Beyond the Hype: Top AI Predictions for 2026

AI predictions for business owners and startup founders. What they should expect and how they can use AI to improve their output.

Mauritius has established itself as a premier business destination in the Indian Ocean, offering a strategic location between Africa and Asia with a sophisticated financial services sector. Understanding the corporate tax landscape is crucial for businesses considering expansion into this stable island nation.

Whether you're exploring market entry, setting up operations, or planning strategic investments, navigating Mauritius's tax framework requires careful consideration. With its business-friendly environment and extensive network of double taxation treaties, Mauritius presents compelling opportunities for international enterprises. Wise Business can help streamline your financial operations as you establish your presence in this dynamic market.

💡 Learn more about Wise Business

This publication is provided for general information purposes and does not constitute legal, tax, or other professional advice from Wise Payments Limited, its subsidiaries or affiliates, and it is not intended as a substitute for obtaining business advice from a tax advisor or any other professional.

The standard corporate income tax rate in Mauritius is 15% for resident companies, making it one of the more competitive rates in the region. This rate applies to companies incorporated in Mauritius and those with their central management and control exercised in Mauritius.1

Non-resident companies are subject to tax only on income derived from Mauritius sources, also at the standard rate of 15%.2 However, companies holding a Global Business Licence (GBL) may benefit from preferential tax treatment under certain conditions.3

Mauritius offers several incentives for specific sectors and activities. Companies engaged in manufacturing, information and communication technology, and other qualifying activities may be eligible for reduced tax rates or tax holidays. The country also provides attractive provisions for holding companies and investment funds, making it a popular jurisdiction for structuring international investments.4

In line with global standards, the country has implemented economic substance requirements, ensuring that companies accessing tax benefits maintain adequate operations and activities in Mauritius. From July 2024, a Corporate Climate Responsibility (CCR) levy of 2% on chargeable income has also been introduced, with reductions available for companies under the partial exemption regime.1

| Read more about Corporate Tax Planning best practices |

|---|

Corporate tax in Mauritius is administered by the Mauritius Revenue Authority (MRA), which maintains a robust online platform for tax filing and payments. Companies must register with the MRA and obtain the required digital access credentials before commencing operations.5

While the formal year of assessment in Mauritius runs from 1 July to 30 June, companies may adopt their own accounting period. After each financial year, companies are required to file their annual corporate tax return (via MRA e-services) within six months of their accounting year-end.6

For companies whose prior year gross income exceeded MUR 10 million and which had chargeable income, an Advance Payment System (APS) applies. Under APS, companies must submit quarterly APS statements and make advance tax payments; the due date for each APS statement and payment is within 3 months from the end of the month in which the APS quarter ends.7

Corporate tax and APS payments must be made in Mauritian Rupees (MUR). Income or transactions in foreign currency must be converted to MUR using exchange rates prescribed by the MRA or by the Bank of Mauritius.8

Late filing of returns triggers a monthly penalty of MUR 2,000 (or part thereof), up to a maximum of MUR 20,000. Late payment of taxes incurs a 5% penalty on the unpaid amount, plus 0.5% interest per month (or part thereof) until full payment is made.8

For a company with an annual turnover of MUR 75 million (approximately £1.5 million), assuming a profit margin of 10%, the taxable profit would be MUR 7.5 million. At the standard corporate tax rate of 15%, the annual tax liability would be:

MUR 7.5 million × 15% = MUR 1.125 million

When expanding your business to Mauritius, the right financial tools will make the process smoother. Using a platform like Wise Business makes it easy to manage international finances. A multi-currency account allows businesses to pay for incorporation costs, registration fees, and government taxes in local currency without paying high exchange rate fees.

Get started with Wise Business 🚀

To comply with Mauritius tax regulations, you have to:

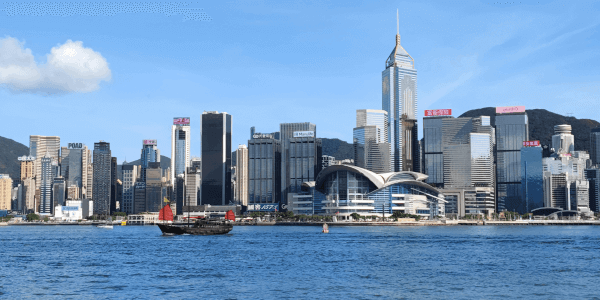

Mauritius, often called the “Star and Key of the Indian Ocean,” has become a leading hub for international business expansion.11 Its strategic position at the crossroads of Asia, Africa, and Europe gives companies seamless access to nearly 70% of the world’s population through an extensive network of free trade agreements12 13. Investors benefit from Mauritius’ role as a financial gateway to Africa and a secure base for global operations.

A politically stable democracy, Mauritius ranked among the 24 “Full Democracies” in the Economist Intelligence Unit’s 2023 index.11 It is the only African country to achieve this distinction. The nation upholds a strong hybrid legal system influenced by both French and British frameworks, providing a solid foundation for corporate tax accounting, regulatory compliance, and investment protection. Businesses also enjoy a high literacy rate of 93% and access to a skilled, multicultural workforce.11

Furthermore, its economy continues to grow steadily, posting a 5.6% real GDP growth rate in 2023 and maintaining one of Africa's highest per capita incomes at USD 11,416. Export activity reached MUR 303 billion in 2023, highlighting opportunities in trade, financial services, tourism, and the blue economy.11 Multinationals are further drawn by the country’s advanced infrastructure, including direct air connections to major global hubs and ambitious port development projects.

