account using the Business Account Closure Form. Before you start, you’ll need to make sure you settle any loans, overdrafts, linked credit cards and linked foreign currency account balances.

All ready to go? Follow these steps:¹

To complete the bank account closure form, you’ll need to provide the following information:²

Have a question about closing your RBS account, or need help with something else?

Here’s the Royal Bank of Scotland business account contact number, along with other ways you can get in touch:³

Once your RBS account is officially closed, you’ll need to find another solution for managing your company’s money.

Trade internationally? A bank is far from the cheapest option if you have clients, customers, workers or suppliers in other countries.

But there is an easy-to-manage, cost saving alternative - the Wise Business account.

Simple to open online, the Wise Business account gives you a powerful platform for sending and receiving international payments, as well as converting money in over 40 currencies.

You can easily pay invoices which come in from all over the world, for low fees and the mid-market exchange rate. And you can easily get paid for your own services, accepting payments in 10 major currencies.

And expenses are sorted with Wise Business expense cards, which you can get for each team member who needs one. It works in 174 countries, and charges no foreign currency transaction fees. As an added perk, there’s even 0.5% cashback on spending.

You can also link your Wise Business account with your favourite accounting tools, such as Xero or Quickbooks.

Get started with

Wise Business 🚀

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

After reading this guide, you should be prepared to go forward closing a RBS business account and shop around for a new provider.

There is a form to fill in, but it’s all online and should only take a few minutes to complete. Then all you need to do is have your signatories authorise the request by email, and RBS will do the rest.

Sources used:

Sources last checked on date: 13-Apr-2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find the best business bank accounts in Canada with our easy guide. We compare top banks and digital providers so you can choose what fits your business best.

Discover the top 6 best business bank accounts with invoicing for businesses in the UK.

Learn about some of the best business bank accounts in Australia, covering fees, features and account types.

Discover some of the best business bank accounts in the US, covering FX fees, eligibility and features.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Here’s an in-depth review of everything you need to know about OFX business accounts in the UK, From fees, plans and key features.