Building the future of global money movement

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

Wise Platform's Head of Correspondent Banking Product, Matt Parish, takes us through the challenges recipient validation solves - and how our product helps you maintain customer trust, reduce operational costs, and save time and resources. Watch our full video.

At Wise Platform, we’re focused on improving international payments – making them low-cost, fast, transparent, and efficient. One of the best ways we can do that is by reducing failed payments and bounce-backs, when a bank transfer fails and is returned to the sender’s account.

Without a doubt, failed payments are among the most problematic issues any organisation can face. Why?

In fact, a recent study found that failed payments cost banks $360K on average, and cost corporations $220K. These costs included bank fees, manual labour for researching, and fixing payments, and customer attrition.1

The root of the problem

So, why are so many payments failing?

The single biggest cause of failures are incorrect recipient details – and throughout Wise’s fifteen years in business, we’ve found that the best way to help our customers is to help them confirm those details before a payment is sent – all while they’re still in the app.

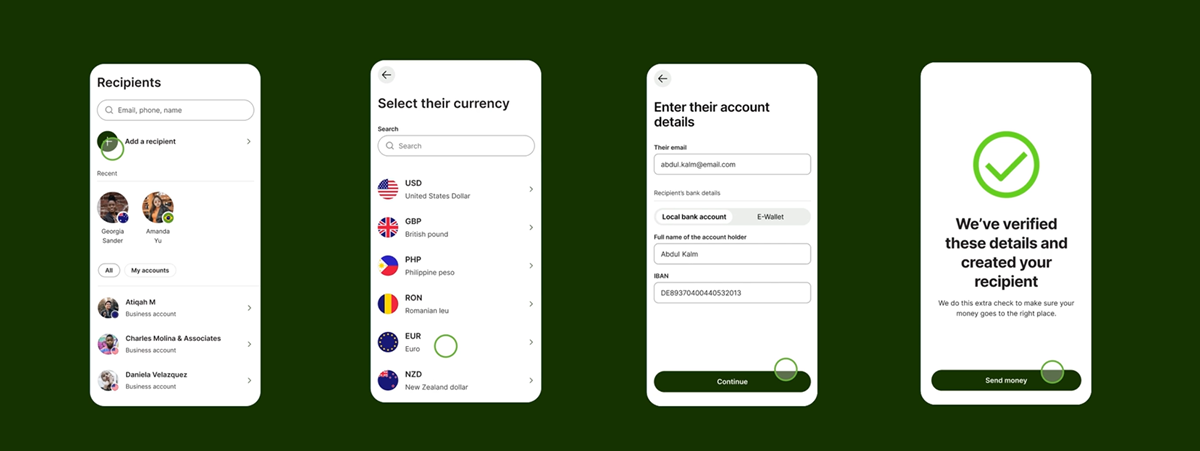

Introducing Global Recipient Verification

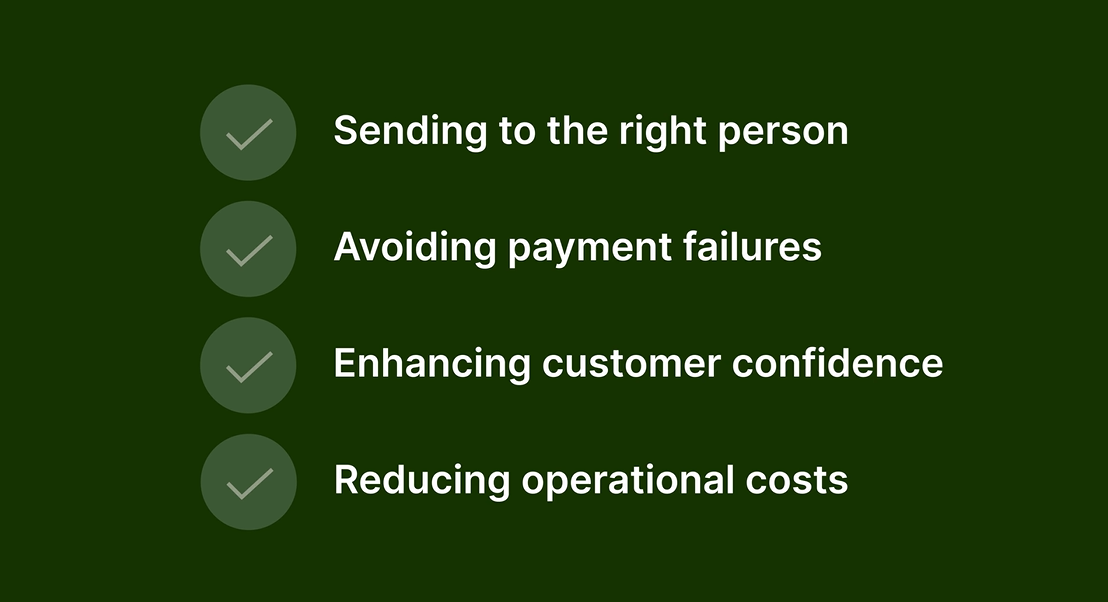

That’s where our global recipient verification product comes in. Recipient verification, the process of confirming that payment details provided by the sender are accurate before the payment is sent, is designed to help your customers send money to the right person, and reduce payment failures – all while enhancing customer confidence and minimising your operational costs.

Our global recipient verification product confirms the authenticity of a recipient's identity - all while enhancing customer confidence and reducing your operational costs.

Our recipient verification product offers:

What’s more, we’re direct participants in eight local payment schemes. This direct participation removes the need for intermediaries which further complicate and delay payments. In turn, this delivers the best possible customer experience for you and your end customers.

Validate recipients within your existing payments flow in a wide range of currencies. At Wise Platform, we run tech-driven formatting and logic checks - ensuring the payment message is complete, correct, and compliant before processing.

Tailored to your needs

Whether your organisation needs verification to improve your customer experience or reduce your costs, or all of the above – we'll help you customise the experience to fit your unique needs.

Say goodbye to failed payments and bounce-backs, and hello to Wise Platform – bringing the speed, convenience, and reliability of Wise to everyone, everywhere.

Ready to reduce failed payments? Talk to our Wise Platform team today.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

Building on momentum, IBKR has now rolled out the same seamless transfer experience to business customers across 50+ countries.

Discover how global fintech Aspire partnered with Wise Platform to deliver over half its payments instantly.

Explore the 5 cross-border payment trends defining 2026. From G20 targets to retail customers, discover how global payments are moving from sprint to standard.

Discover how EQ Bank launched international payments in just one month — with 75% arriving instantly* and 70% becoming repeat users.

Many banks are taking the first steps toward delivering exceptional customer experiences by using next-generation correspondent service providers.