Mauritius’ corporate tax policies are another reason businesses choose the island. The jurisdiction operates a competitive, low-tax system with no capital gains tax, exemptions on dividends and interest withholding tax, and investment incentives such as reduced tax rates of 3% for global trading activities. Access to double taxation treaties with 46 countries enhances tax efficiency, supported by professional corporate tax services, and solicitors guide companies through tax registration and compliance.14

The steps to establish a business in Mauritius are as follows:15

If you’re a business that’s not aware of the regulations in Mauritius, you should perform the required research before setting foot here. Learn about the cultural norms surrounding businesses, the competition, and rules about taking money in and out of Mauritius. This will enable you to tread corporate waters carefully and reach your targets easily.

| Discover the top 5 best Corporate Tax softwares |

|---|

To incorporate a business in Mauritius, companies must register with the Corporate and Business Registration Department (CBRD), which oversees all legal entities.16 The process is relatively simple and benefits from the country’s reputation as one of the easiest places to do business in Africa.

When setting up a company, you will need the following:16

Mauritius offers a supportive environment for business operations and investment, backed by key legislations such as the Business Facilitation (Miscellaneous Provisions) Act 2019, the Companies Act 2001, the Business Registration Act 2002, and the Financial Services Act 2007.

They define several categories of companies:17

The selection of a business entity depends on your long-term goals and operational scope. Companies aiming for international expansion can benefit from corporate tax preparation services and professional consultants in Mauritius to ensure proper compliance and seamless ongoing reporting.

Effective international tax management requires a comprehensive approach that balances compliance with strategic planning. Companies operating across borders should maintain robust documentation and ensure they meet substance requirements in each jurisdiction where they claim tax benefits.

Understanding and leveraging double taxation treaties is crucial for minimising overall tax burdens. Mauritius has an extensive network of tax treaties with over 40 countries, including major economies in Africa, Asia, and Europe. These treaties can provide significant benefits for companies structuring their international operations through Mauritius.

Transfer pricing compliance is increasingly important, with tax authorities worldwide focusing on ensuring that intercompany transactions are conducted at arm's length. Companies should maintain detailed documentation supporting their transfer pricing policies and be prepared for potential audits.

Regular review of corporate structures and tax positions helps identify opportunities for optimisation while ensuring ongoing compliance with evolving international tax standards, including OECD BEPS initiatives and substance requirements.

Researching corporate tax is a crucial step when expanding your business into a new country. The next step is setting up the financial infrastructure to handle the complexities of operating across borders, from managing multi-currency cash flow to mitigating FX risk.

The Wise Business account provides the financial tools to make your international expansion to Mauritius efficient and simple. It's the one account for managing your money globally.

With a Wise Business account, you can:

Pay suppliers and initial fees: Pay suppliers, global payroll, and one-off incorporation costs in the local currency.

Get paid like a local: Use local account details

(only with Wise Business Advanced)

for 8+ major currencies to easily receive payments from customers or investors.

Manage your money across borders: Hold and exchange 40+ currencies in one account, always with the mid-market exchange rate and low, transparent fees.

Streamline your accounting: Integrate with tools like Xero or QuickBooks to simplify tracking your company's international finances.

Empower your team: Provide multi-user access for your finance team and issue expense cards for international spending.

Wise is designed to support every step of your journey, from paying your first registration fee to receiving international payments and managing your global treasury.

Get started with Wise Business 🚀

Companies incorporated in Mauritius and foreign companies with their central management and control exercised in Mauritius are considered resident for tax purposes and are liable for corporate tax on their worldwide income. Non-resident companies are taxed only on income sourced in Mauritius.

Yes, Mauritius offers various tax incentives including reduced rates for manufacturing companies, ICT businesses, and companies in designated economic zones. Investment holding companies and funds may also benefit from preferential treatment under the Global Business sector framework.

Dividends paid by resident companies to resident shareholders are generally exempt from tax. Dividends paid to non-residents may be subject to withholding tax, though this can be reduced or eliminated under applicable double taxation treaties.

Companies must register with the Mauritius Revenue Authority (MRA) and obtain a Tax Account Number (TAN). This can be done online through the MRA's e-services platform or by submitting the required forms and documentation to MRA offices.

Common pitfalls include failing to meet substance requirements for preferential tax treatment, inadequate transfer pricing documentation, late filing of returns and payments, and insufficient understanding of treaty benefits. Companies should also ensure proper classification of income and expenses, and maintain adequate records to support their tax positions.

Sources used in this article:

Sources last checked 30/09/2025

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

AI predictions for business owners and startup founders. What they should expect and how they can use AI to improve their output.

Learn how to open a branch in Germany to expand your UK business. Our guide explains the whole process, from registration to legal requirements and more.

Learn about the best ways to pay international contractors from the UK, including Wise Business, SWIFT, and other methods to help you save on fees.

Learn the features and fees of the best online marketplaces in Asia, Europe, Africa, Australia, and America to sell your products from the UK.

Learn how to apply for an entrepreneur visa in Hong Kong. Our guide explains eligibility criteria, business plan requirements, processing times and more.

Find out how to open a business bank account in Turkey. Our guide covers all the steps involved in detail.